Thozhi Hostel Residents Crushed by Sudden GST-Powered Rent Hike: In the last few months, a growing concern has gripped the residents of Thozhi Working Women Hostels across Tamil Nadu — a sudden, unexplained rent hike. Many women, some earning just ₹12,000–₹20,000 a month, are now being asked to pay 12% more in rent due to Goods and Services Tax (GST) being applied. This has led to frustration, protests, and a wave of confusion over what’s legal — and what’s not. These hostels were once seen as a beacon of empowerment, giving young women from rural and lower-income backgrounds access to safe, affordable housing in urban centers. So why is GST even being considered here? And more importantly, is it legal?

Thozhi Hostel Residents Crushed by Sudden GST-Powered Rent Hike

The issue of GST being wrongly applied to Thozhi Hostels strikes at the heart of public policy. It’s not just about a tax — it’s about equity, access, and empowerment. While the government has taken bold steps to support working women, such initiatives must be protected from administrative loopholes and misinformation. Thozhi Hostels were never meant to be taxed like hotels. And working women should never have to fight just to afford a roof over their heads.

| Topic | Details |

|---|---|

| Project Name | Thozhi Working Women Hostels |

| Purpose | Provide safe, subsidized housing for working women across Tamil Nadu |

| Rent Range | ₹2,000 – ₹10,620/month depending on room type and city |

| GST Concern | Reports of 12% GST being added to rent in some hostels |

| Legal Background | Madras High Court (2024) ruled that hostels used as residences are exempt from GST |

| GST Rate Involved | 12% (standard for commercial accommodation, not residential) |

| Governing Body | Tamil Nadu Working Women’s Hostel Corporation Ltd (TNWWHCL) |

| Impacted Cities | Chennai, Madurai, Coimbatore, Villupuram, Tiruppur, and others |

| Legal Resource | Madras HC GST Ruling |

What Are Thozhi Hostels?

Launched in July 2023 by the Tamil Nadu government, Thozhi Hostels aim to provide high-quality, affordable accommodation for working women, especially those migrating from small towns or villages into urban centers. Backed by the World Bank and operated under a Public-Private Partnership (PPP) model, these hostels are part of a broader push toward women’s economic empowerment.

Each hostel offers:

- Secure biometric entry and CCTV surveillance

- Twin-sharing and dormitory options

- Air-conditioned and non-AC rooms

- Common kitchens and optional meal plans

- 24/7 staff and security

- In some locations, in-house daycare (creches)

Rents vary depending on location and amenities. For example:

- Villupuram: ₹2,000/month for dorm-style accommodation

- Tambaram, Chennai: ₹10,620/month for twin-sharing AC room

- Madurai: ₹5,800–₹7,500/month depending on occupancy

These rates are far below private PGs or rental flats in similar areas. But that affordability is now under threat.

The GST Problem: Why Thozhi Hostel Residents Crushed by Sudden GST-Powered Rent Hike?

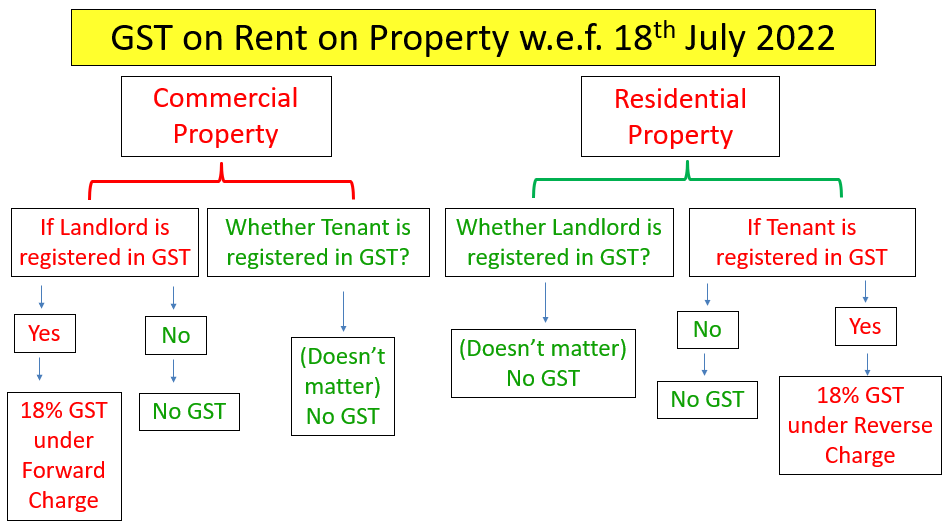

Here’s where it gets tricky. Under India’s GST law, residential rent is tax-exempt. You don’t pay GST on your apartment or home if you’re living there as a tenant.

But commercial accommodation — like hotels, PGs, and serviced apartments — is a different story. These are typically taxed at 12% or more.

The confusion arises because hostels often straddle the line between residential and commercial classification. Some tax officers, especially in states outside Tamil Nadu, have historically treated women’s hostels as commercial lodgings.

That’s why some Thozhi Hostel residents suddenly saw their rent go up — managers either misunderstood the law or added GST as a preventive step.

What the Law Actually Says: Madras HC Clarifies

In a landmark ruling in April 2024, the Madras High Court settled the debate. It ruled that:

Hostels used as long-term residential accommodation for working women or students are considered residential dwellings and are exempt from GST.

The Court emphasized that GST liability should be determined from the perspective of the resident, not the business structure of the hostel operator.

This means that:

- If a woman lives in a hostel as her permanent residence (not a short-term stay),

- And she pays monthly rent,

- No GST should be charged.

Despite this clarity, many residents claim they’re still being asked to pay GST — some openly, others hidden in their rent without explanation.

How It’s Affecting Women on the Ground?

Take Lakshmi, a 32-year-old accountant from Coimbatore:

“I live in a ₹6,000/month room. This month they added ₹720 extra. No explanation. When I asked, they said it’s GST. But it’s a government hostel. Shouldn’t it be exempt?”

Or Meena, 27, a factory worker in Tiruppur:

“I was saving up for a tailoring course. That extra ₹600 every month means I have to delay my training. This is hurting our futures.”

Even a 10%–12% hike can mean the difference between saving for a course, sending money home, or having emergency funds for healthcare.

Hostel vs PG vs Flat Rental: A Cost Breakdown?

| Housing Type | Average Monthly Cost | Amenities Provided | GST Applicable? | Target Group |

|---|---|---|---|---|

| Thozhi Hostels | ₹2,000 – ₹10,620 | Meals, security, Wi-Fi, etc. | No (if residential) | Working women |

| Private PGs | ₹4,000 – ₹15,000 | Variable amenities | Often Yes (12%) | Students, short-term |

| Apartments | ₹6,000 – ₹25,000+ | Self-managed, variable | No | Long-term, families |

Expert Opinion: Why This Matters Nationally

We spoke to Dr. Aparna Balasubramanian, a gender policy researcher:

“When governments create inclusive infrastructure like Thozhi, it’s a win for public policy. But implementation gaps — like unnecessary GST — can reverse the benefits. This is a nationwide issue, not just Tamil Nadu.”

In fact, similar issues have been reported in Delhi, Bhopal, and Bangalore, where hostel operators apply GST out of fear of non-compliance, even when not required.

What Should Residents Do? A Step-by-Step Guide

- Request a Tax Breakdown

Ask your hostel manager to give you a written breakup of your rent and any GST applied. - Refer to the Madras HC Ruling

Print or download the order and share it with hostel staff. Politely explain that you’re a long-term residential tenant. - File a Grievance

Use the TN Government Grievance Portal or call the state women’s helpline at 181. - Contact Local NGOs or Legal Aid

NGOs like Human Rights Law Network or PUCL can help you challenge illegal charges. - Document Everything

Save all rent receipts, communication, and bills in case you need to file a formal complaint or seek refund later.

Suggestions for Policy Makers

To prevent such issues in the future, the following reforms are needed:

- Issue a State-Wide GST Clarification

TN government should officially circulate the High Court ruling to all hostel operators. - Cap Rent Increases

Rent in subsidized or public-private hostels should not exceed a fixed cap without clear justification. - Mandate Transparency in Billing

Hostels must break down rent components clearly — including taxes, utilities, and other services. - Central Government Clarification

The CBIC (Central Board of Indirect Taxes and Customs) should issue a pan-India clarification exempting all long-term residential hostels from GST.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

India’s GDP to Get Smarter? MoSPI Eyes GST, UPI, and Vehicle Data for Accuracy Boost

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines