West Bengal’s GST Revenue Soars 12% in July: In July 2025, West Bengal saw a major uptick in its Goods and Services Tax (GST) collections, reporting a 12% year-on-year increase. This growth is impressive, especially considering the economic challenges faced by many states across India. For the people of West Bengal, this increase signals a shift in the local economy, and for businesses, it’s an indication that consumption and economic activity are on the rise. But what does this really mean for everyday people, businesses, and the state’s financial health? Let’s break it down, step by step, in simple language that everyone can understand. Whether you’re a local business owner, a policymaker, or just someone interested in the state’s economic trends, this article will guide you through the significance of this 12% GST revenue growth and what it means for you.

West Bengal’s GST Revenue Soars 12% in July

In conclusion, West Bengal’s 12% growth in GST revenue in July 2025 is a clear sign of an improving economy, fueled by strong consumption and business activity. Although there are challenges, such as the slight decline in post-settlement SGST, the overall trend remains positive. For businesses, this growth presents new opportunities for expansion, investment, and improved infrastructure. West Bengal’s economic future looks promising, and the state is well on its way to recovering from the setbacks of the pandemic.

| Key Point | Details |

|---|---|

| GST Growth in July | West Bengal’s GST collections in July 2025 grew by 12%, reaching ₹5,895 crore. |

| Comparative Performance | Neighboring states like Jharkhand and Odisha showed lower growth rates. |

| Cumulative GST Growth | For April–July 2025, the state’s GST collections grew by 5% to ₹8,870 crore, despite fluctuations. |

| Post-Settlement Impact | The state’s post-settlement SGST showed a 1% decline, attributed to IGST apportionment and credits. |

| Local Economic Indicators | Positive growth suggests resilience in West Bengal’s economy, with a thriving business climate. |

| Link for More Information | West Bengal’s GST Revenue Growth on Rediff |

Now that we’ve got the highlights out of the way, let’s dive deeper into understanding what this all means, both for the state’s economy and for you.

What Is GST, and Why Is It Important?

To start with the basics, GST (Goods and Services Tax) is a value-added tax applied to goods and services at every stage of the production or distribution process. It’s one of the most important sources of revenue for the government, both at the federal and state levels. When businesses produce goods or offer services, they collect this tax from consumers and then pass it on to the government. For West Bengal, like any other state in India, GST revenue helps fund public services, infrastructure, and development projects. The higher the GST collections, the more money the government has to invest in building roads, schools, hospitals, and creating jobs.

Why Did West Bengal’s GST Revenue Soars 12% in July?

West Bengal’s significant 12% growth in July 2025 is due to several factors that signal positive economic momentum. Here’s why this spike is happening:

1. Increase in Consumption

The primary driver of this increase is a jump in consumer spending. When people are buying more goods and services, it leads to higher GST collections. From retail shopping to large-scale infrastructure projects, the increased demand for products and services across the state resulted in more tax revenue.

For example, industries such as manufacturing, construction, and retail are seeing steady growth, which contributes heavily to the state’s overall tax collections.

2. Stronger Business Activity

As businesses reopen and recover from earlier slowdowns, their growth directly impacts the GST they pay. Businesses are more confident now, investing in expansion and hiring more workers, which boosts production and consumption. This, in turn, contributes more to the tax base.

3. Increased Economic Activity Post-COVID

After the pandemic disrupted economies worldwide, many states are now witnessing an economic recovery. West Bengal is no different. With the state getting back to business and normal life resuming, industries are ramping up their production and sales.

Historical Context: How Has GST Revenue Evolved in West Bengal?

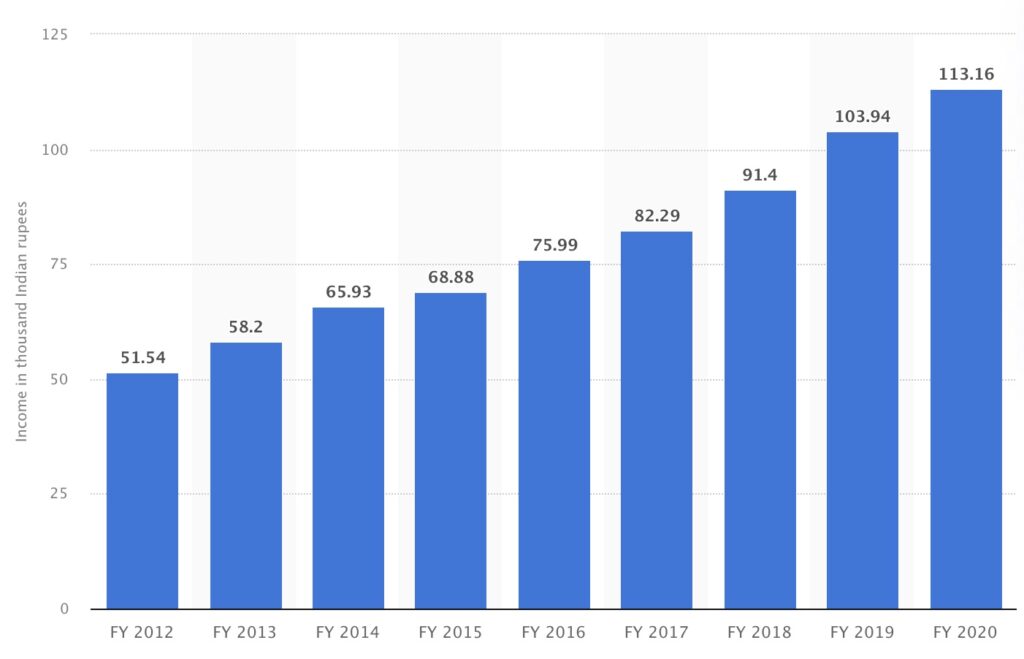

West Bengal’s GST collections have seen steady growth over the past few years. After the implementation of the GST system in 2017, the state, like others, faced initial challenges in adjusting to the new tax structure. However, the state has since improved its tax compliance mechanisms, reduced tax evasion, and increased awareness about GST, resulting in consistent year-on-year growth.

In the years following the GST implementation, West Bengal faced fluctuating revenue due to global and national economic factors. But in recent months, the state has managed to outperform other regions, signaling a more resilient and rapidly recovering economy.

Example: Year-on-Year Growth

In July 2024, West Bengal’s GST collections stood at ₹5,257 crore. By July 2025, that figure jumped to ₹5,895 crore, reflecting a healthy and consistent upward trend in revenue collection.

Sectoral Analysis: Which Industries Are Contributing the Most?

Different sectors in West Bengal contribute to the GST collections, and understanding these can help businesses align themselves with the growing economic trends. Some of the most significant sectors driving growth include:

- Manufacturing: With factories and industries ramping up production, the manufacturing sector contributes heavily to GST revenues. Items like steel, machinery, and chemicals, which are taxed at higher rates, add significantly to the state’s GST pool.

- Retail & E-commerce: Retail businesses and the rise of e-commerce platforms have led to an increase in consumption, especially in metropolitan areas like Kolkata. This has resulted in higher tax revenue from goods like electronics, clothing, and groceries.

- Construction: Infrastructure development is a major contributor to GST collections. With several road, metro, and real estate projects underway, construction companies are paying significant taxes.

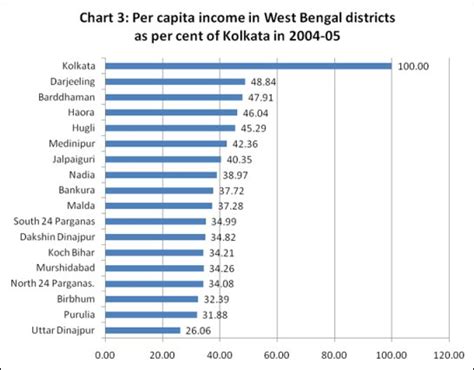

How Does This Growth Compare to Other States?

It’s essential to look at how West Bengal’s performance stacks up against its neighboring states, like Jharkhand and Odisha. While these states have also seen some growth, they haven’t matched West Bengal’s performance.

West Bengal’s ability to outperform these regions indicates a more robust recovery and a higher rate of consumer spending and business activity. This bodes well for future fiscal growth and provides a sense of stability in the state’s economic environment.

How Is This Growth Beneficial for Local Businesses?

The 12% increase in GST revenue in July could be a sign of more favorable conditions for local businesses. Here’s how:

- Lower Tax Burden: With the state’s economy on the rise, more tax revenue means that the government might be able to offer lower tax rates or exemptions for small businesses to keep the economy growing.

- Increased Investment: Higher GST revenue suggests that businesses are doing well. This success attracts new investment into the state, which could lead to further expansion and more job opportunities.

- Improved Infrastructure: More revenue means better funding for infrastructure, including transportation networks, utilities, and digital systems. For businesses, this means smoother operations and a better environment to grow in.

Example: Local Shop Owners

Take the case of a local retail shop owner in Kolkata. If more consumers are buying goods, their sales increase, which means higher GST collections. The increase in revenue could allow the government to invest in better roads, making it easier for deliveries to reach stores quickly. More consumers can also mean more foot traffic, improving overall sales.

What Are the Challenges Despite the Growth?

While the 12% growth in July is impressive, it’s important to understand that not everything is perfect. Post-settlement SGST, which refers to the state’s share of GST revenue after IGST (Integrated GST) adjustments, showed a slight decline of 1%.

This decline suggests there might be issues with how the GST revenue is being distributed between states, and this has caused some concerns. Still, despite this small hiccup, the overall trend is positive, and the state is on the right track toward sustained economic recovery.

A Detailed Breakdown of West Bengal’s GST Performance

For a deeper understanding, let’s break down the GST performance further:

1. Pre-settlement SGST

The pre-settlement SGST is the amount of GST collected directly by the state. For West Bengal, this figure reached ₹8,870 crore from April to July 2025, showing a healthy 5% increase compared to the same period in the previous year. This indicates that local businesses and consumers are actively contributing to the state’s tax pool.

2. Post-settlement SGST

On the other hand, post-settlement SGST refers to the amount that the state receives after the central government settles the IGST. For West Bengal, the post-settlement SGST amounted to ₹15,153 crore, marking a slight decline of 1% compared to the same period last year. While this decline isn’t drastic, it’s a point of concern that needs attention.

Government Initiatives That Helped the Growth

The state government’s efforts in improving the Ease of Doing Business have been pivotal in fostering this growth. By simplifying tax filing processes, digitizing services, and offering incentives for businesses, West Bengal has made it easier for entrepreneurs to thrive.

Moreover, the Pradhan Mantri Gati Shakti Scheme, aimed at improving infrastructure, has also contributed to smoother operations for industries, further supporting the economic boost.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices—Is This a Step Forward or Backward?