2025’s Most Important ITAT Rulings: The first half of 2025 has already given us several landmark decisions from the Income Tax Appellate Tribunal (ITAT), and the impact of these rulings will be felt for years to come. From capital gains exemptions to compliance challenges and NRI taxation, ITAT’s decisions continue to shape India’s tax landscape. These rulings provide clarity on key tax issues, offer fresh perspectives on long-standing tax practices, and will likely influence how tax practitioners approach their cases moving forward. Whether you’re a taxpayer, a tax professional, or someone with a general interest in tax law, understanding these decisions is crucial for navigating the ever-evolving world of taxation. In this article, we’ll break down the most important ITAT rulings from the first half of 2025, highlighting the critical insights, implications, and practical advice that can help both individuals and professionals manage their tax matters more effectively.

2025’s Most Important ITAT Rulings

The ITAT’s rulings in the first half of 2025 have been pivotal in providing clarity on various aspects of taxation. From capital gains exemptions to procedural fairness, these decisions emphasize the importance of proper documentation, timely filings, and compliance with tax regulations. By following these best practices and understanding the legal precedents set by the ITAT, both individuals and professionals can navigate the complex world of taxation with confidence.

| Key Ruling | Summary | Impact | Reference Link |

|---|---|---|---|

| Capital Gains Exemption for Spouses | A wife wins exemption on capital gains from properties gifted by her husband. | Clear distinction between ownership and clubbing provisions. | ET Wealth |

| Joint Property Purchase Validates LTCG | A husband and wife duo are eligible for LTCG exemption despite joint property purchase. | Joint ownership doesn’t disqualify capital gains exemption. | ET Wealth |

| Relief for Misled Taxpayer in Penalty Case | Taxpayer avoids ₹1.4 lakh penalty for falsely claimed deductions. | Emphasizes the role of intent in penalties and tax compliance. | ET Wealth |

| Congress Denied Tax Exemption | ITAT dismisses Congress’ appeal against ₹199 crore tax demand. | Highlights the importance of proper filing and donation documentation. | Times of India |

| NRI Wins Unexplained Investment Case | Indian engineer wins case on ₹69 lakh of unexplained investment from overseas earnings. | Reinforces importance of tax residency and documentation for NRIs. | ET Wealth |

| Reassessment Invalid Without Speaking Order | Reassessment order quashed for failure to dispose written objection. | Stresses the importance of procedural fairness in tax assessments. | LiveLaw |

The ITAT: What You Need to Know

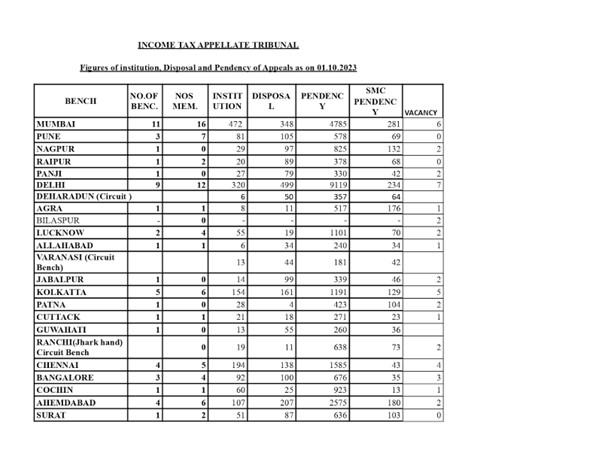

Before diving into the specifics, it’s important to understand who and what the Income Tax Appellate Tribunal (ITAT) is. The ITAT is an independent body that adjudicates disputes between taxpayers and the Income Tax Department. It functions as an appellate tribunal, hearing appeals on a wide range of tax-related matters.

The ITAT plays a crucial role in interpreting tax laws and providing clarity on ambiguous issues. Its rulings, especially those involving high-profile cases or complex issues, set precedents for future cases, making them extremely important for both taxpayers and tax professionals. The tribunal ensures that tax laws are applied consistently, safeguarding the rights of taxpayers and ensuring fair treatment by tax authorities.

1. Capital Gains Exemption: A Win for Spouses

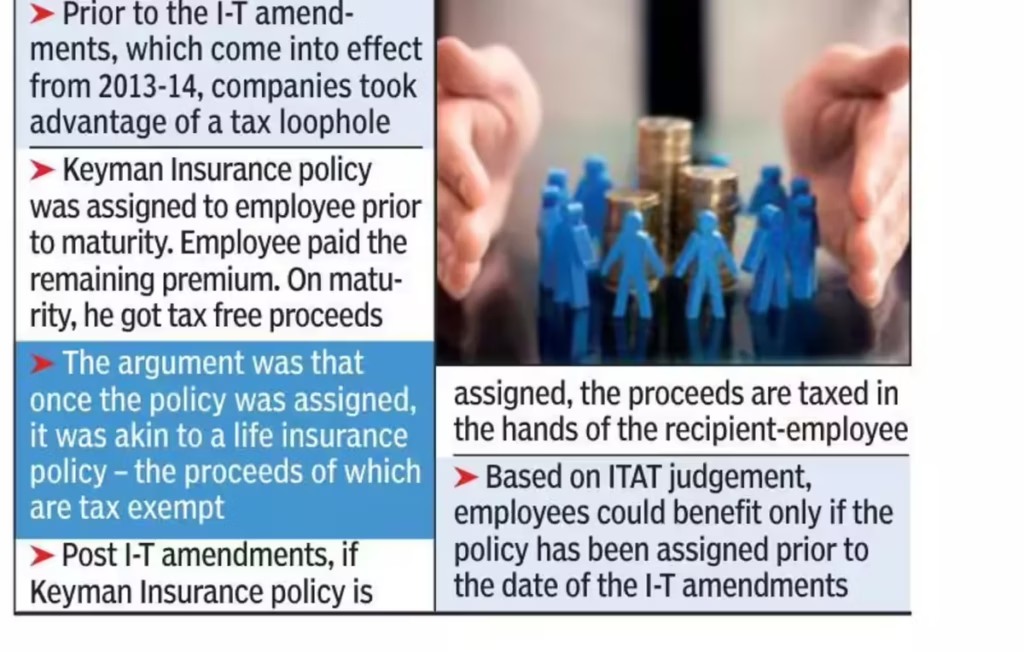

One of the key ITAT rulings from the first half of 2025 involved a wife who successfully claimed capital gains exemption on properties gifted by her husband. In this case, the Income Tax Department had challenged the exemption under the clubbed income provisions, arguing that since the properties were given by the husband, the income should be taxed in his hands.

However, the tribunal ruled in favor of the wife, stating that she was the rightful owner of the properties and had complete legal entitlement to the capital gains exemption under Section 54 of the Income Tax Act. This ruling is significant as it clears up confusion regarding clubbed income provisions, emphasizing that ownership matters when determining eligibility for capital gains exemptions.

Practical Tip:

If you’re involved in intra-family property transfers, make sure that all documentation is in place to establish ownership clearly. This will help in avoiding disputes related to capital gains exemptions down the line.

2. Long-Term Capital Gains (LTCG) Exemption: Joint Ownership Is Not a Hindrance

Another important ruling from ITAT Mumbai involved a husband and wife duo who had sold two properties to purchase a new property jointly. They were seeking long-term capital gains (LTCG) exemption under Section 54. The tax department argued that because the new property was purchased jointly, the exemption should not apply.

The tribunal disagreed, ruling that joint ownership does not automatically disqualify a taxpayer from claiming LTCG exemption, as long as the capital gains are reinvested in the new property as per the law’s requirements. This ruling offers clarity to taxpayers who jointly own a property and are unsure of their eligibility for tax exemptions.

Practical Tip:

If you and a family member or spouse are planning to sell a property and purchase a new one jointly, make sure you understand how joint ownership works in terms of tax exemptions. It’s always best to consult with a tax advisor to ensure compliance with all legal provisions.

3. Relief for Taxpayer Misled into False Deductions

In a case in Pune, a taxpayer was granted relief by ITAT after it was found that he had claimed false deductions in his income tax returns, leading to a significant reduction in his taxable income. The tribunal accepted his explanation that he was misled by a third party and had taken corrective steps as soon as he realized the error. The ITAT emphasized that intent matters when it comes to penalties, and in this case, the taxpayer’s willingness to rectify the mistake worked in his favor.

Practical Tip:

If you’re ever in doubt about a tax deduction or claim, it’s better to consult with a professional before filing your returns. If a mistake happens, be proactive in correcting it and communicate with the tax authorities to avoid heavy penalties.

4. No Relief for Congress in Tax Case: The Importance of Filing on Time

One of the more high-profile cases involved the Indian National Congress, which faced a ₹199 crore tax demand. The party appealed to ITAT, but the tribunal upheld the tax department’s decision, citing violations such as late filing of returns and acceptance of cash donations, both of which are in contravention of tax regulations.

This ruling serves as a reminder of the importance of timely and accurate tax filings, especially for organizations that deal with large sums of money and public donations. Proper documentation and adherence to tax laws are crucial, as even small violations can lead to substantial tax liabilities.

Practical Tip:

Make sure all your returns are filed on time and that donations are properly documented. If you’re involved in handling donations, establish clear protocols to avoid issues with tax compliance.

5. NRI Wins Unexplained Investment Case

In another key ruling, an Indian engineer working in Dubai for several years won his case against a tax demand concerning ₹69 lakh of unexplained investments. The Income Tax Department had accused him of hiding income by failing to explain the source of the funds. However, the ITAT found that the engineer’s investments were made using savings accumulated over his years of working abroad and were legally transferred to India.

This ruling underscores the importance of proper documentation and transparency for Non-Resident Indians (NRIs). The ITAT’s decision reiterates that overseas income, when properly documented and declared, will not be subject to tax penalties if it’s repatriated to India in accordance with the law.

Practical Tip:

For NRIs, keeping detailed records of overseas income and its transfer to India is essential for tax purposes. When filing returns, ensure that all relevant documents, including bank statements and income certificates, are included to substantiate your claims.

6. Reassessment Invalid Without Speaking Order

A crucial ruling from ITAT Kolkata involved the quashing of a reassessment order where the Assessing Officer failed to dispose of the written objections submitted by the taxpayer against the reopening of the assessment. The tribunal emphasized the need for a speaking order, meaning that the authorities must explain their reasons for dismissing the objections. This is a significant procedural safeguard that ensures fairness and transparency in tax assessments.

Practical Tip:

If your assessment is being reopened and you’ve raised objections, ensure that the authorities provide a speaking order addressing your concerns. If they fail to do so, consider challenging the reassessment in court.

How 2025’s Most Important ITAT Rulings Impact the Tax Landscape?

The decisions from the ITAT reflect the tribunal’s commitment to ensuring fair treatment of taxpayers while upholding the integrity of the tax system. These rulings are not just legal decisions—they have real-world implications for taxpayers across the country. By reinforcing the importance of proper documentation, transparent financial practices, and timely filings, ITAT is shaping the future of India’s tax administration.

For tax professionals, these rulings provide key insights that can help guide clients through complex tax matters, ensuring they stay compliant and avoid penalties. For individuals, understanding the intricacies of these rulings can help them make informed decisions and maximize their tax benefits.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Groundbreaking High Court Ruling on GST and Expat Employee Secondments—What It Means for Businesses!