$2,700 Tax Refund for Aussies: When you hear “$2,700 tax refund for Aussies,” it almost sounds like a scammy online headline. But this one’s real—it’s a serious tax reform proposal currently sparking debate across Australia. The idea? Give workers a $2,700 income tax cut while expanding the Goods and Services Tax (GST). Economists say this could unlock a $152 billion windfall and reshape the Aussie economy. So, is this just another political dream, or a realistic chance to rethink how Australians pay tax? Let’s break it down step by step, using clear language, practical examples, and professional insights you can trust.

$2,700 Tax Refund for Aussies

The $2,700 tax refund for Aussies tied to a broader GST expansion is bold, ambitious, and hotly debated. Economists argue it could bring a $152 billion boost, more jobs, and housing reform. But critics warn of higher living costs, equity issues, and political hurdles. For now, it remains a proposal—but one that could fundamentally reshape how Australians work, spend, and invest.

| Element | Details |

|---|---|

| Tax Refund Proposal | $2,700 annual income tax cut for the average worker |

| GST Expansion | More goods/services taxed at 10% rate |

| Projected Windfall | $152–158 billion boost to economy |

| Economic Impact | +6% GDP, +11% business investment, +8% housing supply |

| Other Reforms | Replace stamp duty with land tax; tax corporate “super-profits” |

| Risks | Higher living costs for families; equity concerns |

| Status | Proposal only—not government policy |

| Source | The Guardian |

What the $2,700 Tax Refund for Aussies Actually Means?

This isn’t a one-off handout or “stimulus check” like the U.S. gave during the pandemic. It’s a structural tax cut—a permanent change to how much of your paycheck you keep.

According to economist Chris Murphy, the average Aussie worker could pocket an extra $2,700 per year. To visualize:

- That’s six months’ worth of family groceries.

- Enough for a solid domestic vacation.

- Or a few mortgage repayments knocked out early.

But here’s the kicker: this money doesn’t fall from the sky. It’s funded by expanding the GST, so you’ll pay more tax at the checkout.

How the Bold GST Plan Works?

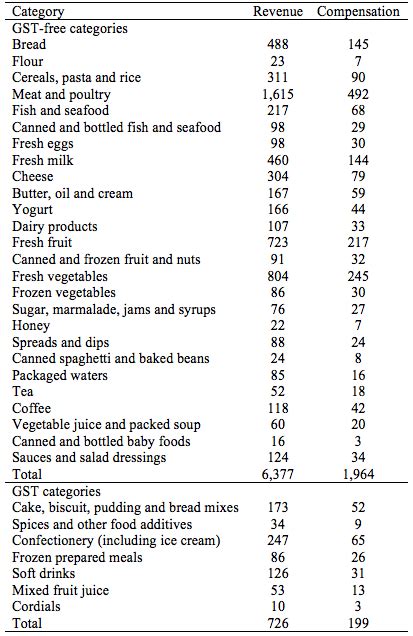

1. Widening the GST Base

Currently, essentials like fresh food, health, and education are GST-free. Under this plan, more of these items could be taxed.

Example: A $500 grocery bill that’s GST-exempt now could jump to $550 if fully taxed. That sounds painful, but across a year, your $2,700 refund could outweigh those costs.

2. Replacing Stamp Duty with Land Tax

Buying a house in Australia comes with stamp duty—a huge upfront tax that can cost tens of thousands. Economists argue it discourages people from moving or downsizing. Replacing it with an annual land tax, similar to U.S. property taxes, would spread costs over time and make housing markets more fluid.

3. Taxing Corporate Super-Profits

Not all business profits are equal. The plan suggests cutting taxes on “normal” profits while taxing super-profits harder—like the billions mining companies make during boom years. This keeps small businesses competitive while ensuring large corporations contribute fairly.

The $152 Billion Economic Windfall

Murphy’s modeling suggests the reform could deliver:

- +6% real GDP growth

- +11% increase in business investment

- +8% more housing supply

That’s a $152–158 billion boost over time—an upgrade to the nation’s economic engine without raising the overall tax burden.

