$700K Tax Evasion and Medical Fraud: When we think of doctors, we often picture trusted professionals who dedicate their lives to saving and improving others’ health. But sometimes, even respected figures fall prey to greed. That’s exactly what happened with Dr. Krishnaswami Sriram, an Indian-origin physician from Illinois, who was sentenced to 34 months in federal prison for $700,000 tax evasion and medical fraud. His case isn’t just about one man—it’s a warning to professionals across industries about the devastating consequences of dishonesty. Beyond the legal penalties, Sriram’s downfall represents the collapse of trust, career, and community reputation that takes decades to build.

$700K Tax Evasion and Medical Fraud

The sentencing of Dr. Krishnaswami Sriram is more than just a headline—it’s a reminder that no one is above the law. His case underscores how dishonesty, especially in trusted professions like medicine, can destroy lives and reputations. For professionals everywhere, the message is simple: integrity matters more than money. Build your career on honesty, because once trust is lost, it may never be regained.

| Details | Information |

|---|---|

| Name | Dr. Krishnaswami Sriram |

| Location | Illinois, USA |

| Offense | Tax evasion (~$1.6M owed) and healthcare fraud |

| Amount Involved | $700,000 transferred overseas |

| Sentence | 34 months in federal prison (August 20, 2025) |

| Career | Practiced internal medicine in Illinois for decades |

| Source | U.S. DOJ Release |

Background: Who is Dr. Krishnaswami Sriram?

Dr. Sriram was a well-established internal medicine physician in the Chicago suburbs. He had built a career serving local patients for decades, earning trust and respect. Like many immigrant doctors, his story began with hard work and long years of medical training, eventually leading to a successful practice in the United States.

However, prosecutors revealed that behind his medical credentials and community presence, Sriram engaged in systematic financial deception. The charges against him were not for minor errors or accidental oversights—they were for willful evasion of taxes and deliberate medical fraud.

How the $700K Tax Evasion and Medical Fraud Worked?

Investigations showed that Sriram:

- Transferred $700,000 from the U.S. to India in an attempt to keep it out of reach from the IRS.

- Under-reported his income while practicing medicine.

- Submitted false or inflated healthcare claims, contributing to healthcare fraud.

- Left about $1.6 million in unpaid taxes, penalties, and interest.

For years, these tactics shielded him from detection. But eventually, federal agencies caught up with him. Once the DOJ and IRS stepped in, Sriram had little choice but to plead guilty.

The Legal Battle and Sentencing

The Department of Justice confirmed that Dr. Sriram entered a guilty plea, acknowledging his fraudulent activities. By pleading guilty, he avoided a full trial, but still faced a stiff penalty.

On August 20, 2025, a federal judge sentenced him to 34 months in prison. Prosecutors argued that Sriram’s conduct showed not only financial misconduct but also a violation of the trust society places in physicians.

In the sentencing memorandum, prosecutors emphasized:

“Healthcare fraud undermines the very foundation of our medical system, while tax evasion shifts the financial burden onto honest taxpayers. Professionals who engage in such conduct must face serious consequences.”

Why This Case Matters?

It may seem like just one doctor’s mistake, but the ripple effects are wide-reaching:

- Patients Pay the Price: Healthcare fraud raises overall medical costs and insurance premiums. Even small frauds affect millions of patients indirectly.

- Taxpayers Lose Out: When someone cheats on taxes, the gap must be covered by law-abiding citizens.

- Trust Is Broken: Doctors hold one of the most trusted positions in America. When that trust is betrayed, it damages public confidence in the system.

The Bigger Picture: Healthcare Fraud in the U.S.

