GST Confusion Ends: If you’ve ever stared at a GST return screen and thought, “Am I doing this right?”, you’re not alone. For many government officers and business owners across India—especially in the Northeast—the Goods and Services Tax (GST) can feel like a never-ending maze of rules, returns, and penalties.

But in Dimapur, Nagaland, a recent high-impact GST training program held on August 5, 2025, turned that confusion into clarity. Organized by the Nagaland Department of Taxes, the event targeted Drawing and Disbursing Officers (DDOs), registered dealers, and key stakeholders, equipping them with practical, hands-on knowledge to navigate India’s complex tax system with confidence. This wasn’t just another bureaucratic event with dry speeches. It was a solution-focused, interactive masterclass aimed at cutting through the jargon and making GST simple and actionable for everyone in the room.

GST Confusion Ends

The GST Training for DDOs and Dealers in Dimapur wasn’t just a government event—it was a practical turning point for hundreds of professionals in Nagaland. By combining expert-led instruction, real-world examples, and easy-to-understand formats, the session helped participants feel empowered, not overwhelmed. This model—of practical, accessible, regionally relevant training—should serve as a blueprint for other states. In a world where tax rules keep evolving, knowledge is your best tax shield.

| Topic | Details |

|---|---|

| Event Date | August 5, 2025 |

| Location | Commissioner of Taxes Training Centre, Dimapur |

| Organized By | Nagaland Department of Taxes |

| Led By | Lima Imsong, Additional Commissioner of Taxes |

| Target Group | DDOs, registered dealers, tax stakeholders |

| Key Topics | GST registration, GSTR filings, TDS, e-Way Bills, Rule 88C |

| Main Outcome | Improved compliance, digital literacy, and understanding |

| Official Source | Nagaland Department of Taxes |

A Fresh, Friendly Approach to Tax Education

The goal of the training was simple: Make GST understandable and usable for professionals who don’t have a tax background. That meant no over-the-top jargon, no assumptions, and no boring lectures.

Instead, trainers created a relaxed and engaging environment using:

- Real case studies from Nagaland-based businesses

- Live walk-throughs of GST filings

- Group discussions to share common issues

- Mock portals to demonstrate return submissions

- Role-based training for DDOs and dealers

Attendees said the style reminded them more of a “financial bootcamp” than a traditional workshop. And it worked. “For the first time, I felt like GST is something I can actually manage without outsourcing,” said one dealer from Chümoukedima.

GST Confusion Ends: GST Concepts Covered in the Training

1. GST Registration: What Every Dealer and Officer Needs to Know

Trainers explained who must register, how to apply, and what documents are needed. This section focused on:

- Threshold limits (₹20 lakh for regular states, ₹10 lakh for special category states)

- Registration process through the GST Portal

- Understanding types of registration: Regular, Composition, Casual

- Managing amendments or cancellations

Practical demo sessions walked attendees through registration steps—right from OTP authentication to document upload.

2. Return Filing Demystified: GSTR-1, GSTR-3B, GSTR-7

GST compliance hinges on timely and accurate returns. The session highlighted:

| Form | Who Uses It | Due Date | Purpose |

|---|---|---|---|

| GSTR-1 | Regular dealers | 11th of next month | Sales/outward supplies |

| GSTR-3B | All registered taxpayers | 20th of next month | Summary of liabilities |

| GSTR-7 | DDOs (for TDS) | 10th of next month | TDS details and payment |

Trainers broke down each form field-by-field. This was particularly helpful for DDOs, many of whom admitted they often outsourced filings due to lack of clarity.

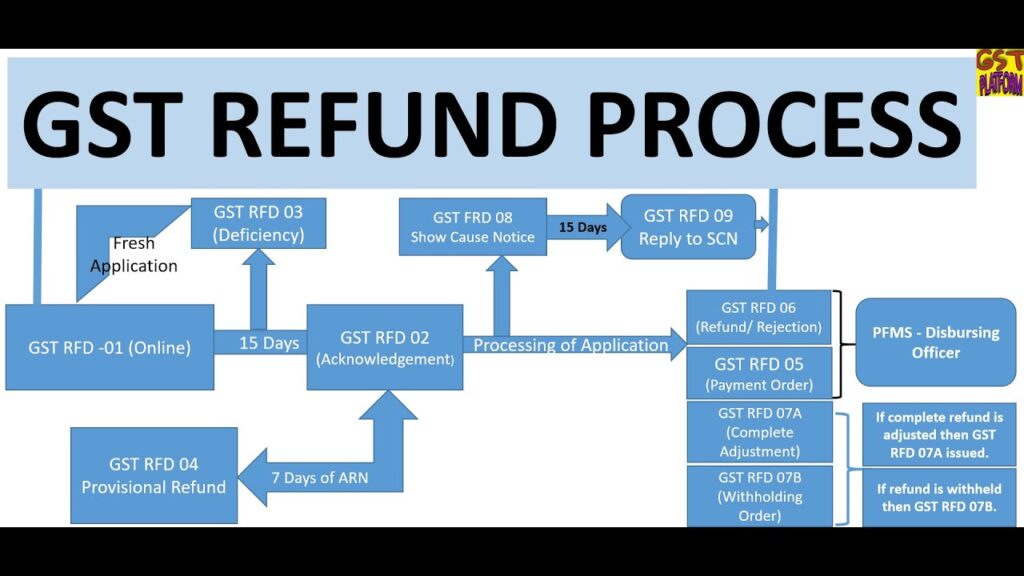

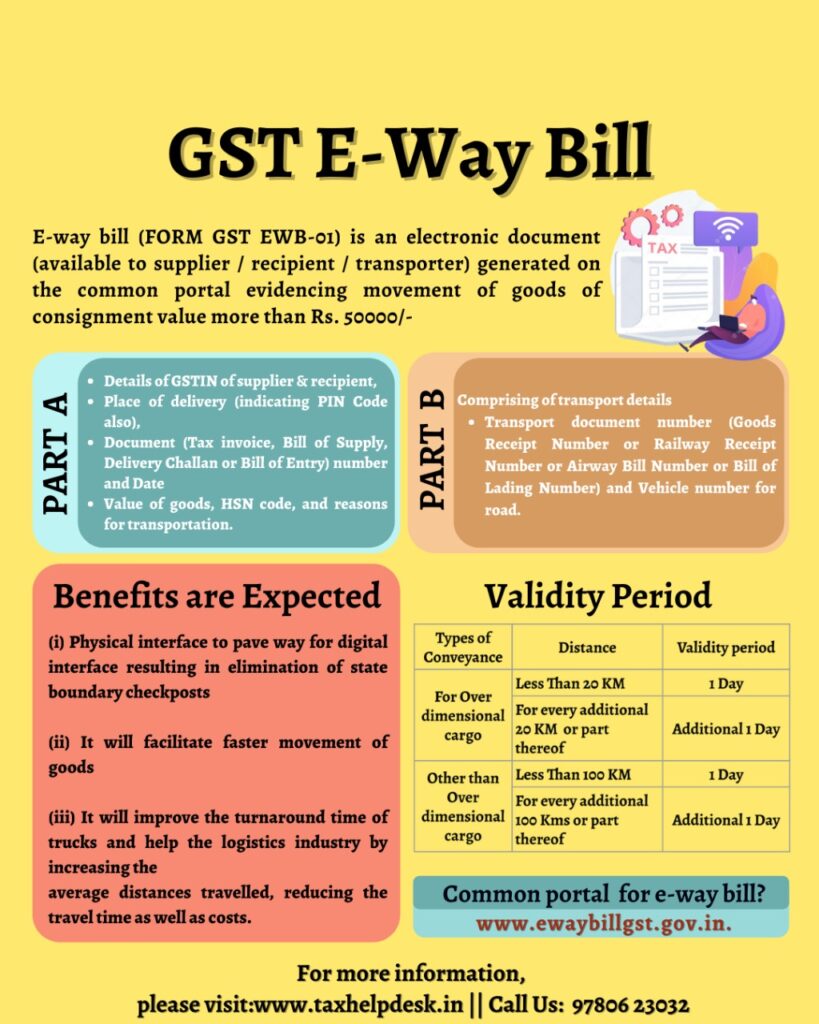

3. e-Way Bills: When and How to Generate Them

Attendees were shown how to generate and manage e-Way Bills using ewaybillgst.gov.in. They learned:

- When an e-Way Bill is mandatory (goods > ₹50,000 in value)

- Difference between Part A (supplier info) and Part B (transporter info)

- Rules for intra-state vs inter-state movement

- Penalties for non-compliance

The training emphasized that even a single missing e-Way Bill can result in detainment of goods and a fine of up to ₹10,000.

Rule 88C: The Rise of AI-Based Tax Notices

In one of the most eye-opening sessions, trainers explained Rule 88C, introduced to plug revenue leakages using AI tools.

If your GSTR-1 sales don’t match your GSTR-3B tax payments, a notice is auto-generated. Attendees were taught how to:

- Check notices on the GST portal

- Respond via Form DRC-01B

- Reconcile discrepancies using Excel

- Avoid common reporting mismatches

Most DDOs and dealers didn’t even know this rule existed before the session, and several later checked their GST portals during the lunch break.

Top Myths Busted During the Training

| Myth | Reality |

|---|---|

| GST only applies to large businesses | Not true. Anyone above the threshold must register |

| DDOs don’t need to worry about TDS | False. Government agencies must deduct 2% TDS |

| Filing late isn’t a big deal | Wrong. ₹200/day penalty + interest adds up |

| e-Way Bills are optional for local deliveries | Only if the invoice is under ₹50,000 |

What Attendees Said: Real Testimonials

“Before this session, I used to call my auditor for every small GST query. Now, I finally understand the system,” said a hardware dealer from Mokokchung.

“I had no idea our department had missed TDS filings for two months. Thanks to the checklist we got during training, we fixed that today itself,” shared a DDO from Phek district.

A young entrepreneur from Zunheboto said, “Honestly, I came here because my CA told me to. But I’m walking away with a better understanding than three months of paid consultancy.”

How This Training Helps Your Career and Business

Whether you’re a DDO, dealer, or tax consultant, understanding GST is no longer optional—it’s a competitive edge. Here’s how:

- DDOs avoid audit red flags and ensure funds flow smoothly

- Dealers reduce the risk of fines, ITC blockages, and cash flow issues

- Businesses build credibility with vendors, banks, and government agencies

- Tax professionals can train others, opening up freelance consulting opportunities

The workshop also handed out digital certification to participants, which adds professional credibility to resumes and LinkedIn profiles.

Future Plans: What’s Next for Nagaland’s Tax Reforms?

This workshop wasn’t a one-off. It’s part of a bigger push to digitize and decentralize tax knowledge in the region. According to the Department of Taxes:

- Over ₹10 crore in tax arrears were recovered between February and May 2025

- State-wide Tax Mitra programs are being launched to help locals

- Regional language GST guides in Nagamese are in development

- Zonal youth engagement programs are being rolled out via colleges and marketplaces

These initiatives tie into the national plan for faceless assessments, real-time GST return pre-filing, and AI-based anomaly detection—all expected by 2026.

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines

How to Add or Edit Bank Details on GST Portal Without Errors—Full Process Explained

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows