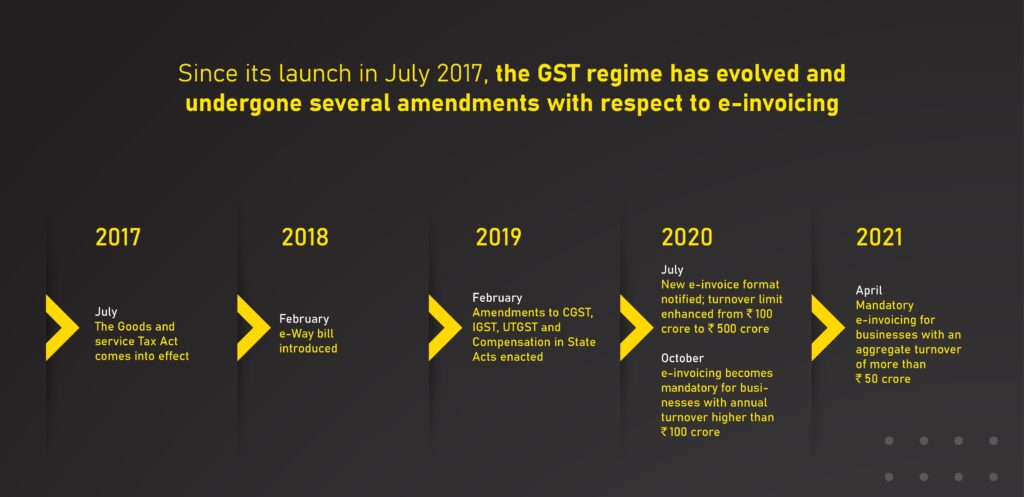

GST Notification 56/2023 Declared Illegal: In a landmark ruling that has sent shockwaves through the Indian tax system, the Madras High Court recently declared GST Notification No. 56/2023 illegal and unconstitutional. This ruling has profound implications for how tax authorities issue orders and how businesses, accountants, and tax professionals navigate India’s Goods and Services Tax (GST) framework. This decision is not just a technical legal matter—it highlights crucial principles about the separation of powers, statutory procedures, and how government bodies should work within their legal framework. In this article, we’ll break down the implications of the ruling and explain what it means for businesses and professionals working within the GST regime.

GST Notification 56/2023 Declared Illegal

The Madras High Court’s ruling on GST Notification No. 56/2023 has set a significant precedent in India’s tax landscape. It has brought clarity to the importance of adhering to constitutional procedures and has emphasized the centrality of the GST Council in shaping the country’s tax policies. For businesses and professionals, it’s crucial to understand the implications of this ruling. By reviewing any affected orders, filing objections within the prescribed period, and staying updated on further developments, you can navigate the changing landscape of GST compliance with confidence.

| Key Topic | Details |

|---|---|

| Case | Madras High Court ruling on GST Notification No. 56/2023 |

| Issue | Extension of time limits for GST orders without proper authorization |

| Court’s Decision | Declared the notification as illegal and ultra vires (beyond legal power) |

| Main Grounds for Ruling | Lack of GST Council recommendation, absence of force majeure, and violation of Supreme Court orders |

| Impact | Quashing of all orders issued under the extended timelines, invalidation of several GST notices |

| Official Link | Official Madras HC Judgment |

What Led to the Court’s Ruling?

The case arose when GST Notification No. 56/2023, issued on December 28, 2023, extended the time limits for issuing orders under Section 73 of the CGST Act. Section 73 pertains to tax assessments and actions against businesses that fail to pay the correct amount of tax.

The Notification’s Original Purpose

The extension was made to help businesses and tax authorities who were facing difficulties, like technological hiccups or infrastructure delays, in meeting compliance deadlines. However, the real issue arose when the GST Implementation Committee (GIC)—a body of tax officials—issued the notification without the GST Council’s prior recommendation, which is a mandatory requirement under the law.

The Legal Reasoning Behind the GST Notification 56/2023 Declared Illegal

The Madras High Court’s judgment rests on three main arguments:

1. Lack of GST Council Recommendation

Under Section 168A of the CGST Act, time limits for filing returns, assessments, and other procedures can only be extended after a recommendation by the GST Council. The GST Council is the official body, consisting of Union and State Finance Ministers, that has the constitutional authority to recommend changes in GST policy.

In this case, the Court found that the GST Implementation Committee (GIC) issued the notification without the GST Council’s approval, which makes the notification legally invalid. The ruling reinforced that the GIC doesn’t have the power to supersede the Council’s recommendations.

2. Absence of Force Majeure

For an extension under Section 168A to be valid, the reasons for the extension must qualify as force majeure events—such as natural disasters, wars, or epidemics—that prevent the timely completion of GST-related actions.

However, the reasons given by the government for this extension were infrastructure delays and systemic inefficiencies, which the Court deemed to be self-inflicted issues. These do not meet the criteria for force majeure, thus invalidating the notification.

3. Contravention of Supreme Court Orders

The Supreme Court of India had already issued an order during the COVID-19 pandemic to exclude the period from March 15, 2020, to February 28, 2022, from limitation periods for legal proceedings. The notification at the heart of this case attempted to override this order by extending deadlines beyond the period covered by the Supreme Court’s exemption.

The Madras HC ruled that such an attempt to bypass a Supreme Court order was not permissible.

What Does This Ruling Mean for Businesses and Tax Authorities?

This ruling is a significant moment in the evolution of India’s GST regime and has far-reaching consequences for how GST-related matters are handled going forward. Here’s what businesses, tax consultants, and professionals need to know:

1. Invalidation of Orders Issued Under the Extended Timelines

The Court quashed all GST orders that were issued under the extended timelines of Notification No. 56/2023. These orders are now considered void, and businesses can file objections. If your business was affected by such an order, you now have the opportunity to challenge it in court.

2. Opportunity to Rectify Mistakes

The Court has given taxpayers eight weeks to file objections to any orders issued during the invalidated period. This is a crucial window for businesses to correct mistakes or discrepancies in their earlier submissions.

3. A Wake-Up Call for Tax Authorities

This ruling sends a strong message to tax authorities about the importance of sticking to legal procedures. It highlights the need for transparency in decision-making, especially when administrative bodies take actions that affect taxpayers. It’s a reminder that even government bodies must operate within the limits set by the Constitution.

Practical Advice: What Should You Do Next?

If your business was affected by this notification, here’s what you should do:

1. Review Your GST Orders

Go over any GST orders or notices you’ve received recently. If they were issued during the extended period covered by Notification No. 56/2023, they may now be invalid. Make sure to get advice from a tax professional to confirm the status of these orders.

2. File Objections

You have eight weeks from the Court’s order to file objections against any invalidated orders. It’s crucial to meet this deadline to ensure your case is heard.

3. Stay Updated

As this ruling could trigger changes in the tax administration system, keep an eye on updates from the GST Council and Central Board of Indirect Taxes and Customs (CBIC). New notifications or procedures might be issued in the near future to clarify how tax matters will proceed.

4. Keep Detailed Records

Ensure that all your communication, orders, and objections are well-documented. This will help you in case of any future disputes or misunderstandings.

Legal Framework and Implications: What Professionals Need to Know

For professionals working in the field of taxation, it’s essential to understand the broader legal framework surrounding the GST Act and its enforcement. The Court’s ruling underscores a few important legal principles:

- Constitutionality of Administrative Actions: The ruling stresses that any administrative decision affecting citizens must comply with constitutional norms, particularly when it comes to procedural law.

- Role of the GST Council: The GST Council is central to all major changes in the GST regime. Tax professionals must stay well-informed about any changes the Council introduces.

- Judicial Oversight: This case is a reminder that the judiciary is vigilant in overseeing the actions of the tax authorities. Legal professionals should be prepared for greater scrutiny of the government’s actions in the future.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

GST Collection Breaks ₹1.96 Lakh Crore Mark — But Why Is Net Growth Cooling?

Hostel Inmates Cry Foul as GST Hike Sends Rents Soaring in Chennai