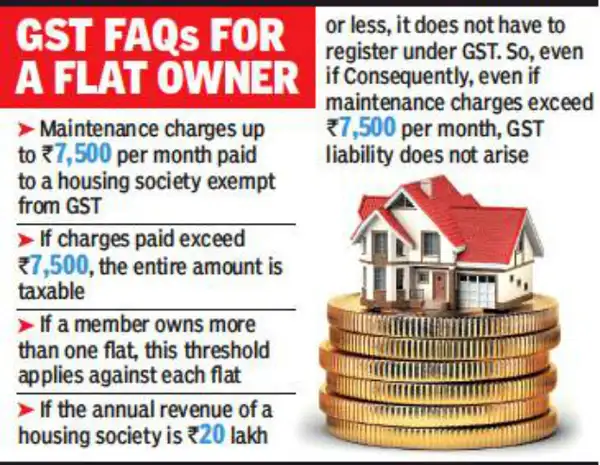

Huge Relief for Homebuyers: For anyone in India who’s been following the tax rules for homebuyers, there’s a big, welcome change in the air! The government has just made it clear that if you live in a smaller apartment, and if your maintenance charges are below Rs 7,500 per month, you’re in luck. These maintenance fees will no longer attract the Goods and Services Tax (GST)! This move is seen as a Huge Relief for Homebuyers who were previously burdened by extra costs due to GST on maintenance services. In this article, we’ll break down this exciting change and explain what it means for you, whether you’re a homebuyer, a homeowner, or someone managing an apartment complex. We’ll also cover how this exemption works, who qualifies, and what to do if you’re unsure about how it affects your apartment. Plus, we’ll give you the official sources, so you can check the details for yourself.

Huge Relief for Homebuyers

This GST exemption is fantastic news for homeowners in India, especially those in smaller apartments. By lifting the GST burden on maintenance charges for apartments with fees under Rs 7,500, the government has provided some much-needed relief. The new rules are simple and straightforward, ensuring that residents of smaller homes don’t face unnecessary tax costs. Make sure to stay up to date with any further developments in tax rules affecting your living situation.

| Key Topic | Details |

|---|---|

| GST Exemption Condition | No GST on maintenance if charges are ≤ Rs 7,500/month |

| GST Applicability | 18% GST applies if charges > Rs 7,500/month |

| Maintenance Fee Criteria | GST is exempt if fees are below Rs 7,500 per resident monthly |

| Annual Turnover of Association | GST registration is required only if annual turnover exceeds Rs 20 lakh |

| Government Source | Official Government Announcement |

| Impact | Helps reduce the financial burden for residents of smaller apartments |

What Is GST (Goods and Services Tax)?

To understand the significance of this exemption, let’s take a quick look at what GST actually is.

GST is a value-added tax that is levied on most goods and services sold for domestic consumption. It was introduced in India to streamline the tax system and ensure uniform taxation across the country. In the case of apartment maintenance, GST applies to services provided by apartment associations or maintenance companies. So, previously, if you lived in an apartment complex, you’d pay a part of your maintenance fee as GST to the association, which then had to remit it to the government.

By exempting maintenance fees below Rs 7,500 from this tax, the government is reducing the financial burden on homebuyers.

Why Is This Change Important for Homebuyers?

This change brings two main benefits to the table for homebuyers:

- Lower Living Costs: For homeowners in smaller apartments, this change means lower costs overall, helping them save money each month.

- Less Tax Confusion: Before this announcement, figuring out whether GST applied to your apartment’s maintenance charges could be confusing. Now, there’s a simple rule—if your charges are under Rs 7,500/month, you’re GST-free!

For those living in apartment complexes with larger maintenance fees, the impact might not be as drastic. However, there’s still hope. GST only applies to the total maintenance fee above Rs 7,500, which means you can still benefit if your charges hover around that number.

The Benefits of GST Exemption

Aside from the Huge Relief for Homebuyers, here’s why this exemption matters:

- Simplified Budgeting: For residents, knowing that no GST will be charged means more straightforward monthly budgeting.

- Encourages Affordable Housing: This policy shift may encourage more developers to focus on affordable housing solutions that cater to smaller apartments, which could lead to an increased supply of budget-friendly homes.

- Reduces Overall Housing Costs: While GST doesn’t apply to the purchase of the property itself (except for under-construction projects), it often impacts ancillary services. Reducing this additional tax on maintenance makes living in smaller apartments less financially daunting.

Who Benefits from This Exemption?

This exemption applies to homebuyers who live in smaller apartments, but let’s get more specific:

- Smaller apartments typically refer to units that fall into a lower price range in the market. These are typically homes that cater to budget-conscious individuals, whether they’re first-time buyers, families, or retirees looking for manageable living expenses.

- If you’re a resident of an apartment where the monthly maintenance charges are Rs 7,500 or less, you’re good to go! No more GST to worry about.

This change also applies to apartment associations that are responsible for managing the complex. Associations with a turnover below Rs 20 lakh and maintenance charges below Rs 7,500 per resident are not required to register for GST at all.

Huge Relief for Homebuyers: A Closer Look

Let’s break it down in steps to make sure everything is crystal clear:

- Maintenance Charge Limit: If the monthly maintenance charge for each resident is below Rs 7,500, GST will not be applied. Simple as that.

- GST for Higher Charges: If the maintenance charge goes above Rs 7,500, the entire maintenance fee will attract 18% GST. So, if you’re paying Rs 10,000 per month, you’ll pay the full Rs 10,000 plus 18% GST on that amount.

- Turnover of Association: The apartment association’s annual turnover plays a role in GST registration. If the association’s turnover is less than Rs 20 lakh and the individual maintenance fee is under Rs 7,500, they don’t have to worry about GST registration.

- For Larger Complexes: If an apartment association manages multiple properties or large complexes where the turnover exceeds Rs 20 lakh annually, GST registration is required, but only if maintenance fees exceed Rs 7,500 per resident.

The Impact of This Change on the Real Estate Market

While this change directly affects the Huge Relief for Homebuyers, it could also have a ripple effect on the broader real estate market. Developers might be incentivized to build more affordable apartments, especially in high-demand urban areas, knowing that this will reduce the tax burden on prospective buyers.

This could lead to an uptick in sales for smaller apartment complexes, especially in cities where affordable housing is scarce. As more people are able to afford maintenance fees without the added cost of GST, developers might find new opportunities to attract first-time buyers and young professionals looking to enter the real estate market.

Practical Advice for Residents and Associations

For Residents:

If you live in an apartment complex, here’s what you need to do:

- Check Your Monthly Maintenance Fee: If it’s below Rs 7,500, congratulations, you’re GST-exempt.

- Verify With Your Association: Confirm with your apartment association whether they are applying the correct GST charges.

For Associations:

If you manage an apartment complex:

- Understand the Threshold: Ensure that your maintenance charges are below Rs 7,500 per resident if you want to avoid GST.

- Stay Compliant: If your turnover is over Rs 20 lakh annually, register for GST, but only if necessary, and ensure that GST is applied only when required.

- Transparent Communication: Keep residents informed about any changes in fees or GST policy to avoid confusion.