MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices: In a significant policy update, India’s Minister of State for Finance, Shri Pankaj Chaudhary, recently revealed that renewable energy devices like solar panels, windmill components, and biogas plants will now be subject to a 12% Goods and Services Tax (GST) instead of the previously expected 5%. This announcement has sparked a debate in the renewable energy sector: Is this a step forward for India’s green energy goals, or does it set the country back in its pursuit of sustainable energy solutions? Let’s dive deeper into this topic, break down the facts, and provide actionable insights for businesses, industry professionals, and anyone invested in the future of renewable energy.

MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices

The introduction of a 12% GST on renewable energy devices might initially seem like a setback for India’s green energy goals, but it’s essential to understand the broader context. While this decision could increase costs in the short term, it aligns with the government’s long-term fiscal needs and its efforts to streamline tax systems. By taking proactive measures, businesses in the renewable energy sector can mitigate the effects of the tax increase. At the same time, stakeholders should continue to engage with policymakers to ensure that renewable energy remains accessible and affordable for all.

| Topic | Details | References |

|---|---|---|

| GST on Renewable Energy Devices | 12% GST rate on renewable energy devices like solar panels, biogas plants, and windmill components. | Taxscan, Sansad |

| Impact on Costs | Increased upfront costs may impact the adoption of renewable energy technology, particularly for small businesses and consumers. | Taxscan |

| Government’s Green Initiative | The 5% GST on electric vehicles (EVs) and reductions in insurance premiums show the government’s continued support for clean energy. | Sansad, Taxscan |

| Stakeholder Concerns | Concerns from stakeholders about the viability of renewable energy projects due to higher tax rates. | Sansad |

| Long-term Effects | Potential for reduced energy costs in the long term, but increased initial investment costs could slow adoption. | Taxscan |

| Future Outlook | Ongoing dialogue between government and industry stakeholders needed to find solutions that support both growth and affordability. | Sansad |

What This Means for Renewable Energy Projects?

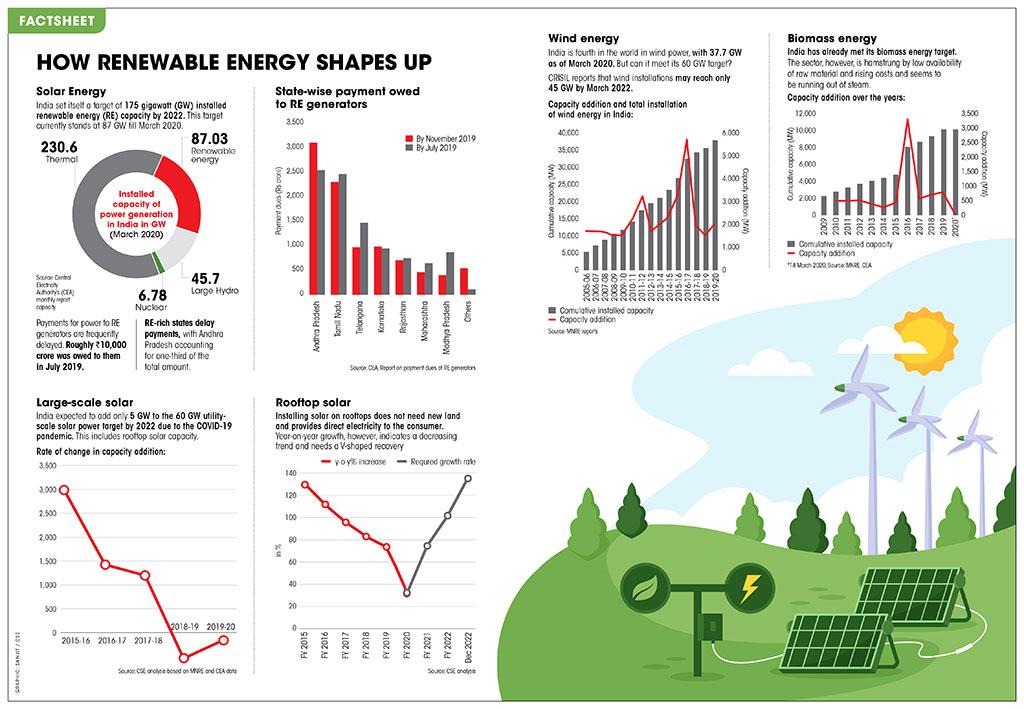

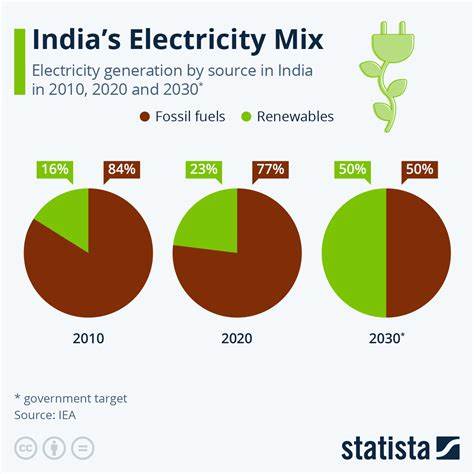

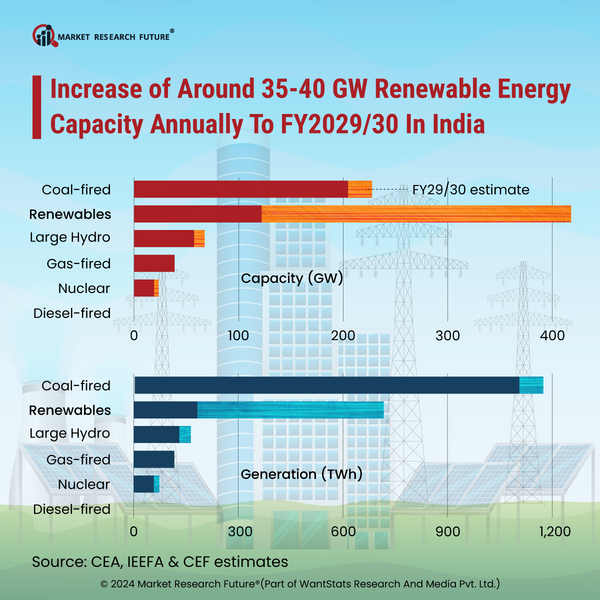

India, like many countries, is pushing hard to meet its ambitious renewable energy goals. The government has outlined that by 2030, it wants to generate 50% of its electricity from renewable sources, including solar, wind, and biomass. This shift is crucial not just for meeting energy demands but for reducing carbon emissions and combating climate change.

The GST rate hike on renewable energy devices from 5% to 12% was a surprise to many. For those who may not be familiar with how GST works, it’s essentially a consumption tax levied on goods and services, and it plays a huge role in determining the cost of projects, especially for industries that rely heavily on imported technology and materials like solar panels and wind turbines.

In simpler terms, this means that if you’re involved in any project using renewable energy technology, the 12% GST will make those devices and components more expensive. This added cost can make it harder for developers to stick to their budgets, especially in the early stages of projects. With India’s renewable energy market already dealing with fluctuations in prices due to international trade and supply chain issues, this tax could exacerbate financial concerns.

Practical Advice for Businesses in the Renewable Energy Sector

If you’re part of the renewable energy business, this change in tax policy could significantly affect your bottom line. Here are a few steps to mitigate the potential downsides:

- Review Project Budgets: Ensure that your financial projections now include the higher 12% GST rate for renewable energy devices and equipment. This will help prevent any unpleasant surprises down the road.

- Look into Exemptions: Some parts of the renewable energy sector may still qualify for tax exemptions or lower rates, especially if they are part of government-backed schemes. Stay up-to-date with the latest circulars and regulations.

- Negotiate with Suppliers: If you’re purchasing materials or components from suppliers, see if they’re able to offer discounts to offset the higher GST, or if there’s flexibility in pricing.

- Pass on Costs Strategically: If you’re developing renewable energy projects, consider passing on some of the additional costs to consumers or clients, but be mindful of how this might affect demand.

- Explore Tax Credits and Incentives: The Indian government is often flexible with offering incentives and subsidies for green energy projects. Look into these opportunities to reduce the overall cost of doing business.

A Green Energy Shift—Why 12% GST on Renewable Energy Devices?

You might be wondering: why would the government increase taxes on something as important as renewable energy? Well, the reasoning can be broken down into a few key factors:

1. Policy Alignment with Revenue Needs

While India is pushing towards a greener economy, it also has substantial fiscal needs. Taxation is a primary way to fund public services, infrastructure, and other government initiatives. In a rapidly growing economy like India’s, balancing revenue generation with environmental goals is no easy feat.

2. Improved Tax Compliance and Collection

With the country’s move towards GST, businesses, and projects in the renewable energy sector are more likely to be held to uniform standards across states, reducing the complexities that come with multiple tax systems. This can also streamline the overall tax collection process, which is essential for the long-term stability of the economy.

3. Raising Revenue for Public Services

Revenue from taxes can be used to fund clean energy infrastructure, research, and development. The government might be betting that over the long term, this additional revenue could boost India’s energy transition by making cleaner energy sources more mainstream.

The Big Picture: Impact on Stakeholders

Although the policy shift might look like a minor tweak in tax rates, its impact will ripple through various stakeholders in the renewable energy market. For instance:

- Small to Medium Enterprises (SMEs): Smaller companies, which typically have thinner margins, could find the higher tax rate difficult to absorb. The added financial burden might delay or halt some smaller projects.

- Developers and Consumers: Larger developers may have the scale to manage the tax hike, but it could lead to delays in project completion due to the higher upfront costs. Consumers, too, might find the price of renewable energy systems less affordable than before.

- Government Policy Makers: As the government has made it clear that it supports a greener future, there’s potential for this policy to be revisited. Renewable energy businesses and environmental advocates will need to engage with policymakers to ensure this shift doesn’t harm the sector’s growth.

Global Context: How Does India Compare?

India’s decision to increase GST on renewable energy devices aligns with broader global trends where taxation on renewable energy systems varies widely. For example, in the United States, the federal government has consistently supported renewable energy projects through tax credits and incentives, such as the Investment Tax Credit (ITC), which allows for a significant deduction on solar energy investments.

Meanwhile, Germany — a world leader in renewable energy adoption — uses a different model where high taxes on solar panels and wind turbines are offset by substantial subsidies for installation and R&D. Countries like China and Australia also use a mix of tax breaks and tariffs to encourage green energy, although their rates and structures differ.

Thus, India’s decision places it somewhere in between countries that heavily subsidize green tech and those that tax it more aggressively. While it’s a step towards a more standardized tax regime, the impact on growth in the sector may be uneven, especially for cost-sensitive stakeholders.

Market Trends and Innovations in Renewable Energy

Despite the added tax burden, the global market for renewable energy continues to grow at an unprecedented rate. According to a Global Renewable Energy Report, global investment in renewable energy was expected to reach $500 billion in 2023, with solar energy continuing to dominate the sector. In India, solar power alone is expected to account for 60% of the renewable energy share by 2030, with wind and biomass contributing the rest.

Technological advancements are also making renewable energy systems more affordable in the long term. Innovations in solar panel efficiency, energy storage systems, and biomass conversion technology are driving down the costs of renewable energy projects, which may help offset the short-term financial impact of higher taxes.

Case Study: Solar Power in India

A successful example of how government policies can drive renewable energy adoption comes from Gujarat, a state in western India, which has been leading the charge in solar power installations. Thanks to government incentives and a push for large-scale projects, Gujarat has seen a significant reduction in installation costs for solar systems. While this doesn’t directly offset the 12% GST, it shows how government support can mitigate the financial impact of policy changes.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties