7,000 Vendors Without Registration Now Targeted in Karnataka: The recent push by the Karnataka government to target over 7,000 Vendors Without Registration for Goods and Services Tax (GST) has left many small traders scrambling. Many of these vendors, particularly those who’ve been accepting digital payments, have exceeded the ₹40 lakh annual transaction threshold, triggering the scrutiny. With penalties looming, it’s essential to understand what’s going on, why it matters, and what steps you can take to avoid getting caught in the penalty trap. This guide breaks down the situation, explains your obligations, and provides practical advice on how to stay compliant with GST regulations.

7,000 Vendors Without Registration Now Targeted in Karnataka

The recent crackdown on Vendors Without Registration in Karnataka has highlighted the importance of GST registration for small businesses. By taking action now—registering for GST, maintaining detailed records, and staying on top of your tax obligations—you can avoid penalties and ensure the long-term success of your business. The government is offering resources, including an amnesty scheme and educational campaigns, to help vendors comply, so don’t miss out on these opportunities.

| Key Data / Information | Details |

|---|---|

| Number of Vendors Targeted | 7,000 unregistered vendors in Karnataka |

| GST Transaction Threshold | ₹40 lakh per annum for digital transactions |

| Penalties Imposed | Up to 50% of the vendor’s revenue, depending on the severity of non-compliance |

| Government Action | Withdrawal of GST notices for vendors dealing in exempt goods, amnesty schemes, and helplines for vendor support |

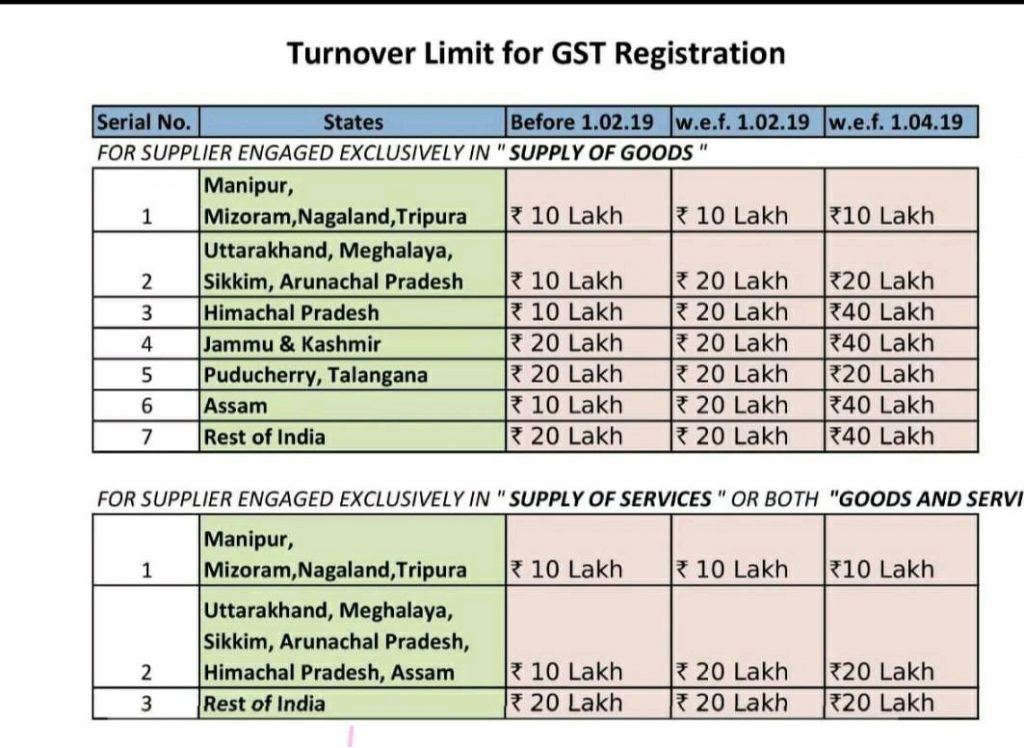

| GST Registration Requirements | Vendors must register for GST if turnover exceeds ₹40 lakh for goods or ₹20 lakh for services |

| Government Awareness Campaigns | ‘Know GST’ campaign to educate vendors on their tax obligations |

| Reference to Official Resources | GST Website |

What’s Happening in Karnataka?

