Groundbreaking High Court Ruling on GST and Expat Employee Secondments: In a landmark ruling, the Karnataka High Court has provided crucial clarity on Goods and Services Tax (GST) in relation to expatriate employee secondments. The ruling, which quashed a massive ₹5,794 crore GST demand raised by tax authorities, is expected to have far-reaching implications for multinational corporations (MNCs) engaged in cross-border employee transfer arrangements. By determining that secondments do not constitute a taxable supply under GST, the Court has significantly altered the landscape for MNCs operating in India, ensuring compliance and easing their financial burdens. In this article, we’ll break down what expatriate employee secondments are, what the Court’s ruling means, how businesses should adjust their operations, and the wider implications for GST compliance.

Groundbreaking High Court Ruling on GST and Expat Employee Secondments

The Karnataka High Court’s ruling on GST and expatriate employee secondments marks a significant turning point for businesses with cross-border employee transfer arrangements. By confirming that secondments do not qualify as taxable manpower supply, the ruling provides much-needed clarity for MNCs, potentially saving them millions in tax liabilities. As businesses move forward, ensuring compliance with this new interpretation is key. From maintaining solid documentation to reviewing past GST payments, businesses can now proceed with greater confidence in managing their expatriate secondment arrangements.

| Key Takeaway | Details | Source |

|---|---|---|

| Case Name | Alstom Transport India Limited v. Commissioner of Commercial Taxes | Link to Case Summary |

| Court Ruling | Expatriate employee secondments are not taxable under GST | Official Court Order |

| Amount at Stake | ₹5,794 crore GST demand was quashed | Karnataka High Court |

| Impact on MNCs | Provides clarity for businesses with foreign employees on their GST liabilities | EY.com |

| Practical Advice | Businesses should ensure compliance by maintaining detailed employee and operational records | Business Guide |

| Important Legal Reference | Central Board of Indirect Taxes and Customs Circular No. 210/4/2024-GST | CBIC Circular |

What is Expatriate Employee Secondment?

Before diving into the ruling, it’s essential to understand expatriate employee secondment. Secondment refers to the temporary transfer of employees from a parent company or foreign affiliate to its subsidiary or associated business unit, typically in another country. The expatriates continue to be employed by the parent company, but they work for the subsidiary, often in a management, technical, or operational capacity.

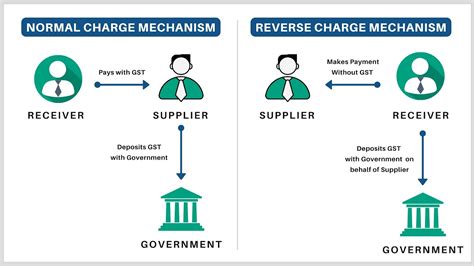

In these arrangements, the parent company bears the cost of employee salaries, benefits, and other allowances, while the subsidiary benefits from their expertise and skills without needing to directly employ them. From a GST perspective, the key issue has been whether these secondments are considered taxable transactions, as the Indian GST law generally applies to the supply of services, including manpower supply, and this has been a gray area.

Groundbreaking High Court Ruling on GST and Expat Employee Secondments

The Karnataka High Court ruled that the secondment of expatriate employees does not amount to the supply of manpower under GST. This decision overturned a ₹5,794 crore GST demand imposed by tax authorities on Alstom Transport India, which was one of the MNCs engaged in expatriate secondment.

Key Factors the Court Considered:

- Employer-Employee Relationship: The Court emphasized the employer-employee relationship between the Indian subsidiary and the expatriates, who were on the Indian company’s payroll and had their salaries subject to Indian tax (TDS). The judgment stated that this arrangement was not taxable under GST, as per Schedule III of the CGST Act, which specifically excludes services rendered by an employee to an employer.

- Integration into Indian Operations: The Court also considered that the expatriates were fully integrated into the operations of the Indian subsidiary and worked under its direct control. This integration was essential in concluding that the services provided by expatriates were not taxable as manpower supply.

- Absence of Separate Service Contracts: The expatriates were not hired under separate service contracts with the Indian subsidiary. The Court pointed out that the expatriates continued to work within the framework of their original employment with the parent company, further negating the claim of a taxable supply.

- CBIC Circular Reference: The Court referenced the CBIC Circular No. 210/4/2024-GST, which states that services received from a foreign affiliate, which do not involve an invoice, may not attract GST. The circular strengthens the argument that secondments should be treated as non-taxable, provided the payments are subject to the Indian income tax regime.

Practical Implications for Businesses

1. No GST on Secondment Costs

The most direct implication of this ruling is that businesses engaging in expatriate secondments no longer need to pay GST on the costs associated with such secondments, provided the criteria outlined above are met. This includes salary payments, benefits, and allowances paid to expatriates working under the Indian entity’s operational control.

Example: If your business has expatriates working in India, and they are on the payroll of the foreign parent company, you will not have to pay GST on the salary or related benefits of these employees. This can save businesses a significant amount in tax liabilities.

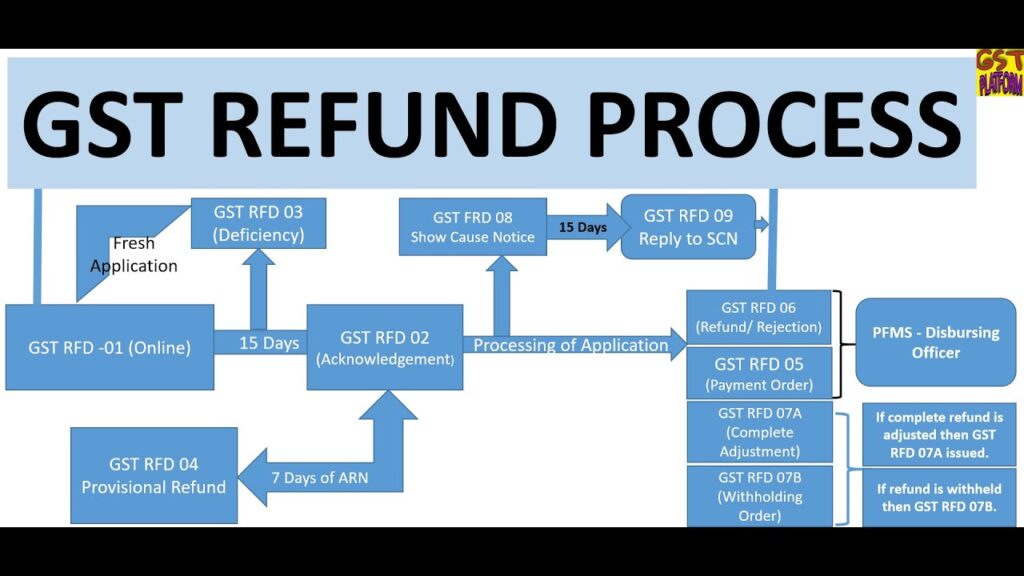

2. Opportunity for Refunds

If your company has already paid GST under the reverse charge mechanism on expatriate secondment costs, you may be eligible for refunds. The ruling opens the possibility for businesses to recover GST paid on secondment-related costs if those payments were incorrectly taxed as manpower supply. It’s recommended to consult tax advisors to initiate this process.

3. Documentation Is Key

While the ruling brings relief, businesses must ensure they have adequate documentation to prove their secondment arrangements comply with the Court’s criteria. This means maintaining:

- Employee contracts that clearly show the expatriates remain employees of the foreign company.

- Payroll records showing TDS deductions under Indian tax laws.

- Operational integration records that demonstrate the expatriates are working within the Indian entity’s operations.

4. Impact on Business Models

This ruling encourages MNCs to review their business models and secondment agreements. Companies should assess whether any of their foreign employee arrangements could be seen as taxable under GST. Additionally, if the arrangement involves any reimbursed expenses like social security contributions or insurance, those should be handled carefully to ensure they are in line with the ruling.

Steps to Ensure Compliance Going Forward

For businesses affected by expatriate secondment, here’s a step-by-step guide on ensuring compliance with the new ruling:

Step 1: Review Your Expatriate Secondment Contracts

Carefully review all contracts involving expatriate employees. Ensure that the employer-employee relationship is clear and that the expatriates are working under the operational control of the Indian subsidiary.

Step 2: Maintain Detailed Documentation

Compile detailed records of expatriates’ employment contracts, payroll data, TDS records, and evidence of their integration into the Indian operations. This will be crucial during any audit or compliance review.

Step 3: Assess Past GST Payments

Work with your finance team or tax professionals to assess whether your business has paid GST on secondment-related costs in the past. If so, determine whether you are eligible for a refund based on the new ruling.

Step 4: Review Reimbursement Practices

If you reimburse the foreign parent company for expatriates’ expenses, ensure that such reimbursements are at actual cost and without markup, to avoid any inadvertent GST liabilities.

Step 5: Consult with Experts

Given the complexities of GST law and the potential for future changes in the interpretation of tax provisions, it’s advisable to consult with tax professionals to navigate the nuances of this ruling effectively.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties