No GST on UPI Payments: In a country powering through its digital transformation, India has become a shining example of how technology can bridge economic gaps. At the heart of this transformation is Unified Payments Interface (UPI) — a real-time payment system that has redefined how Indians transact daily. But recently, confusion gripped small businesses and consumers alike: “Is the government planning to impose GST on UPI payments over ₹2,000?”

Let’s clear the air with facts, not fear. On July 22, 2025, during a session in the Rajya Sabha, Pankaj Chaudhary, the Union Minister of State for Finance, unequivocally stated that no Goods and Services Tax (GST) is being levied on UPI transactions — whether the payment is ₹200 or ₹2,00,000.

“There is no recommendation of levying GST on UPI transactions of over ₹2,000 from the GST Council.”

The clarification comes at a time when misinformation was spreading rapidly, with concerns that taxing digital payments could derail India’s financial inclusion efforts.

No GST on UPI Payments

The government’s statement in the Rajya Sabha makes it official and binding: No GST applies to UPI payments, regardless of the transaction size. What matters for GST is:

- What you’re selling

- Your annual turnover

- Whether you’re registered under GST

UPI is simply a tool — one that has democratized finance and empowered millions. Don’t let misinformation slow down India’s digital momentum. Keep scanning those QR codes. The only thing you’re transferring is money — not a new tax.

| Aspect | Details |

|---|---|

| Government Position | No GST on UPI transactions, regardless of value |

| Clarification Date | July 22, 2025 |

| Announced By | Union Minister of State for Finance, Pankaj Chaudhary |

| Legal Authority | GST Council and CGST Act |

| Why the Panic Started | Traders in Karnataka received GST notices referencing UPI data |

| Who Pays GST | Only those selling taxable goods/services above the GST registration threshold |

| UPI Stats | 14.04 billion transactions in July 2025; ₹20.6 lakh crore value |

| Official Reference | gstcouncil.gov.in |

What Is UPI and Why Is It So Important?

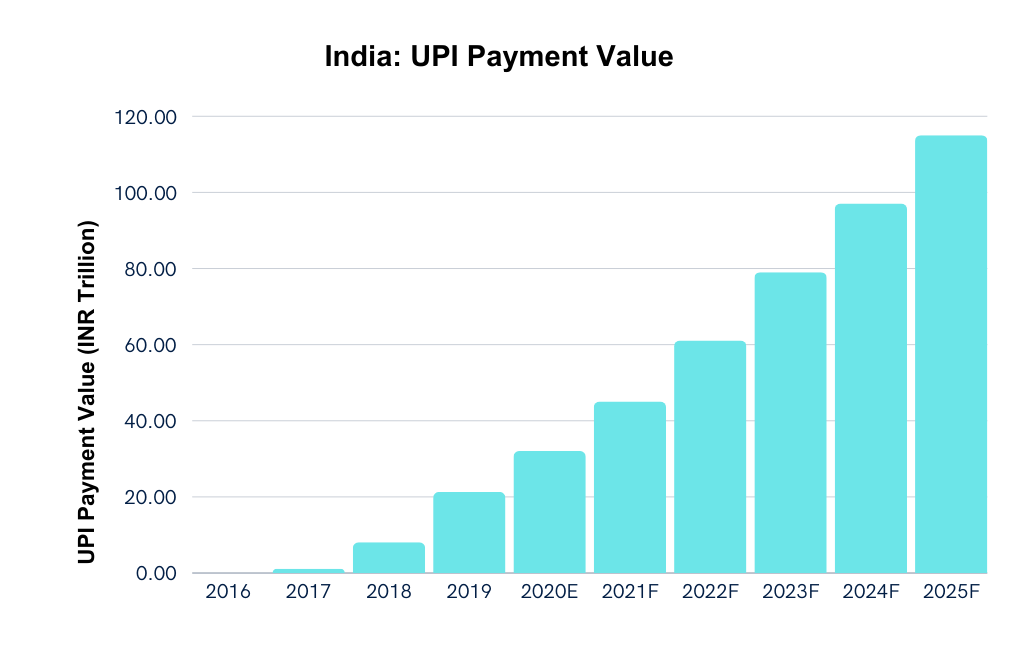

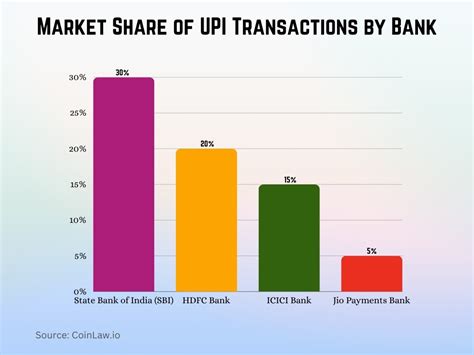

Unified Payments Interface (UPI), developed by the National Payments Corporation of India (NPCI), is one of the most revolutionary financial tools India has ever seen. Launched in 2016, UPI allows seamless, real-time transfers between bank accounts using just a mobile device and a PIN. It integrates multiple bank accounts into a single app and supports peer-to-peer as well as merchant payments.

Why it’s a game-changer:

- No need for IFSC codes or bank account numbers.

- Available 24/7, even on holidays.

- Most transfers are free, especially for small businesses and individual users.

- Works with over 300 banks and payment platforms like PhonePe, Google Pay, Paytm, and BHIM.

Where Did the GST Confusion Come From?

The confusion began when small traders in Karnataka received notices from tax authorities referencing high volumes of UPI transactions. Many feared this meant that GST was now being applied directly to UPI payments — leading to panic, especially among sole proprietors and small businesses relying on QR-code-based digital payments.

But here’s what actually happened:

- These GST notices were not about taxing UPI.

- Authorities were using UPI transaction data to estimate potential business turnover and detect non-compliance among unregistered businesses.

- If a trader has UPI receipts exceeding ₹40 lakh annually and is not registered under GST, that raises a red flag.

UPI was just the evidence trail, not the tax trigger.

What the GST Law Actually Says?

Let’s simplify this for everyone — whether you’re a student, shop owner, or tax professional.

Under the GST regime:

- GST is charged on the supply of goods and services.

- It is not charged on the mode of payment.

- UPI is a payment mechanism, not a taxable supply.

According to Section 9 of the Central Goods and Services Tax (CGST) Act, tax is levied on supplies and not on how a customer chooses to pay — be it cash, card, cheque, or UPI.

Unless and until the GST Council, a constitutional body comprising representatives from the Centre and all States, recommends such a tax, no GST can be levied on UPI payments.

Real-World Examples to Make It Clear

Let’s break down two everyday examples to drive home the point.

Case 1: Sita’s Home Salon – No GST Required

Sita runs a small home-based salon in Jaipur. She receives payments only through UPI and earns ₹15 lakh a year. She’s not registered under GST and doesn’t need to be, as she’s well below the ₹20 lakh threshold for services.

Outcome:

No GST applies to her UPI receipts, nor should she fear any tax notice — unless her turnover rises above the threshold.

Case 2: Arvind’s Electronics Store – GST Applies

Arvind owns a mid-size electronics shop in Pune. He accepts payments via UPI, cash, and card. His total turnover is ₹90 lakh a year. He is GST-registered and collects GST on applicable items (e.g., 18% on laptops).

Outcome:

He pays GST on what he sells, not how he’s paid. UPI is merely a payment method.

Practical Advice for Traders, Freelancers, and Entrepreneurs

Here’s what you need to keep in mind if you’re concerned about this news:

What You Should Do:

- Track your total annual turnover. If it crosses ₹40 lakh (₹20 lakh for services), you may need to register for GST.

- Keep clean records of all receipts and sales, whether via UPI or any other channel.

- Use UPI for convenience — there is no extra GST just for accepting UPI.

What You Should Not Do:

- Don’t avoid UPI due to rumors. UPI is secure, traceable, and supported by the government.

- Don’t assume every GST notice is about UPI tax. It could be about turnover or registration issues.

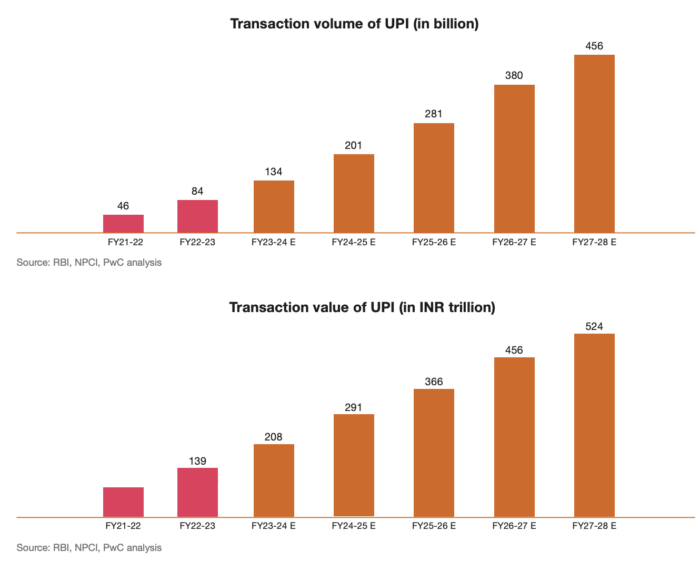

UPI by the Numbers: How Big Is It?

According to NPCI (July 2025):

- UPI clocked 14.04 billion transactions worth over ₹20.6 lakh crore.

- Over 350 million monthly active users.

- Over 55 million merchants accept UPI payments across India.

UPI now accounts for more than 75% of all digital retail transactions in India.

What the Experts Are Saying About No GST on UPI Payments

“You don’t tax a road just because people are driving more. UPI is a road for payments — it should be encouraged, not taxed.”

– Ramesh Agarwal, Chartered Accountant and Tax Consultant

“Data analytics is now part of tax compliance. Just because authorities are tracking UPI doesn’t mean the system itself is being taxed.”

– Dr. Neha Bansal, Policy Fellow, Indian School of Business

Legal Takeaways from the GST Council

The GST Council, which consists of finance ministers from both the Centre and States, has:

- Not made any recommendation to tax digital payment methods.

- Not passed any proposal related to GST on UPI.

- Affirmed its stance on keeping digital payment channels tax-neutral to support adoption.

Remember: No GST change can happen unless it passes through this Council.

Could This Change in the Future?

While there’s no plan to tax UPI now, here are a few things that might evolve:

- The government may introduce AI-driven alerts for traders with high UPI volumes to identify tax evasion — but this still doesn’t mean UPI will be taxed.

- Certain business-to-business (B2B) UPI transactions may eventually involve interchange or platform fees, which may attract GST on the service fee, but not on the transaction amount.

- All this would still require full transparency, public debate, and a GST Council resolution.

Supreme Court Set to Decide on 28% GST for Online Gaming—The Verdict That Could Change the Industry!

How Local Trade Helped July GST Collections Reach an Impressive Rs 1.96 Lakh Crore—The Inside Story

Mandatory HSN Code Reporting in GSTR-1/1A: The 2025 GST Compliance Guide You Can’t Miss