₹167 Crore Property Tax Collected In Just Weeks: When you read the headline “₹167 Crore Property Tax Collected in Just Weeks – How PCMC Pulled It Off”, it sounds almost unbelievable. How can one city collect such a massive sum of property tax in such a short period? Yet, that’s exactly what happened in Panvel, Maharashtra, under the Panvel City Municipal Corporation (PCMC). The secret? A bold and well-timed amnesty scheme that encouraged thousands of property owners to settle their overdue taxes by waiving fines and penalties. It’s like when your favorite store runs a “limited-time clearance sale”—the urgency makes everyone rush to buy. PCMC applied the same principle to taxes, and the results were nothing short of historic.

₹167 Crore Property Tax Collected In Just Weeks

The case of ₹167 crore property tax collected in weeks by PCMC is a lesson in modern governance. It shows how incentives, deadlines, and psychology can move thousands of citizens into compliance. But it also reminds policymakers that trust and fairness are as important as money. For cities, the message is clear: amnesty can be a short-term win, but long-term reform is the real prize. For homeowners, the advice is simple: don’t wait for waivers—pay early, save stress, and stay on the right side of civic duty.

| Key Point | Details |

|---|---|

| Municipal Body | Panvel City Municipal Corporation (PCMC), Maharashtra |

| Total Collected | ₹167 crore in just 2 months |

| Collection Period | July 18 – September 20, 2025 |

| Taxpayers Participated | 60,082 property holders |

| Major Relief | 37,519 taxpayers got 90% fine exemption, saving ₹64.8 crore |

| Rebate Tiers | 75% (Aug 16–31), 50% (Sept 1–10), 25% (Sept 11–20) |

| Public Response | Widespread protests against “unfair” tax load |

| Official Reference | PCMC Official Website |

Why This Story Matters?

Property tax often flies under the radar, but it’s the financial backbone of local government. These collections pay for essential services like waste management, public lighting, road maintenance, and clean water supply. Without strong revenue collection, city life suffers.

That’s why PCMC’s achievement matters. Established only in 2016, the municipal body is still relatively new. Yet, within a few years, it pulled off one of the fastest and most effective property tax collections in India’s municipal history. This move not only strengthened its financial position but also became a case study in urban governance.

Historical Context – PCMC’s Revenue Journey

Panvel has grown rapidly over the past decade, thanks to its proximity to Mumbai and Navi Mumbai. With new housing projects, commercial developments, and industrial estates, the city’s tax base has expanded. Yet, collections remained weak:

- 2017–18: PCMC collected roughly ₹30 crore in property tax.

- 2019–20: Collections improved slightly but hovered under ₹80 crore.

- 2022–23: Revenue touched around ₹110 crore, but penalties and dues kept piling up.

- 2025 (Amnesty Period): ₹167 crore was collected in just two months—a record-breaker.

This shows that the money was always out there. The challenge was getting people to pay, and PCMC finally cracked the code.

The Amnesty Scheme – How It Worked

The amnesty program was cleverly designed. Here’s the breakdown:

- July 18 – Aug 15: 90% penalty waiver

- Aug 16 – Aug 31: 75% penalty waiver

- Sept 1 – Sept 10: 50% penalty waiver

- Sept 11 – Sept 20: 25% penalty waiver

The structure was simple but powerful. By lowering the discount every few weeks, PCMC created urgency. Homeowners realized the earlier they paid, the more they saved.

This wasn’t just a discount gimmick. It was rooted in behavioral economics. Psychologists know that deadlines and declining rewards push people to act. And with property fines often running into lakhs, the chance to save big was too tempting to pass up.

The Numbers – Who Paid and How Much

The amnesty drive brought in 60,082 taxpayers. Out of these:

- 37,519 grabbed the 90% waiver, saving ₹64.8 crore in fines.

- Thousands more paid later but still benefited from reduced penalties.

- Overall, PCMC collected ₹167 crore in property tax within the short amnesty window.

For context, ₹167 crore could fund new schools, healthcare centers, and improved sanitation across the city.

The Other Side – Why People Protested

Despite the financial success, not everyone was celebrating. Panvel saw massive protests. Here’s why:

- Tax Rate Concerns: Citizens claimed PCMC levied “Mumbai-level” taxes, even though Panvel is classified as a D-class municipal body. To them, it felt like paying for a luxury car but driving a scooter.

- Political Promises: Before coming to power, the ruling party had promised not to impose new taxes for five years. The protests highlighted a credibility gap.

- Equity Question: Many punctual taxpayers felt punished. Why should defaulters get big waivers while honest citizens got no benefits?

This underlines a timeless truth: revenue collection must be matched with fairness and transparent communication.

Expert Opinions – Why Amnesty Works

Economists often debate the role of amnesty programs.

- Dr. Raghunath Kelkar, an urban governance researcher, argues:

“Amnesty schemes can unlock quick revenue, but they should be rare. If overused, people delay payments, waiting for the next waiver.” - Behavioral finance experts say the PCMC scheme was smart because it created urgency. By shrinking rebates over time, it pushed people to act before losing the benefit.

Globally, tax amnesty programs have worked in places like Italy, the U.S., and South Africa. The IRS in the U.S., for example, raised billions through voluntary disclosure schemes for undeclared foreign income.

