Commercial Taxes Dept. Ordered to Intensify Efforts to Curb GST Evasion Across the State: The state government of Telangana has recently embarked on a bold new initiative aimed at tackling one of the most persistent issues plaguing its economy—GST evasion. Under the leadership of the Chief Minister (CM), the Commercial Taxes Department has been instructed to ramp up its efforts in combating Goods and Services Tax (GST) fraud. This new directive aims to ensure greater transparency in business operations, curb fraudulent activities, and enforce stricter compliance among businesses. But what does this mean for businesses, taxpayers, and the economy? Let’s dive deeper into this transformative effort.

Commercial Taxes Dept. Ordered to Intensify Efforts to Curb GST Evasion Across the State

Telangana’s CM has initiated a robust strategy to combat GST evasion, using a combination of AI technology, stricter enforcement, and support for taxpayers. This comprehensive approach aims to enhance compliance, safeguard government revenue, and create a level playing field for businesses. For businesses in Telangana, this is a call to ensure transparency and compliance with tax regulations. By doing so, not only will you avoid penalties, but you will also contribute to a healthier and more sustainable economy.

| Key Points | Data & Insights |

|---|---|

| GST Fraud Cases Detected | 304 fake GST cases uncovered since April 2025 |

| Amount Blocked | ₹170 crore in fraudulent tax credits |

| Amount Recovered | ₹8.36 crore in tax evasion recovery |

| Notices Issued | ₹49.7 crore in notices sent to offenders |

| Government Measures | AI integration, tax call centers, and stricter complianc |

What Is GST Evasion and Why Does It Matter?

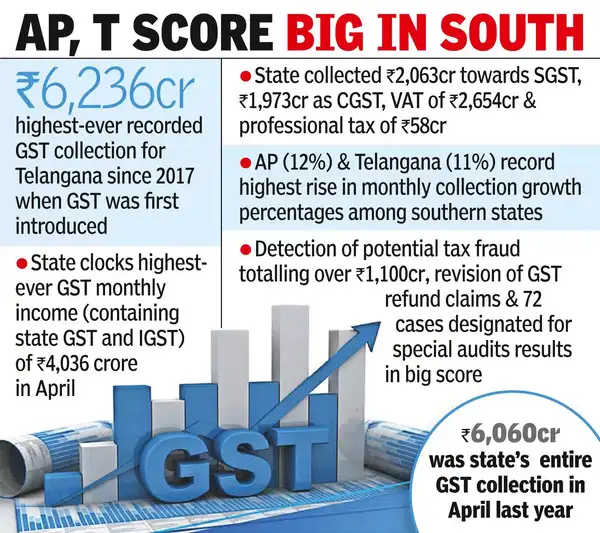

GST, or Goods and Services Tax, is one of the largest indirect taxes in India, levied on the sale of goods and services. It was introduced in 2017 to simplify the taxation process and remove multiple layers of indirect taxation. However, with its complexity, some businesses have taken advantage of loopholes in the system to evade taxes.

The issue of GST evasion has led to significant losses for the government. The state loses out on tax revenues, which impacts public services such as education, healthcare, infrastructure, and social welfare programs. Moreover, businesses engaging in fraudulent activities create an uneven playing field, putting compliant businesses at a disadvantage.

In light of this, the CM’s decision to crack down on these fraudulent activities is vital for restoring fairness in the tax system, safeguarding government revenue, and ensuring that every business pays their fair share.

The CM’s Vision and Role in Tackling GST Evasion

The CM’s directive to intensify efforts against GST evasion comes at a critical time. By focusing on accountability, compliance, and technology, the government aims to provide a balanced solution that benefits both businesses and taxpayers. Here’s how the CM plans to implement these measures:

Technology Integration: A Step Toward Modernization

One of the most significant changes is the incorporation of Artificial Intelligence (AI) and data analytics into the GST compliance process. AI allows the Commercial Taxes Department to analyze vast amounts of transaction data, identify patterns, and detect discrepancies that may indicate fraudulent activities. AI can also help pinpoint suspicious tax returns, making enforcement quicker and more efficient. This means that businesses involved in tax evasion will find it much harder to hide under the radar.

Moreover, the government is enhancing its digital infrastructure to provide better services to taxpayers. For example, AI-based chatbots could be deployed to assist businesses in filing taxes and resolving queries. The use of data analytics is expected to expedite the audit process and identify fake invoices, which are one of the main contributors to GST fraud.

