FM Sitharaman Clears the Air on GST Issue for Apartment Associations: In a country like India, the introduction of the Goods and Services Tax (GST) was a groundbreaking step in simplifying the tax structure. While it has benefitted many sectors, it has also led to confusion, especially for apartment associations. Recently, Finance Minister Nirmala Sitharaman provided crucial clarity on how GST applies to maintenance fees and apartment associations, which has helped resolve much of the uncertainty. Whether you’re a resident or involved in managing an apartment complex, it’s important to understand how these changes affect you. This article breaks down everything you need to know about the new guidelines, providing both an overview and practical advice to help you navigate the GST landscape in apartment complexes.

FM Sitharaman Clears the Air on GST Issue for Apartment Associations

The recent clarification from Finance Minister Nirmala Sitharaman on GST for apartment associations has been a welcome change. With a clearer understanding of who is responsible for paying GST and under what conditions, residents and apartment associations can move forward with more confidence. For smaller complexes, the ₹7,500 exemption provides relief, while larger complexes will need to register for GST and comply with tax filing. By following the steps outlined in this article, apartment associations can ensure compliance and avoid any penalties. This updated guidance not only resolves confusion but also streamlines the process of GST compliance for both residents and associations. Understanding these guidelines is essential for managing finances smoothly and ensuring that everyone stays on the right side of the law.

| Key Point | Details |

|---|---|

| Who is responsible for GST | GST compliance falls on the apartment association, not individual residents. |

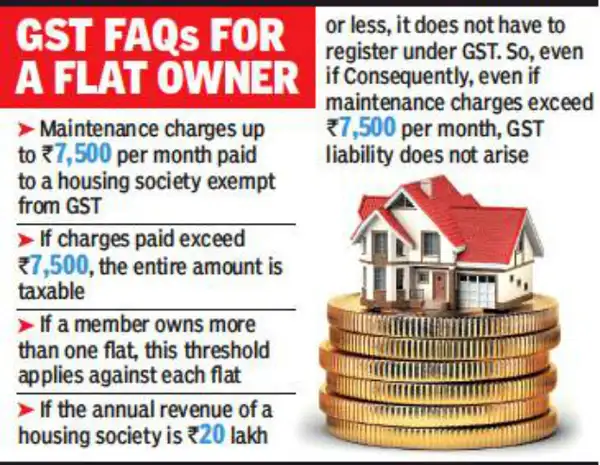

| GST Registration Requirement | Associations must register for GST only if their annual turnover exceeds ₹20 lakh (₹10 lakh for special category states). |

| Exemption for Maintenance Charges | No GST on maintenance charges up to ₹7,500 per month per resident. |

| GST Rate | If maintenance charges exceed ₹7,500, GST at 18% is applied to the entire fee. |

| Penalty Relief for Past Dues | Associations that missed paying GST dues between 2017 and 2020 can settle with reduced penalties by March 31, 2025. |

| No Need for Documentation | Neither residents nor associations need any official letter regarding their GST status. |

Why This Matters for You?

GST has long been a topic of confusion for apartment residents and management committees. With the latest clarification by Finance Minister Nirmala Sitharaman, the fog around GST on apartment maintenance charges has finally cleared. This article will dive deep into the core points of the clarification and explain them in simple terms. Whether you’re a resident wondering about your monthly charges or a managing committee member tasked with ensuring GST compliance, this guide will help you make sense of the updates.

Understanding the finer details of this ruling could save apartment associations and residents a lot of money and headaches, especially as India moves towards greater digital tax compliance.

What Does the FM Sitharaman Clears the Air on GST Issue for Apartment Associations Mean?

1. Who Has to Pay GST?

The biggest concern that arose from the introduction of GST was whether residents of apartment complexes would be required to pay GST on maintenance charges. Thankfully, the Finance Minister’s clarification puts all concerns to rest. Residents do not have to pay GST on maintenance charges. This means that if your monthly maintenance fee is ₹5,000 or ₹7,000, you won’t see any additional GST added to that fee.

For those wondering whether individual residents will be liable to GST, the clear answer is no. It is the responsibility of the apartment association to handle all matters related to GST compliance. Residents won’t face any direct burden in terms of paying GST, unless the maintenance fee surpasses the ₹7,500 threshold.

2. What About Apartment Associations?

While residents are off the hook for GST, the onus falls on the apartment association. If the association’s aggregate annual turnover exceeds ₹20 lakh (₹10 lakh for special category states), they must register for GST and comply with tax filing requirements. The turnover includes all income generated by the association, primarily from maintenance fees, but also from any additional sources like parking fees, club memberships, etc.

3. The Exemption Limit

The Finance Minister also clarified that maintenance charges up to ₹7,500 per month per resident are exempt from GST. This is important for residents in smaller complexes where the maintenance fees are lower. So, if the association charges ₹6,000 or ₹7,000 per month, no GST will apply, which makes life easier for those living in smaller apartments.

But if the charges exceed ₹7,500, GST will apply to the entire maintenance fee, not just the amount above ₹7,500. This means if your maintenance fee is ₹8,000, GST at 18% will apply on the full ₹8,000, which translates to ₹1,440 as GST.

How Does GST Impact Maintenance Fees?

The clarity provided by the Finance Minister also has a direct impact on how apartment associations should structure their maintenance fees. Here’s how the fees break down with the new GST guidelines:

- For Fees Below ₹7,500

If an apartment complex charges ₹7,500 or less per month for maintenance, no GST will apply. This means no extra tax burden for residents in smaller apartments. - For Fees Above ₹7,500

If the maintenance charge exceeds ₹7,500 per month per resident, the entire amount is subject to 18% GST. For instance, if the monthly charge is ₹8,000, residents will need to pay ₹1,440 as GST on top of the ₹8,000. This means the total maintenance fee for that resident will now be ₹9,440.

Practical Steps for Apartment Associations

For those managing apartment associations, the key to compliance lies in understanding the turnover and correctly applying GST. Here’s how associations can ensure they are GST-compliant:

Step 1: Calculate the Turnover

The first thing an apartment association needs to do is determine its total annual turnover, including income from maintenance charges, parking fees, and any other revenue. If the turnover exceeds ₹20 lakh (₹10 lakh for special category states), GST registration is necessary.

Step 2: Register for GST

If required, the association can register on the official GST portal. Once registered, they will need to start collecting and remitting GST, as well as filing returns.

Step 3: Apply GST to Maintenance Charges

Once registered, associations must apply 18% GST on maintenance charges that exceed ₹7,500. It’s crucial that the association stays transparent with residents about these charges.

Step 4: File GST Returns

The next step is filing periodic GST returns, which can be done quarterly or annually. These returns will need to account for all revenue, GST collected, and any tax paid on expenses. This step ensures the association remains in compliance with the law.

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties