Madras HC Slams GST Notice on Nizam Pakku: If you’ve ever run a business in India or dealt with GST classification, you know one thing for sure — clarity is everything. And when the system throws that clarity out the window, businesses are left vulnerable. That’s exactly what happened in the recent case involving Nizam Pakku, a popular sweetened areca nut product. But here’s the twist: the Madras High Court stepped in and slammed the GST department, calling their 18% tax demand a “clear abuse of law.”

This case isn’t just about one product. It’s a landmark ruling that reinforces taxpayer rights, legal finality, and good governance. And today, we’re breaking it all down — from the legal jargon to the business implications — in a way that even a 10-year-old could follow, but also offers value for seasoned professionals.

Madras HC Slams GST Notice on Nizam Pakku

The Madras High Court’s ruling on Nizam Pakku is a milestone in India’s tax law. It reasserts that government agencies must respect legal precedents and avoid subjecting businesses to repeated harassment. For every entrepreneur, legal expert, and business owner in India, this judgment sends a simple but powerful message: The law must protect, not persecute. Finality matters. Fairness matters.

| Topic | Details |

|---|---|

| Main Issue | GST Department attempted to reclassify Nizam Pakku under a higher tax bracket (18%) |

| Actual Classification | Chapter 08028090 — Flavored Areca Nut (5% GST) |

| Product in Question | Nizam Pakku – a sweetened, flavored areca nut |

| Manufacturer | M/s Azam Laminators Pvt Ltd |

| Court’s Observation | Reopening settled issues without new facts is a “clear abuse of process of law” |

| Final Verdict Date | August 6, 2025 |

| Importance | Sets precedent protecting AAAR rulings and taxpayer certainty |

| Official Source | Taxscan Article on the Ruling |

What Sparked the Controversy?

It all started when the Directorate General of GST Intelligence (DGGI) issued a show cause notice to Azam Laminators Pvt Ltd in May 2022. They alleged that the company’s product, Nizam Pakku, was misclassified and should actually be taxed under Chapter 2106, attracting 18% GST, instead of the existing 5%.

But here’s the kicker: an AAAR (Appellate Authority for Advance Ruling) ruling in February 2021 had already classified Nizam Pakku under Chapter 08028090, which covers sweetened areca nuts and falls under the 5% GST bracket.

More importantly, the tax department never challenged that ruling. They accepted it at the time — only to attempt a complete U-turn more than a year later, with no new facts, no new legal grounds, and no regulatory changes.

And that’s where the court drew the line.

What the Madras High Court Said?

The bench, led by Justice Krishnan Ramasamy, didn’t hold back. The judgment emphasized:

- Legal finality matters. Once a matter is ruled on and not challenged, it becomes binding.

- Tax authorities must not act arbitrarily. Reclassifying products without new evidence is not only wrong but also unfair to businesses.

- Taxpayer protection is vital for economic trust. Businesses should be able to rely on legal rulings without fear of surprise reversals.

“Issuing a show cause notice under the same circumstances, after accepting a contrary ruling, reflects non-application of mind and is a clear abuse of law.” – Madras HC

This is more than just strong language. It’s a legal landmark that protects companies from administrative overreach.

What Is Nizam Pakku, Really?

Let’s step back. What exactly is Nizam Pakku?

It’s a flavored, sweetened areca nut (popularly called supari), made using:

- Chopped areca nuts

- Sugar syrup

- Menthol

- Essential oils like clove or cardamom

- Flavoring agents

It is non-tobacco and used commonly as a mouth freshener, particularly in southern parts of India.

The GST department had tried to categorize it as a processed food product, which would have pulled it under Chapter 2106 (18% GST). But the court said no — its core ingredient is agricultural (areca nut), and it fits squarely under Chapter 08028090, which applies to flavored or sweetened nuts.

The Legal Backbone: Past Rulings That Support the GST Notice on Nizam Pakku

This isn’t the first time the courts have had to deal with this type of classification issue. Here are a few precedents that played a major role:

1. Crane Betel Nut Powder Works v. CCE (Supreme Court, 2007)

The apex court ruled that sweetened supari is not a processed food, but a flavored nut, classifying it under the heading for agricultural produce.

2. Pan Parag Case (CESTAT Ruling)

In a similar case involving pan masala without tobacco, the CESTAT sided with the manufacturer, rejecting reclassification by the department.

3. AAAR Ruling on Nizam Pakku (2021)

The Appellate Authority clearly stated that Nizam Pakku was a sweetened areca nut, taxable at 5% — a decision never challenged by the department.

All of these set strong legal precedents. The GST authority’s move in 2022 ignored these, and the court took note.

GST and Classification: Why This Happens So Often

One of the biggest grey areas in India’s GST regime is product classification.

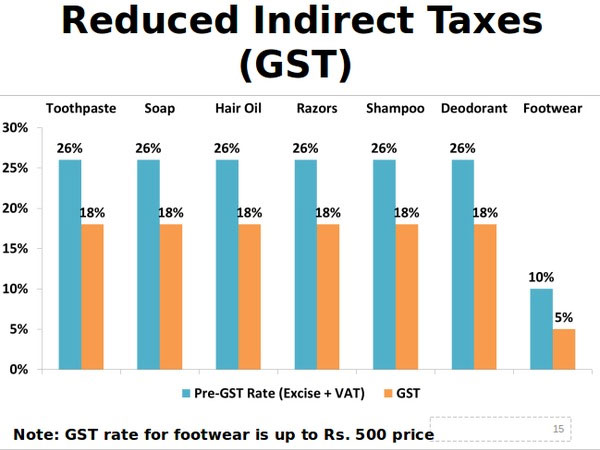

There’s a reason so many legal battles are fought here — because the tax rate depends entirely on the code assigned to a product. For example:

- Raw areca nut? 5%

- Flavored areca nut? 5%

- Pan masala with tobacco? 28% + Cess

- Processed supari? 18%

Misclassification can make or break a business — especially in FMCG, food processing, or agriculture-linked sectors.

That’s why Advance Rulings are crucial. They give businesses certainty — unless, of course, the government decides to ignore its own rulings later. And that’s exactly what the High Court objected to.

Expert Insights from Tax Professionals

We spoke to legal and tax professionals to understand how this ruling will impact the industry.

CA Ramesh Patel, Indirect Tax Specialist:

“This is a strong reminder that AAAR rulings carry legal weight. You can’t just change your mind after letting it stand for years. This will give businesses more confidence.”

Advocate S. Krishnan, GST Litigation Expert:

“A lot of similar products — like herbal supari, pan flavorings, and mouth fresheners — face the same issue. This judgment gives them a solid defense.”

What Other Businesses Should Learn from This?

This isn’t just about Nizam Pakku. If you’re in any of these categories, you should pay attention:

- Manufacturers of food products with herbal or agricultural ingredients

- Exporters/importers of edible nuts or mouth fresheners

- FMCG players using flavoring or packaging innovation

- Startups entering traditional markets like ayurveda or indigenous foods

Here’s what you should do:

- Apply for Advance Ruling early.

- Document your product’s ingredients and usage.

- Save packaging photos, marketing materials, and invoices.

- Stay updated on classification changes at CBIC’s official portal: GST Rates & HSN Codes.

If you already have an AAAR ruling in your favor, keep a copy of the full order and file it with your tax records.

Step-by-Step: How to Handle a GST Classification Dispute

If you ever find yourself in a classification mess, here’s how to handle it:

Step 1: Review GST Schedule and HSN Codes

Find the closest match to your product using CBIC’s official portal.

Step 2: Apply for AAR (Advance Ruling)

If classification isn’t clear, submit an application to the state-level AAR.

Step 3: Appeal to AAAR if needed

If the AAR ruling goes against you, you can appeal to AAAR within 30 days.

Step 4: If challenged again, move to High Court

File a writ under Article 226 of the Constitution if administrative bodies try to reclassify without reason.

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines

India’s GDP to Get Smarter? MoSPI Eyes GST, UPI, and Vehicle Data for Accuracy Boost

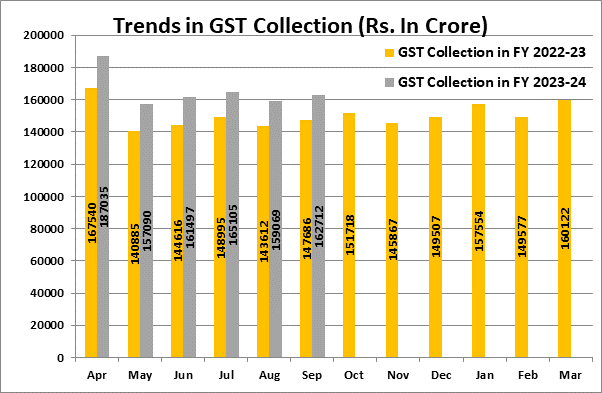

GST Collection Breaks ₹1.96 Lakh Crore Mark — But Why Is Net Growth Cooling?