2025 Tax Slabs Revealed: If you’ve ever looked at your payslip and thought, “Wait, where did all my hard-earned cash go?”, you’re not alone. Taxes can feel like that nosy neighbor who’s always taking a peek into your business — only, in this case, they’re taking a piece of your paycheck, too. But here’s the kicker: The 2025 Tax Slabs are shaking things up in a way that could keep a whole lot more money in your pocket. And not just spare change — we’re talking amounts big enough to cover a vacation, a new laptop, or even a down payment on a car.n Whether you’re a fresh graduate just stepping into the workforce or a seasoned professional planning your retirement, understanding these changes isn’t optional — it’s essential. And lucky for you, I’ve done the heavy lifting so you can get the full picture without wading through pages of government jargon.

2025 Tax Slabs Revealed

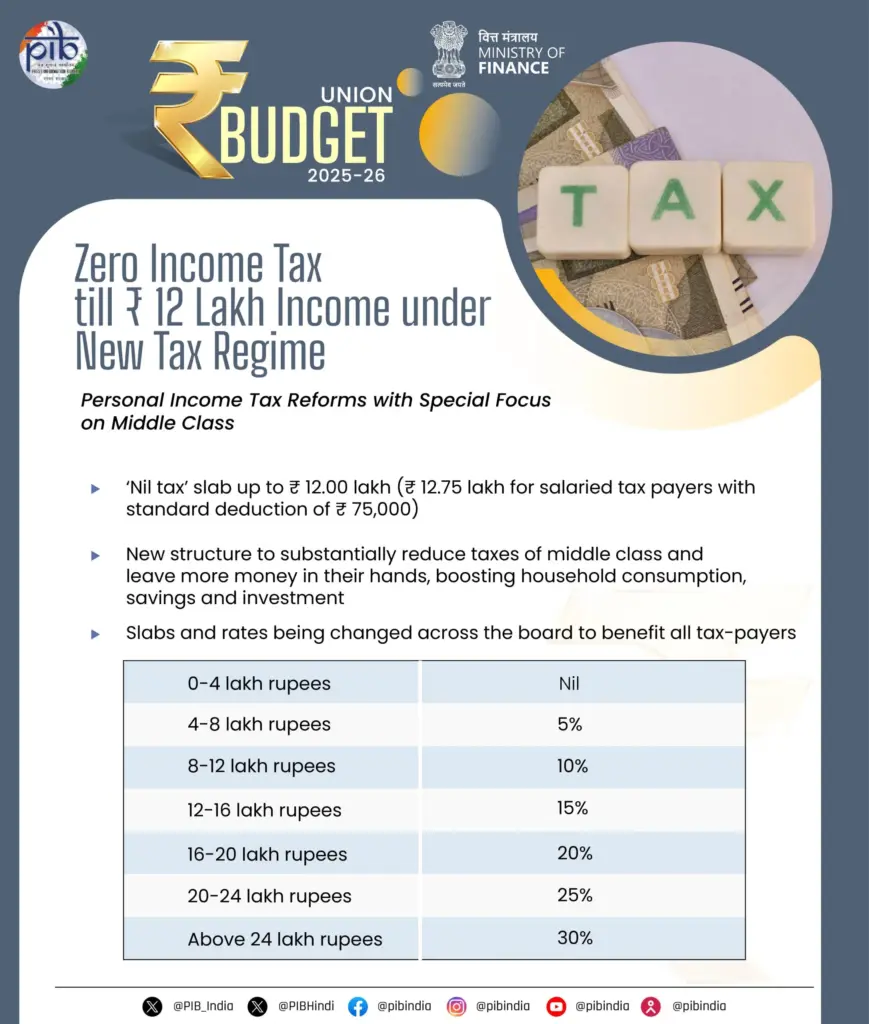

The 2025 tax slabs are more than just new numbers on a chart — they’re a chance to keep more of what you earn, plan smarter, and maybe even enjoy life a little more. With ₹12 lakh tax-free and a bigger standard deduction, the system is fairer, simpler, and more rewarding for the middle class. Whether you’re crunching numbers in a corner office or just starting out at your first desk job, understanding these changes could save you thousands — and that’s worth every minute you spent reading this.

| What You Get | Why It Matters | Official Reference |

|---|---|---|

| ₹12 lakh tax-free | This is a huge jump from last year — it means millions of middle-income earners pay zero income tax. | Government Budget 2025 |

| Standard Deduction ₹75k | Salaried folks get to knock this amount off taxable income, making ₹12.75 lakh effectively tax-free. | Government Budget 2025 |

| Progressive slabs | Keeps tax fair — higher earners pay more, but lower earners keep more of their paycheck. | Government Budget 2025 |

Why These Changes Matter?

Let’s call it like it is — the jump from ₹7 lakh to ₹12 lakh for the tax-free threshold is a game-changer.

In the past, even someone with a modest ₹8 lakh salary would feel the tax pinch right away. Now, you can earn substantially more before the taxman comes knocking. This directly increases disposable income for a massive chunk of the population.

From a macroeconomic standpoint, when more people have extra money in hand:

- They spend more on goods and services (good news for businesses).

- They invest more in mutual funds, stocks, or property (good for capital markets).

- They’re less tempted to evade taxes, since the system feels fairer.

Professionally speaking, this is a huge chance for financial planners and accountants to help clients restructure pay packages, optimize investments, and strategize for long-term gains. For salaried employees, it’s a rare moment where government policy is directly putting more cash in your wallet.

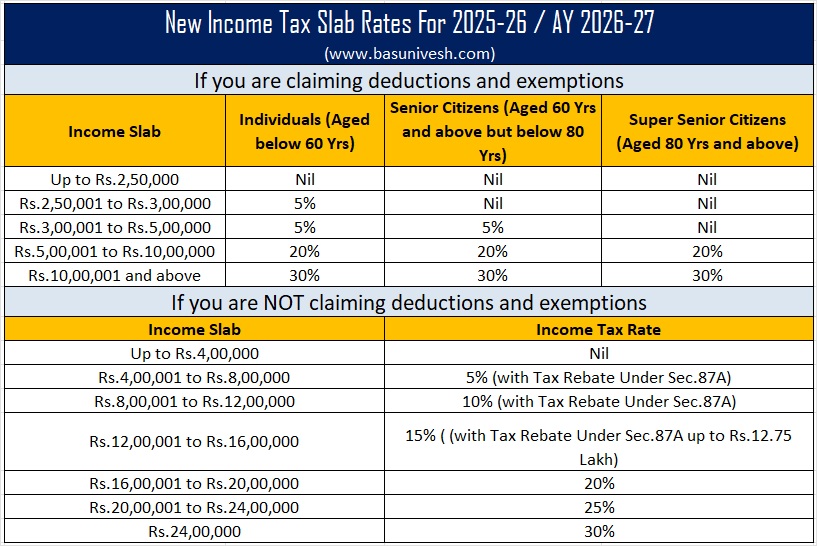

The 2025 Income Tax Slabs – New Regime

Here’s the official breakdown for FY 2025–26:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹4 lakh | 0% |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| ₹12 lakh – ₹16 lakh | 15% |

| ₹16 lakh – ₹20 lakh | 20% |

| ₹20 lakh – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

Key takeaway: If you’re earning up to ₹12 lakh (₹12.75 lakh if salaried), you’re in the tax-free club. Beyond that, taxes scale up gradually, so you’re not slammed with a big tax jump all at once.

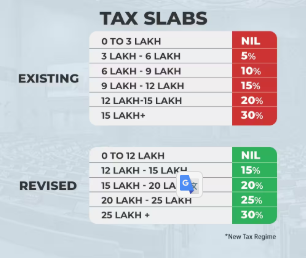

What’s Changed From Previous Years?

This isn’t just a small tweak — it’s a structural shift.

- Zero-Tax Threshold Raised

Last year’s limit (with rebate) was ₹7 lakh. This year? A whopping ₹12 lakh. That’s like giving yourself a raise without asking your boss. - Bigger Standard Deduction

Salaried deduction up from ₹50,000 to ₹75,000 — meaning even more income stays untouched. - Senior Citizen Benefits

TDS on bank interest raised to ₹1 lakh for seniors — a move that protects their income streams. - Simplified Compliance

Filing deadline now extended to 4 years from the end of the relevant assessment year, giving people more breathing room.

These changes clearly encourage people to switch to the new regime — fewer exemptions, lower rates, and much less paperwork.

Real-Life Examples

Example 1: Fresh Graduate

- Income: ₹8 lakh/year.

- New Regime: Only ₹4 lakh taxable at 5% = ₹20,000 tax.

- Old Regime: Much higher due to lower threshold — big difference in first-year savings.

Example 2: Mid-Level Manager

- Salary: ₹12.75 lakh/year.

- Minus ₹75k deduction = ₹12 lakh taxable.

- Rebate applies → ₹0 tax.

That’s potentially ₹60,000–₹90,000 more in take-home compared to last year.

Example 3: Senior Executive

- Income: ₹30 lakh/year.

- Uses progressive slabs → total tax is still lower than what it would’ve been under old regime at the same income.

How to Plan Your Finances in 2025 As 2025 Tax Slabs Revealed

1. Understand Your Breakpoints

If you’re just over ₹12 lakh, you might lower your taxable income through:

- Extra retirement contributions.

- Buying eligible insurance plans.

- Employer-sponsored benefits.

2. Compare Regimes Before Filing

The new regime works for most, but if you’ve got heavy home loan interest or multiple deductions, the old regime could still save you more.

3. Leverage the Savings

Don’t just let the extra cash sit there — put it to work:

- Build an emergency fund covering at least 6 months of expenses.

- Increase SIP (Systematic Investment Plan) contributions.

- Make an extra EMI payment to cut debt faster.

4. Keep Clean Records

Even in the simpler regime, proof matters. Keep payslips, Form 16, bank statements, and investment proofs handy.

Professional Insights

For accountants and tax advisors:

- This is a prime time to educate clients about the advantages of moving to the new regime.

- Use before-and-after scenarios to highlight savings.

- Help clients reinvest savings into tax-efficient instruments.

For employers:

- Redesign salary structures to maximize in-hand pay.

- Offer non-cash perks like health benefits or meal vouchers that don’t increase tax burden.

Economic Impact

Why is this policy such a big deal economically?

- It stimulates consumer demand.

- It encourages formal employment since the benefits are greater for declared income.

- It aligns with global best practices where middle-income earners get substantial tax relief.

Economists call this a “multiplier effect” — every rupee saved by a taxpayer potentially generates multiple rupees in economic activity.

Step-by-Step Tax Calculation Guide for 2025

- Find Your Gross Income

Add salary, bonuses, rental income, etc. - Apply Standard Deduction

If salaried, knock off ₹75,000. - Check Rebate Eligibility

If taxable ≤ ₹12 lakh, you may owe ₹0 tax. - Apply Slab Rates

Start from 0% and move up progressively. - Add Cess & Surcharge

4% health & education cess, surcharge if applicable. - Compare Regimes

Use official calculators on Income Tax India to verify.

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom