Odisha’s GST Act Set for Major Overhaul: The Goods and Services Tax (GST) Act in Odisha is undergoing a significant transformation aimed at making it more business-friendly, easier to navigate, and aligned with the national GST 2.0 reforms. These upcoming changes will simplify the GST system and provide greater flexibility to businesses, especially small and medium-sized enterprises (SMEs), while reducing the burden of compliance. The amendments, approved by the state government, promise to help businesses save time and effort by clarifying complex provisions, decriminalizing minor offenses, and enhancing online tax registration and filing processes. So, what exactly are these changes, and why should you care? Whether you’re a business owner, a tax professional, or simply someone trying to understand how these changes might impact you, this article will break everything down in simple, actionable terms.

Odisha’s GST Act Set for Major Overhaul

The overhaul of Odisha’s GST Act is a significant step forward for businesses in the state. By simplifying the provisions, decriminalizing minor offenses, and introducing online processes, the government is paving the way for a more efficient and business-friendly tax system. The changes are expected to not only improve tax compliance but also foster a more transparent and streamlined process for businesses, especially small and medium-sized enterprises. For businesses, staying informed, utilizing online tools, and consulting tax professionals are the best ways to adapt to these changes and fully benefit from the reforms. As the national GST 2.0 reforms continue to roll out, Odisha’s proactive approach ensures that the state remains ahead in creating a conducive environment for business growth.

| Key Information | Details | Source/Reference |

|---|---|---|

| Amendment Focus | Simplification, decriminalization, and improved taxpayer facilities. | Odisha Bytes |

| Key Changes | Increase in prosecution threshold, online processes, and easier tax compliance. | SAG Infotech |

| GST 2.0 Reforms | Aligned with national efforts to simplify GST processes. | GST Learn |

| Implementation | Online GST processes and professional tax registration deemed approved. | Odisha Tax |

| Projected Benefits | Faster registration, less burden for taxpayers, and greater tax compliance. | Omcom News |

Context: The Evolution of GST in Odisha

The introduction of GST in India was a landmark move aimed at simplifying the complex web of indirect taxes like VAT, service tax, and excise duties, into one unified system. Odisha adopted this new framework in line with the rest of India when GST was introduced in 2017. The shift to a single tax system aimed to boost economic efficiency and increase revenue generation by eliminating state-specific tax barriers.

However, over the years, businesses in Odisha have faced challenges. Small enterprises, in particular, struggled with the intricate compliance requirements, complex filing procedures, and fear of harsh penalties for minor mistakes. The state government acknowledged these issues and has been working on reforms to make the tax structure more adaptable and taxpayer-friendly.

The Key Changes in the Odisha’s GST Act Set for Major Overhaul

1. Simplification of Tax Provisions

With the goal of making GST easier to understand and apply, the amendments focus on streamlining the language of the tax provisions. Previously, businesses often found it challenging to interpret tax codes and guidelines, leading to confusion and mistakes. The state government aims to resolve this by offering clearer tax rules, thus allowing businesses to stay compliant without getting bogged down by complex regulations. For instance, small business owners will no longer have to deal with jargon-heavy legal provisions, making it easier to understand what is expected from them.

2. Decriminalization of Minor Offenses

Previously, businesses faced criminal charges for simple non-compliance issues, such as missing a filing deadline or failing to maintain certain records. This move reduced the threshold for initiating prosecution from ₹1 crore to ₹2 crore. This reduction will significantly help small businesses that may have previously feared harsh penalties for minor mistakes. The focus of enforcement will now shift towards more severe tax evasion cases, providing relief to businesses dealing with unintentional errors.

3. Enhanced Taxpayer Facilities

Taxpayer facilitation has always been a challenge in many states, but Odisha is changing that. The new amendments offer taxpayers improved services, such as faster processing of returns, simplified registration processes, and easy access to information. The changes also include help desks and online support systems, ensuring that businesses and individuals get prompt assistance when dealing with tax issues.

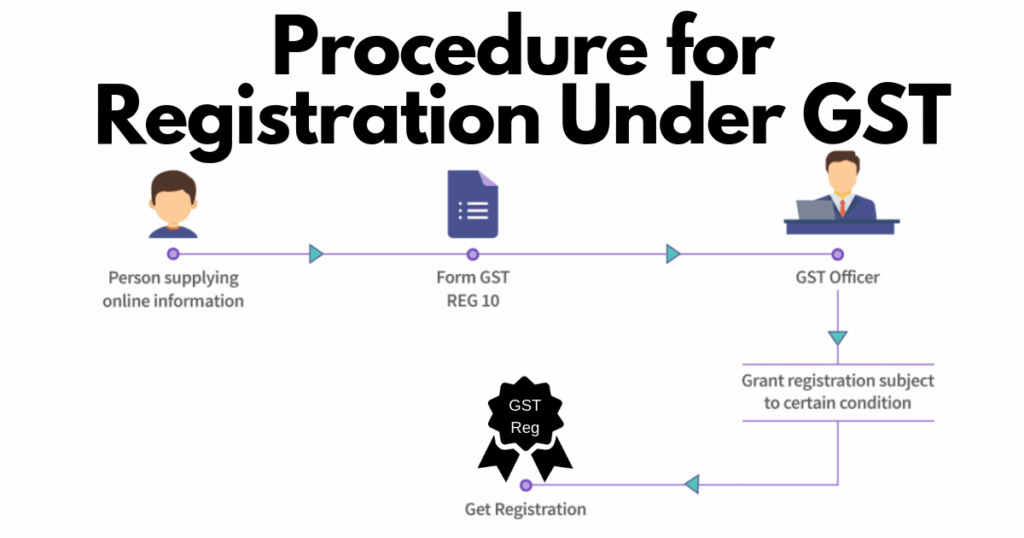

4. Online GST and Professional Tax Registration

In an effort to make the process more efficient, Odisha is introducing online GST processes. Businesses can now file their returns, make payments, and handle issues via online platforms. For professional tax registration, the state has made it possible for registration to be automatically approved once the online application is submitted. These changes will significantly reduce paperwork and streamline the entire process for businesses, especially startups.

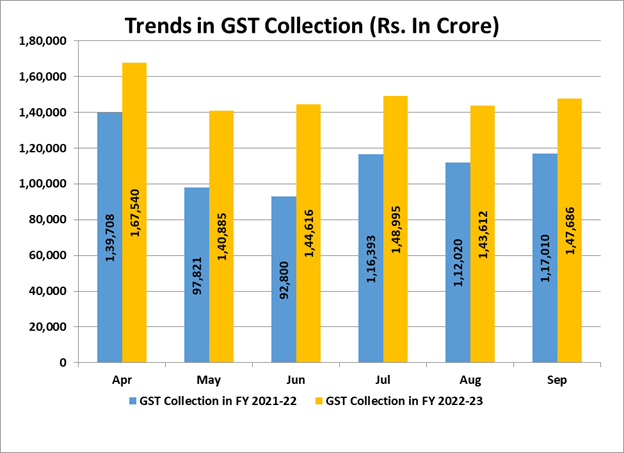

The Broader Picture: GST 2.0 and National Reforms

While Odisha is making strides with its own reforms, these changes are aligned with the GST 2.0 reforms being implemented across the country. The GST 2.0 initiative is aimed at simplifying the overall GST structure, rationalizing tax slabs, and improving the overall tax compliance framework.

At the national level, the government is also considering tax structure changes, such as reducing the number of GST slabs or making the system more transparent. The GST 2.0 reforms also aim to address concerns related to GST filing complexities and improve ease of doing business.

For Odisha, these national changes mean that the state’s recent reforms are only the beginning. The state is setting an example of what a simplified, transparent, and taxpayer-friendly tax system should look like.

Practical Tips for Businesses in Odisha

To make the most of these changes, here are a few actionable tips for businesses in Odisha:

- Stay Informed: As the reforms continue to be implemented, it’s important to stay updated on the latest amendments to ensure you don’t miss out on any important changes.

- Leverage Online Tools: Take full advantage of the new online GST registration and filing platforms. These tools will save you time and effort, making compliance much easier.

- Consult a Tax Professional: If tax compliance isn’t your strength, consider hiring a tax professional who can help you navigate the new changes. Their expertise will ensure you stay compliant while focusing on growing your business.

- Keep Your Records in Order: With the new reforms, businesses are required to keep detailed records for their GST filings. Use accounting software to ensure your financial data is organized and easily accessible.

- Understand Decriminalization: Minor offenses will no longer result in criminal charges unless they involve significant sums. This change will allow you to focus more on running your business without fearing small errors.

Examples of How These Changes Will Help Businesses

Consider a small retailer in Bhubaneswar who struggles to comply with the existing tax rules. The retailer often misses filing deadlines or makes errors in return filing due to complex tax rules. With the new amendments, the business owner can expect clear tax provisions, automatic online registration, and the peace of mind that minor mistakes won’t lead to severe penalties.

For a startup in Cuttack looking to get GST registration, the streamlined online process will reduce the time it takes to officially register and start doing business. This quicker turnaround time means entrepreneurs can spend more time focusing on innovation rather than bureaucratic processes.

FM Sitharaman Clears the Air on GST Issue for Apartment Associations—What You Need to Know

GST Collections for July 2025: You Won’t Believe Which State Tops the List!