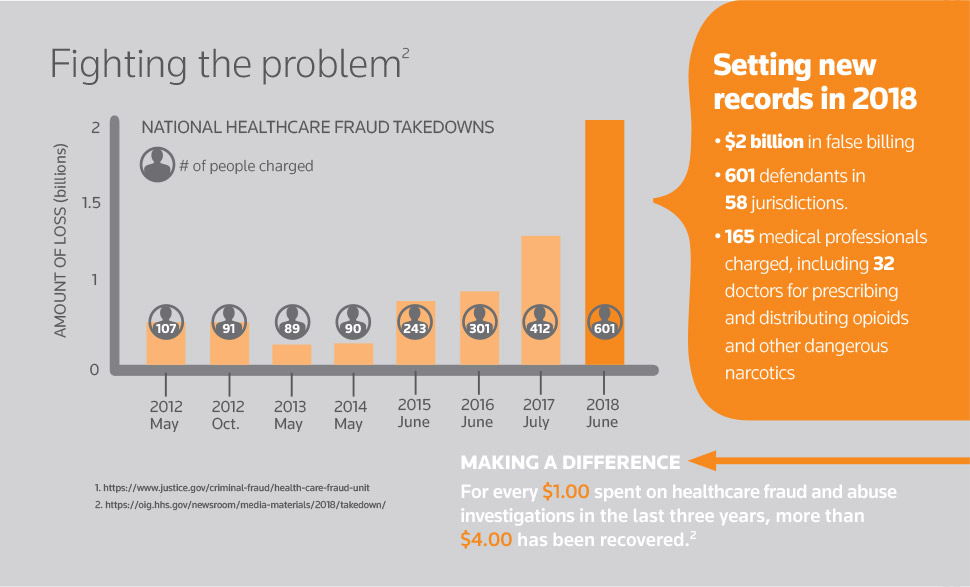

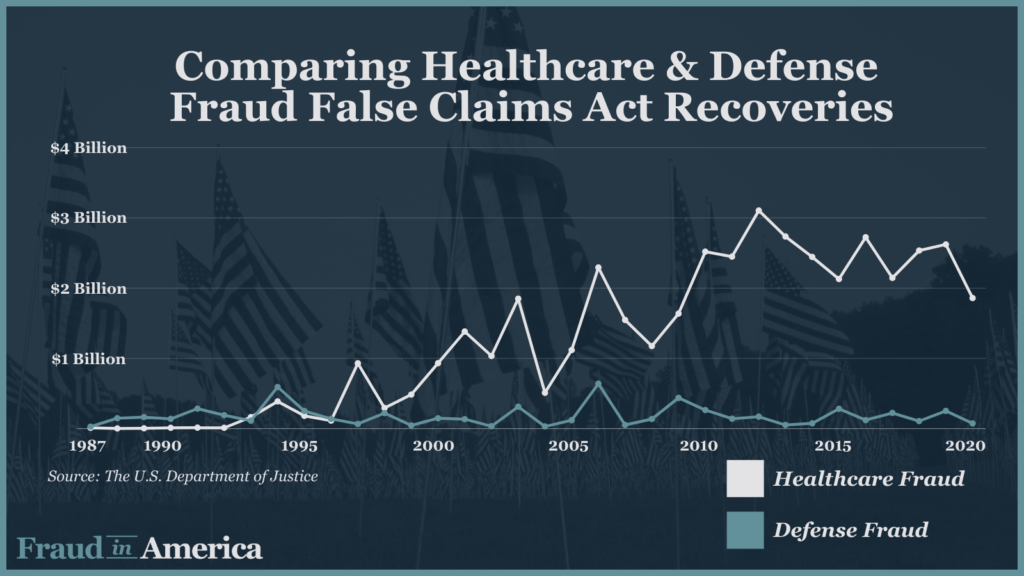

According to the National Health Care Anti-Fraud Association (NHCAA), healthcare fraud costs the United States tens of billions of dollars annually.

- The FBI estimates 3–10% of total U.S. healthcare spending is lost to fraud.

- In 2023 alone, the DOJ recovered $2.5 billion in healthcare fraud settlements and judgments.

- Medicare and Medicaid are often the biggest targets, costing taxpayers billions.

Sriram’s case, though significant, is just one of thousands the government investigates each year.

Examples of Medical Fraud

To put things into perspective, here are common ways fraud happens in healthcare:

- Phantom Billing: Charging for services never performed.

- Upcoding: Billing for more expensive services than actually provided.

- Unnecessary Procedures: Performing or billing for treatments not needed.

- Kickbacks: Receiving illegal payments for patient referrals.

Dr. Sriram’s misconduct likely involved several of these tactics, especially false billing practices, which contributed to his downfall.

Other Indian-Origin Doctors Convicted of Fraud

Sriram isn’t alone. Unfortunately, several other Indian-origin physicians in the U.S. have faced similar charges:

- Dr. Mona Ghosh (Chicago, IL): Sentenced to 10 years in prison for a $2.4 million healthcare fraud scheme involving false insurance claims.

- Dr. Neil Anand (Pennsylvania): Convicted in a $2.3 million healthcare fraud and money laundering scheme.

- Tonmoy Sharma (California): Arrested for an alleged $149 million fraud tied to a network of psychiatric clinics.

These cases highlight a growing concern in the healthcare industry and the importance of accountability.

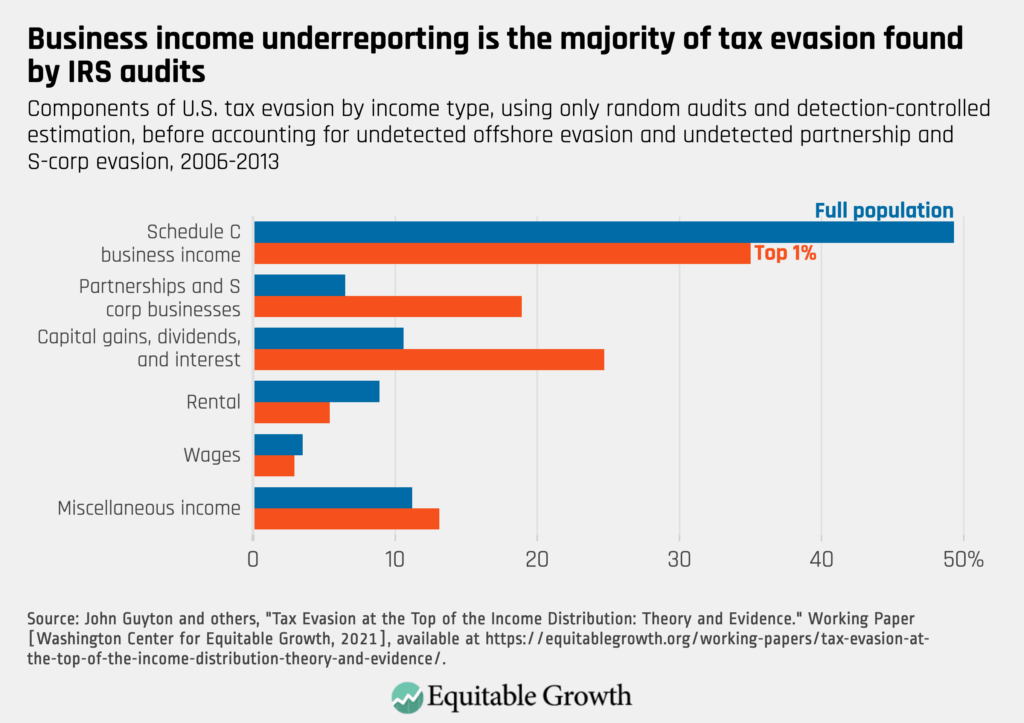

Explaining Tax Evasion for Everyone

Think of it this way: imagine you run a neighborhood car wash and make $500 a week. The law requires you to report all $500 and pay taxes on it. But instead, you only report $300, pocketing the rest tax-free. That’s tax evasion—and it’s illegal.

On a much larger scale, Dr. Sriram did the same by hiding hundreds of thousands of dollars from the IRS and shifting funds overseas.

Lessons for Professionals

This case is more than just a cautionary tale—it’s a playbook for what not to do.

Lesson 1: Never Underestimate the IRS

The IRS’s Criminal Investigation Division is one of the most advanced in tracking financial misconduct. If you’re thinking of cutting corners, think again.

Lesson 2: Reputation Over Riches

A doctor’s reputation is built over years. But just one scandal can erase decades of service.

Lesson 3: Transparency Wins Every Time

Trying to shuffle money internationally or hide income may seem clever, but it only increases risk.

Lesson 4: Think Long-Term

Is saving a few hundred thousand dollars worth losing your license, reputation, and freedom? Almost never.

How Professionals Can Avoid Mistakes Like This?

Here’s a step-by-step guide:

- Keep Accurate Records: Use reliable accounting software like QuickBooks or FreshBooks.

- Hire Professionals: CPAs and tax attorneys exist for a reason—don’t try to outsmart the system.

- Stay Compliant: Medical professionals should follow billing guidelines from CMS.gov.

- Audit Regularly: Self-auditing can help catch red flags early.

- Prioritize Ethics: Always ask, “Would I be comfortable if this decision were on the front page of a newspaper?”

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

Assam Scores Big in Tax Evasion Fight—₹7.5 Crore Recovered from Haryana Firm

Tax Audit Evasion Crackdown Coming—Automated File Selection to Catch More Offenders