Strengthening Taxpayer Support

The government is not only focusing on enforcement but also on education and support for businesses. The establishment of dedicated call centers will provide a direct line for businesses to clarify any doubts regarding GST procedures. This move will ensure that businesses understand the nuances of tax filing, preventing honest mistakes that may lead to penalties.

The CM also proposed creating more awareness programs for businesses, especially small and medium enterprises (SMEs), which often struggle with compliance. These programs will include step-by-step guides on how to file taxes correctly, avoid common pitfalls, and stay updated on the latest regulations.

How Commercial Taxes Dept. Ordered to Intensify Efforts to Curb GST Evasion Across the State is Being Tackled?

The government’s approach to tackling GST fraud is multifaceted, involving technology, stricter enforcement, and increased transparency. Let’s take a closer look at how this is being done:

1. AI-Powered Fraud Detection

AI is playing a crucial role in detecting fraudulent activities. The Central Board of Direct Taxes (CBDT) has already been using AI to track discrepancies in income tax filings, and now, the Commercial Taxes Department in Telangana is adopting similar methods for GST-related activities. AI can quickly flag inconsistent patterns, such as fake invoices, ghost transactions, or unusual claims for Input Tax Credit (ITC). Once these anomalies are flagged, tax officers can take immediate action.

For instance, Keshaan Industries LLP, a company in Hyderabad, issued fraudulent invoices for copper supplies that never existed. This allowed them to claim Input Tax Credit (ITC) of ₹33.2 crore—a clear example of how AI can prevent such fraud in the future.

2. Crackdown on Fake Invoices

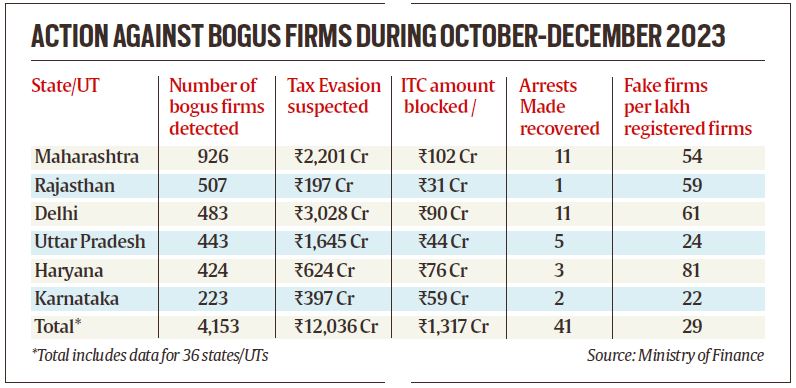

One of the primary ways businesses avoid paying GST is by issuing fake invoices. These invoices give the appearance of a legitimate transaction, enabling businesses to claim ITC without actually providing goods or services. To combat this, the Commercial Taxes Department has already uncovered 304 fraudulent GST cases since April 2025, blocking ₹170 crore worth of tax credits.

Additionally, the government is working to standardize invoicing practices and encourage businesses to conduct transactions through digital platforms that leave a clear audit trail. This would make it more difficult for fraudsters to manipulate the system.

3. Increased Compliance Measures

The state is stepping up its compliance efforts by requiring businesses to submit regular GST returns, undergo audits, and adhere to stricter tax filing procedures. There is now increased scrutiny on businesses claiming large amounts in Input Tax Credit and refunds, which has often been the loophole used by fraudsters.

To further increase transparency, the government plans to use blockchain technology in the future, allowing for an immutable record of transactions, making it even harder for fraudsters to alter or delete data.

What Does This Mean for Businesses?

If you’re a business owner in Telangana, here’s what you should know:

What Are the Key Takeaways?

- Prepare for More Scrutiny: The government is going to be more vigilant in reviewing tax filings, so businesses must ensure their tax returns and invoices are accurate and legitimate. Keeping clean records will save you from potential audits or penalties.

- AI and Automation: With the introduction of AI, businesses may notice faster audits and reviews. While this could feel like an extra layer of scrutiny, it will also help identify legitimate businesses and streamline the tax process, making it quicker for everyone.

- Know Your Obligations: Ensuring compliance with GST is not optional anymore. Avoid the temptation of trying to get around the rules, as the penalties for fraud are steep, including heavy fines and business shutdowns.

Compliance Benefits

Adhering to tax rules not only keeps you out of trouble but also benefits the economy as a whole. When all businesses comply, it leads to:

- Fair Competition: Honest businesses have a fair shot at thriving when tax evasion is curbed.

- Improved Public Services: The funds raised from GST go into funding essential public services like schools, hospitals, and infrastructure development.

- Reputation Building: A business known for transparency and integrity is more likely to attract customers and partners who value ethical practices.

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties