GST Portal to Be Down August 2–3: The GST Portal (www.gst.gov.in) will be completely unavailable from 10:00 PM IST on August 2 to 6:00 AM IST on August 3, 2025, for a scheduled Disaster Recovery Drill. This eight-hour outage comes right as businesses prepare for upcoming return deadlines.

If you’re thinking about filing late on Saturday night or making a payment just before bed, you might want to rethink that plan. This scheduled maintenance means all services will be down — no filings, no challans, no invoice uploads. That’s right, nothing will work on the GST Portal during the blackout. Whether you run a local shop in Pune, manage a corporate tax team in Chicago, or work remotely as a freelance consultant — this applies to you. Filing late during this window may mean missed deadlines, penalties, or compliance disruptions.

GST Portal to Be Down August 2–3

The GST Portal will be inaccessible from 10:00 PM IST on August 2 to 6:00 AM IST on August 3, 2025. While this drill is essential for system security and future readiness, it could lead to significant disruption if you wait until the last minute to file returns or make payments. Avoid filing stress, missed deadlines, and penalties by completing your filings before Saturday night. Notify your clients, sync with your accountant, and take advantage of the advance notice. When it comes to tax compliance, early is always better than sorry.

| Topic | Details |

|---|---|

| Downtime Window | August 2, 10:00 PM IST – August 3, 6:00 AM IST |

| Reason | Scheduled Disaster Recovery Drill (System Test) |

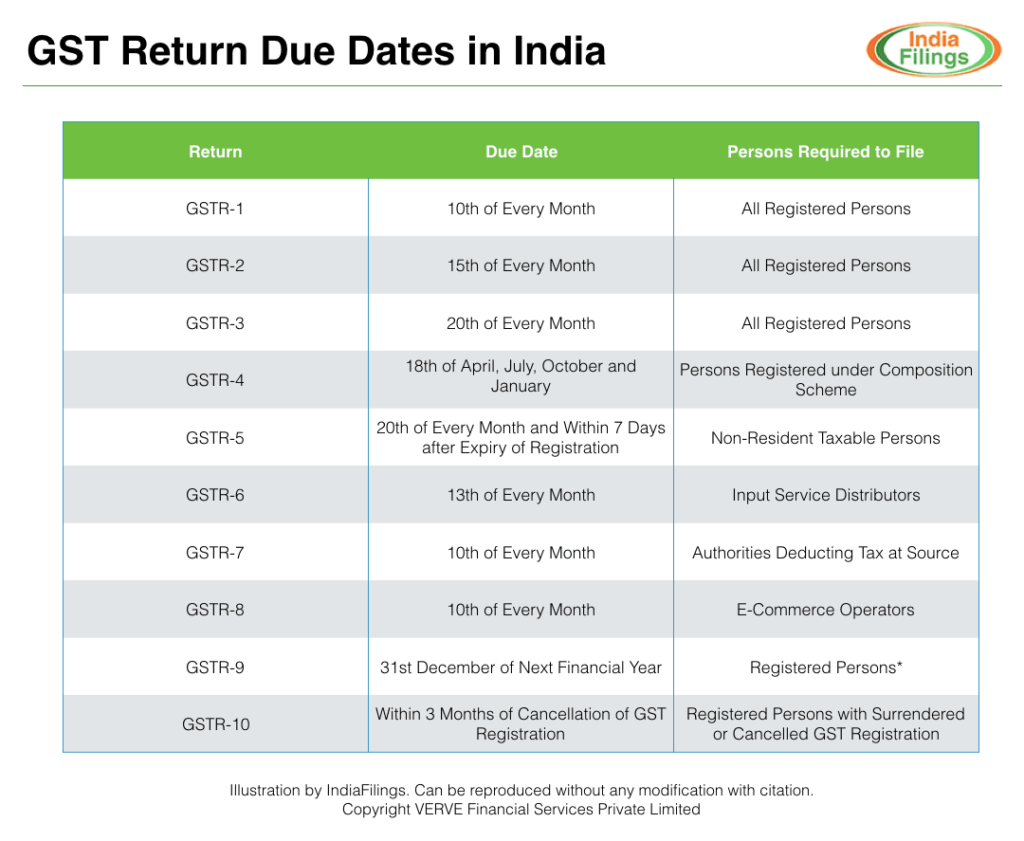

| Affected Services | GSTR-1, GSTR-3B, GSTR-4, e-Payments, Registrations, Refunds, e-Invoicing |

| Impact | Portal will be completely inaccessible during this time |

| Deadlines Affected | GSTR-1 (Aug 11), GSTR-3B (Aug 20), GSTR-9 (Dec 31 tentative) |

| Official Source | www.gst.gov.in |

What Is a Disaster Recovery Drill and Why Should You Care?

The Disaster Recovery Drill is a proactive technical exercise by GSTN (Goods and Services Tax Network) to ensure that its infrastructure can recover and perform smoothly in case of a real-world crisis — such as server failures, cyber-attacks, or system crashes. It’s like a mock drill for IT systems to test their resilience.

While this is good for long-term reliability, in the short term, it means you will not be able to access anything on the GST Portal during the 8-hour window. This applies even if you’re using private software or APIs that depend on GSTN — they’ll stop working too.

This isn’t just a minor slowdown. It’s a total lockout.

What Services Will Be Unavailable?

The downtime will affect nearly every taxpayer and service that depends on the GST system:

- Filing of monthly, quarterly, and annual returns: GSTR-1, GSTR-3B, GSTR-4, GSTR-5, GSTR-9

- Generation of challans and payment of GST dues

- New registration applications and amendments

- GST refund applications and status tracking

- Access to credit ledger, liability ledger, and cash ledger

- Upload of invoices for B2B or B2C supplies

- Use of e-invoicing and IRN generation through APIs

- Input Tax Credit reconciliation tools and HSN/SAC code search

Even login and dashboard access may be disrupted. The system will essentially be non-functional.

What Deadlines Are Approaching?

This downtime is especially critical because it comes just before several important compliance deadlines. Here’s what’s coming up:

| Form | Purpose | Due Date |

|---|---|---|

| GSTR-1 | Outward Supplies Return | August 11, 2025 |

| GSTR-3B | Summary Monthly Return | August 20, 2025 |

| GSTR-4 | Composition Scheme Return | August 31, 2025 |

| GSTR-5 | Non-resident Taxpayer Return | August 20, 2025 |

| GSTR-9 | Annual Return for FY 2024-25 | December 31, 2025 (tentative) |

If you’re planning to file around these dates or on the weekend, it’s best to act early. The downtime could lead to missed deadlines, delayed payments, or late fees.

The New 3-Year Rule You Need to Know

Starting August 1, 2025, taxpayers will not be able to file GST returns more than 3 years past their original due date. This rule affects all return forms, including GSTR-1, GSTR-3B, and GSTR-9.

That means if you haven’t filed for a previous period and it’s already three years past due, you may lose the opportunity entirely — and that could have serious legal and financial consequences.

This is another reason why you must stay ahead and ensure returns are filed on time. The downtime shouldn’t be an excuse for further delays.

What Happens If You Ignore the Downtime?

If you try to access the GST Portal during the blackout window, you will likely encounter maintenance messages or failed connections. Ignoring this could result in:

- Late filing penalties ranging from ₹50 to ₹200 per day, depending on the return type

- Interest charges up to 18% annually for late payment of GST

- Delayed processing of refunds, which could impact working capital

- Loss of input tax credit if vendors’ filings are also delayed

- Compliance notices or audit risks if returns are not filed on time

Many taxpayers assume a few hours won’t hurt. But if you’re filing close to the deadline and run into technical issues, there’s little recourse. The system does not guarantee deadline extensions for scheduled maintenance.

Action Plan: What You Should Do As GST Portal to Be Down August 2–3

Here’s a practical checklist to help you avoid issues during the GST Portal blackout:

1. Finalize Invoices and Data Early

By Friday, August 2, make sure all your outward and inward supply invoices are entered into your accounting system. Double-check reconciliations and corrections in advance.

2. Complete Uploads by 9:30 PM IST, August 2

The portal might begin slowing down before the official shutdown. Start uploads and validation processes before 9:00 PM to be safe.

3. Make Payments in Advance

Generate and pay challans by the evening of August 2. Avoid making payments after 9 PM IST to sidestep banking or system sync issues.

4. Download Filing Receipts and Proofs

Save all Acknowledgement Reference Numbers (ARNs), payment confirmations, and return summaries in PDF. Store them securely for future reference.

5. Communicate With Clients or Teams

If you’re a tax consultant or CA managing multiple businesses, inform all clients of the downtime and reschedule filings accordingly.

Expert Advice: Insights From the Industry

“Every year we see taxpayers rushing at the last minute, and that’s when errors and portal slowdowns hit. With this drill scheduled, you’ve got a clear window to prepare. Use it.”

— Anisha Mehta, GST Practitioner, Delhi

“We always tell our international clients: GST compliance in India is deadline-driven. The portal doesn’t care if it’s a weekend or 2 AM. The smart ones file early.”

— James R. Kapoor, Tax Consultant for Indo-US Entities

“APIs and third-party tools won’t save you if the core portal is down. This blackout is a reminder to keep backups and avoid working last minute.”

— Rakesh Jain, Head of Compliance Automation, Mumbai

Recommended Tools to Stay Ahead

Here are some digital platforms that can help you manage GST compliance and avoid last-minute issues:

- ClearTax GST – Ideal for CA firms and large enterprises with high invoice volumes

- Tally Prime – Trusted by small and mid-sized businesses for offline prep

- Zoho Books – Popular for seamless GST integrations and automated filing

- GSTHero – Excellent for API-based filing and reconciliation

- RazorpayX GST – Good for startups looking for easy challan management and reminders

Make sure whichever tool you use, you complete data syncing and API calls before the scheduled downtime.

Historical Lessons: Past Downtimes and What Happened

This isn’t the first time the GST Portal has gone down. Here are some key examples:

- May 2024: A server upgrade resulted in unannounced downtime for 4 hours, causing delay in GSTR-1 uploads for over 30,000 users.

- November 2023: Peak filing time for GSTR-3B saw unexpected lag and timeouts, with complaints reported across social media and tax forums.

- July 2022: Partial outage affected e-invoicing, causing businesses using API systems to lose a day’s worth of data entry.

The consistent trend? Those who filed early didn’t face problems.

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%

GST Collections for July 2025: You Won’t Believe Which State Tops the List!