Delhi High Court Rules GST Show-Cause Notice Invalid: If you’ve ever owned or shut down a business in India, chances are you’ve run into the complex world of Goods and Services Tax (GST). For many, the transition into GST compliance hasn’t been smooth—especially when businesses cease operations but still face penalties or notices years later. In a game-changing judgment delivered in August 2025, the Delhi High Court ruled that a GST show-cause notice (SCN) is invalid if issued after a taxpayer’s registration has been cancelled, particularly when that cancellation has been applied with retrospective effect. This ruling has major implications for businesses, legal practitioners, and tax professionals across India—and even U.S.-based business owners with operations in India. Whether you’re managing tax for a startup, advising small businesses, or simply want to understand your rights, this article breaks down everything you need to know in plain, practical language.

Delhi High Court Rules GST Show-Cause Notice Invalid

The Delhi High Court’s 2025 ruling has thrown a spotlight on a long-standing problem in India’s GST framework—unfair and illogical notices issued to entities that have already shut shop. The judgment affirms that once a GST registration is canceled, particularly with retrospective effect, the taxpayer cannot be legally required to file returns for those periods. This is not a loophole—it’s the law working the way it should. It upholds fairness, clarity, and predictability in tax enforcement. For taxpayers, it means peace of mind. For professionals, it’s a powerful tool in your compliance kit.

| Section | Details |

|---|---|

| Case | Kamal Kindra v. Commissioner of State Tax, Delhi |

| Ruling Date | August 2025 |

| Issue | Show-cause notice issued after GST registration cancellation |

| Cancellation | Retrospective to July 1, 2017 |

| SCN Issued | July 2021 |

| Court’s Ruling | SCN post-cancellation is legally invalid |

| Official GST Portal | https://www.gst.gov.in |

What Is a GST Show-Cause Notice (SCN)?

A show-cause notice (SCN) is a formal legal document issued by the GST department asking a registered taxpayer to explain a failure to comply with GST laws. These typically involve:

- Non-filing of returns (GSTR-3B, GSTR-1)

- Short payment or non-payment of tax

- Mismatch between returns and e-way bills

- Fraudulent claims of Input Tax Credit (ITC)

Once an SCN is issued, the taxpayer is required to respond, usually within 7 to 15 days. Failure to reply could lead to penalties, cancellation of registration, or recovery actions.

However, as the Delhi High Court made clear, such notices can’t be sent to taxpayers whose registrations no longer exist, especially if their cancellation is backdated.

Summary of the Case: Kamal Kindra v. Commissioner of State Tax

Background:

- Kamal Kindra was a sole proprietor who closed his business in 2019.

- He applied for GST registration cancellation in May 2019.

- The government processed the cancellation in June 2020, but made it effective from July 1, 2017—the date GST was first implemented in India.

- In July 2021, the tax department issued an SCN to him for non-filing of returns for the financial year 2019–20.

Court’s Decision:

The Delhi High Court ruled in favor of Kamal Kindra, stating that:

“Once the registration is canceled with retrospective effect, the taxpayer cannot be held liable for not filing returns for that period. The show-cause notice is therefore invalid in law and contrary to the principles of natural justice.”

How the Ruling Aligns with Natural Justice?

The ruling leans heavily on the concept of natural justice, which includes two fundamental principles:

- You can’t be penalized for something you’re not responsible for.

- Everyone must be given a fair chance to present their side before action is taken.

In this case, the GST department issued an SCN for a time when the business technically did not exist in the eyes of the law. The High Court found this not only irrational but unlawful.

How This Impacts Other GST Registrants?

The judgment sets a precedent for many similar cases:

- Businesses that shut down operations but received SCNs later

- Entities whose GST registration was canceled retroactively

- Professionals handling appeals for GST compliance or disputes

This ruling can be cited in representations to tax officers, appeals, or even writ petitions, to protect businesses from invalid notices.

Impact on Tax Enforcement and GST Compliance

This ruling doesn’t mean that businesses can escape liability by canceling registration. Instead, it sends a message to tax authorities that:

- Retrospective cancellation should be justified and rare.

- SCNs must be issued within the correct legal framework.

- Compliance mechanisms must be fair, not punitive.

GST officers are now expected to exercise greater diligence and issue reasoned SCNs backed by clear legal authority. This could lead to a more professional and accountable enforcement environment.

Step-by-Step Guide: What to Do If You Receive a Delhi High Court Rules GST Show-Cause Notice Invalid

If you or a client receives a GST SCN despite having canceled your registration, here’s what you should do:

Step 1: Check Your Cancellation Order

- Visit https://www.gst.gov.in

- Login using your credentials

- Navigate to “Services” → “Registration” → “Track Application Status”

- Download and verify the cancellation order and effective date

Step 2: Read the SCN Thoroughly

- Look for which period the SCN refers to

- See whether that period is after the effective date of cancellation

Step 3: Draft a Response

- Quote the High Court judgment: Kamal Kindra v. Commissioner of State Tax, Delhi (2025)

- Mention that your registration was canceled with retrospective effect

- Attach the cancellation order as proof

Step 4: Submit the Response on the GST Portal

- Use the “Reply to SCN” feature

- Upload your response and supporting documents

- Keep a copy of the acknowledgment

Step 5: Seek Legal Help (If Necessary)

If your reply is ignored or rejected, consult a tax lawyer and file a writ petition before the jurisdictional High Court. Use the Kamal Kindra ruling to support your case.

Expert Reactions from the Industry

Several tax professionals and associations have weighed in:

CA Ritesh Mehra, Indirect Tax Partner at a Delhi-based firm, says:

“This is a very important ruling. It forces the tax department to act more responsibly when dealing with old or closed businesses. Compliance should be logical, not oppressive.”

All India Federation of Tax Practitioners (AIFTP) issued a note praising the judgment:

“A clear win for procedural fairness and the small business community. No taxpayer should be penalized for periods when they are legally not liable.”

Real-Life Example: A Freelancer’s Story

Consider this:

Ritika, a freelance graphic designer, registered for GST in 2017. After two years, she moved abroad and canceled her registration in 2020, which was backdated to 2018. In 2023, she received an SCN demanding GSTR-3B returns for 2019.

Thanks to this High Court ruling, she responded with proof of cancellation and reference to the Kamal Kindra case. The tax officer withdrew the notice within weeks.

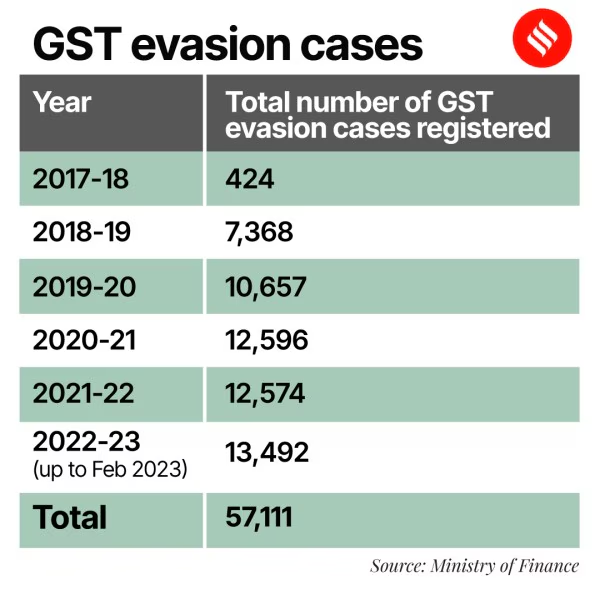

Statistics: How Common Are These Issues?

| Metric | Data (FY 2023–24) |

|---|---|

| Total Active GST Taxpayers | 1.4 crore |

| GST Registrations Canceled | Over 7.2 lakh |

| SCNs Issued by CBIC | 15 lakh+ |

| Top Cause of GST Litigation | Retrospective cancellation + SCNs |

| Source | PIB India, CBIC Annual Reports |

These numbers show that millions of businesses are impacted by cancellation and post-cancellation compliance every year. This ruling can potentially reduce 10–15% of unjustified GST litigation.

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

West Bengal’s GST Revenue Soars 12% in July

Cabinet Greenlights Major GST Act Amendments—What These Changes Mean for Businesses and Consumers