Local Trade Helped July GST Collections: July 2025 saw India’s Goods and Services Tax (GST) collections soar to an impressive ₹1.96 lakh crore, a 7.5% increase from the same period last year. This surge in revenue was powered mainly by local trade, a factor that helped buffer the impact of global uncertainties and maintain India’s robust economic performance. But what exactly drove this impressive figure? Let’s break down the story, explore how local trade played a key role, and see how it impacted businesses and the economy.

Local Trade Helped July GST Collections

The record-breaking ₹1.96 lakh crore in GST collections for July 2025 reflects a steady and robust economic recovery, fueled by local trade. Both manufacturing and consumption sectors contributed significantly to this increase, underscoring the strength of India’s domestic economy. Businesses, large and small, can take lessons from this growth to improve their operations and stay compliant with evolving GST regulations. As India’s economy continues to grow, it’s important to stay informed, keep accurate records, and embrace the evolving tax landscape to ensure long-term success.

| Key Metric | Value | Insights |

|---|---|---|

| Total GST Collection | ₹1.96 Lakh Crore | 7.5% year-on-year increase in GST collections for July 2025. |

| Domestic Trade Contribution | ₹1.43 Lakh Crore | Local trade, especially manufacturing and consumption, made a major contribution. |

| GST from Imports | ₹52,712 Crore | Imports also saw significant growth, with a 9.7% rise in GST collections from international goods. |

| GST Refunds | ₹27,147 Crore | A 66.8% increase in refunds helped boost liquidity for businesses. |

| Sectoral Performance | Positive Growth in Manufacturing | The manufacturing sector recorded its highest activity in over a year, supporting GST growth. |

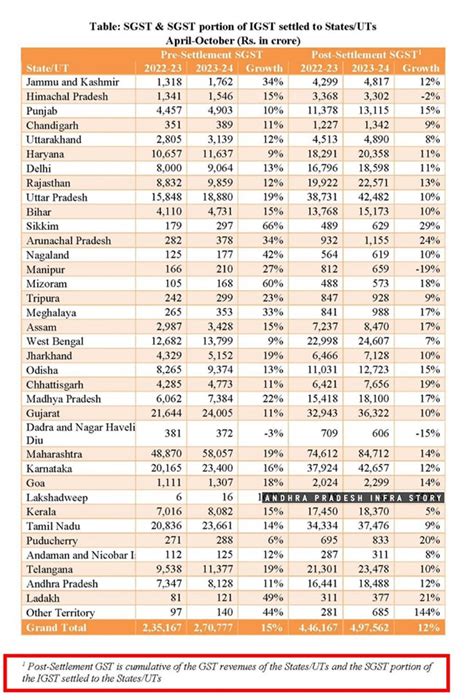

| Regional GST Growth | 18% in Madhya Pradesh | Regional growth in states like Madhya Pradesh and Bihar showed strong local economic activity. |

| Source | Financial Express | Provides detailed stats on the rise of GST collections and factors behind the growth. |

What is GST and Why Does It Matter?

GST, or Goods and Services Tax, is a comprehensive tax levied on goods and services sold in India. Essentially, it replaces many older indirect taxes like excise duty and VAT, simplifying the tax structure across states. It ensures that businesses only pay tax on the value added at each stage of production and distribution, keeping the system transparent and efficient.

The government’s ability to collect GST accurately is critical to managing India’s finances, paying for infrastructure, public services, and social welfare programs. For businesses, complying with GST regulations is essential to maintaining operations and profitability.

July GST Collection: A Major Milestone

In July 2025, the GST collections reached a total of ₹1.96 lakh crore, marking a 7.5% growth over the same period last year. This is a significant achievement and reflects a strong, resilient economy despite global challenges.

The domestic trade or local trade played a pivotal role in this rise. Let’s dive deeper into how local trade, both in the form of manufacturing and consumption, contributed so heavily to these figures.

How Local Trade Helped July GST Collections?

Manufacturing Resurgence

India’s manufacturing sector recorded impressive growth, reaching a 16-month high in July 2025. As the country began to recover from the impacts of previous economic slowdowns, local manufacturing units began operating at full capacity again.

This increased output naturally translated into higher GST collections from the manufacturing sector. More goods were produced, more businesses were invoicing their clients, and as a result, the tax base widened.

For example, industries like textiles, machinery, and electronics saw significant surges in both domestic and export demand. As these sectors picked up pace, the GST paid by these companies became a major contributor to the total collection.

Consumer Spending Boost

On the consumer side, spending patterns also supported GST growth. The consumer market remained resilient, with many Indians choosing to spend on goods and services, particularly in sectors like retail, hospitality, and electronics.

Higher consumer spending meant more transactions, which meant more GST payments flowing into the government’s coffers. It was a combination of demand and supply that really helped power this growth.

Rise in Service Sector Contributions

Beyond goods, the service sector has also played a significant role. Businesses in sectors like education, IT services, transportation, and health services have seen increased activity, which led to higher GST collection from the services sector. Services account for about 55% of India’s GDP, so their positive performance was a big deal.

For example, the IT and software services industry reported strong growth in exports and domestic sales, which directly contributed to the increase in GST collections.

Strong Regional Contributions

What’s interesting is the role played by different states in this rise. States like Madhya Pradesh and Bihar have seen substantial growth in their GST collections, with numbers reported at 18% and 16%, respectively. This suggests that local businesses in these regions are becoming more active and compliant with tax rules, further supporting the national growth figures.

The story of local trade driving GST growth is not just about larger cities like Mumbai or Delhi. Smaller cities and rural areas also saw a boost in GST revenue, highlighting how India’s vast internal market is contributing to the economy.

Impact on the Indian Economy

The rise in GST collections is not just an isolated statistic; it reflects broader economic trends in India. Higher GST collections typically suggest stronger consumer confidence, higher industrial output, and increased business activity. For the government, it means more resources to invest in infrastructure, healthcare, and other public services.

Additionally, it also reflects India’s resilient economy in the face of global uncertainties. With the world facing trade tensions, rising inflation, and slower global growth, India’s domestic economy is proving to be a pillar of stability. This increase in GST collections can be seen as an indicator of how local trade and self-reliance are becoming central to India’s future economic growth.

Insights from Industry Leaders

According to Arvind Subramanian, former Chief Economic Advisor to the Government of India, “The rise in GST collections is a direct result of India’s expanding internal market. It’s not just about growing exports or import duties but a testimony to the vibrancy of our domestic economy, which continues to gain momentum despite global challenges.”

This statement from an industry expert underscores the fact that local trade, driven by Indian consumers and manufacturers, is not just important for the current fiscal year but will continue to play a crucial role in shaping India’s economic future.

Steps the Government is Taking to Improve GST Compliance

To ensure that businesses continue to comply with GST regulations, the Indian government has rolled out a series of reforms aimed at simplifying the process. These include:

- Digitization: The government has moved towards a more digital and automated system for tax filing, allowing businesses to file returns and pay taxes online without physical paperwork.

- E-way Bill System: This system tracks the movement of goods, helping reduce tax evasion by ensuring that goods in transit are properly accounted for in GST returns.

- Better Refund Mechanisms: The government has improved the refund process for businesses, particularly in sectors like exports and input tax credit, ensuring smoother transactions and reducing delays.

- Public Awareness Campaigns: To ensure businesses understand their obligations under the new system, the government regularly conducts educational campaigns for small and medium businesses.

Long-Term Trends: GST Growth and What the Future Holds

Looking ahead, GST growth is expected to continue as India focuses on enhancing its local manufacturing capabilities and consumer consumption. The government’s push for Atmanirbhar Bharat (self-reliant India) will likely spur local businesses to innovate and grow, directly contributing to more tax revenue.

As India’s economy matures, we can expect the following trends:

- Greater Tax Compliance: As more businesses comply with GST regulations, the tax base will expand, ensuring consistent growth in collections.

- Increased Contribution from Services: As the service sector continues to grow, so will the proportion of GST coming from services like education, IT, and health.

- Regional Growth: With better infrastructure and policy support, smaller cities and rural areas will increasingly contribute to GST collections.

The Future of Local Trade in GST Growth

As India’s internal market continues to grow, local trade will remain a critical component of the country’s economic structure. Businesses should focus on improving local supply chains, boosting regional trade, and adapting to digital tax systems to stay ahead.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!