Supreme Court Dismisses SLP Against GST Order on ECL Blocking: In a landmark decision that has significant implications for taxpayers across India, the Supreme Court recently dismissed a Special Leave Petition (SLP) filed by the Directorate General of GST Intelligence (DGGI) against a ruling by the Delhi High Court. The case revolved around the blocking of a taxpayer’s Electronic Credit Ledger (ECL) under the Goods and Services Tax (GST) regime. The High Court had earlier issued a verdict that the blocking of a taxpayer’s ECL—beyond the available credit—was not permissible.

With the Supreme Court’s recent dismissal of the SLP, this decision has now been upheld, marking a significant victory for taxpayers and providing clarity on the application of GST law. In this article, we’ll break down the case, its implications, and what it means for taxpayers and professionals in the GST domain. Whether you’re a business owner, accountant, or a law professional, this case offers crucial insights into how GST laws are evolving and how taxpayers can protect their rights under the law.

Supreme Court Dismisses SLP Against GST Order on ECL Blocking

The Supreme Court’s decision to dismiss the SLP filed against the Delhi High Court ruling is a big win for taxpayers and businesses operating under the GST regime. It strengthens the protection of taxpayer rights, particularly regarding the blocking of the Electronic Credit Ledger. This ruling provides clarity on the limits of the government’s power and ensures that businesses are not unfairly penalized. As a taxpayer, it’s crucial to stay informed, comply with GST regulations, and seek professional advice when necessary. By doing so, you can ensure your business remains on the right side of the law, while also protecting your valuable input tax credits.

| Key Points | Details |

|---|---|

| Case Overview | The case involves a dispute regarding the blocking of the Electronic Credit Ledger (ECL) under GST rules. |

| Ruling by Delhi High Court | The court ruled that negative blocking of the ECL is not permissible under Rule 86A of the GST Rules. |

| Supreme Court’s Stance | The Supreme Court dismissed the Special Leave Petition (SLP), reinforcing the High Court’s decision. |

| Legal Precedent | The case referred to earlier rulings, including Best Crop Science Pvt. Ltd. v. Principal Commissioner. |

| Key Legal Focus | Rule 86A of the CGST (Central Goods and Services Tax) Rules, concerning ECL blocking. |

| Impact on Taxpayers | Taxpayers can now feel confident that their ECL cannot be arbitrarily blocked beyond their available credit. |

| Official Resources | Visit the official GST website for more info. |

The ruling is especially important for taxpayers dealing with the complexities of GST compliance, as it lays down a critical principle about the limits on the blocking of input tax credits. So, let’s dive into the details of this case and why it’s a big win for taxpayers.

What is Electronic Credit Ledger (ECL) and Why Does It Matter?

Before we dive into the case details, it’s essential to understand what the Electronic Credit Ledger (ECL) is and why it plays such a crucial role in the GST framework.

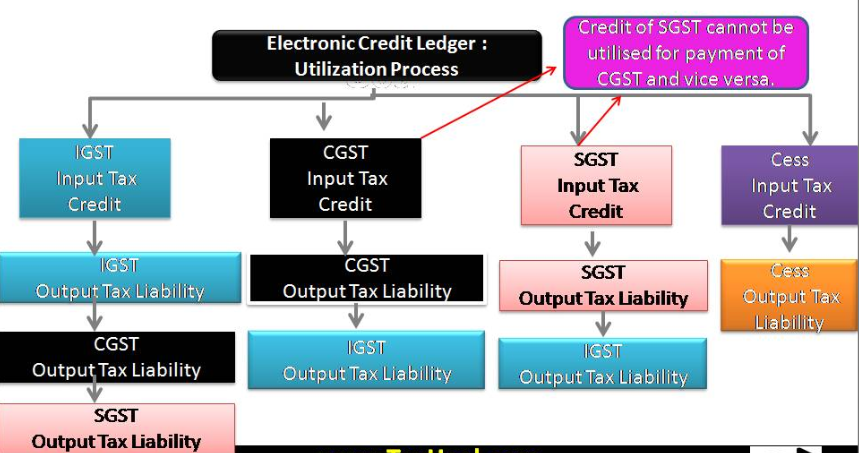

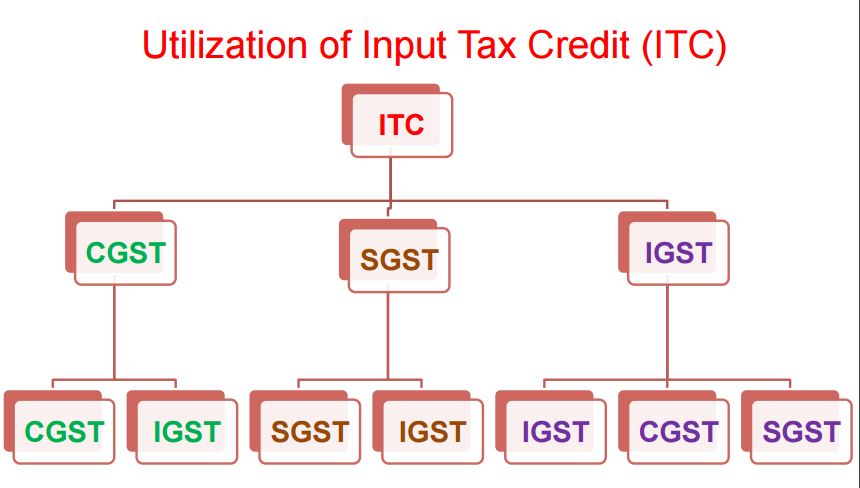

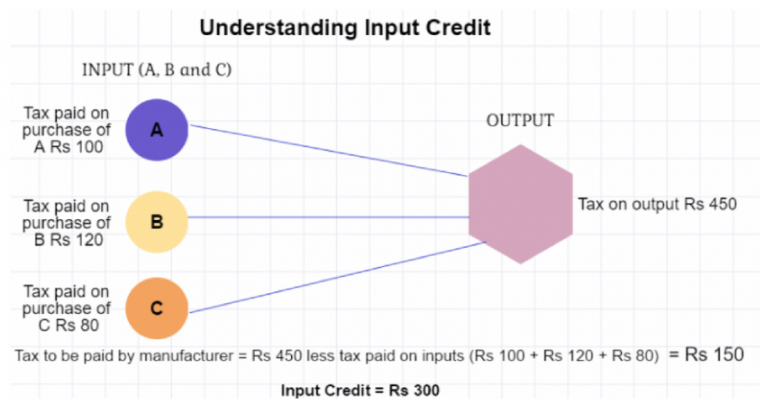

Under India’s Goods and Services Tax (GST), businesses are allowed to set off the taxes they’ve paid on inputs against the taxes they collect on sales. This input tax credit (ITC) is tracked through the ECL. Essentially, the ECL acts like a virtual bank account where all a business’s eligible ITC is recorded.

Businesses can use the credit in their ECL to pay their output tax liability. If a business is not able to use the full credit, it remains in the ledger, available for future use. However, certain restrictions apply to prevent fraud, and that’s where things get tricky.

The Case: What Happened and Why It Matters

The case that led to the Supreme Court’s decision began when the Directorate General of GST Intelligence (DGGI) attached the bank account of Kings Security Guard Services Pvt. Ltd. (the taxpayer) and blocked their ECL. The DGGI argued that this action was necessary due to concerns about tax evasion.

However, the Delhi High Court ruled in favor of the taxpayer, stating that the blocking of the ECL to create a negative balance was impermissible under the law. Specifically, Rule 86A of the GST Rules does not allow for blocking the ECL beyond the available credit.

The government disagreed with the High Court’s ruling and filed a Special Leave Petition (SLP) in the Supreme Court, hoping to overturn the decision. However, the Supreme Court dismissed the SLP, agreeing with the High Court’s interpretation of the law.

The Legal Ramifications: Rule 86A of GST

At the heart of the ruling lies Rule 86A of the Central Goods and Services Tax (CGST) Rules. This rule provides the government with the authority to block the ECL of taxpayers if they suspect that there is a risk of tax evasion or fraud. However, the rule is clear that this action cannot extend to blocking the ledger beyond the available credit.

The Delhi High Court’s decision focused on this point—arguing that while the government has the power to block an ECL, it cannot block more credit than what is available. The court interpreted Rule 86A in a way that protects taxpayers from arbitrary restrictions that could cripple their ability to conduct business.

Implications for Taxpayers

The Supreme Court’s dismissal of the SLP has far-reaching consequences for taxpayers in India. Here are a few key takeaways:

- Protection of Input Tax Credit: Taxpayers can rest assured that their input tax credits (ITC) cannot be blocked beyond the available balance. This ensures that businesses can continue to operate smoothly and claim credit for taxes paid on inputs, which is vital for cash flow management.

- Clarity on ECL Blocking: The ruling provides much-needed clarity on the legal limits of ECL blocking. This ensures that businesses are not arbitrarily affected by GST authorities, as the law now clearly defines the boundaries of action under Rule 86A.

- Precedent for Future Cases: The dismissal of the SLP establishes a precedent that could influence future cases where the blocking of ECL is in dispute. This could result in more taxpayer-friendly rulings and interpretations of GST rules.

What Businesses Need to Know?

If you’re a business owner or professional working with GST, here’s what you need to take away from this case:

- Ensure Compliance with GST Rules: Stay on top of GST compliance to avoid the risk of your ECL being blocked. If your business is under scrutiny for tax evasion, make sure all your records are in order, and your ITC claims are legitimate.

- Seek Legal Assistance if Needed: If you believe your ECL has been unjustly blocked, don’t hesitate to seek legal counsel. As this case shows, the courts can provide relief when taxpayers’ rights are violated.

- Monitor GST Notifications: Keep an eye on GST notifications and amendments, as the landscape is constantly evolving. New rulings and regulations can significantly affect how businesses operate under GST.

Supreme Court Dismisses SLP Against GST Order on ECL Blocking: A Step-by-Step Guide to Avoid ECL Issues

- Maintain Proper Documentation: Always keep a clear record of all your input tax credits. This includes invoices, receipts, and all related documents. If you’re ever questioned about your ECL, having these records on hand can save you a lot of trouble.

- Check Your ECL Regularly: Keep track of your Electronic Credit Ledger on the GST portal. Make sure there are no discrepancies or unexpected blockages that could affect your business operations.

- Consult with Experts: If you’re unsure about the rules around ECL blocking or any other GST issues, it’s always a good idea to consult with a GST expert or tax professional.

- Challenge Unlawful Blocking: If your ECL is blocked without cause, consider filing an appeal. The legal process can be lengthy, but it may be worth it to protect your rights and continue your business operations.

Impact on Different Sectors

The ruling has a profound impact on various sectors that rely heavily on input tax credit (ITC) for smooth operations. Small businesses, exporters, and industries with complex supply chains will benefit most from this ruling. For instance:

- Small Businesses: For smaller businesses with lower cash reserves, the ability to use their ITC without interruption is critical for liquidity. The ruling ensures that their working capital isn’t unnecessarily tied up due to arbitrary ECL blockages.

- Exporters: Since exporters often deal with large amounts of input tax credit that they cannot claim back in the form of refunds, ensuring that their ECL remains intact is crucial for maintaining profitability.

Potential Future Developments

The case could set the stage for broader reforms in the GST system. As this issue has now been legally settled, it might prompt further review of the GST framework, particularly around the power of the GST authorities. Taxpayers and businesses may see more clarity and improved processes in the future that aim to reduce arbitrary decision-making.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

GST Amnesty Scheme Alert — Must-Read Advisory for All Registered Taxpayers