Lessons for Businesses and Policymakers

The PCMC story isn’t just about property tax—it offers lessons for leaders everywhere:

- Incentivize, Don’t Punish: Carrots often work better than sticks. Offer discounts or perks for early compliance.

- Deadlines Drive Action: Tiered deadlines with declining benefits push people to act quickly.

- Balance Fairness: Don’t alienate the compliant majority. Offer loyalty benefits for regular taxpayers too.

National and Global Comparisons

PCMC is not alone in using amnesty schemes.

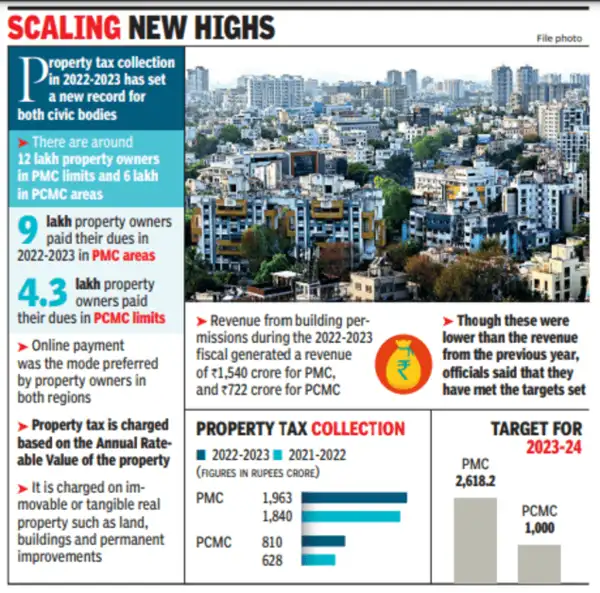

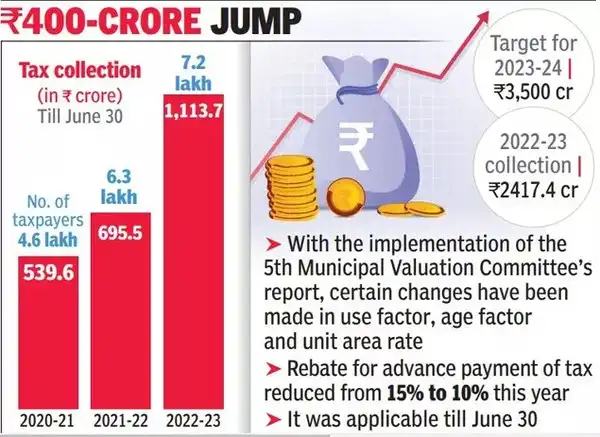

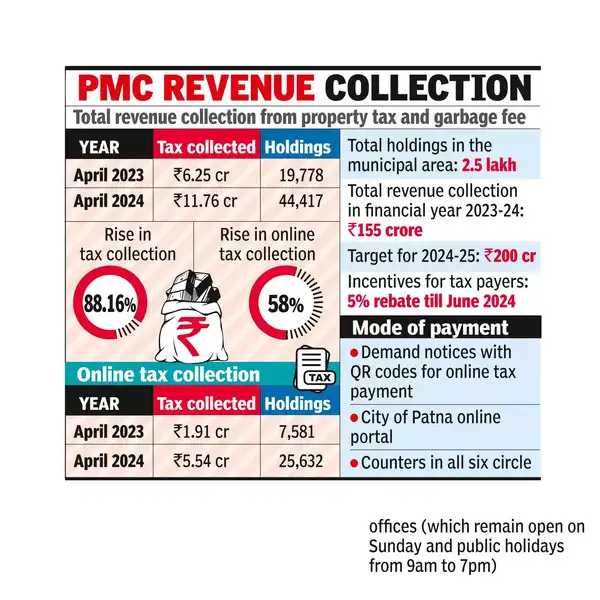

- Pune Municipal Corporation (PMC): Collected over ₹250 crore in 2022 via an amnesty drive.

- Delhi Government: Used “One-Time Settlement” schemes for electricity dues with significant success.

- Internationally: The U.S. IRS, Italy, and Indonesia have all raised billions through tax amnesty programs.

These examples show that amnesty is a proven global strategy for governments strapped for quick revenue.

₹167 Crore Property Tax Collected In Just Weeks Impact on Citizens

For homeowners, the scheme was a lifesaver. Imagine a family owing ₹1.5 lakh in overdue taxes and fines. Under the 90% waiver, they only had to pay the base tax, saving over ₹1 lakh instantly.

For many middle-class families, that meant being debt-free without draining savings. Of course, critics argue that law-abiding taxpayers who paid on time got no such relief, raising questions of fairness.

Future Outlook for PCMC

What lies ahead?

- Short-Term Win: With ₹167 crore in the bank, PCMC can invest in infrastructure.

- Long-Term Risk: If residents expect amnesties every few years, tax discipline may erode.

- Needed Reforms: Transparent spending, fairer tax slabs, and digital payment systems could improve compliance without the need for frequent waivers.

Practical Advice for Homeowners

- Check Regularly: Always check your city’s official website for tax notifications.

- Pay Early: Don’t wait for penalties. Settling on time avoids stress and extra charges.

- Plan Ahead: Treat property tax like a monthly utility bill—budget for it.

- Use Digital Platforms: Most municipalities, including PCMC, allow online payments for convenience.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth