36 Shops Sealed in Indore: When you hear “36 shops sealed in Indore – property tax non-payment crackdown intensifies,” it’s more than just another news update. It’s a real-life lesson about civic duty, financial discipline, and what happens when citizens ignore their obligations. This enforcement took place in Indore, Madhya Pradesh, India’s cleanest city. But the lesson applies to homeowners and business owners everywhere, from New Delhi to New York: ignore property tax long enough, and the government will step in — sometimes harshly.

36 Shops Sealed in Indore

The 36 shops sealed in Indore are not just about non-payment — they’re about how critical property tax is to the functioning of a city. Civic services, infrastructure, and even the city’s pride depend on it. For shopkeepers, the lesson is simple: property tax is not an optional expense. For homeowners in the U.S., the message is just as clear: pay on time, or risk foreclosure, liens, and auctions. At the end of the day, property tax is the price of community living. Pay it, and you enjoy well-lit roads, garbage-free streets, and reliable services. Skip it, and the cost multiplies — financially, socially, and legally.

| Detail | Information |

|---|---|

| What happened | 36 shops sealed in Siddhi Vinayak Market 2, Jail Road, Indore |

| Reason | Non-payment of property tax and garbage collection fees |

| Authority | Indore Municipal Corporation (IMC) – Zone 3 team |

| Penalties | Shops sealed; dues must be cleared to reopen |

| Next Steps for Shopkeepers | Submit property registration docs, open tax account, pay dues (same-day processing) |

| Official Resource | Indore Municipal Corporation Website |

What Triggered the Crackdown?

The Indore Municipal Corporation (IMC) had been sending notices to shopkeepers in Siddhi Vinayak Market 2 for months. These notices warned about unpaid property tax and garbage collection fees. Despite repeated reminders, many shopkeepers ignored them.

Finally, IMC’s Zone 3 enforcement team acted. They arrived on Jail Road, locked up 36 shops, and pasted bright notices across the shutters. Now, if these shopkeepers want their businesses reopened, they must:

- Submit registration documents proving ownership.

- Open a property tax account with IMC.

- Pay outstanding dues, calculated based on shop size and type.

According to ARO Anil Nikam, the shopkeepers were given multiple chances. Sealing was only done after non-payment persisted.

A Brief History of Indore’s Property Tax Enforcement

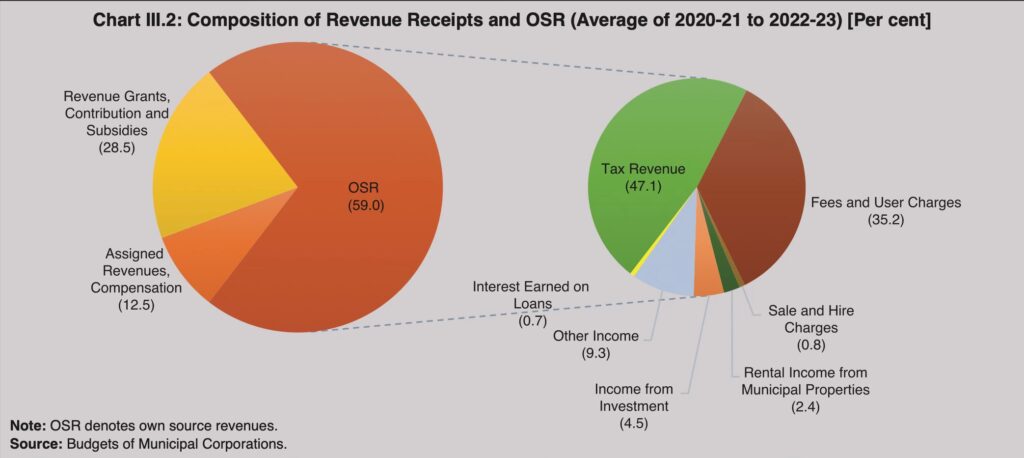

Indore has earned recognition as India’s cleanest city under the government’s Swachh Bharat Abhiyan for several years in a row. But maintaining this reputation isn’t cheap. Property tax is the city’s largest source of revenue.

- In 2019, IMC sealed over 50 shops for unpaid dues.

- In 2021, Indore launched an online property tax portal to make payments easier.

- In 2022, the corporation sealed shops in busy commercial hubs like Rajwada and MG Road.

IMC also uses “name-and-shame” tactics by publishing lists of top defaulters in local newspapers. This strategy, though controversial, often pushes property owners to clear dues quickly to avoid embarrassment.

36 Shops Sealed in Indore: Why Property Tax is Essential

Property tax isn’t just another bill — it’s the financial engine that keeps a city running. Here’s what it funds in Indore:

- Garbage collection (essential for keeping Indore at the top of cleanliness rankings).

- Street lighting and maintenance of roads.

- Water supply and sewage treatment plants.

- Firefighting services and local policing.

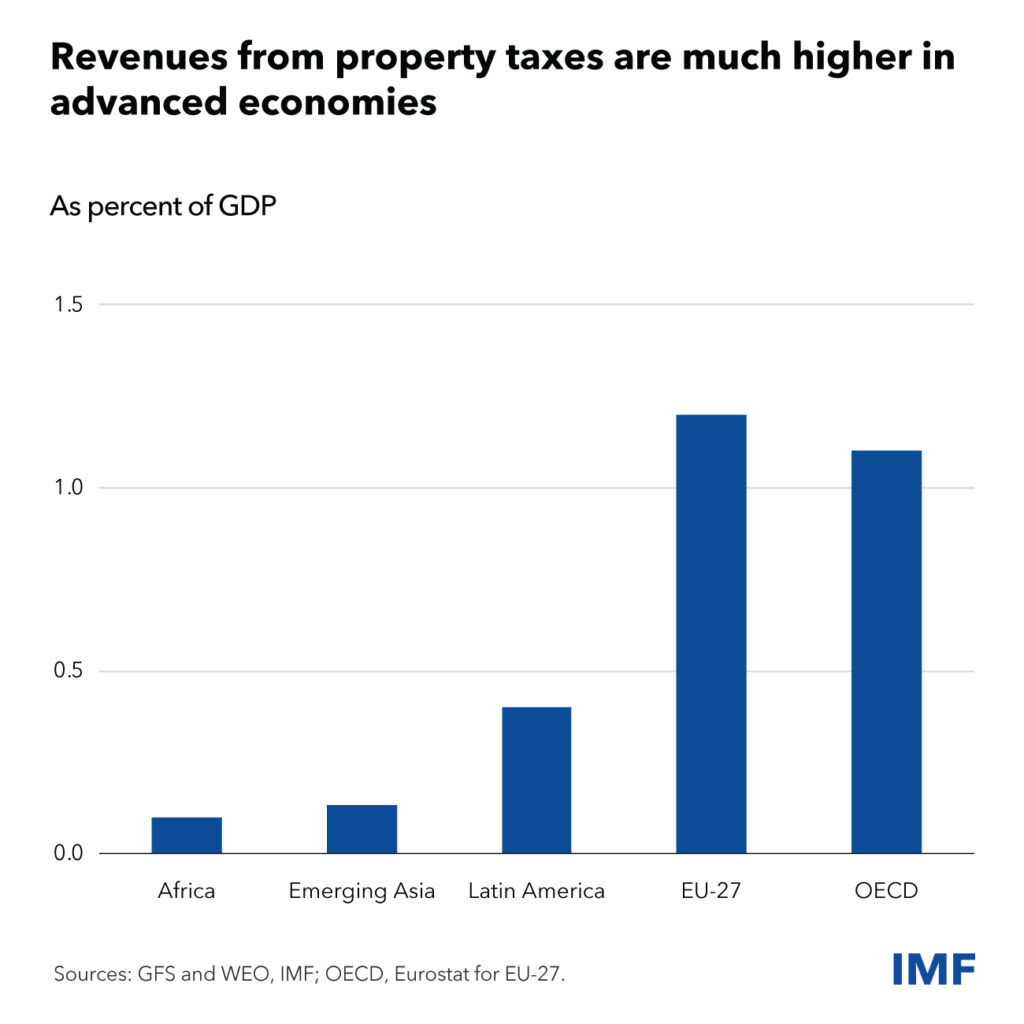

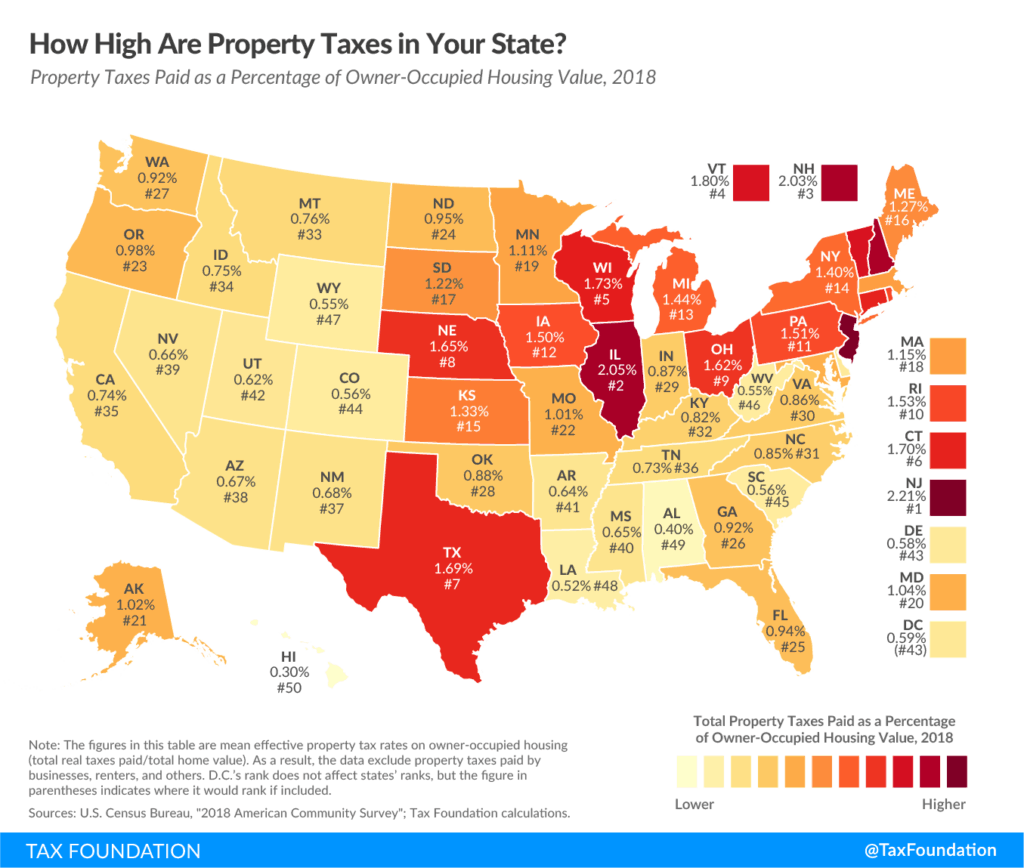

In the U.S., property taxes are even more critical. According to the Urban Institute, about 72% of local government revenue comes directly from property taxes. These funds cover schools, police departments, libraries, and infrastructure.

So, whether you’re in Indore or Illinois, skipping property tax means undermining the very services you rely on daily.

Legal Framework Behind Property Tax Enforcement

In India, municipal corporations operate under state-level legislation. For Indore, the Madhya Pradesh Municipal Corporation Act gives IMC the authority to:

- Issue demand notices.

- Impose penalties on late payments.

- Seal properties temporarily.

- Auction properties if dues remain unpaid for long periods.

Similarly, in the U.S., state laws dictate timelines for foreclosure or tax lien sales. For example:

- Texas: Properties can be foreclosed within 6 months of non-payment.

- California: Counties can auction properties after 5 years of delinquency.

- Illinois: Delinquent taxes are sold at tax lien sales, where investors buy the right to collect taxes with interest.

The legal teeth may differ, but the principle is the same: the government protects its revenue stream at all costs.

The Economic Fallout of Shop Sealing

When 36 shops in Indore were sealed, the effect rippled beyond those business owners:

- Shopkeepers lost daily income.

- Employees working in those shops lost wages.

- Customers had to travel farther for basic needs.

- The local economy slowed down in that commercial zone.

Consider a small tailoring shop earning ₹4,000 ($48) daily. A week of closure wipes out nearly ₹28,000 ($340) in revenue — not counting the cost of clearing dues and penalties.

Multiply that by 36 shops, and you see how non-payment doesn’t just affect the city — it hurts entire communities.

A Case Study: Rajesh the Shopkeeper

Take the example of Rajesh, who owns a stationery shop in Siddhi Vinayak Market. His property tax bill was ₹15,000 ($180). He ignored it, thinking it was too small to worry about.

Now his shop is sealed. To reopen, he must pay the original tax plus a penalty, totaling ₹18,000 ($220). Meanwhile, he’s losing ₹5,000 ($60) a day in sales. In just one week, the financial damage is far worse than the original bill.

This shows the false economy of ignoring property taxes.

Social and Psychological Effects

Property sealing isn’t just a financial blow — it’s also socially damaging. In India, businesses thrive on reputation and trust. Seeing a shop sealed creates doubt in customers’ minds: “If he can’t even pay taxes, is he reliable?”

The embarrassment of having your business locked up publicly often motivates shopkeepers to pay quickly. But it also leaves scars on reputation that can take years to rebuild.

Practical Guide: How to Stay Out of Property Tax Trouble

Here’s a step-by-step plan for shopkeepers and homeowners everywhere:

1. Understand Your Property Tax Bill

- In India, it’s often based on annual rental value.

- In the U.S., it’s calculated on assessed market value.

2. Automate Payments

- In the U.S., most mortgages include an escrow account for taxes.

- In Indore, you can use the IMC online portal.

3. Know the Relief Programs

- Senior citizens, low-income families, and veterans often qualify for rebates or exemptions.

- For example, U.S. veterans can get major reductions through VA programs.

4. Don’t Ignore Notices

Notices are official warnings, not junk mail. Address them immediately to avoid penalties.

5. Seek Professional Help

If your taxes feel overwhelming, consult a property tax consultant or accountant. Realtors can also explain obligations to new buyers.

Parallels in the U.S.

The situation in Indore mirrors enforcement in American cities.

- Cook County, Illinois: In 2023, thousands of delinquent properties were listed for tax lien sales.

- Texas: Monthly auctions sell off properties of tax defaulters.

- California: Counties publish public notices and eventually auction off homes.

While the enforcement style may differ, the result is the same: pay late, and risk losing your property.

Expert Voices

Dr. Sunil Gupta, an urban economist, explained in an interview:

“Municipal bodies must balance strict enforcement with taxpayer education. Indore is doing the right thing by enforcing laws, but the bigger win will come when citizens see tax payment as civic pride, not just an obligation.”

This is the larger challenge — shifting the mindset from forced payment to voluntary civic responsibility.

Future Outlook – What Lies Ahead for Indore

Indore is already ahead of many Indian cities in tax compliance. But the sealing of 36 shops shows gaps remain. Going forward, we can expect:

- More digital payment systems to simplify compliance.

- Awareness campaigns educating citizens on why property tax matters.

- Harsher penalties for chronic defaulters, including permanent property seizure.

For U.S. cities, similar trends are visible — greater reliance on online portals, automated notices, and stricter foreclosure laws.

Deadline Extended: Property Tax Defaulters Get Time Till August 31 to Settle Dues

₹167 Crore Property Tax Collected In Just Weeks – How PCMC Pulled It Off