In recent months, the Karnataka government has set its sights on small Vendors Without Registration for Goods and Services Tax (GST), despite their digital sales crossing the ₹40 lakh mark. This move comes as part of a broader national effort to ensure that businesses, large and small, comply with tax regulations.

For many of these vendors, the situation has caught them off guard. Many small traders, such as vegetable vendors or local grocers, have been conducting their businesses with cash transactions, and only recently began accepting digital payments through platforms like UPI (Unified Payments Interface). It’s only now, with the data from these transactions, that the government has flagged them for non-compliance.

Why Does This Matter?

As digital payments become more common, the government is relying on transaction data to enforce tax laws. The threshold for mandatory GST registration is ₹40 lakh for businesses dealing in goods. If your business exceeds this threshold, it’s crucial to comply with the law to avoid penalties. However, failure to register for GST can result in fines that may exceed 50% of your revenue.

Small vendors, unaware of their obligations, are now caught in the web of compliance rules they didn’t even know existed. Understanding GST and the role it plays in business compliance is essential for vendors who want to keep their businesses running smoothly.

What Vendors Can Do to Stay Compliant?

If Vendors Without Registration received a GST notice, or if you want to avoid receiving one in the future, it’s important to act quickly. Here’s what you can do to ensure you stay compliant and avoid hefty penalties:

1. Register for GST (If You Haven’t Already)

The first step is simple: register for GST. If your business turnover exceeds the threshold of ₹40 lakh for goods or ₹20 lakh for services, you must register for GST. While this may seem like a hassle, it’s necessary for continued operations.

How to Register for GST:

- Visit the official GST portal

- Click on “Services” and select “Registration”

- Follow the instructions to complete your GST registration. You will need to provide business details such as your PAN, business address, and bank account information.

- After registration, you will receive a GSTIN (GST Identification Number), which you’ll use for all tax-related matters.

Once you’re registered, make sure you keep track of the deadlines for GST returns and tax payments. A delay in filing can lead to penalties and interest charges.

2. Understand Your Tax Obligations

Being registered for GST is just the beginning. Once registered, you must understand your ongoing obligations. This includes filing returns every month or quarter (depending on your turnover), and paying the tax due on time.

Here’s what you need to do:

- File GST returns on time (usually on a monthly or quarterly basis).

- Keep track of sales and purchases and maintain proper records of invoices and receipts.

- Pay your tax liabilities promptly to avoid interest charges or penalties.

3. Keep Detailed Records of Your Transactions

It’s essential to maintain accurate records of all your transactions. Digital payments through UPI or bank transfers should be documented with receipts or transaction records. Even if you operate a small business, staying organized will prevent costly errors when filing your taxes.

What You Should Record:

- Sales invoices

- Receipts for all payments (digital and cash)

- Purchase invoices from suppliers

- Transaction records for any digital payments

Using accounting software can make this easier and help you stay organized.

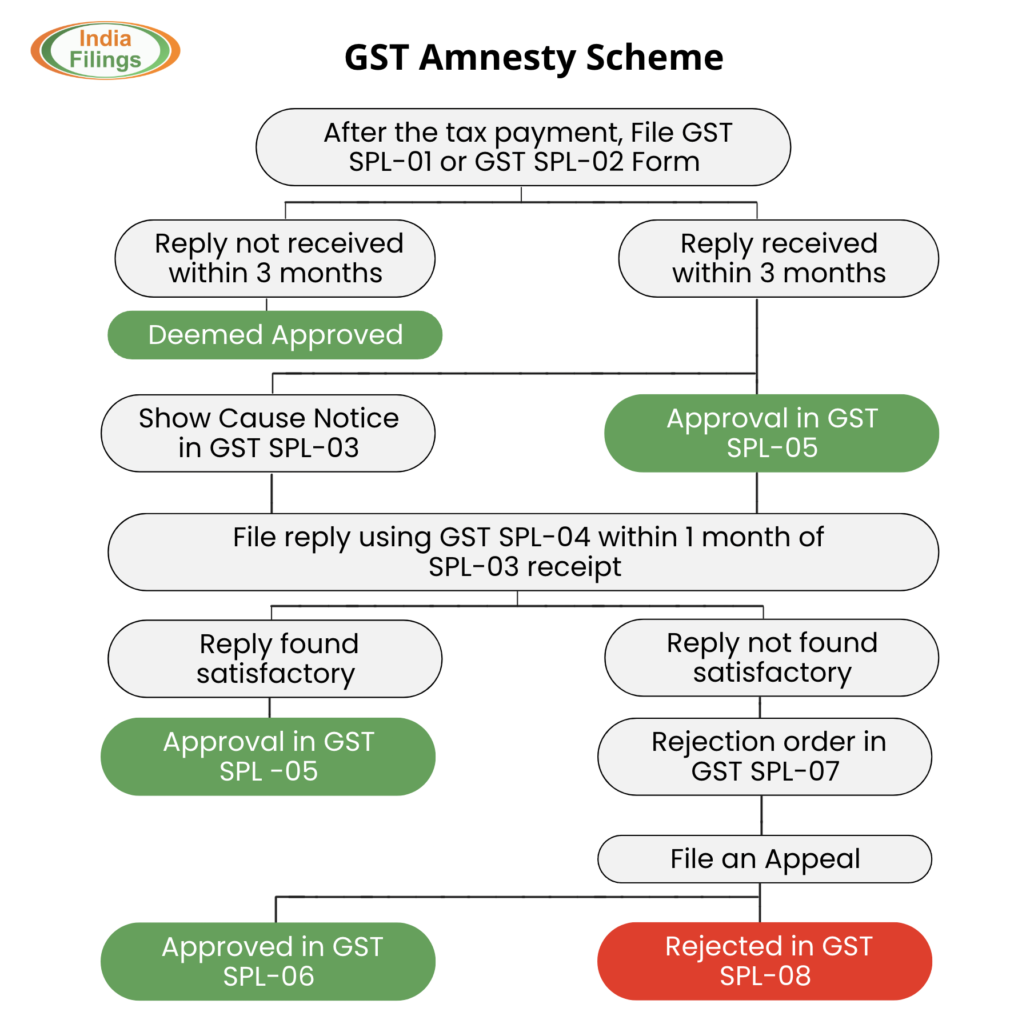

4. Take Advantage of the Amnesty Scheme

Good news for vendors caught in this situation: the Karnataka government has introduced an amnesty scheme for businesses that failed to register for GST in the past. If you come forward now and register for GST, you can avoid penalties on any backdated dues.

This is a rare opportunity to rectify past mistakes without suffering significant financial damage, so don’t miss out on this chance to get back in compliance.

5. Use Government Resources and Helplines

The government has launched a “Know GST” campaign and set up helplines to guide vendors through the process of registration and compliance. You can get assistance in understanding the filing process, resolving doubts about tax liabilities, and answering any other questions you may have about GST.

Real-Life Case Studies: 7,000 Vendors Without Registration Now Targeted in Karnataka

Case Study 1: Vegetable Vendor’s GST Notice

Rajesh, a vegetable vendor in Bangalore, has been running his small shop for over 10 years. He only recently started accepting UPI payments to cater to a younger clientele. His digital transactions quickly exceeded ₹40 lakh, but Rajesh wasn’t aware that this meant he needed to register for GST.

He was shocked when he received a GST notice demanding registration and payment. With no knowledge of the process, he was worried about hefty fines. After consulting with a tax professional, Rajesh registered for GST, and he took advantage of the amnesty scheme to avoid penalties. Now, he files his returns on time and keeps his records up to date, avoiding future issues.

Case Study 2: Local Grocery Store’s Record-Keeping Mistakes

Leela owns a small grocery store in a local market. She always accepted cash and kept informal records. When she started accepting digital payments, she didn’t update her record-keeping practices. Unfortunately, during an audit, Leela was flagged for not maintaining proper transaction records.

Leela learned the hard way that maintaining detailed and organized records is crucial. After receiving her GST notice, she started using accounting software and kept track of every transaction. Now, Leela is compliant and has peace of mind knowing she’s following the law.