₹4 Crore Bank Fraud in Bhopal Exposed: When you hear about scams, most folks picture shady phone calls, spam emails, or someone trying to sell you a fake vacation package. But in Bhopal, India, a ₹4 crore bank fraud (about $480,000) slipped under the radar for years—until the victim got an income tax notice. That’s when the whole scheme unraveled, exposing not just one fraudster but also loopholes in the banking system. This case isn’t just about one man’s nightmare. It’s a wake-up call for anyone—whether in India, the U.S., or anywhere else—about identity theft and weak financial safeguards.

₹4 Crore Bank Fraud in Bhopal Exposed

The ₹4 crore Bhopal bank fraud is more than a shocking news item. It’s proof that identity theft, insider fraud, and weak oversight can combine into a perfect storm. While the police are on the case, the broader lesson is clear: treat your identity like currency. Protect it, monitor it, and react quickly if something feels off.

| Aspect | Details |

|---|---|

| Amount Involved | Nearly ₹4 crore (~$480,000) |

| Trigger | Income Tax Notice in October 2024 |

| Timeline | Fraudulent account opened in February 2021 |

| Method Used | Misuse of shared ID documents, fake SIM, forged details |

| Suspects | Former bank employee, suspected negligence by branch manager |

| Police Action | Probe ordered by Bhopal Police Commissioner; 3 suspects under scanner |

| Systemic Issue | Account lacked victim’s signature & mobile verification |

| Official Source | Free Press Journal |

The Backstory: How Did This Happen?

- The victim shared ID documents with an insurance advisor for a health policy.

- Those documents were misused to open a fake bank account in February 2021.

- Over three years, ₹4 crore worth of transactions passed through it.

- The victim only found out when the Income Tax Department flagged “undeclared income” in October 2024.

When he checked with the bank, he was stunned: the account had no valid signature or mobile number. Yet, somehow, it operated smoothly for years.

How Banks Dropped the Ball?

Banks in India (and globally) are bound by KYC (Know Your Customer) norms. These require checking:

- Identity proof

- Address proof

- Mobile linkage

But in this case, the bank didn’t follow even basic steps. Worse:

- The victim complained months earlier, but the bank ignored him for six months.

- Police suspect an ex-employee may have created the account, with the branch manager’s negligence (or collusion) playing a role.

If this sounds outrageous, it’s because it is. Imagine a U.S. bank letting someone open an account without a Social Security number verification. That’s the scale of the oversight here.

The Investigation: Who’s in the Hot Seat?

- Police Commissioner Harinarayanchari Mishra ordered a probe.

- Three suspects are currently under scrutiny.

- A fake SIM card tied to forged documents was linked to the account.

- Notices have been served to the bank, which must explain its failures.

Investigators are now digging deeper into whether the fraud was a solo act or part of a wider organized cybercrime network.

Why ₹4 Crore Bank Fraud in Bhopal Exposed Matters Beyond Bhopal?

This isn’t just “an Indian thing.” Identity theft is a global epidemic:

- In the U.S., the Federal Trade Commission (FTC) logged 1.1 million identity theft reports in 2022.

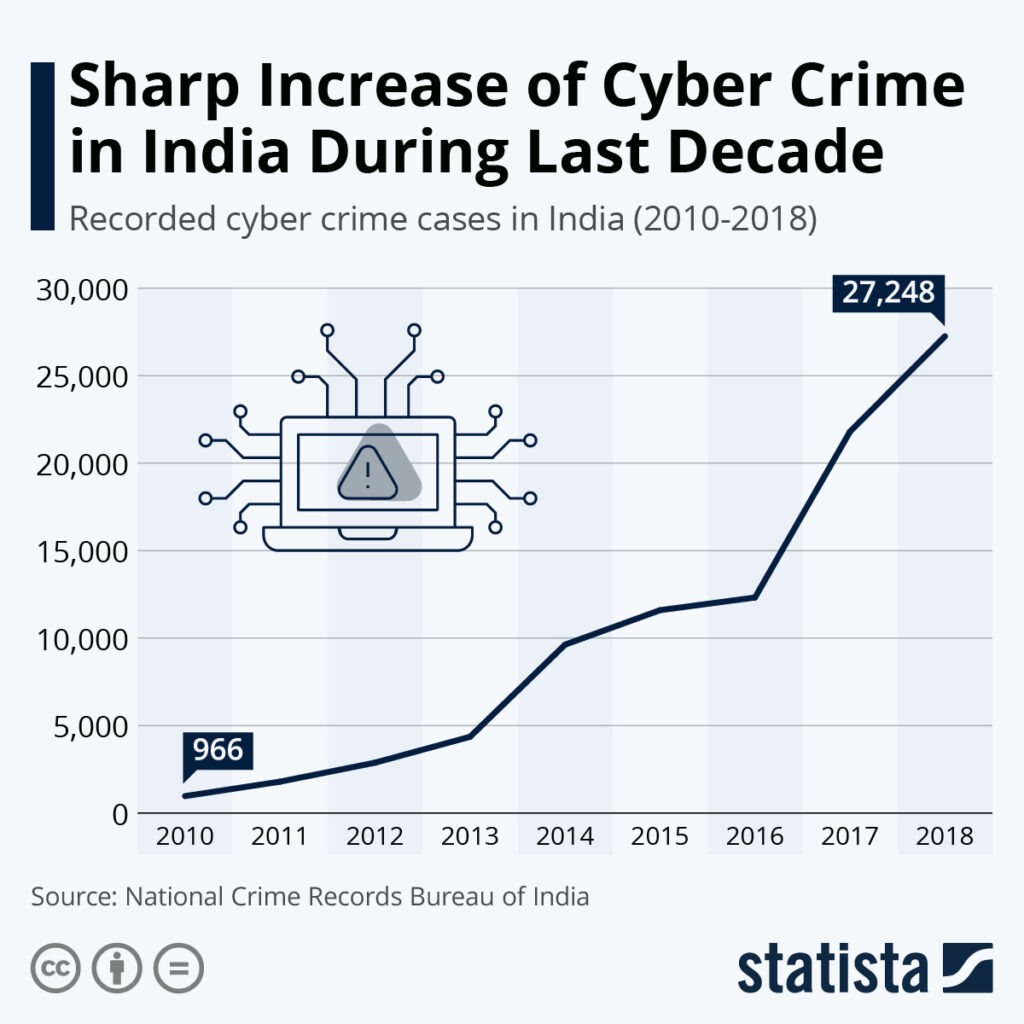

- In India, the National Crime Records Bureau (NCRB) reported 52,974 cyber fraud cases in 2022, showing double-digit growth compared to earlier years.

- In the UK, fraud accounts for over 40% of all crimes, with identity misuse a leading factor.

The message is simple: your ID is global currency. Protect it.

Expert Insights: Why Identity Fraud is Growing

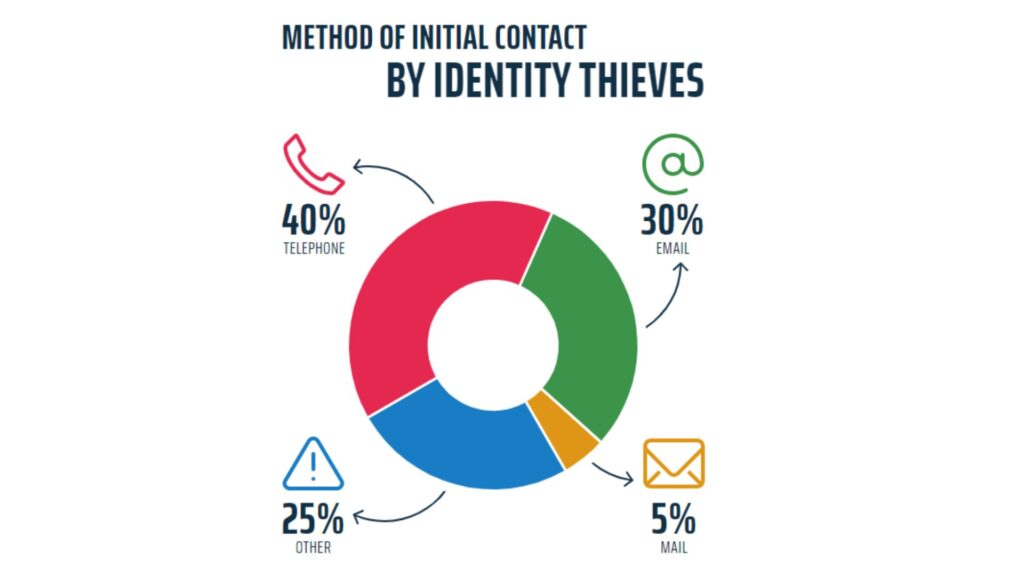

According to cybersecurity analysts, three factors fuel scams like this:

- Over-reliance on paper documents – easy to forge, hard to track.

- Banking negligence – understaffed branches and lax oversight.

- Tech-enabled fraud networks – using fake SIMs, mule accounts, and instant transfers.

Banking fraud expert James Lewis from the Center for Strategic and International Studies (CSIS) notes:

“The biggest problem isn’t the tech—it’s the humans behind the systems. When insiders get involved, fraud detection systems often fail.”

The Victim’s Struggle

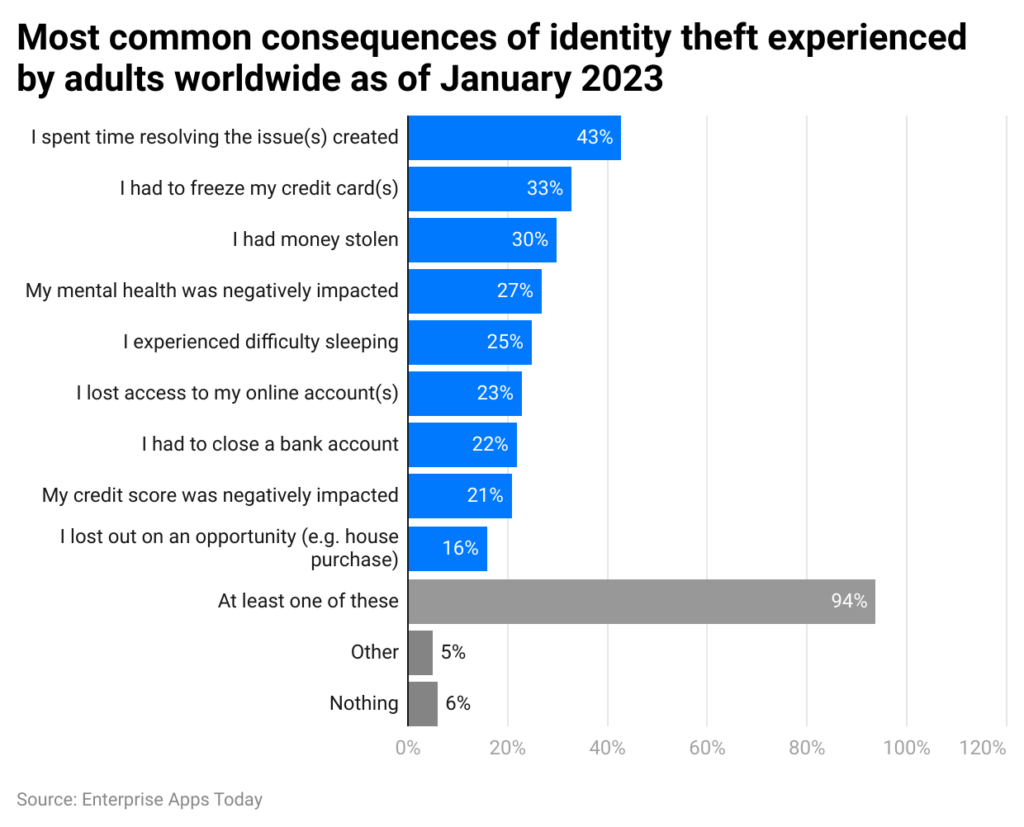

Beyond the numbers, think of the real human impact. The victim here wasn’t just fighting fraudsters—he was battling his bank, the tax department, and his own shock. Imagine being told you owe tax on ₹4 crore you never earned. For most people, that’s life-altering stress.

This is why fraud cases often lead to emotional trauma, not just financial mess. Victims face:

- Reputational damage (being linked to suspicious accounts)

- Hours of paperwork and legal fights

- Anxiety over further misuse of their IDs

Practical Advice: Protect Yourself from Bank Frauds

Here’s your no-nonsense checklist:

1. Guard Your Documents

- Never hand over IDs casually.

- Add a watermark like “For Bank Use Only” when sharing copies.

2. Monitor Your Credit & Taxes

- In India: use the Income Tax Portal.

- In the U.S.: check free reports at AnnualCreditReport.com.

3. Lock or Freeze Credit

- U.S. users: Contact Equifax, Experian, and TransUnion to freeze credit.

- Indian users: Enable CIBIL credit monitoring.

4. Activate SMS/Email Alerts

Banks provide free transaction alerts. Turn them on—always.

5. Escalate Quickly

- In India: Report to Banking Ombudsman if banks delay.

- In the U.S.: Escalate to Consumer Financial Protection Bureau (CFPB).

Tech Tools That Help

- Biometric KYC – Fingerprint/face scans prevent fake accounts.

- AI Fraud Detection – U.S. banks like JPMorgan Chase use AI to flag unusual activity.

- Credit Monitoring Apps – Experian, Credit Karma, and India’s CIBIL now send real-time alerts.

Global Comparisons: Similar Scams

- U.S. (2021): A Wells Fargo employee was jailed for helping fraudsters launder money.

- UK (2022): Fake accounts worth £1.2 billion uncovered, many tied to forged IDs.

- India (2023): Pune police cracked a ₹20 crore scam using SIM swaps and fake IDs.

The common thread? Weak verification plus inside help.

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

Two Company Directors Arrested – Separate Tax Fraud Cases Expose New Crackdown

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud

Step-by-Step: What To Do If You’re a Victim

- File a police FIR (or FTC Identity Theft Report in the U.S.).

- Inform your bank and freeze accounts.

- Alert the tax authorities.

- Check your credit reports for other fraud.

- Escalate to regulators if banks delay action.

- Keep all records—emails, notices, complaint receipts.

The Role of Regulators

In India, the Reserve Bank of India (RBI) has been tightening rules, introducing:

- Video KYC for stronger identity checks

- Mandatory fraud reporting by banks

- Fines on banks that delay customer complaints

In the U.S., agencies like the FDIC and CFPB set strong compliance requirements. But even there, cases of negligence pop up.

Lesson? Rules help, but without enforcement and vigilance, fraudsters still win.