₹500 Crore GST Scam Busted in Guwahati: The ₹500 Crore GST Scam busted in Guwahati has shocked the nation and raised big questions about tax compliance in India. Officials uncovered a massive web of fake billing, fraudulent invoices, and tax evasion running into half a thousand crores. The Directorate General of GST Intelligence (DGGI), Guwahati Zonal Unit, confirmed four arrests in this high-profile case. To give you some context, ₹500 crore is equal to nearly $60 million USD. That’s the kind of fraud you’d expect to hear about in Wall Street documentaries or Netflix crime shows, not in a northeastern city like Guwahati. But as history proves, financial fraud doesn’t care about borders, and scams can pop up anywhere.

₹500 Crore GST Scam Busted in Guwahati

The ₹500 Crore GST Scam in Guwahati is more than just a headline—it’s a reminder of the importance of transparency and compliance. Fraudulent networks not only drain government revenue but also undermine trust in the system. As enforcement agencies ramp up their technology and oversight, businesses must adapt by becoming more vigilant. The fight against tax fraud is a shared responsibility, and every honest taxpayer has a role to play.

| Aspect | Details |

|---|---|

| Scam Amount | ₹500 crore (~$60 million USD), may rise with investigation |

| Arrests Made | Gaurav Agarwal, Deepak Agarwal, Vinod Agarwal, Guddu Singh |

| Scam Technique | Fake companies, fraudulent GST invoices, tax evasion |

| Operation Spread | Assam, West Bengal, Delhi; linked to coke plants in Meghalaya & Arunachal Pradesh |

| Raids Conducted | Over 10 properties in Guwahati (Beltola & Lalmati) |

| Law Enforcement | Booked under GST Act, possible action under PMLA |

| Reference | Directorate General of GST Intelligence |

How the Scam Was Uncovered?

Investigators discovered that the accused had floated multiple shell companies—businesses that existed only on paper. These entities were used to generate fake invoices for non-existent sales and purchases. Using these invoices, they claimed Input Tax Credit (ITC), essentially receiving tax benefits for transactions that never happened.

The DGGI, acting on intelligence, conducted simultaneous raids across Guwahati, including high-end apartments and offices in Beltola and Lalmati. Authorities confiscated digital evidence, computers, and transaction records linking the group to illegal businesses, particularly coke plants operating in Meghalaya and Arunachal Pradesh.

Officials believe that the ₹500 crore figure could grow even larger as investigators trace more companies and accounts tied to the syndicate.

Why ₹500 Crore GST Scam Busted in Guwahati Matters?

A scam of this scale is not just about money—it directly impacts taxpayers, businesses, and the economy.

- Taxpayer Burden: Honest citizens end up paying higher taxes to cover what fraudsters evade.

- Public Services Impact: Lost GST revenue means less money for public infrastructure like schools, hospitals, and roads.

- Business Environment: Fake firms distort competition by undercutting genuine businesses.

In simple terms, when fraudsters skip out on taxes, you and I pick up the tab. It’s like everyone splitting the dinner bill, and one guy sneaks out before paying—annoying, unfair, and damaging.

Step-by-Step Breakdown of the Scam

For those unfamiliar with how GST fraud works, here’s a straightforward breakdown:

Step 1: Create Fake Companies

The accused registered shell companies under GST. These entities existed only on paper.

Step 2: Issue Fake Invoices

They generated invoices for sales that never happened. For example: Company A “sells” goods worth ₹50 crore to Company B—but no goods ever changed hands.

Step 3: Claim Input Tax Credit (ITC)

Using these invoices, they claimed tax credits from the government. ITC allows businesses to reduce tax liability on purchases, but in this case, the purchases were fake.

Step 4: Launder the Money

Funds were diverted to illegal businesses such as coke plants and also invested in assets like land and gold.

This is almost identical to IRS refund fraud in the U.S., where scammers file false tax returns to claim money that doesn’t belong to them.

Government’s Response

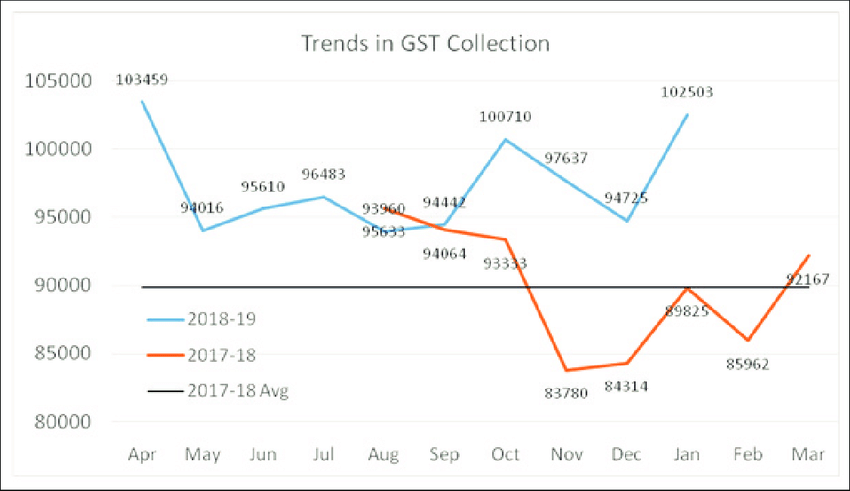

This case highlights how Indian authorities are increasingly using technology to fight fraud. GST systems now rely on:

- AI-based Analytics: Flagging companies with suspiciously high ITC claims.

- E-way Bill Cross-checks: Matching invoices with actual transport and logistics data.

- Banking Records: Verifying that declared transactions align with actual fund flows.

These measures mirror the IRS’s advanced fraud detection systems in the United States, showing that India is strengthening its compliance net.

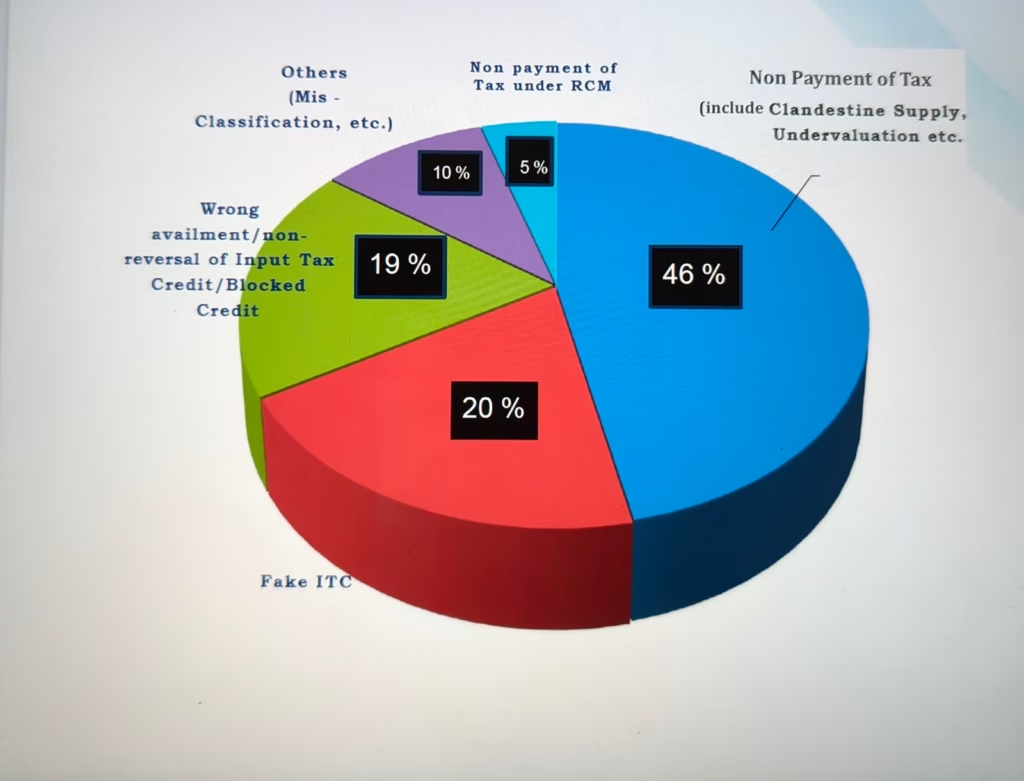

Historical Context – Other Major GST Frauds

The Guwahati case isn’t the first, and unfortunately, it won’t be the last. India has seen multiple large-scale GST frauds:

- Delhi (2020): Fake ITC claims worth ₹3,000 crore through paper companies.

- Mumbai (2021): Real estate developers caught in a ₹1,200 crore fraud.

- Pan-India (2023): More than 7,000 fake firms unearthed in a nationwide crackdown.

According to a 2023 government report, India loses over ₹70,000 crore annually to GST fraud. That’s money that could fund national healthcare or rural development programs.

Expert Opinions

Tax experts warn that fake billing scams are the biggest threat to GST’s credibility.

- CA Rajiv Mehta, Chartered Accountant: “The ITC mechanism is vital for businesses, but it’s being exploited. Companies must do due diligence when selecting vendors.”

- Dr. Anita Sinha, former CBIC official: “Expect stronger compliance checks in coming months—especially real-time invoice matching.”

Their advice highlights a growing reality: compliance isn’t optional, it’s survival.

What Businesses and Professionals Can Do?

To stay safe and compliant, here’s a clear action plan:

Verify Vendors

Check GST registration on the GST Portal. Don’t deal with dubious suppliers.

Claim ITC Wisely

Only claim Input Tax Credit on legitimate purchases. Ensure invoices are genuine.

Keep Thorough Records

Store invoices, bank statements, and transport receipts for at least five years.

Embrace Technology

Adopt accounting software that integrates with GST compliance systems.

Be Audit-Ready

Maintain clean books. The government has the right to audit or raid at any time.

Global Comparisons

This scam fits into a global pattern of tax frauds:

- European Union: VAT fraud costs the EU around €50 billion every year, according to the European Commission.

- United States: The IRS estimates tax fraud costs America $441 billion annually.

- UK Carousel Fraud: A VAT fraud scheme in the 2000s cost the UK billions before being cracked down.

The message is clear: tax fraud is not just India’s problem—it’s a worldwide issue, and enforcement agencies everywhere are fighting it.

Impact on Policy

Large scams like this usually lead to policy reforms. Expect:

- Stricter ITC Verification: Real-time invoice authentication may become mandatory.

- Harsher Penalties: Longer jail terms and higher fines for tax offenders.

- Cross-agency Collaboration: Cases may involve the Enforcement Directorate (ED) under the Prevention of Money Laundering Act.

Such measures are crucial if India wants to meet its ambitious revenue targets and reduce dependency on borrowing.

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

₹2 Crore Fake GST Scam Busted in Chhatarpur — 3 Firms Raided, 2 Were Just on Paper