Big Win for Educational Institutions: In a major win for educational institutions across India, the government has officially declared that no Goods and Services Tax (GST) will be levied on services related to pre-examination materials like hall tickets, question papers, OMR sheets, and answer booklets. This ruling brings much-needed relief to educational bodies by reducing the financial burden they face when conducting examinations. If you’re part of an educational institution or an associated service provider, this update is not just a relief, but a game-changer for the entire education ecosystem. This decision comes on the back of a ruling by the Tamil Nadu Authority for Advance Ruling (AAR), which clarified that services such as the printing and scanning of these materials are exempt from GST when provided to educational institutions. This includes printing hall tickets, question papers, answer booklets, and more. Let’s break this down further and explore the impact it will have on the education sector.

Big Win for Educational Institutions

This GST exemption ruling for educational institutions is a significant step forward for the education sector, providing both clarity and relief to institutions and service providers alike. By reducing the financial strain on schools, colleges, and universities, it opens up opportunities for reinvestment in education quality and student resources. For service providers, the ruling streamlines the business process, ensuring clearer contracts and competitive pricing. In summary, no GST on hall tickets, question papers, and related materials is a major victory for educational institutions, cutting costs and simplifying processes. This ruling not only benefits the educational community but sets a precedent for more tailored, practical regulations in the future.

| Key Point | Details |

|---|---|

| GST Exemption | Printing of pre-exam materials like hall tickets and question papers exempt from GST. |

| Services Included | Printing of answer sheets, OMR sheets, certificates, and scanning services. |

| Impact | Reduction in operational costs for educational institutions. |

| Regulatory Basis | Reference to Notification No. 12/2017-Central Tax (Rate), amended by Notification No. 2/2018-Central Tax (Rate). |

| Official Reference | Taxo Online, GST Vidhi, Centax Online. |

To give you a better sense of the situation, let’s take a step back and look at the nuts and bolts of how this decision came about, who benefits, and what this means for the future of educational institutions and service providers in India.

What Does This Decision Mean for Educational Institutions?

Educational institutions, from schools to universities, are often faced with the complex challenge of organizing examinations. This involves a host of logistical steps, one of the most significant being the preparation and printing of examination-related materials. These include hall tickets (admit cards), question papers, answer booklets, OMR sheets, and even post-examination materials like mark sheets and certificates.

Before this ruling, these services often attracted GST, leading to additional costs that schools and colleges had to factor into their budgets. However, with the new ruling, educational institutions no longer have to worry about GST on these essential services. This decision is especially helpful for institutions that rely on printing and scanning services, as it will significantly cut down on operational expenses.

Big Win for Educational Institutions: A Deeper Dive Into the Legal Framework

The decision was grounded in the provisions of Sl. No. 66(b)(iv) of Notification No. 12/2017-Central Tax (Rate), which covers exemptions for educational services. This notification was later amended by Notification No. 2/2018-Central Tax (Rate). Under these provisions, services rendered to educational institutions that involve activities directly related to examinations—such as printing hall tickets, distributing question papers, and scanning answer sheets—are considered non-taxable.

The ruling also aligns with Circular No. 151/07/2021-GST, issued by the GST Department, which clarifies that such services provided to educational institutions are exempt from GST, provided they are rendered for the purpose of facilitating the education process.

The Ripple Effect on the Education Sector

This GST exemption is a win for several stakeholders within the education system. Not only does it benefit educational institutions by reducing their operating costs, but it also provides clarity for service providers in the printing, scanning, and certification industries. It simplifies the taxation process and ensures compliance with GST regulations without creating unnecessary financial burdens.

Moreover, this ruling has implications for educational services beyond just the examination process. Institutions are now incentivized to focus on other areas of improvement, such as upgrading infrastructure, offering better resources, and enhancing overall educational experiences for students.

Impact on Students

While the GST exemption directly benefits educational institutions, students stand to gain indirectly. With reduced costs on examination-related services, educational institutions can redirect those savings into areas that improve the student experience. This could include better facilities, more technology integration in classrooms, improved teaching resources, and, perhaps most importantly, enhanced scholarships and financial aid programs.

Additionally, fewer financial burdens on institutions might also translate into more affordable tuition fees and exam-related costs for students in the long run. This relief could pave the way for institutions to reinvest in student welfare programs, creating a more holistic and supportive learning environment.

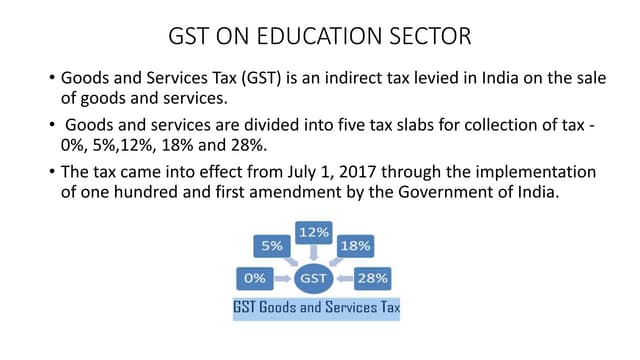

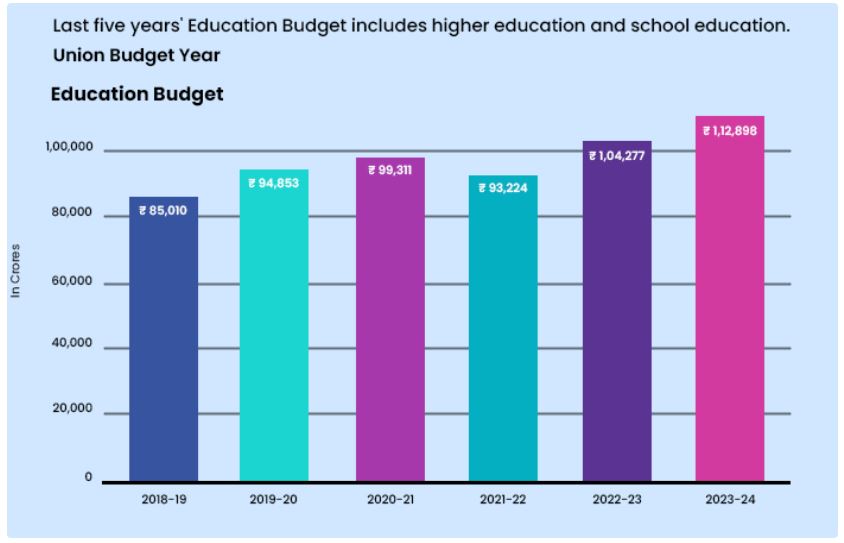

Broader Context of Education Sector Reforms

This ruling is part of a broader trend of reforms aimed at reducing financial barriers within India’s education sector. Over the last few years, the government has been rolling out several initiatives aimed at making education more accessible and affordable. This includes GST exemptions on services related to education, the push for digital learning, and funding initiatives to upgrade school infrastructure. The ruling is a clear example of how policy changes can provide tangible benefits to the entire education ecosystem, promoting quality and sustainability.

How Educational Institutions Can Leverage the Savings?

With this newfound exemption from GST, educational institutions now have an opportunity to reallocate resources towards various improvement projects. Here are a few actionable steps institutions can consider:

- Invest in Digital Tools: Use the savings to adopt more advanced technology in classrooms. This could include digital whiteboards, e-learning platforms, and online collaboration tools.

- Upgrade Infrastructure: From creating new classrooms to renovating old ones, institutions can reinvest in better facilities to provide a more conducive learning environment for students.

- Boost Student Support Programs: Reinvest in scholarships, career guidance programs, and counseling services to support students’ holistic development.

- Reduce Student Fees: In some cases, institutions can pass on the savings to students by reducing examination fees or other academic-related charges, making education more affordable.

- Expand Research and Development: For universities and colleges, the savings can be directed into research initiatives, promoting innovation and academic growth.

Practical Examples of the Impact

To make this clearer, let’s consider a hypothetical example:

Example 1: A large university is preparing for its semester-end exams. Previously, the cost of printing hall tickets, question papers, and answer sheets would have been subject to GST. If the total cost for printing these materials was $5,000, the GST could have added an additional $900 or more to the expense. With the new ruling, the university saves that amount, reducing overall examination-related costs.

Example 2: A private school needs to print 2,000 answer sheets for an upcoming exam. If this service were previously taxed at 18%, the school would have had to pay an additional $1,800 in GST. With the new ruling, that $1,800 stays in the school’s pocket, allowing the funds to be reinvested into resources like teaching materials or student welfare programs.

How Does This Impact Service Providers?

This decision isn’t just great for educational institutions; it also impacts companies that provide services like printing, scanning, and certification. These service providers can now enter into contracts with educational institutions without the added complexity of dealing with GST charges for examination-related services.

For example, a printing company contracted to print 100,000 question papers no longer has to include GST in their invoices to educational clients. Instead of passing on that tax to the institutions, they can offer more competitive rates, potentially opening up new business opportunities in the education sector.

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties