12% Surge in GST! West Bengal’s Economy Rebounds: West Bengal has made economic headlines again—this time for all the right reasons. With a solid 12% year-on-year rise in GST collections for July 2025, the state government is celebrating what it calls a sign of “economic resilience.” Chief Minister Mamata Banerjee, who had stayed mum on the fiscal front in recent months, has now publicly lauded this achievement as evidence that Bengal’s economy is back on track. But what does this 12% surge actually mean for businesses, citizens, and policy-makers? Is the state’s economy truly on a rebound, or are we simply looking at a temporary bump fueled by seasonal factors? In this deep dive, we’ll unpack what the numbers really tell us, why they matter, and how this could impact Bengal’s short- and long-term economic trajectory.

12% Surge in GST! West Bengal’s Economy Rebounds

West Bengal’s 12% GST growth in July 2025 is a welcome development—and potentially a sign of structural economic improvement. However, maintaining this growth will require careful management, infrastructure development, and cooperation between state and central governments. If the gains are translated into real-world benefits—like jobs, cleaner cities, better roads, and education—then this surge will be more than just a headline. It’ll be a turning point.

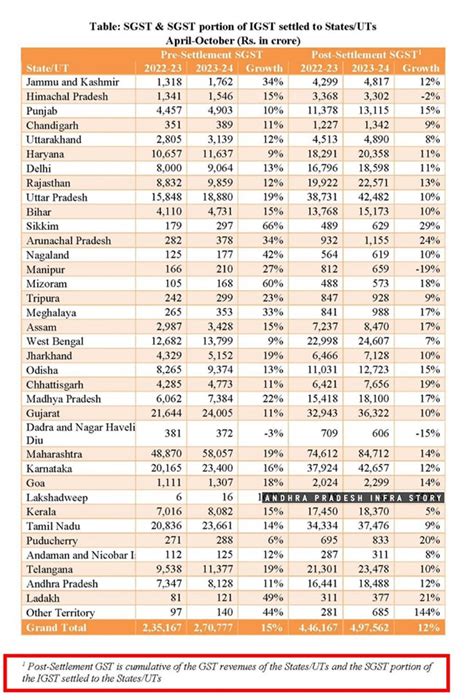

| Point of Interest | Details |

|---|---|

| GST Growth Rate (YoY) | 12% increase in July 2025 |

| GST Collection Amount | ₹5,895 crore (up from ₹5,257 crore in July 2024) |

| Fiscal Year Cumulative Growth | 7.71% (April to July 2025) |

| SGST Collection Target (FY 2025–26) | ₹49,771 crore |

| Debt-to-GSDP Ratio | Reduced from 40.6% in 2010–11 to 36.8% in 2024–25 |

| CM’s Public Statement | “Steady improvement in business and consumption” |

| Official Source | GST Council India |

Understanding GST: Why It’s a Key Economic Indicator

Goods and Services Tax (GST) is a comprehensive indirect tax system implemented in India in 2017. It replaced a tangled web of central and state taxes and created a single tax regime across the country. GST is collected on goods sold and services rendered, and when collections go up, it typically signals rising consumption and stronger business activity.

In simple terms, GST is like a health check for a state’s economy. A consistent rise in collections means more businesses are operational, more transactions are happening, and economic activity is robust.

What Drove 12% Surge in GST! West Bengal’s Economy Rebounds?

According to Business Standard, West Bengal collected ₹5,895 crore in July 2025—up from ₹5,257 crore in the same month last year. The cumulative growth for the financial year so far (April to July) stands at 7.71%.

Several factors contributed to this impressive performance:

1. Economic Recovery Post-COVID

West Bengal’s micro, small, and medium enterprises (MSMEs), particularly in sectors like textiles, food processing, and tourism, have gradually bounced back since the pandemic. These sectors generate significant transactional volume, contributing heavily to GST collections.

2. Improved Compliance and Tech-Based Enforcement

The state has implemented advanced tools like AI-based fraud detection and e-invoicing to reduce tax evasion. These systems are streamlining operations for businesses and improving audit capabilities for the government.

3. Increased Consumer Spending

Durga Puja and the upcoming festive season always trigger a surge in retail sales, from electronics to clothing to FMCG. With rising consumer confidence, people are spending more—another reason for the bump in GST revenue.

4. Digitization of Taxation

From small retailers in Howrah to large-scale exporters in Haldia, GST returns are now being filed more consistently thanks to easier online access, automation, and educational outreach by the Finance Department.

Mamata Banerjee’s Response: A Political and Economic Statement

Chief Minister Mamata Banerjee posted on X (formerly Twitter), celebrating the tax surge as a mark of Bengal’s fiscal competence. She stated that the growth reflects the steady improvement of business activity and consumption in the state.

But her statement wasn’t just economic. Banerjee used the occasion to raise long-standing grievances with the central government, reiterating that ₹1.7 lakh crore in central dues remain unpaid to West Bengal. She argues that these funds could dramatically improve development projects and social welfare schemes in the state.

While supporters hail her for defending state autonomy, critics see it as politicizing economic data. Still, few can deny that the 12% jump adds momentum to her economic narrative.

A Look at National and Global Comparisons

How does West Bengal’s performance stack up against other Indian states and economies?

| Region/State | July 2025 GST Growth |

|---|---|

| West Bengal | 12% |

| Maharashtra | 8.9% |

| Tamil Nadu | 9.2% |

| Karnataka | 9.3% |

| Gujarat | 7.5% |

| National Average (India) | 11% |

| Vietnam (VAT Q2 2025) | 5.2% |

| South Africa (VAT Q2 2025) | 4.1% |

Bengal is not just performing above average in India—it’s outpacing VAT growth in several emerging economies.

Ground Reality: What Local Voices Are Saying

We spoke to a cross-section of residents and professionals to understand how this growth is being felt at the grassroots level.

Farida Bibi, a small business owner in Howrah:

“I don’t know all the numbers, but I can tell you people are shopping again. That’s enough proof for me.”

Dr. Sayan Roy, economist, Jadavpur University:

“While GST growth is promising, we must analyze whether this trend is sustainable or seasonal.”

Anjali Dutta, HR manager, Durgapur industrial zone:

“Our factory is hiring again, but we still face a shortage of skilled labor. That’s a long-term challenge Bengal needs to address.”

Potential Risks and Challenges

While the numbers look promising, Bengal’s economy still faces several challenges:

1. Inflationary Pressure

Global and domestic inflation could reduce disposable income, impacting consumption and, by extension, GST collections.

2. Political Tensions

Ongoing disputes with the central government over funds may impact project execution and investment inflows.

3. Rural-Urban Divide

While urban centers are driving revenue, rural areas still lag in terms of income generation and formalization, which limits the tax base.

4. Subsidy Burden

The state’s ambitious welfare programs, like power subsidies and direct cash transfers, could strain fiscal resources if not balanced by long-term revenue generation.

What This Means for Businesses and Citizens?

For entrepreneurs, professionals, and taxpayers alike, this surge in GST collection sends multiple signals:

- Improved business climate means better investment opportunities.

- Higher government revenue can potentially translate into better roads, hospitals, and public services.

- Efficient tax administration builds trust in the system, especially for small businesses.

- Policy predictability increases when a government consistently meets its fiscal targets.

Expert Forecast: What Lies Ahead for Bengal?

Financial analysts are cautiously optimistic. If Bengal continues this trend and maintains fiscal discipline, it could emerge as one of India’s most resilient regional economies.

Economist Rituparna Sen from CRISIL notes:

“If this momentum holds and is supported by smart infrastructure investments and improved human capital, Bengal could climb into the top-5 contributing states to India’s GDP by 2030.”

How to Track GST Collection Data Yourself?

Here’s a simple, practical guide for anyone who wants to follow state GST performance:

- Visit gstcouncil.gov.in

- Click on ‘GST Collection Trends’ under ‘Statistics.’

- Choose monthly or annual data by state.

- Cross-check targets from the state budget document.

- Review commentary from the Reserve Bank of India or Ministry of Finance reports.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

GST Cracks Down on Fake Firms — 11 Bogus Companies Served Notices Amid Ongoing Probe

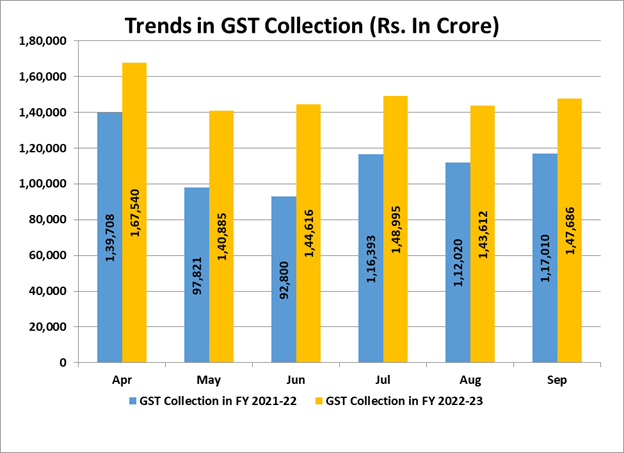

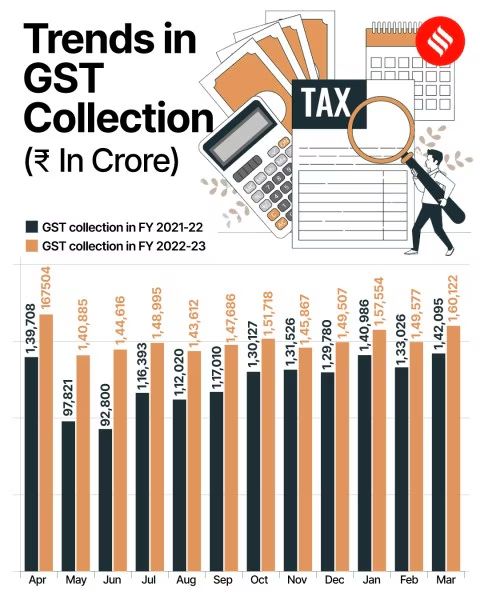

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows