₹273.5 Crore GST Notice Against Patanjali Ayurved: When the Supreme Court halts a ₹273.5 crore GST notice against Patanjali Ayurved, it’s not just legal chatter—it’s headline news in India’s corporate and tax world. Imagine the IRS in America fining Whole Foods or GNC millions for alleged tax misreporting, only for the U.S. Supreme Court to step in and pause the penalty. That’s exactly the kind of drama unfolding in India right now. This case is not only about one company—it’s about how India interprets tax law, enforces compliance, and treats penalties in a complex GST regime. Let’s break it down step by step.

₹273.5 Crore GST Notice Against Patanjali Ayurved

The Supreme Court halting the ₹273.5 crore GST penalty against Patanjali Ayurved is more than a corporate pause button—it’s a moment that could reshape India’s GST law and compliance culture. For businesses, the message is loud and clear: transparency is everything. For consumers, it’s a reminder that corporate legal battles often ripple down to product shelves and household budgets. The final verdict will not just decide Patanjali’s fate—it will set the tone for how India enforces tax penalties in the years to come.

| Point | Details |

|---|---|

| Case | Supreme Court of India halts ₹273.5 crore GST penalty recovery against Patanjali Ayurved |

| Who’s Involved | Patanjali Ayurved, Directorate General of GST Intelligence (DGGI), Union Government, Supreme Court of India |

| Date of SC Order | August 14, 2025 |

| Background | DGGI issued penalty notice in April 2024 for alleged GST violations (suppression of supply & misuse of input tax credit) |

| HC Ruling | Allahabad High Court upheld penalty in May 2025 |

| Current Status | Supreme Court granted interim relief; penalty recovery on hold |

| Official Website | Supreme Court of India |

A Quick Background on Patanjali

Founded in 2006 by Baba Ramdev, India’s most famous yoga guru, and his close associate Acharya Balkrishna, Patanjali Ayurved has grown from a small herbal products maker into a multi-billion-dollar FMCG powerhouse.

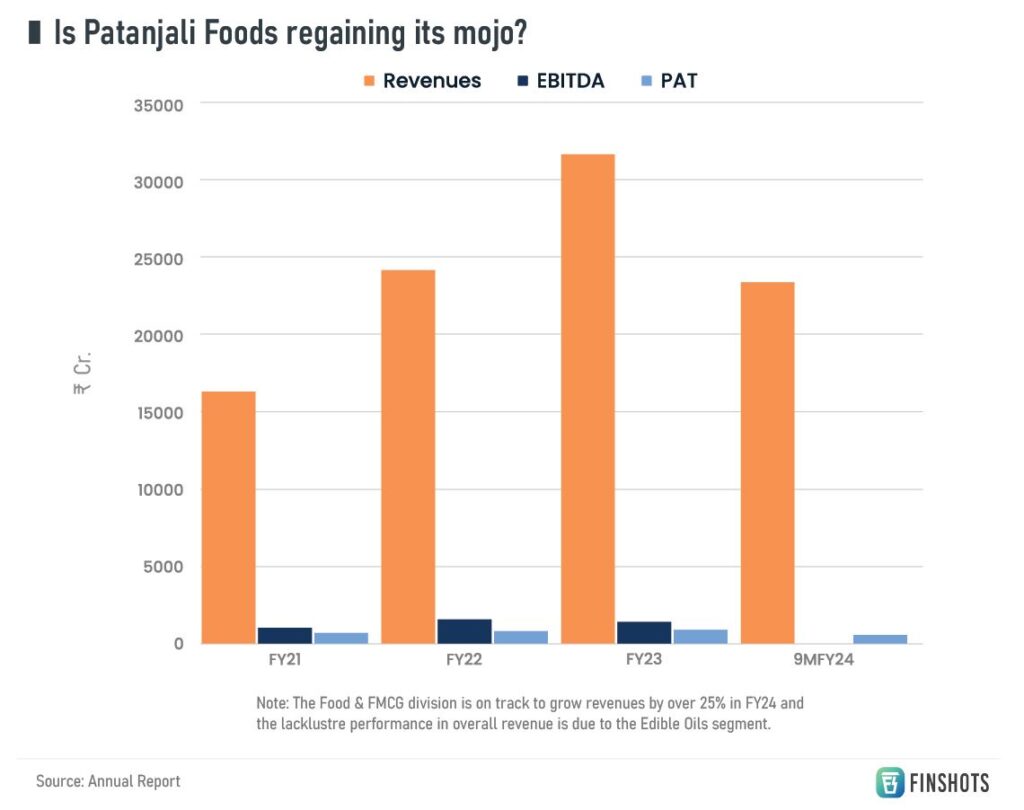

- In 2023, Patanjali reported revenues crossing ₹30,000 crore (approx. $3.6 billion).

- It competes head-to-head with multinational giants like Colgate, Nestlé, Hindustan Unilever, and Dabur.

- Patanjali has positioned itself as a “Swadeshi alternative”, appealing to national pride and the rising trend of natural products.

For millions of Indians, Patanjali products—from toothpaste and ghee to herbal shampoos—are household staples. That’s why a ₹273.5 crore penalty isn’t just a corporate dispute; it has consumer and market-level consequences.

₹273.5 Crore GST Notice Against Patanjali Ayurved: The Legal Timeline (Simplified for Everyone)

April 2024: The Show-Cause Notice

The Directorate General of GST Intelligence (DGGI) accused Patanjali of:

- Suppressing supply of goods (basically under-reporting sales).

- Misusing input tax credit (ITC) through circular trading.

A show-cause notice was issued proposing a penalty of ₹273.51 crore under Section 122(1) of the CGST Act.

January 2025: Some Relief, But Penalty Stays

The government withdrew a separate tax demand under Section 74, admitting that Patanjali’s transactions were genuine. But they continued with the penalty under Section 122.

Translation: “Okay, you don’t owe us back taxes, but we still think you broke compliance rules—so pay the fine.”

May 2025: Allahabad High Court Decision

- The Allahabad High Court ruled against Patanjali.

- It said that penalties under Section 122 are civil in nature.

- This means they are independent of whether a tax demand under Section 74 exists or not.

August 2025: Supreme Court Steps In

- Justices P.S. Narasimha and A.S. Chandurkar stayed the recovery.

- The Supreme Court issued notices to the Union Government and the DGGI, seeking their response.

- For now, Patanjali doesn’t have to pay until the Court gives its final word.

What Section 122 Really Means?

Section 122 of the GST Act covers penalties for various offenses, such as:

- Supplying goods without invoices.

- Issuing fake invoices.

- Misusing input tax credit.

- Failing to register under GST when required.

Think of it like the penalty box in hockey—even if you don’t commit the “big crime” of tax evasion under Section 74, you can still face fines for breaking smaller compliance rules.

The big debate is: Should penalties still apply if the main tax claim is gone?

Expert Insights

- Tax Lawyers: Argue that continuing penalties without a tax demand creates double jeopardy.

- Economists: Say this case will impact India’s FMCG sector, valued at $110 billion, where compliance costs are already high.

- Policy Analysts: Point out that nearly 35% of GST disputes in India involve penalties. A favorable ruling for Patanjali could reduce litigation across industries.

According to Business Standard, businesses across manufacturing, pharma, and retail are closely watching this case for clues on future compliance.

Impact on Consumers

Why does this matter to you as a shopper?

- Product Prices: If penalties are enforced, companies may pass costs to consumers. That could mean pricier toothpaste or ghee.

- Brand Trust: Legal disputes shake consumer confidence. Some might switch to rivals like Dabur or Colgate.

- Market Competition: If Patanjali weakens, multinational corporations could gain ground, reducing the “desi vs. global” competition balance.

Global Comparisons

This isn’t unique to India. Tax authorities worldwide use civil penalties even when tax claims are adjusted:

- United States: The IRS often imposes “accuracy-related” penalties of 20% on underreported income, even if the main tax bill is reduced.

- European Union: VAT penalties can be enforced independently, with fines of up to 100% of the tax amount.

- Australia: The ATO imposes administrative penalties under strict liability rules, separate from tax recovery.

So, India is following a global compliance trend—tough on reporting errors, not just tax evasion.

Market Repercussions

Patanjali is not just a company—it’s a stock market and supply chain influencer:

- Supply Chain: Farmers supplying raw materials to Patanjali could feel the pinch if cash flows tighten.

- Stock Market: Investors often panic when large penalties are in play. Analysts estimate this dispute could shave off 2-3% of Patanjali-linked market valuations if the penalty is upheld.

- Competitors: Rivals like Dabur and Hindustan Unilever may benefit if Patanjali’s reputation suffers.

Practical Takeaways for Businesses

- Document Transactions Meticulously – Every invoice matters. Digital records save lives in audits.

- Don’t Misuse Tax Credits – ITC is attractive, but any misuse can bring massive penalties.

- Invest in Compliance Teams – Skipping professional tax advisors may save money now but cost millions later.

- Learn from Legal Precedents – Court rulings shape compliance standards. Businesses should stay updated.

Possible Outcomes of the Case

- Supreme Court Favors Patanjali

- Penalties under Section 122 won’t survive without tax demands.

- Businesses breathe easier, litigation drops.

- Supreme Court Upholds Penalty

- Patanjali pays ₹273.5 crore.

- Regulators gain stronger enforcement powers.

- Mixed Outcome

- Penalty reduced or restructured.

- Court clarifies rules for future cases.

Infosys Hit With GST Fine In Singapore – What The Filing Reveals

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

Apollo Tyres Hit With ₹61.52 Lakh GST Demand Over Ineligible Input Tax Credit