Kanpur Tax Relief: When it comes to taxes, nobody wants to end up in a court battle—especially over small amounts. That’s why the Kanpur Tax Relief initiative is making headlines across India. In a bold and taxpayer-friendly move, the Income Tax Department (ITD) has announced it will withdraw appeals involving disputes under ₹50 lakh in Kanpur. That’s right, if you’re a taxpayer in Kanpur with a pending tax appeal filed by the government under ₹50 lakh, you might just be off the hook. This isn’t just about Kanpur—it’s part of a nationwide policy shift announced by India’s Finance Ministry to reduce unnecessary tax litigation and bring relief to honest taxpayers. Let’s break it down, plain and simple, with real talk, expert tips, and all the deets you need to know—whether you’re a salaried pro, small business owner, or just someone trying to keep Uncle Sam (or rather, the Indian equivalent) off your back.

Kanpur Tax Relief

The Kanpur Tax Relief 2025 is a massive win for honest taxpayers. Whether you’re a salaried employee, a side hustler, or a business owner, this initiative clears the clutter. It’s a welcome move that shifts the tax landscape from confrontation to collaboration. Tax law in India is finally evolving into something more human, more practical, and—dare we say—more just. The government’s message is clear: “If it’s not worth the fight, let’s not fight at all.”

| Key Point | Details |

|---|---|

| Initiative | Govt withdrawing tax appeals under ₹50 lakh in Kanpur |

| Beneficiaries | Over 5,000 taxpayers |

| Deadline | 3 months from June 23, 2025 (i.e., by September 23, 2025) |

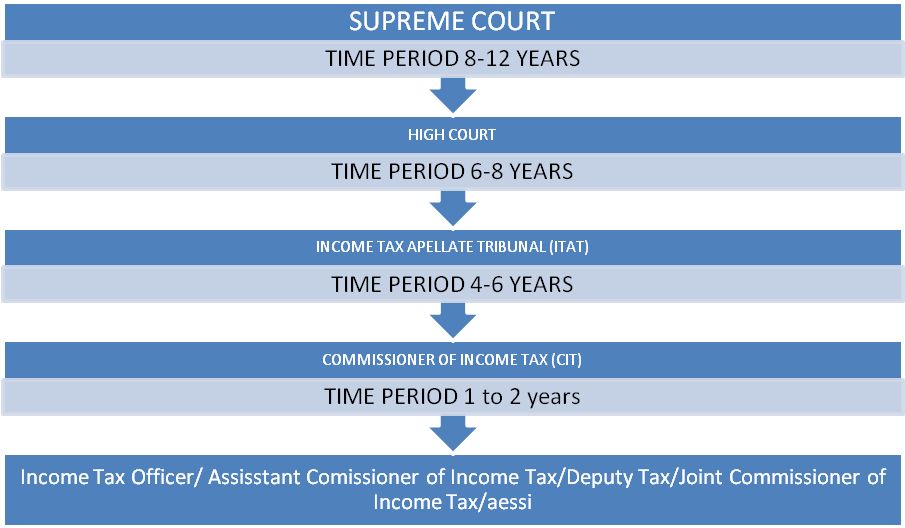

| Scope | Income-tax appeals filed by the department in ITAT, High Courts |

| Official Announcement | CBDT Circular via Income Tax Dept |

| National Stats | 2.25 lakh appeals below new monetary limits; ₹10 lakh crore involved |

| Appeals Already Withdrawn | Over 4,600 cases so far nationwide |

| Thresholds Updated To | ₹60L (ITAT), ₹2Cr (HC), ₹5Cr (SC) |

What Is the Kanpur Tax Relief About?

The Kanpur Tax Relief 2025 is part of a broader effort by the Central Board of Direct Taxes (CBDT) to reduce tax litigation. On June 23, 2025, the CBDT raised the monetary limits for filing departmental appeals across different courts and tribunals. Here’s what’s changed:

- ₹60 lakh limit for appeals at the Income Tax Appellate Tribunal (ITAT)

- ₹2 crore limit for appeals at the High Court

- ₹5 crore limit for appeals at the Supreme Court

So what does this mean for you? If the tax amount in dispute is below ₹50 lakh, and the government filed the appeal, they’ll withdraw it automatically—no questions asked.

Why the Change? (And Why Now?)

This shift in policy is designed to:

- Reduce the burden on taxpayers

- Free up court dockets

- Promote trust-based compliance

- Align with international best practices

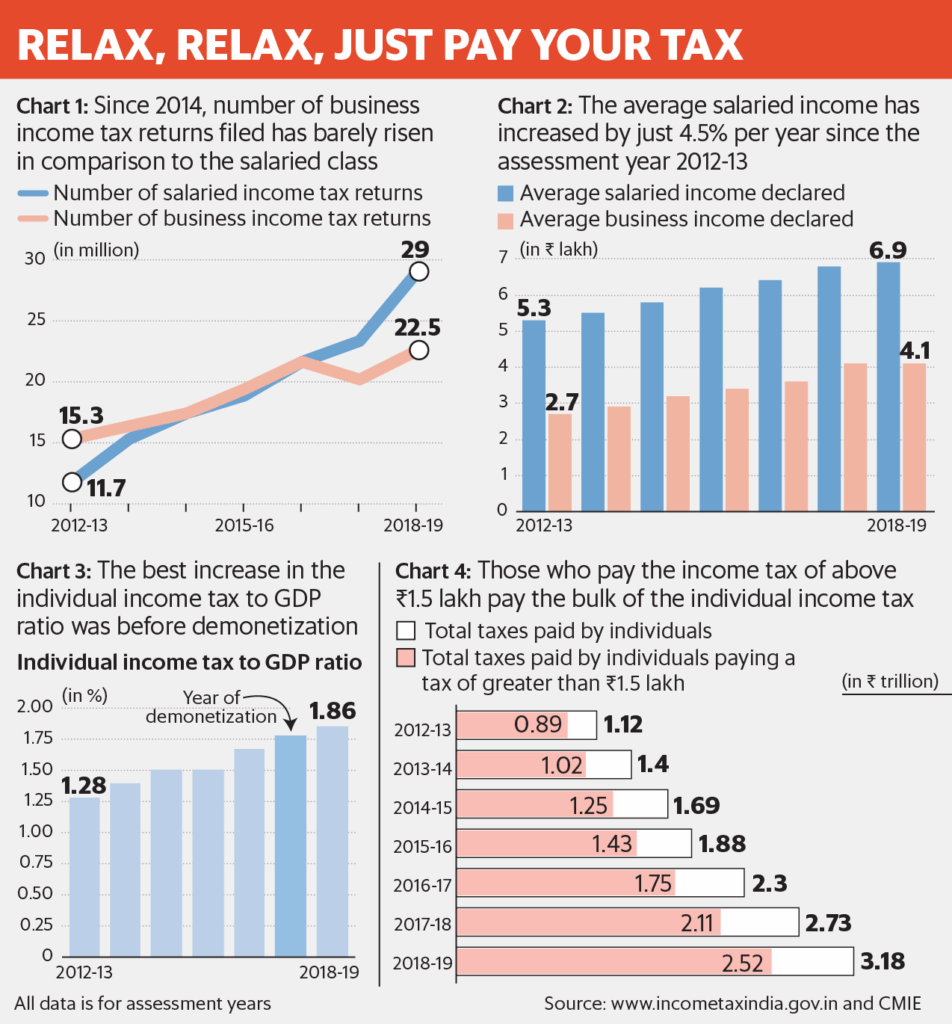

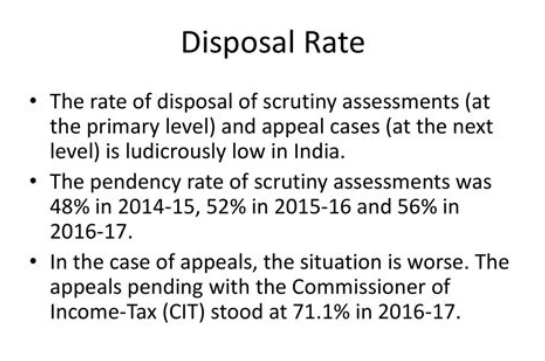

With nearly 5.77 lakh appeals pending in Indian courts, nearly 2.25 lakh involve tax demands under the new monetary thresholds. That’s a huge backlog, and it diverts both administrative and judicial resources away from higher-stake issues.

Moreover, the cost to pursue each appeal (in legal and administrative overhead) is sometimes more than the disputed amount itself. That’s a bad return on investment—for both taxpayers and the government.

This is not the first time India has raised litigation thresholds. Earlier changes came in 2018 and 2019, but the 2025 update is the most aggressive yet in terms of scope and relief offered.

Who Benefits? Real Talk, Real People

Let’s say you’re a freelancer in Kanpur who got a tax notice for a ₹35 lakh income mismatch. You fought it, and the government filed an appeal. Under this policy, that appeal is automatically dropped. You’re off the hook—no hearing, no extra lawyer bills, no stress.

Or maybe you’re a small manufacturing unit caught in a ₹42 lakh depreciation dispute. If the appeal was filed by the department, it’s now withdrawn under this scheme.

This move helps:

- Salaried individuals

- Small businesses

- Startups

- Independent contractors

- Senior citizens under scrutiny

- Self-employed professionals (doctors, consultants, etc.)

- Partnership firms and LLPs

- Non-profits and educational institutions under audit

The impact is also psychological—fewer notices, fewer proceedings, and fewer sleepless nights. It encourages voluntary compliance and fosters a more cooperative taxpayer-government relationship.

Legal Expert Opinion

According to Ankita Verma, a High Court tax litigator, “This move represents a maturity in tax administration. It acknowledges that not every rupee needs to be pursued through courts. It also protects the integrity of the legal system by reserving resources for serious litigation.”

In the legal community, this has been widely welcomed—especially as it reduces frivolous and outdated disputes that have been languishing for years with no resolution.

How to Check If You Qualify for Kanpur Tax Relief: Step-by-Step Guide

Step 1: Log in to Your Income Tax e-Filing Portal

Visit https://www.incometax.gov.in

Step 2: Go to “e-Proceedings” → “Case History”

Here, look for any active appeals. If you see “Departmental appeal withdrawn,” you’re clear.

Step 3: Not Seeing Updates? Contact Your AO

Your Assessing Officer (AO) can confirm your case status. Log in to your portal and check your profile to find their contact details.

Step 4: Wait It Out or File a Grievance

If no action is taken by September 23, 2025, file a grievance via:

- CPGRAMS portal

- Income Tax Helpline: 1800 103 0025

Global Comparison: How Other Countries Do It

This move also brings India closer to global best practices. For example:

- United States IRS often drops litigation under a materiality threshold and encourages pre-trial settlements through Alternative Dispute Resolution (ADR).

- UK’s HMRC has structured frameworks like “litigation and settlement strategy” that avoid costly court time on low-value disputes.

- Australia has clear policies for small business dispute resolution, often handled via independent mediation.

India adopting similar philosophies reflects a growing emphasis on ease of doing business and minimizing tax friction.

Practical Checklist for Businesses

Here’s what small business owners should do right now:

- Review all pending cases on the income tax portal

- Consult your CA or legal counsel about ongoing litigation

- Keep documentation of withdrawn appeals

- Avoid making new appeals that fall under the new monetary limit

- Track your correspondence with tax officials for closure records

If your own business had departmental appeals pending for AY 2020–21, 2021–22, or 2022–23, chances are high they’re eligible for withdrawal.

GST Fraud on the Rise: Towed Vehicles and Issued E-Way Bills—What the Authorities Are Hiding!

Madras HC Strikes Down GST Order Issued Just Before Hearing—A Major Violation of Natural Justice!

Mandatory HSN Code Reporting in GSTR-1/1A: The 2025 GST Compliance Guide You Can’t Miss