₹12 Lakh Tax Free Limit Isn’t What You Think: The Indian government’s recent announcement of a ₹12 lakh tax-free limit under the new tax regime created a storm of excitement across the country. For millions of taxpayers, the news seemed almost too good to be true: “No taxes if I earn up to ₹12 lakh a year? Sign me up!” But as with most things in taxation, the reality isn’t quite that simple. Here’s the truth: the ₹12 lakh tax-free limit isn’t exactly what you think. There’s a catch buried in the details, and if you don’t understand it, you may still end up owing taxes even when your income seems well within the so-called “tax-free” range. This article explains everything you need to know—clearly, practically, and with real examples you can relate to.

₹12 Lakh Tax Free Limit Isn’t What You Think

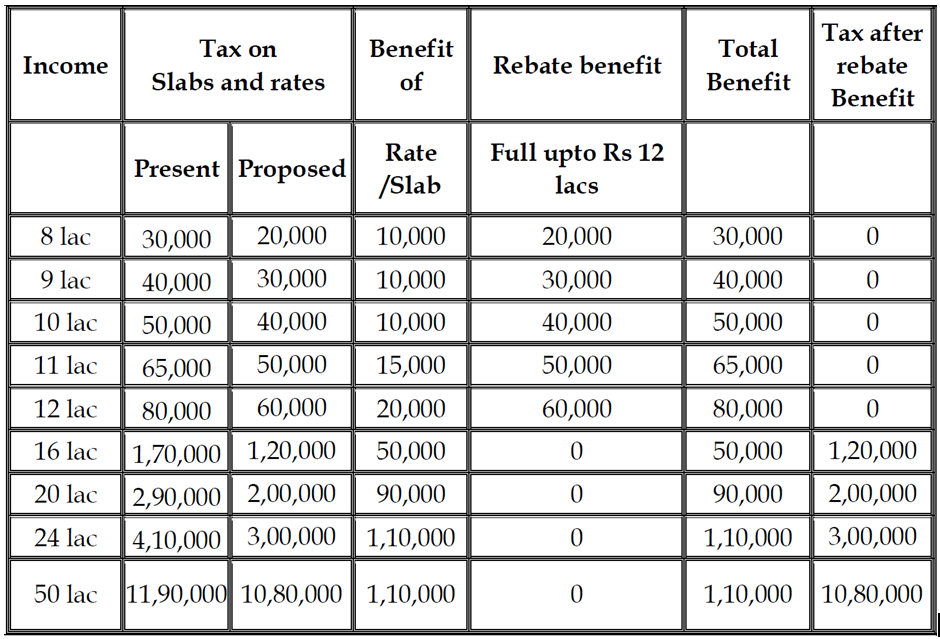

The government’s announcement of a ₹12 lakh tax-free limit under the new tax regime is a major step for salaried middle-class Indians. But it is not the blanket exemption that many headlines suggest. The rebate applies only to slab-rated incomes, leaving out capital gains, lottery winnings, and other special incomes. For those with only salary income, this rule is a game-changer. For professionals, freelancers, and investors, the catch is significant. Understanding the difference between exemption and rebate, planning your income smartly, and seeking professional advice will ensure you make the most of this new provision.

| Point | Details |

|---|---|

| Tax-Free Threshold | Income up to ₹12 lakh is tax-free under Section 87A rebate in the new tax regime. |

| Standard Deduction | Salaried taxpayers get an additional ₹75,000 deduction, raising the effective limit to ₹12.75 lakh. |

| The Catch | The rebate does not apply to special incomes such as capital gains, lottery winnings, or windfalls. |

| Example | Salary of ₹11.5 lakh + stock gains of ₹1 lakh = Tax applies on stock gains at 15%. |

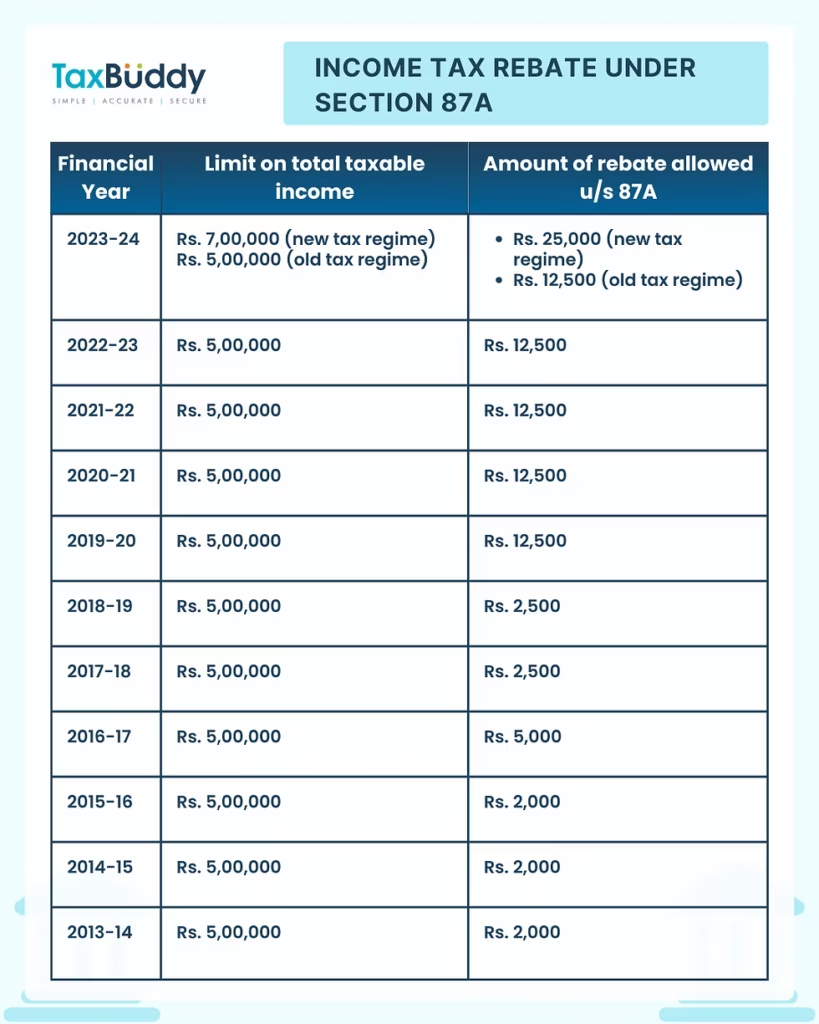

| Historical Growth | Section 87A rebate limit increased from ₹5 lakh (2019) to ₹7 lakh (2023) and now ₹12 lakh (2025). |

| Source | Press Information Bureau, Govt of India |

How We Got Here: A Quick History of the Section 87A Rebate

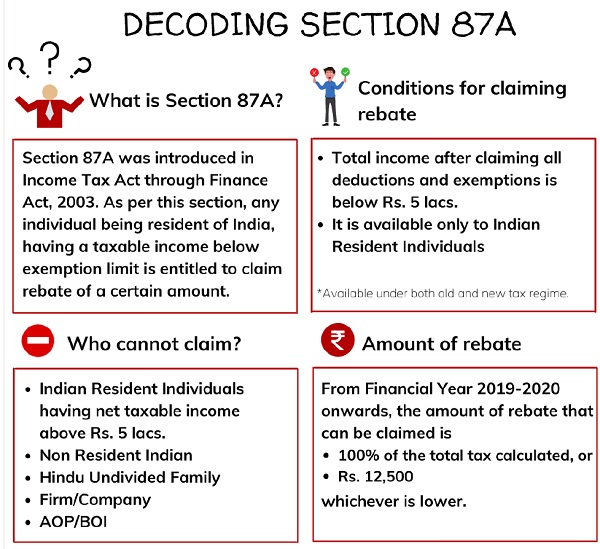

The Section 87A rebate was first introduced in 2013 to give relief to small taxpayers. Over the years, successive budgets increased its limits to match inflation and provide relief to the middle class.

- In 2013, it started with a modest rebate of ₹2,000 for incomes up to ₹5 lakh.

- By 2019, the rebate was ₹12,500, making income up to ₹5 lakh effectively tax-free.

- In 2023, under the revamped new tax regime, the rebate increased to ₹25,000, pushing the tax-free threshold to ₹7 lakh.

- Finally, in the 2025 Budget, the rebate jumped dramatically to ₹60,000, making income up to ₹12 lakh (₹12.75 lakh for salaried employees with a standard deduction) effectively tax-free.

This was the government’s way of boosting disposable income for nearly four crore taxpayers, mostly in the middle-income category.

The Catch Nobody Tells You

While the headline sounds straightforward—“No tax up to ₹12 lakh”—the fine print says otherwise. The rebate under Section 87A applies only to income taxed under the normal slab system.

This means certain incomes, taxed at special rates, do not qualify for the rebate. These include:

- Short-Term Capital Gains (STCG) on shares and equity mutual funds (15%).

- Long-Term Capital Gains (LTCG) on equities above ₹1 lakh (10%).

- Winnings from lotteries, game shows, or betting (30%).

- Other special incomes under the Income Tax Act.

Example

Suppose Priya earns ₹11.5 lakh from her job and an additional ₹1 lakh profit from selling stocks within a year. Her total income is ₹12.5 lakh. At first glance, she might think she’s covered under the ₹12 lakh tax-free limit.

But here’s the twist: the rebate wipes out her liability on salary income, but the ₹1 lakh short-term capital gain is still taxable at 15%. She owes ₹15,000 plus cess, even though her total income looks like it’s within the “tax-free” range.

Rebate vs Exemption: Why the Difference Matters

Many people confuse a rebate with an exemption. The difference is crucial:

- An exemption means a portion of income is not taxed at all. For example, agricultural income is exempt.

- A rebate means you first calculate your tax liability and then reduce it by the rebate amount.

So, under Section 87A, the government lets you reduce your tax by up to ₹60,000 if your taxable income is within ₹12 lakh. But this rebate does not cancel out taxes on special-rate incomes.

Step-by-Step Guide to Checking If You Qualify for ₹12 Lakh Tax Free Limit Isn’t What You Think

- Add all income sources: Salary, business, pension, capital gains, etc.

- Apply deductions: Salaried employees can deduct ₹75,000. Others apply relevant deductions under Sections 80C, 80D, etc., if opting for the old regime.

- Calculate slab tax: Apply normal slab rates on salary/business income.

- Apply Section 87A rebate: Reduce liability by up to ₹60,000 if your income qualifies.

- Calculate special income tax separately: STCG, LTCG, lottery winnings, etc.

- Add both parts: The sum is your final tax liability.

Who Benefits and Who Doesn’t?

The announcement created winners and losers depending on the type of income earned.

Beneficiaries

- Salaried employees earning only wages or pensions.

- Retirees with pensions under ₹12 lakh.

- Families without stock market activity or property sales.

Not Fully Benefiting

- Stock market traders and investors.

- Freelancers or professionals with significant capital gains.

- NRIs, since the rebate applies only to resident individuals.

Real-Life Case Studies

Case 1: Salaried Employee

Rohan earns ₹12 lakh salary. After ₹75,000 standard deduction, his taxable income is ₹11.25 lakh. Section 87A wipes out his entire liability. Net tax: zero.

Case 2: Side Hustle Investor

Neha earns ₹10.5 lakh salary and ₹2 lakh in short-term capital gains. The rebate clears her salary tax, but the ₹2 lakh gains are taxed at 15%. She owes ₹30,000 plus cess.

Case 3: Property Seller

Amit earns ₹8 lakh salary and sells property with ₹6 lakh LTCG. Only his salary qualifies for rebate. LTCG taxed at 20% (after indexation). He still owes ₹1.2 lakh tax.

How This Compares Globally?

In countries like the United States, taxpayers enjoy credits like the Earned Income Tax Credit (EITC) or Child Tax Credit, which reduce tax liability directly across income types. India’s rebate, however, is narrower. It only covers income taxed under slabs and excludes special categories like capital gains.

This makes the Indian system more restrictive, though it is targeted specifically at wage earners.

Expert Advice for Smart Tax Planning

- Hold investments longer: Convert short-term gains into long-term for lower tax rates.

- Reinvest capital gains: Use Sections 54, 54EC, or 54F to reduce property gain taxes.

- Avoid last-minute surprises: Track income sources separately, especially special incomes.

- Get professional help: A Chartered Accountant can help optimize savings and avoid penalties.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay