₹50 Crore GST Scam Busted: The ₹50 crore GST scam busted in Mumbai is making waves not just in India, but also among financial crime watchers globally. It’s a stark reminder that tax systems, no matter how well designed, can be exploited when oversight meets opportunism. If you’re in the U.S., imagine the IRS catching someone claiming huge refunds on taxes they never paid — using businesses that existed only on paper. The Maharashtra State GST Department (SGST) recently arrested Yashwant Kumar Tailor and Om Jay Ramrakhiani in two separate cases of fraudulent Input Tax Credit (ITC) claims. Together, the alleged tax evasion amounts to ₹50 crore — more than $6 million USD. And these weren’t simple bookkeeping errors; authorities allege these were calculated schemes using fake invoices, sham suppliers, and ghost businesses.

₹50 Crore GST Scam Busted

The ₹50 crore GST scam in Mumbai shows how loopholes can be exploited when oversight meets intent to cheat. But it also highlights India’s increasing ability to detect and act against fraud, thanks to technology and tighter laws. For businesses, the takeaway is clear: stay compliant, document everything, and choose your partners wisely. In a system built on trust and transparency, cutting corners can cost far more than it saves.

| Key Point | Details |

|---|---|

| Total Fraud Amount | ₹50+ crore (~$6M USD) |

| Main Suspects | Yashwant Kumar Tailor (Magic Gold Bullion Pvt. Ltd.), Om Jay Ramrakhiani (RFIC Trading Pvt. Ltd.) |

| Period of Fraud | June 2020 – June 2025 (Case 1) |

| Fraud Method | Bogus invoices, fake suppliers, ITC claims without actual goods/services |

| Arresting Authority | Maharashtra State GST Department, Mumbai |

| Official Source | GST Portal |

Case 1: The ₹30.51 Crore Gold Rush That Never Happened

Yashwant Kumar Tailor, director of Magic Gold Bullion Pvt. Ltd., allegedly claimed ₹30.51 crore in fraudulent ITC between June 2020 and June 2025. Investigators say his company “purchased” gold from suppliers that were essentially ghost entities — no warehouses, no employees, no legitimate operations.

Key red flags that tipped off authorities included:

- High turnover with zero physical infrastructure.

- Inability to produce genuine invoices or stock records.

- Links to suppliers that had no tax compliance history.

It’s like claiming you bought truckloads of gold from a “business” operating out of a P.O. box and expecting tax authorities to hand you a refund check.

Case 2: ₹20.05 Crore in “Metal” That Wasn’t There

Om Jay Ramrakhiani, director of RFIC Trading Pvt. Ltd., allegedly claimed ₹20.05 crore in fraudulent ITC. This included ₹3.73 crore received from Bharat Metal Corporation, which itself sourced from bogus entities with canceled GST registrations.

The company’s registered address was a residential property — no manufacturing units, no trade records, nothing resembling a legitimate business. This raised immediate suspicion during physical verification.

Understanding GST and ITC

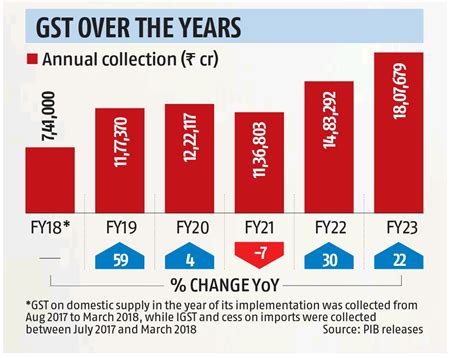

GST (Goods and Services Tax) is India’s unified indirect tax system, introduced in 2017 to replace a complex web of state and central taxes. It’s similar to a nationwide sales tax in the U.S., but with a unique feature: businesses can claim Input Tax Credit on purchases.

Input Tax Credit means you can deduct the GST you’ve already paid on inputs (like raw materials) from the GST you owe on sales. For example:

- You buy raw gold for ₹1 crore, paying ₹30 lakh GST.

- You sell jewelry for ₹2 crore, charging ₹60 lakh GST.

- You owe only ₹30 lakh because you offset the ₹30 lakh paid earlier.

Fraud occurs when businesses claim this credit without real purchases, often using fake invoices or shell suppliers.

How GST Fraud Affects Everyone?

Fraudulent ITC claims don’t just hurt the government — they harm the entire economy. The government loses revenue, forcing it to cut spending on public services or raise taxes elsewhere. Honest businesses face unfair competition, as fraud-backed companies can offer unrealistically low prices.

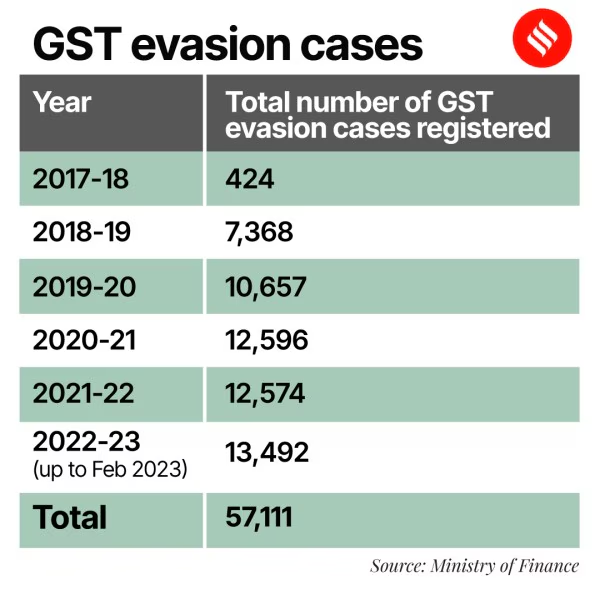

According to India’s GST Council, authorities have detected ITC fraud worth over ₹57,000 crore since GST’s rollout. That’s money that could fund infrastructure, education, and healthcare.

How Authorities Catch ₹50 Crore GST Scam Busted?

The SGST and CGST departments use a mix of technology and on-the-ground verification:

- Data Matching: Cross-verifying buyer and seller GST returns.

- AI and Risk Profiling: Flagging suspicious patterns like high ITC claims with no corresponding stock movement.

- Physical Verification: Inspecting premises to check if businesses exist in reality.

- Bank Transaction Tracking: Looking for circular payments or dummy accounts.

- Cross-Department Coordination: Working with other agencies like the Enforcement Directorate (ED) for deeper probes.

The Legal Side: GST Law and Penalties

Under Section 132 of the Central GST Act, fraud involving more than ₹5 crore is a non-bailable offense and can lead to up to five years in prison, plus fines. Repeat offenders may face stricter prosecution and longer sentences.

For smaller but deliberate frauds, penalties can include heavy fines, cancellation of GST registration, and even blacklisting from government tenders.

India’s Fight Against GST Fraud

Since 2020, the GST Council has tightened compliance rules to curb fake invoice fraud:

- E-invoicing: Mandatory for businesses above a certain turnover.

- Real-time invoice reporting: To prevent backdated or fabricated invoices.

- Increased audits: Especially in high-risk sectors like metals, gems, and electronics.

In December 2023 alone, the Directorate General of GST Intelligence (DGGI) arrested over 140 people nationwide in connection with ITC fraud.

Impact on Supply Chains

Fraudulent GST claims often involve multiple layers of suppliers, some real and others fake. This can taint legitimate businesses unknowingly connected to the chain. For example:

- A legitimate jewelry maker buys gold from a supplier who unknowingly sourced from a bogus trader.

- That jewelry maker’s ITC claim can be questioned, creating cash flow issues.

- Even innocent parties can face audits, delays, and reputational harm.

Expert Commentary

“GST fraud is not just a legal violation — it’s a breach of public trust,” says Ramesh Kumar, former GST commissioner. “The cascading effect on supply chains means even honest players can get caught up in the mess.”

“Technology is making it easier to detect anomalies, but fraudsters are also evolving. That’s why businesses need to be proactive, not just reactive,” adds Meera Shah, a chartered accountant specializing in indirect taxes.

Lessons Learned

For businesses:

- Vet your suppliers using the GSTIN Verification Tool.

- Keep thorough documentation for every transaction.

- Train staff to understand GST compliance basics.

- Review your GST ledger regularly to spot irregularities.

For policymakers:

- Continue enhancing AI-based fraud detection.

- Encourage whistleblower programs to report suspicious activity.

- Simplify compliance to reduce the temptation for shortcuts.

Other High-Profile Cases

- 2023, Delhi: ₹400 crore scam involving 100+ fake firms in construction and metals.

- 2022, Gujarat: ₹1,000 crore ITC racket in chemicals and dyes.

- 2021, Nationwide: DGGI’s “Operation Clean Credit” led to 1,200+ fake firms being deregistered.

Accountant Hacks Firm’s GST Portal and Steals ₹1.80 Crore with Fake Invoices!

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

₹730 Crore GST Scam Explodes: ED Raids 8 Hotspots Across 3 States in Massive Crackdown