Lessons From History and Abroad

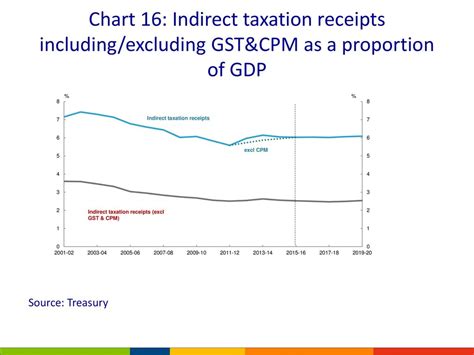

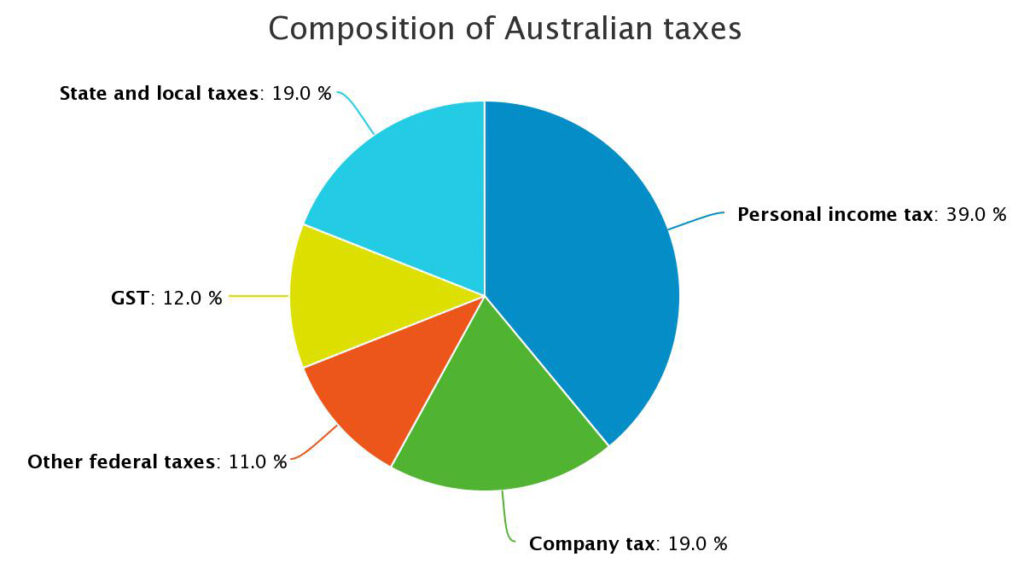

Australia has seen tax shake-ups before. The original GST launched in 2000 under Prime Minister John Howard. Despite fierce opposition at the time, it modernized the tax system and remains a core revenue source today.

Globally:

- U.S.: Relies on income and payroll taxes federally, with states charging their own sales tax (varies by state, usually 4–10%). No national GST.

- Europe: Uses VAT (Value Added Tax), often higher than Australia’s GST. The U.K., for example, charges 20%.

So, Australia’s idea mirrors Europe’s VAT-heavy approach—less tax on wages, more on spending.

Why This Matters for Everyday Aussies?

- More Take-Home Pay: Workers keep a bigger slice of their paycheck.

- Housing Access: Stamp duty reform could open doors for first-time buyers.

- Job Growth: More investment = more jobs and higher wages.

Think of it like swapping out an old Ford truck for a hybrid—same function, better efficiency.

How This Reform Could Affect Different Groups of Australians?

Not everyone experiences tax changes the same way. Here’s how different groups could feel the impact:

Families

Households with kids may see grocery and education costs rise if GST applies to essentials. But the $2,700 income tax cut could offset those costs, especially for dual-income families.

Young Professionals

Early-career workers stand to benefit most. They’ll pocket the refund and face fewer barriers to buying a home if stamp duty disappears.

Retirees

Since retirees don’t earn wages, they won’t enjoy income tax cuts but would still face higher GST. This group would need targeted rebates or welfare top-ups to avoid unfair pressure.

Small Businesses

Lower corporate taxes on regular profits could give small businesses breathing room. But compliance costs with broader GST rules may increase.

Big Corporations

Mining giants, banks, and resource exporters would face higher taxes on “super-profits.” This could level the playing field, ensuring everyday taxpayers don’t carry the load alone.

Pros & Cons of the GST Expansion Plan

| Pros | Cons |

|---|---|

| $2,700 tax cut gives workers more income | GST on essentials could hit family budgets |

| Boosts GDP, jobs, and investment | Low-income households spend more on taxed goods |

| Makes housing more accessible via land tax | Politically risky—“new taxes” are unpopular |

| Targets corporate super-profits fairly | Requires strong welfare compensation programs |

Risks and Criticisms

While economists love the efficiency, critics warn of pitfalls:

- Living Costs: Expanding GST could hike grocery, health, and education bills.

- Equity Concerns: Low-income families spend a higher share of income on basics, so they’d feel the squeeze most.

- Political Blowback: No government wants to be remembered for making food more expensive—even if voters get refunds elsewhere.

Experts say welfare “top-ups” or rebates would be needed to protect vulnerable households.

Political Reality Check

- Treasurer Jim Chalmers: Open to reform but insists it must go through public debate and bipartisan discussion.

- Prime Minister Anthony Albanese: More cautious—says the government will stick to its election promises for now.

Bottom line: the $2,700 refund is still theoretical. Politicians are testing the waters.

Practical Advice: What Aussies Can Do Now

- Audit Your Taxes – Know how much you’re paying in income tax vs GST today.

- Run Budget Scenarios – What happens if groceries and school fees attract GST? Practice now.

- Monitor Housing Policies – If you’re buying soon, stamp duty reform could reshape your decision.

- Stay Plugged In – Reliable sources like the Australian Tax Office and Treasury post updates.

GST Rate Rejig to Benefit Farmers and Middle Class – FM Sitharaman Outlines Reform Gains

GST Reform to Cut Rates on Vehicles – Will Two-Wheeler and Car Sales Finally Rebound?

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future