City Company’s Clever Trick: In the world of business and taxation, scams can be as elaborate as they are shocking. One such fraud has recently come to light, involving a Hyderabad-based company that managed to pull off a massive ₹100 crore GST scam. This elaborate scheme used empty vans, fraudulent invoices, and clever manipulation of e-way bills to deceive the government and claim a substantial amount in input tax credits.

If you’re not familiar with GST (Goods and Services Tax), it’s a system used by the Indian government to streamline tax collection. It helps businesses and the government keep track of goods and services being exchanged across the country. But as with any system, it’s vulnerable to exploitation. This latest scam proves how creative some businesses can get when trying to bypass regulations. This article will break down the shocking details of the scam, how the fraud was carried out, and why it’s important for businesses, tax professionals, and consumers to stay vigilant. Whether you’re someone with a keen interest in finance or just curious about how tax evasion schemes work, we’ve got you covered. Let’s dive in!

City Company’s Clever Trick

The ₹100 crore GST scam uncovered in Hyderabad is a prime example of the creative methods some businesses use to evade taxes. While the authorities have cracked down on this particular case, it’s a stark reminder that GST fraud is a real issue that affects the economy. As businesses and individuals, it’s crucial to stay vigilant, keep up-to-date with tax laws, and always ensure that financial records are accurate and transparent. By following best practices, investing in proper tools, and consulting experts when necessary, businesses can protect themselves from falling victim to such scams. The key takeaway here is simple: transparency, honesty, and vigilance go a long way in building a business that can thrive in any regulatory environment.

| Topic | Details |

|---|---|

| Fraud Type | ₹100 Crore GST scam using empty vans and fake invoices. |

| Methods Used | Fraudulent invoices, empty vans to simulate transportation, manipulation of e-way bills. |

| Total Fraud Amount | ₹100 Crore. |

| Input Tax Credit Claimed | ₹33.2 Crore. |

| Outcome | Raids conducted, financial records seized, police investigations ongoing. |

| Detected Through | Analysis of toll gate data and discrepancies with e-way bills. |

| Industry Impact | Highlights the growing issue of tax evasion through e-way bill manipulation. |

| Source | Times of India and TaxScan for more info. |

Understanding the City Company’s Clever Trick: The Basics

At the heart of this scam is a company based in Hyderabad, which cleverly used empty vans to create the illusion of goods being transported. Here’s how it worked:

- Fake Invoices: The company issued invoices for copper supplies that never actually existed. These invoices were tied to fake shipments that were never made.

- Empty Vans as Props: To back up these fake invoices, the company dispatched empty vans. These vans were supposed to carry copper, but in reality, they didn’t carry anything at all. It was all a show to create the appearance of legitimate transactions.

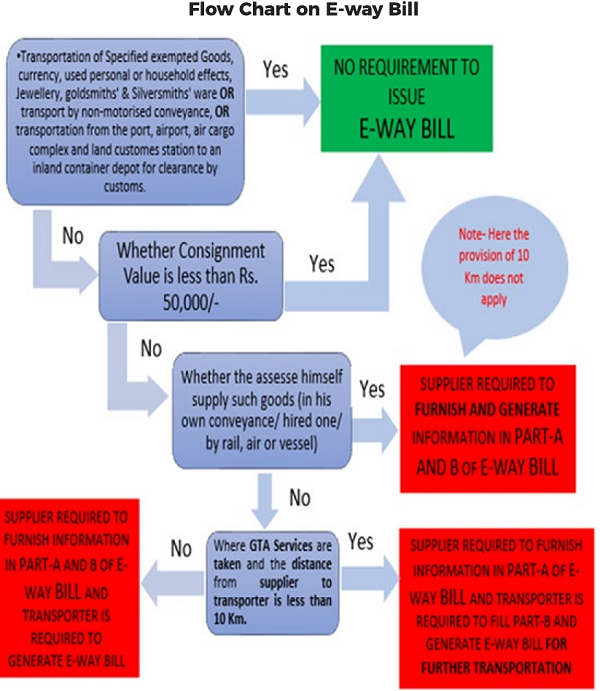

- Manipulation of E-way Bills: An e-way bill is a document required under the GST system to track the movement of goods. The company used e-way bills to make it look like goods were moving, while in reality, no goods were ever shipped.

- Claiming Input Tax Credits: With these fake invoices and manipulated e-way bills, the company was able to claim input tax credits (ITCs) amounting to ₹33.2 crore. This allowed them to reduce their actual tax liability—an illegal practice that resulted in a ₹100 crore scam.

How the Fraud Was Uncovered?

This type of scam isn’t easy to detect, but the authorities were able to uncover it thanks to a combination of technology and diligence:

- Toll Gate Data Analysis: The authorities analyzed data from toll gates. When vehicles pass through toll gates, their data is logged. This helped officials notice discrepancies between the toll records and the e-way bills issued by the company.

- Raids and Seizures: After identifying the discrepancy, authorities raided multiple locations associated with the company. They seized financial records, hard drives, and CCTV footage, all of which provided further evidence of the fraud.

- Legal Actions: The company’s directors are now under investigation, with criminal charges likely to follow. A formal complaint has been lodged with the Hyderabad police.

The Legal Consequences of GST Fraud

The consequences of committing GST fraud are severe. Not only does the company face a significant financial penalty, but the individuals involved in the scam—especially the directors and those who facilitated the fraud—are liable for criminal charges.

In this case, the directors could face imprisonment, significant fines, and may also be barred from participating in business operations. A company found guilty of GST fraud may also have its business license revoked, damaging its reputation irreparably.

For businesses and individuals, the legal risks of participating in fraudulent activity far outweigh any potential short-term financial gains.

Case Studies of Similar Scams

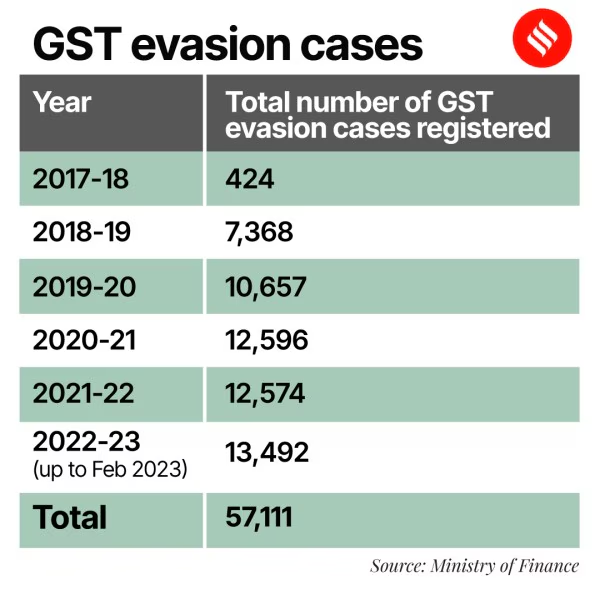

This ₹100 crore GST scam is not an isolated incident. Across India, there have been multiple cases where businesses have manipulated the GST system to evade taxes. Here are a couple of examples:

- ₹15,000 Crore GST Scam (2023): A massive ₹15,000 crore fraud was uncovered when authorities identified over 100 bogus firms that were involved in creating fake invoices to claim GST refunds. The scam affected businesses across multiple states, and it was only discovered after a deep dive into their financial activities and cross-referencing with toll gate data and e-way bills.

- The ₹2,500 Crore E-way Bill Scam (2022): In this case, a network of firms exploited the e-way bill system by falsifying records to simulate the movement of goods. Authorities caught on to the scam after noticing irregularities in the transportation data, leading to a series of raids and arrests.

These examples highlight how widespread the issue of GST fraud is and how important it is for businesses to adhere to regulations.

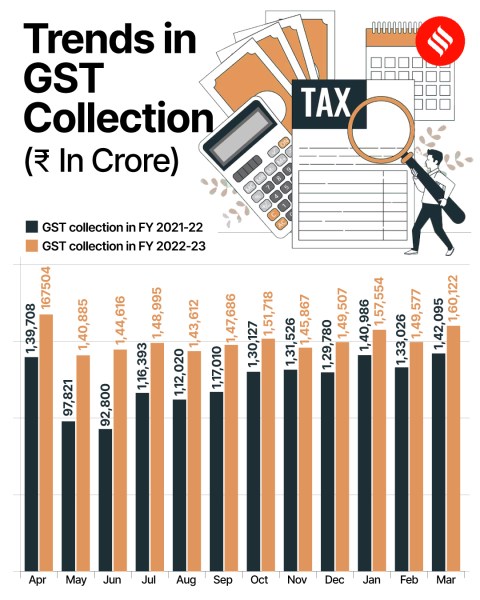

Government Measures to Combat GST Fraud

The Indian government has been cracking down on GST fraud with increasing intensity. Some of the key measures include:

- E-way Bill Monitoring: The government has implemented stricter monitoring of e-way bills and toll gate data. They are now using advanced technology to cross-reference data across various platforms, making it harder for fraudsters to bypass the system.

- GST Audits: The government is conducting more frequent and thorough GST audits. They are focusing on businesses that show inconsistencies in their records or those who deal with high-value transactions.

- Whistleblower Programs: The government has established programs that encourage people to report fraudulent activity, offering rewards for those who provide actionable information.

- Stricter Penalties: The penalties for GST fraud have become more severe, with stricter fines and longer sentences for those found guilty of tax evasion.

These measures are helping to combat fraud, but businesses need to play an active role in ensuring compliance with tax regulations.

Tips for Businesses to Avoid GST Fraud

If you’re a business owner or tax professional, here are some tips to avoid falling into the trap of GST fraud:

- Ensure Accurate Invoices: Always ensure that your invoices match the actual goods being transported. Any discrepancy between the invoice and the goods will raise red flags.

- Track E-way Bills Carefully: E-way bills are crucial for tracking the movement of goods. Make sure your company’s records align with e-way bill data and that you’re following all rules regarding their use.

- Regular Audits: Conduct regular internal audits to ensure that all financial transactions are legitimate. This includes cross-checking invoices, e-way bills, and transport logs.

- Invest in Software: Modern accounting and ERP systems can help track and manage your tax obligations more effectively. Investing in reliable software will help keep your records clean and reduce the risk of errors that could lead to fines or fraud allegations.

- Stay Updated on GST Laws: Tax laws evolve, and staying updated on changes to the GST system will help you avoid inadvertently making mistakes. You can follow government portals or tax advisories for updates.

- Consult a Professional: If you’re ever unsure about any aspect of GST or taxation, consult a tax professional. It’s better to invest in expert advice than to risk running into legal trouble.

Tips for Consumers to Avoid Supporting Fraudulent Businesses

Consumers also have a role to play in preventing scams like this. Here’s how:

- Check the Legitimacy of Vendors: Always ensure that the businesses you’re buying from have proper documentation and certifications. If a deal sounds too good to be true, it probably is.

- Look for GST Registration Numbers: Legitimate businesses should be registered under GST. Always check for a GSTIN number before making big purchases.

- Verify E-way Bills: If you’re a business-to-business (B2B) consumer, verify that e-way bills provided to you are valid and correspond with the actual goods you’ve ordered.

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday