Time Limit for Availing ITC on Import IGST: In recent developments, the Tamil Nadu Authority for Advance Ruling (AAR) made an important decision regarding the time limit for availing Input Tax Credit (ITC) on Integrated Goods and Services Tax (IGST) paid on imports through a re-assessed Bill of Entry. The ruling emphasizes that the time limit for claiming ITC, as per Section 16(4) of the Central Goods and Services Tax (CGST) Act, starts from the date of reassessment, not the original date of importation. In this article, we’ll break down what this ruling means, why it’s crucial for businesses, and how importers can take advantage of it to stay compliant with GST regulations. Whether you’re new to the world of GST or a seasoned professional, we’ve got you covered with actionable insights, examples, and a clear step-by-step guide.

Time Limit for Availing ITC on Import IGST

| Key Topic | Details |

|---|---|

| Topic | Time Limit for Availing ITC on Import IGST via Re-assessed Bill of Entry |

| Legal Reference | Section 16(4) CGST Act 2017 |

| Time Limit | 30th November following the end of the financial year or annual return filing date |

| AAR Ruling | Time limit starts from date of reassessment of Bill of Entry |

| Re-assessed Bill of Entry | Only applicable for claiming ITC under re-assessment |

| Important Fact | TR-6 Challans not valid for ITC claims on IGST |

| Link to Official Website | CGST Act 2017 |

What Does This Ruling Mean for Importers?

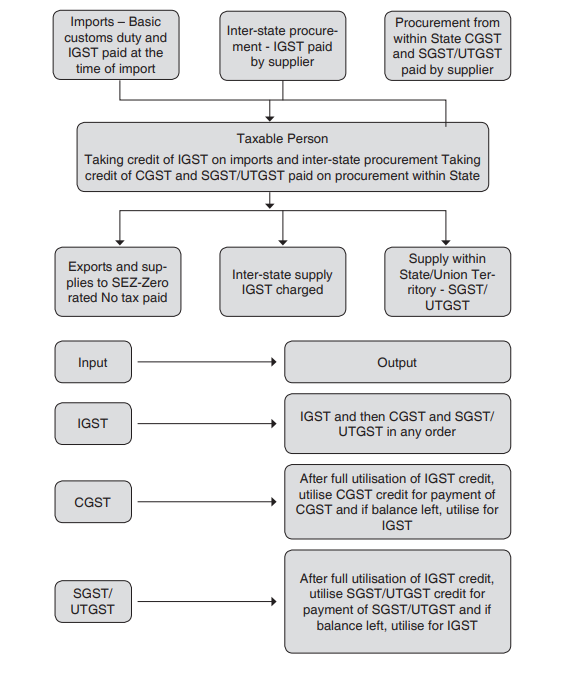

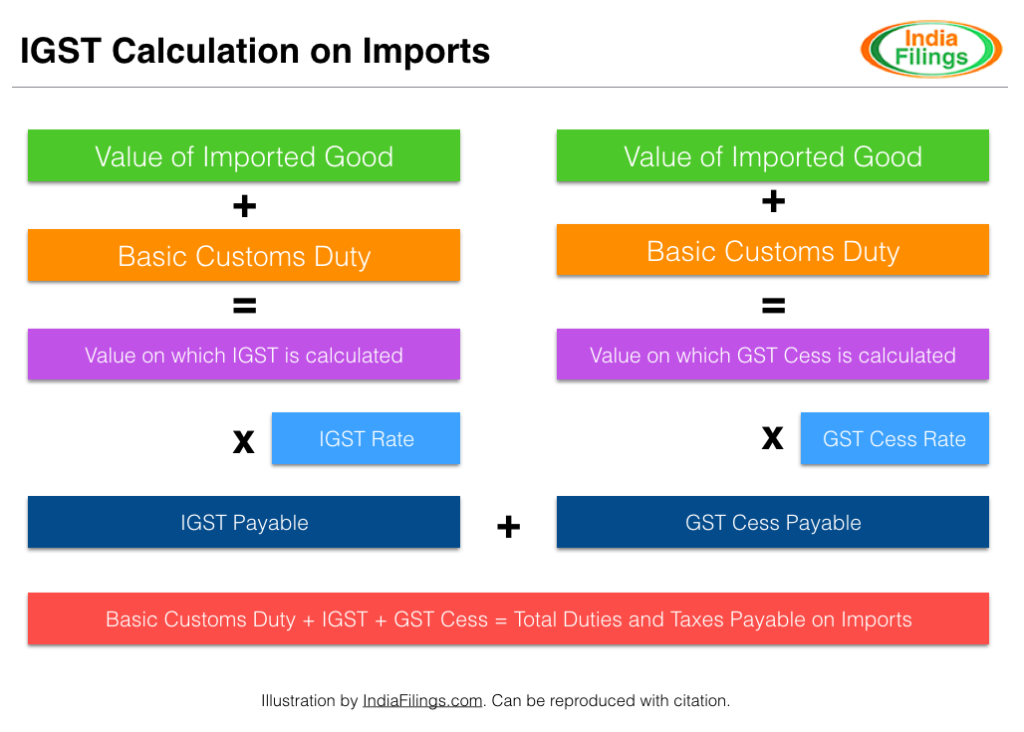

Let’s start with some context. When goods are imported into India, the Integrated Goods and Services Tax (IGST) is paid on those imports. Once IGST is paid, businesses can claim an Input Tax Credit (ITC), which allows them to offset their tax liabilities. However, this can only happen if the ITC is claimed within a certain timeframe, as set by Section 16(4) of the CGST Act.

Under normal circumstances, the time limit to claim ITC is the 30th of November following the end of the financial year to which the Bill of Entry pertains, or the date of filing the annual return, whichever comes earlier.

Re-assessed Bill of Entry and ITC

Now, things get a bit more interesting when the Bill of Entry is re-assessed. This could happen when there’s a price revision after the initial import, leading to a higher duty payment. The AAR ruling clarifies that in this case, the time limit for availing ITC starts from the date of reassessment, not from the date the goods were originally imported.

This is a significant distinction because it gives businesses a new window of opportunity to claim ITC on the differential IGST paid during the reassessment process. Importers should keep track of such re-assessments to ensure they don’t miss out on claiming the available credit.

Practical Example

Let’s say your business imported goods in March 2023, and you paid IGST on the import at that time. Later, in July 2023, the value of the goods was reassessed, resulting in additional IGST being paid. The AAR ruling means that the time limit to claim ITC for this additional IGST starts from the date of reassessment (July 2023), and not from when the goods were originally imported (March 2023).

This can make a big difference when it comes to tax planning and filing. By knowing this, businesses can claim their ITC even beyond the typical filing window that applies to their original Bill of Entry.

Steps for Availing ITC on Import IGST

Here’s a step-by-step guide to help businesses understand how to proceed with claiming ITC on a re-assessed Bill of Entry:

1. Check the Re-assessment Status

- Make sure your Bill of Entry has been re-assessed due to a price revision or any other reason. You can find this information through your Customs Department or by reviewing your Customs Import Data.

2. Obtain the Re-assessed Bill of Entry

- Once the re-assessment is complete, you will receive a revised Bill of Entry from the Customs Department. This document will reflect the updated duties and taxes, including the IGST paid.

3. Review the Time Limit

- The time limit for claiming ITC will start from the date of reassessment, which is crucial in this case. Remember, this is different from the original importation date.

4. Ensure Compliance with Section 16(4)

- Ensure that your claim for ITC is made by 30th November of the year following the end of the financial year when the reassessment occurred, or by the date when you file your annual return, whichever is earlier.

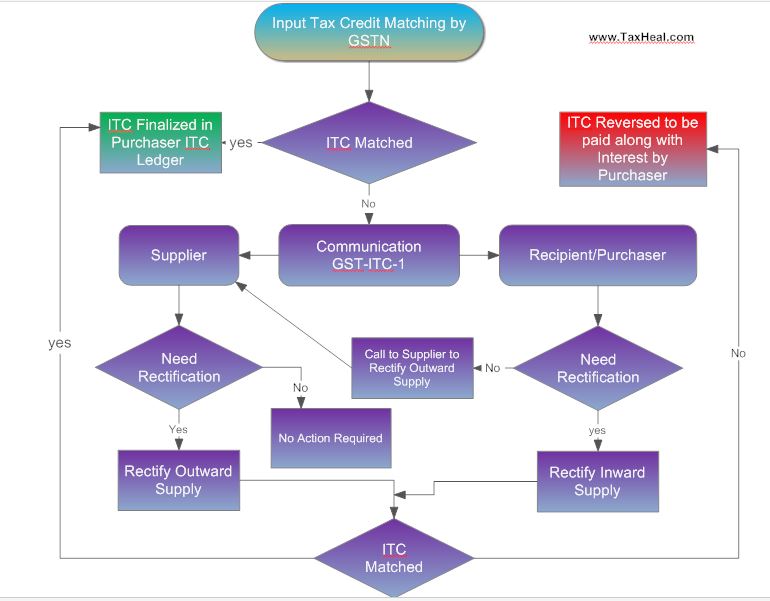

5. File ITC Claim in GST Returns

- File your claim for ITC in the appropriate GST returns (GSTR-3B). Ensure that the revised Bill of Entry is uploaded and that all documents are in place for proper verification.

TR-6 Challans Not Valid for ITC Claims

In addition to the re-assessment of the Bill of Entry, the AAR also ruled that businesses cannot claim ITC on IGST paid via TR-6 Challans. This is because TR-6 Challans are not considered valid documents for the purpose of ITC under the current CGST rules.

For ITC claims to be valid, businesses must rely on the re-assessed Bill of Entry, which is considered a valid document for claiming ITC under Rule 36(1)(d) of the CGST Rules.

Importance of Proper Documentation

Proper documentation is crucial when it comes to claiming ITC. Businesses must ensure that they retain and maintain accurate records of their import transactions, Bills of Entry, re-assessments, and IGST payments. The Customs Department and GST authorities will require this documentation for verification, and failure to provide accurate documents may result in the rejection of ITC claims.

Always ensure you have a clear paper trail for each import, especially when it involves reassessments or changes to the IGST paid. This can help you avoid unnecessary delays in claiming credits or face disputes with tax authorities.

Challenges Faced by Importers

Many businesses face challenges in navigating the complexities of GST, especially when it comes to claiming ITC on imports. Common challenges include:

- Missing deadlines: Businesses sometimes fail to claim ITC on time due to mismanagement of records or misunderstanding of the time limits.

- Incomplete or incorrect documentation: Inadequate or incorrect Bills of Entry, or missing reassessment documents, can result in the rejection of ITC claims.

- Complexity of reassessments: Dealing with reassessments and updated Bills of Entry can be tricky, especially if there’s confusion about the new date and time limits for claiming ITC.

Recent Trends in ITC Claims on Imports

As businesses become more familiar with GST regulations, there has been a noticeable increase in the number of importers claiming ITC on reassessed Bills of Entry. According to recent data, more than 60% of importers have started taking advantage of the reassessment window, which provides them with a second chance to claim ITC. This trend reflects a growing understanding of GST and how to navigate its complexities effectively.

Expert Tips for Ensuring Compliance

Here are some expert tips to help businesses stay compliant and ensure that they make the most of their ITC claims:

- Stay Organized: Keep a dedicated record of all Bills of Entry, customs documentation, and any reassessments.

- Track Reassessments: Monitor your import transactions and look out for reassessments so that you don’t miss claiming ITC.

- Consult with GST Experts: If you’re unsure about the process or deadlines, don’t hesitate to consult with a GST consultant or tax professional.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices—Is This a Step Forward or Backward?