GST Attachment Trouble: If you’re running a business and got hit with a GST attachment notice, your head is probably spinning. Bank accounts frozen. Properties tied up. Panic mode on. But hold up — should you rush to court or go to the GST Commissioner first? A recent High Court ruling cuts through the noise and tells us exactly what the law expects. Whether you’re a small business owner, a tax consultant, or a student trying to understand GST law, this article will help you understand where to go first, how to respond, and how to protect your business assets — with zero legal jargon.

GST Attachment Trouble

So, what’s the final word? Always go to the Commissioner first. The law is clear. The courts have reinforced it. And the process — though bureaucratic — is designed to give you a fair shot. Running a business is hard enough. Getting sideswiped by a GST attachment can feel like a death blow. But with the right approach, the right forms, and the right attitude, you can handle it like a pro — and protect your assets the legal way.

| Topic | Details |

|---|---|

| Primary Keyword | GST Attachment Trouble |

| Core Issue | Whether to go to Commissioner or Court first |

| Relevant Law | Section 83 of the CGST Act, 2017; Rule 159 of CGST Rules |

| Court Ruling | Punjab & Haryana High Court mandates going to Commissioner first |

| Case Reference | Magna Wires Pvt. Ltd. & Ors. v. Union of India (2021) |

| Official Forms | DRC-22 (order), DRC-22A (objection), DRC-23 (release order) |

| Best For | Business owners, tax professionals, CA firms, legal students |

| Official GST Site | https://www.gst.gov.in |

What Is a GST Attachment?

A GST attachment is a tool used by the tax department to temporarily freeze a taxpayer’s property or bank account when they suspect tax evasion or pending dues. This is legally known as a “provisional attachment”, and it’s governed by Section 83 of the Central Goods and Services Tax (CGST) Act, 2017.

Imagine running a business, and one day, your bank emails you saying, “Your account is frozen by order of the GST department.” That’s the kind of shock a provisional attachment brings.

The idea behind the law is simple: to safeguard the revenue of the government. But when misused, it can paralyze a business overnight.

Why Is Section 83 Important?

Section 83 gives the Commissioner of GST the authority to issue a provisional attachment order when certain proceedings (like tax evasion investigations) are underway.

However, it cannot be issued randomly. These are the key checks:

- The power can only be exercised during the pendency of proceedings under Sections 62, 63, 64, 67, 73, or 74 of the CGST Act.

- There must be a valid reason to believe that the taxpayer might try to move assets or avoid payment.

- The order must be documented using Form DRC-22 and follow due process.

Rule 159: The Backbone of the Process

This Rule lays down the procedures for issuing, objecting to, and canceling a GST attachment:

- Form DRC-22: Issued by the Commissioner to attach your property.

- Form DRC-22A: Filed by the taxpayer to object to the attachment.

- Form DRC-23: Issued if the Commissioner is satisfied with your objection and cancels the attachment.

This is a proper administrative process. You can’t just ignore the order, but you also don’t need to panic — there’s a remedy built into the law.

The Game-Changing Court Case: Magna Wires Pvt. Ltd. v. Union of India

In the 2021 landmark case, the Punjab and Haryana High Court clarified an important procedural point:

“The affected party must first file an objection before the GST Commissioner before moving to High Court.”

The company involved went directly to the High Court without using the objection mechanism under Rule 159(5). The court dismissed their petition, saying they hadn’t exhausted the legal remedy available to them.

In legal terms, this is called the “Doctrine of Exhaustion of Remedies.” It means that if the law provides a specific mechanism (like going to the Commissioner), you have to follow that route before seeking constitutional remedies from the courts.

Real-World Example: What Happens If You Skip the Commissioner?

Suppose you’re the CEO of a manufacturing firm in Texas (or Chennai, India), and your business account is suddenly locked due to a GST notice.

You immediately call your lawyer, who says, “Let’s go to High Court.”

That sounds great — but if you haven’t filed an objection via Form DRC-22A, your petition may get thrown out. Courts will ask you: “Did you even try talking to the Commissioner first?”

You lose time. Money. And credibility.

Facts and Stats: The Bigger Picture

- Over 2,200 provisional attachments were issued in 2023-24, per CBIC.

- More than 40% of those were challenged using Form DRC-22A.

- Around 65% of challenged cases resulted in full or partial release of property after Commissioner hearings.

- In the case of Radha Krishan Industries v. State of Himachal Pradesh (2021), the Supreme Court warned that attachment powers must not be exercised arbitrarily, reaffirming the need for fair hearings.

Step-by-Step Guide: What To Do If You Get a GST Attachment Trouble

Step 1: Confirm the Order

- Check if Form DRC-22 was officially issued.

- Confirm it’s signed by the proper authority (Commissioner-level).

- Verify the GST sections mentioned — the order is valid only if relevant proceedings are pending.

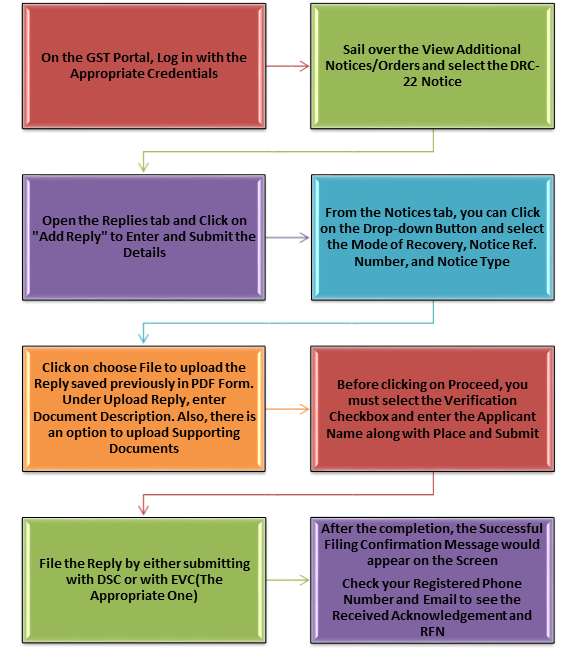

Step 2: File Your Objection

- Submit Form DRC-22A on https://www.gst.gov.in.

- Explain why the attachment is incorrect or unnecessary.

- Attach documents: bank statements, GST returns, payment receipts, audit reports.

Step 3: Attend the Hearing

- A hearing must be scheduled by the Commissioner.

- Bring a legal representative or GST expert with you.

- Be transparent. The goal is to prove that your business poses no revenue risk.

Step 4: Wait for Final Order

- If successful, the Commissioner will issue Form DRC-23 to release the property.

- If rejected, you may appeal or file a writ petition in the High Court.

Common Mistakes to Avoid

- Ignoring the DRC-22: It won’t disappear. Respond immediately.

- Bypassing the Commissioner: Courts will dismiss your case if you skip steps.

- Incomplete Objection: Always back your claim with valid, verifiable documents.

- Aggressive language in objection: Be respectful — this is a quasi-judicial process.

- Missing timelines: While not explicitly defined, prompt response is key (ideally within 7 days).

Penalties for Mishandling a GST Attachment

If you fail to comply with an attachment order or obstruct proceedings:

- You can be penalized up to 10% of the tax due.

- Under Section 122, you may face Rs. 10,000 or higher as penalty for each instance of obstruction.

- Continuing to operate attached assets (like selling frozen inventory) can invite criminal charges under Section 132.

Should You Go to Commissioner or Court First? (Comparison Table)

| Criteria | Commissioner | Court |

|---|---|---|

| Primary Process | File Form DRC-22A | File writ petition (Art. 226) |

| Cost | Low to Nil | High (legal fees, court costs) |

| Speed | 2-4 weeks | 3-6 months or more |

| Needed Before Court? | Yes | Only if Commissioner route fails |

| Appropriate For | Procedural fairness, minor disputes | Fundamental rights violation, undue delay |

| Legal Requirement | Mandatory first step | Secondary remedy |

₹2 Crore Fake GST Scam Busted in Chhatarpur — 3 Firms Raided, 2 Were Just on Paper

GST Not Applicable on Renting Property to Government for Girl’s Hostel, Says AAR

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling