3-Year-Old Customs Duty Drawback Recovery Case: The Madras High Court recently made waves in the world of customs and trade law by ruling on a significant case involving the recovery of customs duty drawback after a prolonged period. The case centers on the government’s attempt to recover ₹74.57 lakh in customs duty drawback benefits, which were granted in the past but later questioned by authorities after a delay of over three years. This case highlights important lessons for both exporters and government agencies in ensuring fairness, transparency, and due process in customs and trade-related matters. In this article, we’ll break down the Madras High Court’s ruling, explain the customs duty drawback concept, discuss the implications of the court’s decision, and offer practical insights for businesses involved in international trade. Whether you’re a seasoned trade professional or someone just getting started in the field, this article will provide valuable insights into how customs proceedings work and how businesses can navigate them.

3-Year-Old Customs Duty Drawback Recovery Case

The Madras High Court’s ruling serves as a reminder to both government authorities and businesses that fairness, transparency, and timeliness are essential in all customs and trade-related proceedings. By ensuring proper communication and following due process, customs authorities can avoid legal challenges and disputes. For businesses, it’s a call to stay on top of documentation, address updates, and be proactive in responding to any notices or proceedings. Ultimately, this case sheds light on the importance of upholding natural justice in the world of international trade. Ensuring that businesses are given the opportunity to present their case fairly is not just a legal requirement but a foundational principle of fair business practice.

| Key Highlight | Details |

|---|---|

| Case Overview | The case involves the recovery of ₹74.57 lakh in customs duty drawback benefits. |

| Issue | Recovery proceedings were initiated three years after the export transactions were conducted. |

| Court’s Decision | The Madras High Court quashed the recovery order and remanded the matter for reconsideration. |

| Key Focus Areas | Natural Justice, timely communication, procedural fairness. |

| Court’s Instructions | Personal hearing to be granted, documents considered, and clear communication with the exporter. |

| Authority Reference | Taxscan’s Detailed Report |

| Time Frame | The court instructed proceedings to be completed within 12 weeks. |

What is Customs Duty Drawback?

Before we dive into the details of this case, let’s take a quick refresher on what customs duty drawback actually is.

In the world of international trade, customs duties are taxes imposed on goods imported into a country. However, to encourage exports, the government allows businesses to claim a refund of customs duties paid on goods that are later exported. This refund is known as a customs duty drawback.

For instance, if an exporter pays customs duties on raw materials imported to manufacture a product, and then exports that product, the government might refund the customs duties to encourage the export activity. This system is essential for promoting exports, maintaining a competitive edge in the global market, and ensuring that international businesses remain profitable.

Example of Duty Drawback in Action

Let’s say an American company imports raw materials like steel or electronics to produce a product that will later be sold overseas. The company pays customs duties on those materials when they enter the country. If the company then exports the finished products abroad, they can file for a duty drawback to recover the customs duties previously paid on those raw materials.

The Madras High Court Case: A Timeline of Events

Now that we understand what customs duty drawback is, let’s dive into the specifics of the Madras High Court case.

Background of the Case

The petitioner in this case, M/s. New Sun Innovaation, was a company that had claimed customs duty drawbacks on 211 shipping bills for export transactions carried out between 2004 and 2014. The issue arose in 2018 when the government sought to recover a sum of ₹74.57 lakh that was previously granted to the company as a duty drawback.

What makes this case intriguing is the significant delay in initiating the recovery process. The government issued a show cause notice for the recovery of the amount in May 2018, more than three years after the export transactions had occurred. This delay raised questions about the timeliness and fairness of the proceedings, which ultimately led to the involvement of the Madras High Court.

The Dispute

The central issue in this case was whether the recovery process was initiated within a reasonable time frame. The exporter argued that the show cause notice was time-barred, given that it was issued over a decade after the export transactions took place. This delayed action led to questions about whether the exporter had been given a fair opportunity to present their side of the story.

The Court’s Findings

The Madras High Court found that the customs department had failed to follow proper procedure in notifying the exporter about the recovery proceedings. Specifically, the department had sent the notices to an outdated address, despite the petitioner having updated their address with the Directorate General of Foreign Trade (DGFT).

Moreover, the court noted that the personal hearing notices were never received by the petitioner because of this address issue. The department had relied on public notices and notice board postings as a means of communication, which the court determined to be insufficient for ensuring that the exporter was properly informed.

The Court’s Ruling

In its decision, the Madras High Court refrained from outrightly declaring the recovery order invalid. Instead, the court chose to quash the impugned order and sent the matter back to the Assistant Commissioner for fresh adjudication. The court’s ruling emphasized the importance of natural justice, including the right to be heard and timely communication with the concerned parties.

The court ordered that a personal hearing be provided to the petitioner, and that the timeliness of the recovery be considered. Furthermore, the authorities were instructed to allow the petitioner to submit any relevant explanations and documents, including the Bank Realization Certificates (BRCs) that were missing from the original proceedings.

Practical Implications of the 3-Year-Old Customs Duty Drawback Recovery Case

This ruling has wide-ranging implications for businesses involved in export and import activities. Here are a few important takeaways:

1. Importance of Timely Action

The ruling underscores the importance of timeliness in customs proceedings. Government agencies are expected to act within reasonable time frames, and delays can significantly impact businesses. Exporters should ensure that their documentation is in order and updated regularly to avoid unnecessary complications down the road.

2. Proper Notification Procedures

One of the key points raised by the court was the issue of communication. Customs authorities must ensure that all notices, especially those related to recovery proceedings, are sent to the correct address. This case serves as a reminder for exporters to keep their contact information updated with customs and trade agencies, including the DGFT.

3. Right to Fair Hearing

The court’s decision highlights the importance of natural justice principles. Exporters have the right to be heard and to present their case before decisions that may impact their financial standing are made. Therefore, businesses should always ensure that they respond to show cause notices promptly and keep records of their communications with authorities.

Customs Duty Drawback Process Explained

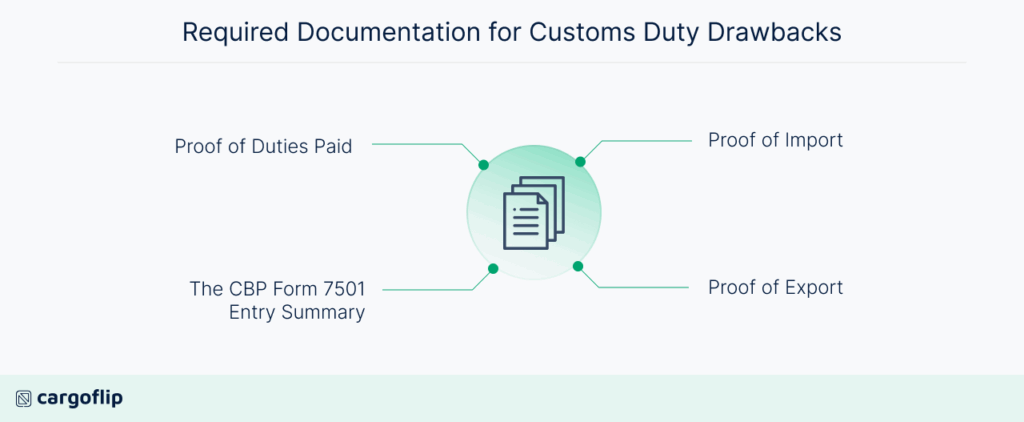

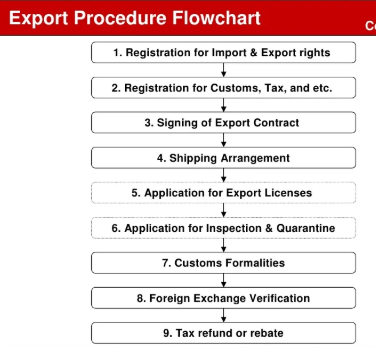

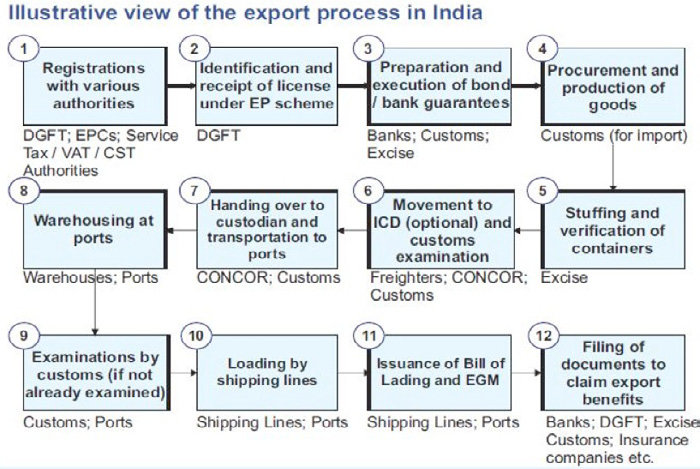

The customs duty drawback process involves several important steps that an exporter must follow to claim refunds on duties paid on imported goods that are subsequently exported. Here’s a quick breakdown of the process:

1. Eligibility Check

Before applying for a drawback, exporters must ensure they meet certain eligibility criteria, such as having paid customs duties on the goods they imported.

2. Filing the Application

Exporters must file an application with the customs department, providing details such as shipping bills, invoices, and any other relevant documents. The process can vary slightly depending on the country or customs office, but generally, exporters must also show proof of export.

3. Verification

Once the application is filed, customs will verify that the goods have been exported and that the exporter is eligible for a drawback. The exporter must also provide supporting documentation, such as Bank Realization Certificates (BRCs), which verify that payments for the goods have been received.

4. Claim Processing

After verification, the claim is processed, and the exporter may receive the refund. This can take several weeks to months, depending on the efficiency of the customs office.

Legal Precedents and Role of Courts in Customs Disputes

The Madras High Court’s ruling is not an isolated case. Historically, courts have played an important role in ensuring fair procedures are followed in customs disputes. For instance, similar cases in the past have involved issues of undue delays or improper notice that have been rectified by the courts to ensure the principles of natural justice are upheld.

These precedents are important reminders for businesses and government agencies to respect legal processes and timelines.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Retrospective Penalties in CENVAT Credit Dispute: CESTAT Clears the Air with Landmark Ruling

Groundbreaking High Court Ruling on GST and Expat Employee Secondments—What It Means for Businesses!