GST Fraud on the Rise: The world of GST fraud has been shaking up businesses and governments alike, and a troubling trend has emerged: towed vehicles being used to issue fraudulent e-way bills. This scam, though not new, has recently gained significant attention in places like Hyderabad, where fraudsters have been exploiting the system to evade taxes. What makes this situation even more concerning is the complexity and scale of the fraud, which has now been linked to substantial sums of money—leading to financial implications worth hundreds of crores. In this article, we’ll unpack what’s going on with GST fraud involving towed vehicles and e-way bills, explain the loopholes in the system, and provide insights into how these scams are carried out. Additionally, we’ll provide you with tips on how businesses can protect themselves from such fraudulent activities.

GST Fraud on the Rise

GST fraud involving e-way bills and towed vehicles is a growing concern for both businesses and authorities. With the system being manipulated, the government has been forced to take strong action to combat these fraudulent activities. However, businesses must also be vigilant to ensure they are compliant with the regulations and protect themselves from potential risks. By staying informed, verifying documents, and implementing best practices, businesses can safeguard themselves from falling victim to these scams.

| Key Aspect | Details |

|---|---|

| GST Fraud Amount | ₹100 crore in fraudulent invoices and input tax credit claims |

| Method of Fraud | Towed or stationary vehicles used for issuing e-way bills |

| Involved Parties | Hyderabad-based companies, Maharashtra firms, and others |

| Government Action | ₹170 crore in blocked fraudulent credits, ₹49.7 crore in notices issued, ₹8.36 crore recovered |

| Legal Consequences | Penalties, fines, and seizure of goods for fraudulent e-way bill usage |

| Fraudulent Activities Detected | Fake invoices for non-existent goods, empty vehicle shipments |

| Preventative Measures | Vigilance from the Telangana commercial taxes department |

What is GST Fraud and How is It Affecting Businesses?

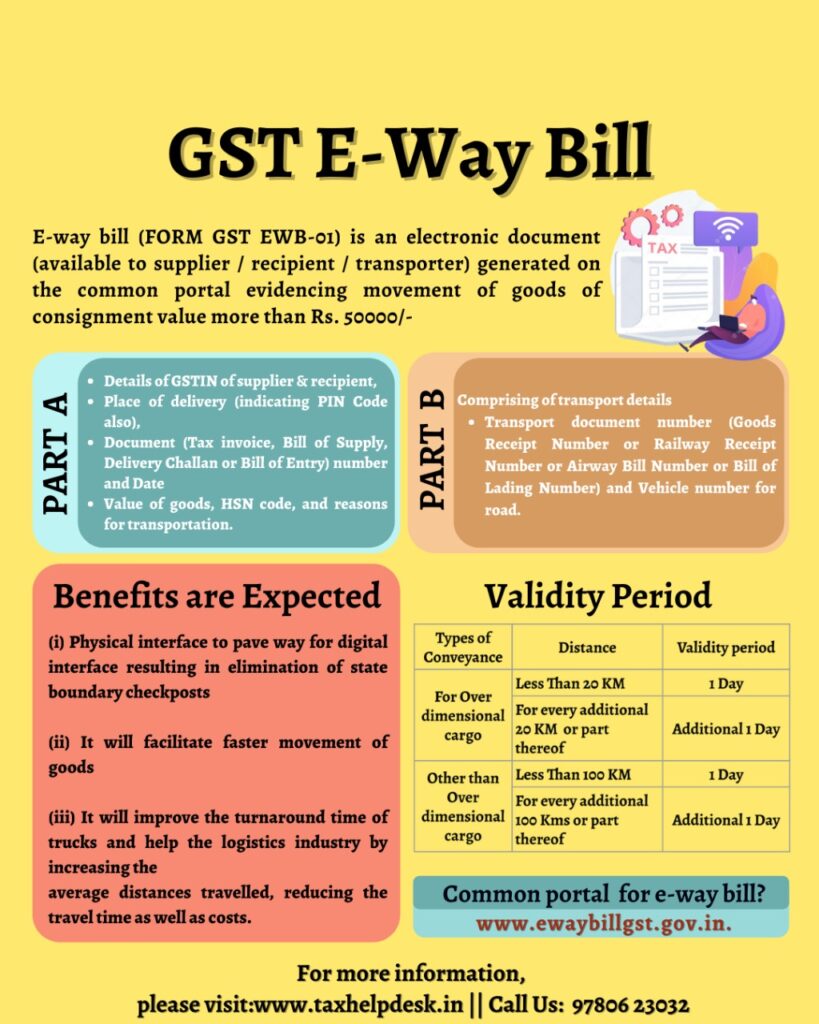

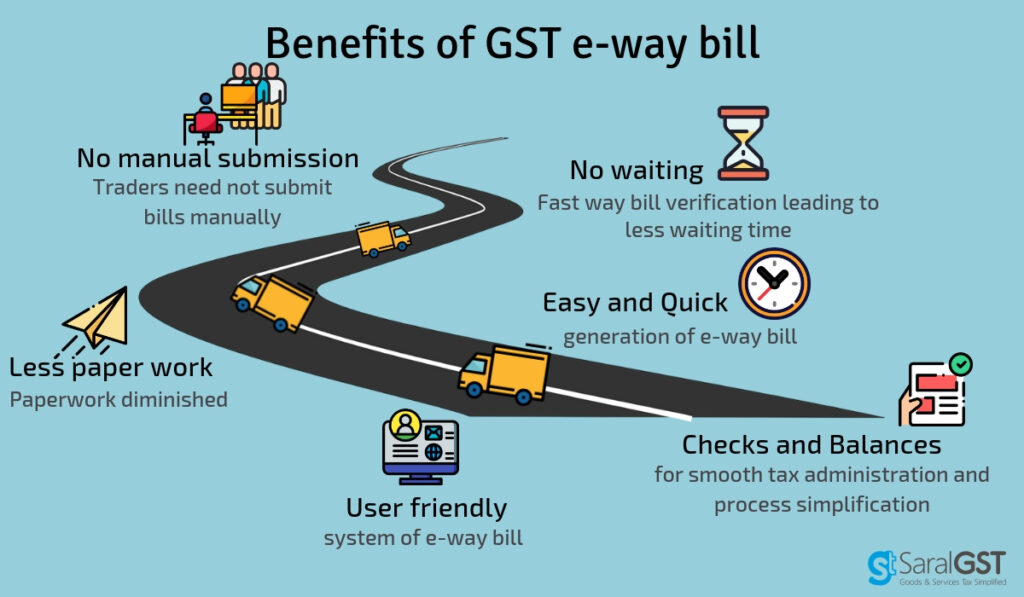

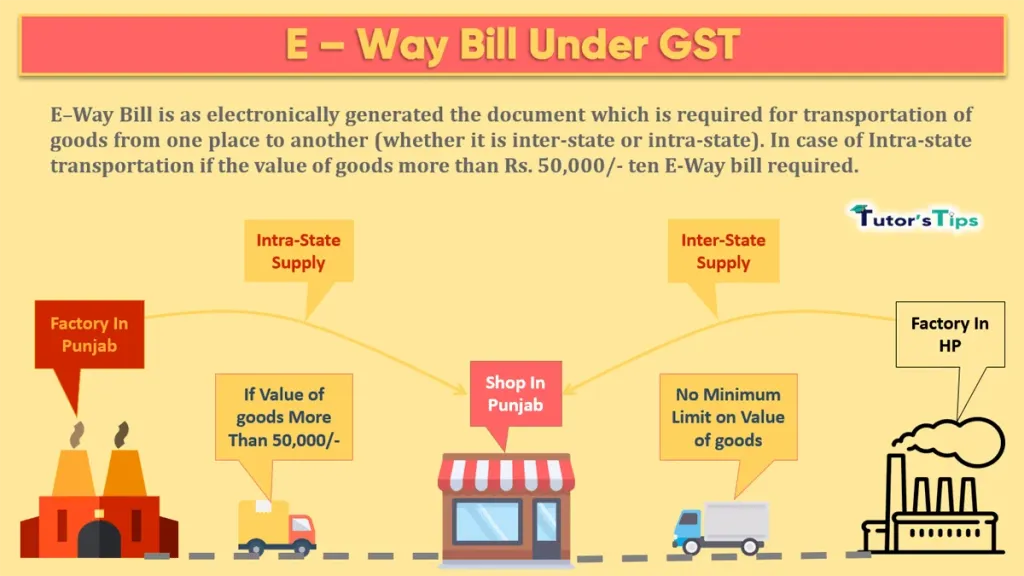

GST (Goods and Services Tax) is a key tax system in India, designed to streamline taxation and create a simpler, unified system for businesses. Under GST, when goods worth more than ₹50,000 are transported, an e-way bill must be generated. This e-way bill serves as a proof of movement for the goods and helps in tracking shipments. However, fraudsters have found ways to exploit loopholes in the system, leading to fraudulent claims and illegal tax evasion.

The Rise of Fraudulent E-Way Bills

The most recent wave of GST fraud involves e-way bills being issued for goods that don’t exist. In this case, criminals have taken advantage of towed vehicles or stationary vehicles to generate e-way bills, even though no goods are actually being transported. The system doesn’t check if a vehicle is in motion, and it’s relatively easy for fraudsters to use the registration details of a towed or impounded vehicle to issue e-way bills. This fraudulent activity can involve multiple bills being generated for a single vehicle, despite it not even leaving the parking lot.

For example, authorities recently uncovered a case in Hyderabad where a vehicle that had been impounded since June 2025 was still being used to generate fake e-way bills. The owner of the vehicle had no idea about the misuse of their car, leading to speculations that their details were stolen or abused by someone else.

How the Scam Works?

In simple terms, the scam is carried out as follows:

- Fake invoices are created for goods that don’t exist, such as copper supplies or other materials.

- Towed vehicles are used to generate e-way bills, often with the same vehicle number being used multiple times.

- Fraudulent businesses issue empty goods shipments, usually with no actual goods in transit, and they produce falsified documents, such as driver photographs and CCTV footage to back their claims.

- The fraud is detected when authorities intercept vehicles at toll gates, discovering that the goods aren’t actually in the vehicle, and the invoices are bogus.

These actions not only violate the GST regulations but also lead to significant financial loss for the government. For instance, the Telangana commercial taxes department has flagged over ₹100 crore in fraudulent transactions and blocked fraudulent input tax credits amounting to ₹170 crore.

Common GST Fraud Techniques Beyond E-Way Bills

While e-way bill fraud is currently one of the more rampant schemes, it’s far from the only form of GST fraud businesses may face. Other common techniques include:

- Fake Invoices for Non-existent Goods: This is the most common form of fraud, where businesses create invoices for goods that were never sold or transported. The fake invoices are then used to claim input tax credits, thereby reducing their tax liability.

- Bogus Returns: Fraudsters sometimes file false GST returns, inflating their sales figures to claim higher input tax credits than they are entitled to.

- Fake GST Registrations: Some fraudsters set up shell companies with fake GST registrations, then issue fraudulent invoices to claim input tax credit without actually engaging in any real business activities.

These frauds can be quite complex, involving multiple entities across various states, making it difficult for authorities to track down the perpetrators quickly.

The Role of Technology in Preventing GST Fraud

As the scale of fraud increases, so does the reliance on technology to detect and prevent these schemes. Governments and businesses can leverage advanced tools to improve monitoring and auditing of transactions. Technologies like blockchain, artificial intelligence (AI), and machine learning (ML) are becoming increasingly useful for tracking suspicious activities in real-time. AI-based algorithms, for instance, can identify patterns in the vast amounts of transaction data generated every day, flagging irregularities such as fake invoices or discrepancies between goods and invoiced items.

Furthermore, integrated compliance systems can help businesses maintain transparent records, making it easier for authorities to validate transactions and catch fraud early.

Case Studies of Real-Life GST Fraud Cases

Real-life examples of GST fraud help to drive home the gravity of the issue. For instance:

Case 1: Hyderabad’s Fake Copper Invoice Scheme

In Hyderabad, a company falsified invoices for copper—a commodity traded in bulk. They used empty vehicles to create the illusion of transport, and the invoices were linked to non-existent goods. The scheme was exposed when authorities intercepted empty vehicles at a toll gate and discovered the fake invoices. This fraud resulted in the loss of crores of rupees to the government in unpaid GST.

Case 2: Maharashtra’s Fraudulent e-Way Bill Scheme

A business based in Maharashtra was found using stolen vehicle details to issue multiple e-way bills for non-existent shipments. Despite the vehicles being stationary or towed, the fraudsters managed to generate fake e-way bills and claim input tax credits, leading to a significant loss in tax revenue.

These cases demonstrate the sophisticated methods fraudsters are using to exploit the system.

How to Protect Your Business from GST Fraud on the Rise?

As a business owner, the rise in GST fraud should not be ignored. Whether you are involved in goods transportation or not, it’s important to ensure you’re compliant with all GST regulations. Here are a few practical tips to avoid falling victim to or inadvertently participating in e-way bill fraud:

1. Stay Up-to-Date on GST Regulations

The GST law evolves regularly, so ensure you’re informed about the latest rules and regulations. Follow updates from trusted sources like the GST Council and the Income Tax Department to stay on top of the changes.

2. Verify All E-Way Bills

Always verify that your e-way bills are correct and reflect the actual movement of goods. This will help you avoid issues later. It’s also a good idea to cross-check with your suppliers and ensure that the e-way bills generated for deliveries match the invoices.

3. Track Your Fleet’s Movements

Implement a vehicle tracking system to ensure that your shipments are properly documented and follow the correct route. This can also help you avoid being implicated in any fraud carried out using your vehicle’s registration number.

4. Audit Your Invoices Regularly

Ensure all your invoices are authentic and reflect the correct details of goods and services being sold or transported. Regular audits help catch discrepancies before they snowball into larger problems.

5. Collaborate with Trusted Partners

Whether it’s suppliers, transporters, or even consultants, only work with trusted business partners. A reputable partner will follow all necessary guidelines and avoid putting your business at risk.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties