GST Officers Take Down Tax Evader in Major Crackdown: Tax evasion is something no one should take lightly. The Goods and Services Tax (GST) system, while designed to be simple and efficient, has found itself under attack by fraudsters seeking to avoid paying their dues to the government. A significant case recently unfolded where GST officers uncovered a whopping ₹16.30 crore tax evasion scheme. This crackdown by the Central Goods and Services Tax (CGST) Delhi South Commissionerate has not only sent shockwaves through the business community but also highlighted the growing efforts to combat tax fraud. In this article, we’re going to break down what happened, how the authorities caught the fraudsters, and why it matters. We’ll also cover some practical advice on how businesses can avoid falling into the same trap, making sure you stay on the right side of the law.

GST Officers Take Down Tax Evader in Major Crackdown

In conclusion, the ₹16.30 crore GST tax evasion case is a stark reminder of the importance of tax compliance for businesses of all sizes. While the authorities are working tirelessly to crack down on fraudulent activities, businesses must also do their part by staying honest and transparent. Using technology, conducting regular audits, and educating employees are all critical steps in ensuring compliance. The government’s efforts to reduce fraud, combined with advancements in digital tools, will continue to make it harder for tax evaders to succeed. For businesses, the key takeaway is simple: pay your taxes, stay compliant, and keep your records clean.

| Topic | Details |

|---|---|

| Total Tax Evasion Uncovered | ₹16.30 Crore |

| How the Fraud Occurred | Underreporting GST liabilities by three companies |

| Type of Companies Involved | Manpower supply & facility management services |

| Key Arrest | Common director of three companies arrested |

| Current Status | Investigation ongoing |

| Punishment | Cognizable & non-bailable offense under CGST Act |

| GST Fraud Cases Detected in FY 2024-25 | ₹2.23 Lakh Crore in over 30,000 cases |

| Official Link for Reference | GST Fraud News |

What Happened in the Recent Crackdown?

The latest crackdown by the CGST officers took place after an extensive investigation into three related companies involved in the supply of manpower and facility management services. These businesses, which operate in a booming sector, were found to have significantly under-reported their GST liabilities. They had been collecting taxes from their clients but weren’t remitting them to the government.

The arrested individual, the common director of all three companies, admitted to orchestrating the fraud. This person’s role was pivotal in ensuring that the companies’ GST liabilities were not reported in full, despite having received taxes from clients. The authorities are now working to track the flow of funds and identify any other individuals or companies that might have benefited from this tax evasion scheme.

The investigation revealed that the companies had been operating in this manner for several financial years, making the evasion amount a staggering ₹16.30 crore. This tax evasion scheme wasn’t just a minor error; it was a deliberate effort to avoid taxes and ultimately defraud the government and citizens.

Breaking Down the Impact

The government has taken a very strong stance against such fraudulent activities. Under the CGST Act of 2017, this offense is considered cognizable and non-bailable due to the large amount of money involved. This means that those responsible could face severe consequences, including arrest and imprisonment.

What’s interesting here is the fact that these companies were involved in manpower and facility management services—two industries that see a lot of cash flow, making them attractive targets for fraud. It’s also worth noting that this crackdown is part of a broader effort by tax authorities to combat GST fraud.

Why Does GST Officers Take Down Tax Evader in Major Crackdown Matter?

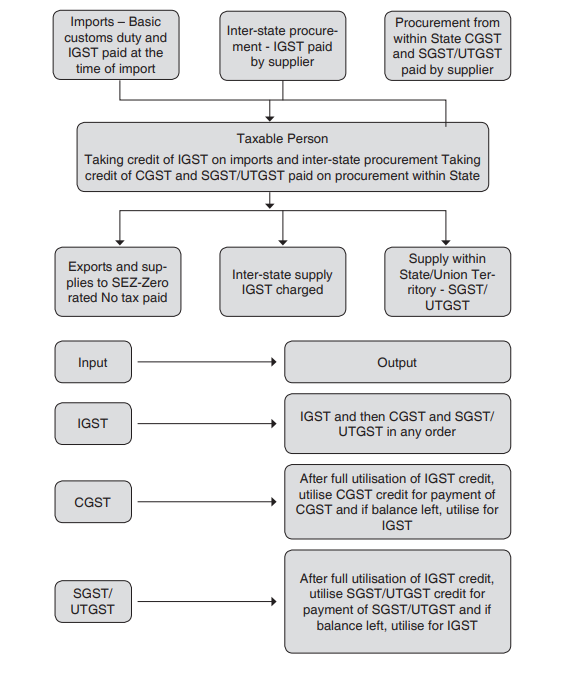

The ₹16.30 crore evasion may seem like a lot of money, but it’s just the tip of the iceberg. In the fiscal year 2024-25 alone, over ₹2.23 lakh crore in GST evasion was detected across 30,056 cases. A huge chunk of this came from fraudulent Input Tax Credit (ITC) claims. These claims allow businesses to reduce their GST liability by crediting the tax paid on their purchases. However, fraudsters exploit this system by making fake claims or inflating their expenses.

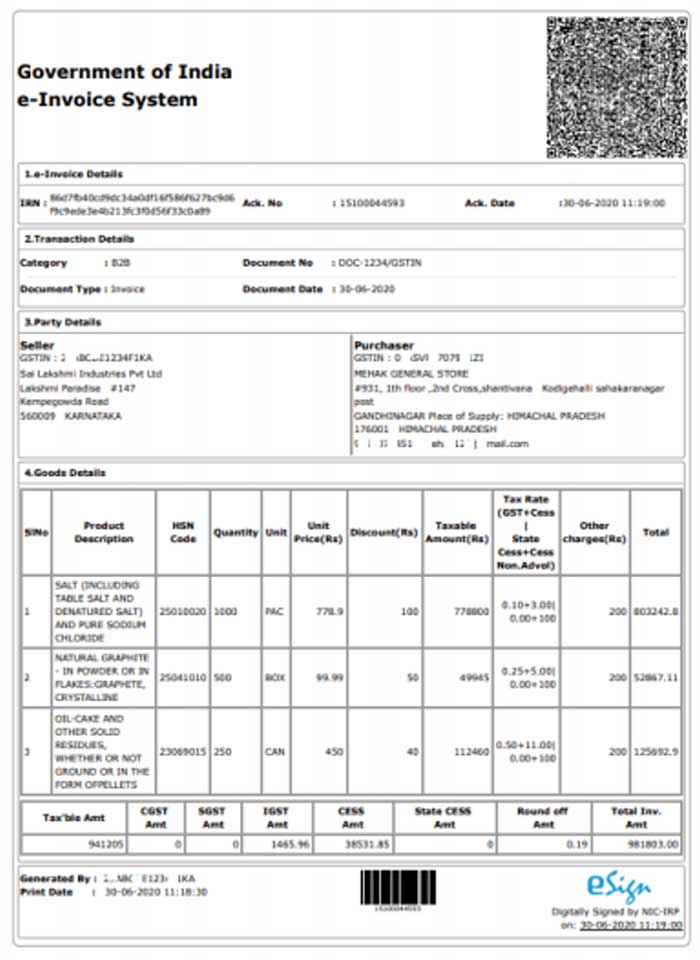

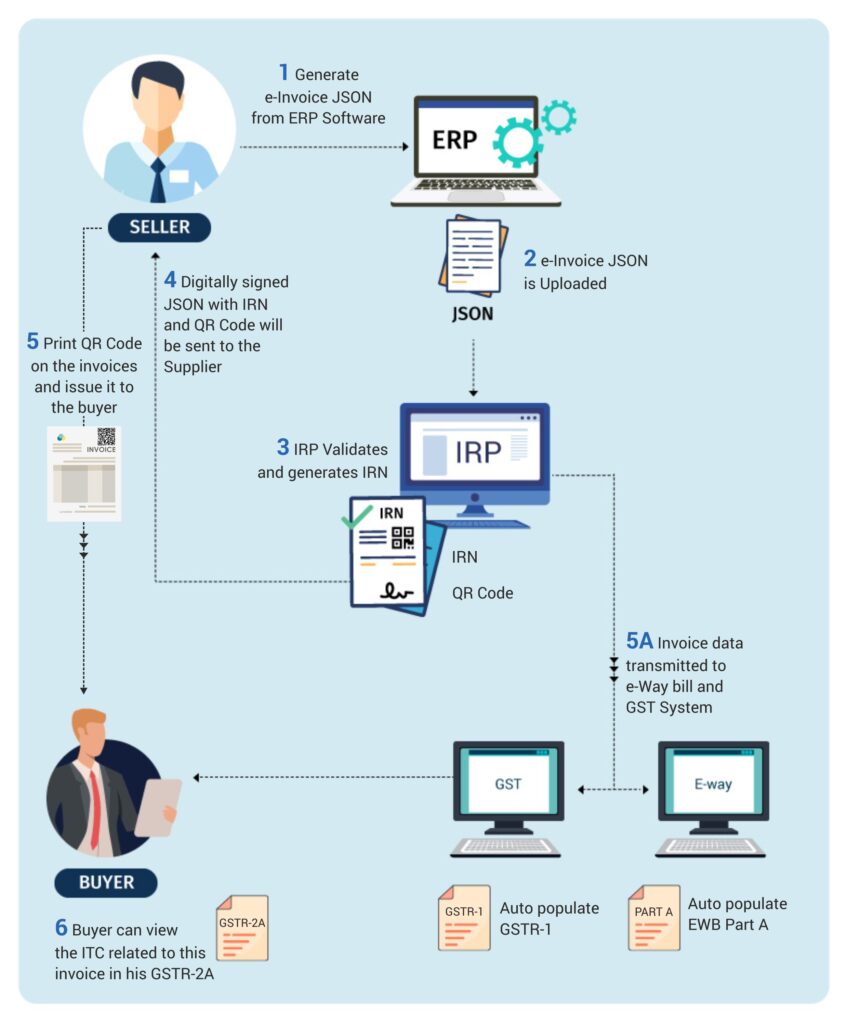

The government is actively trying to crack down on these fraudsters using technology. Digital tools like e-invoicing, advanced analytics, and risk-based audits are being used to identify discrepancies and red flags in tax filings. While these technologies help, they also highlight the importance of businesses being vigilant and honest when filing their taxes.

How Can Businesses Avoid Falling into the Same Trap?

Now that we know what happened in this case and why it matters, let’s dive into some practical advice for businesses to avoid similar situations.

1. Stay Transparent with Your Tax Records

One of the most important things you can do as a business is to maintain honest and transparent records. When you report your GST, ensure you’re not inflating your expenses or under-reporting your income. This goes beyond just avoiding tax evasion; it’s about building trust with the government and your customers.

2. Regularly Audit Your GST Returns

In the case of the ₹16.30 crore tax evasion, the companies involved were not diligent about auditing their returns. Performing regular internal audits of your GST filings can help you identify discrepancies early on. It’s a good idea to involve an accountant or a tax professional to ensure everything is in order.

3. Use Technology to Your Advantage

In today’s world, technology is your friend. Utilize e-invoicing, automated accounting software, and other digital tools to ensure that your GST filings are accurate. These tools can also help you track payments, expenses, and taxes in real-time, making your filings more accurate and reducing the chances of error.

4. Be Careful with Input Tax Credit (ITC) Claims

One area where businesses commonly get into trouble is fraudulent ITC claims. If your business is claiming ITC, make sure it’s legitimate. Avoid claiming credits for purchases that aren’t supported by genuine invoices or payments. Keep track of all your transactions to ensure that your ITC claims are accurate.

5. Educate Your Team

Your employees are a crucial part of your business’s tax compliance. Conduct training sessions to educate them about the importance of tax compliance and the consequences of fraud. When everyone is on the same page, you can avoid costly mistakes that could lead to investigations or penalties.

6. Know the Law and Seek Professional Advice

It’s always a good idea to stay informed about the latest changes in tax laws. The CGST Act of 2017 is comprehensive and can be complex to navigate. If you’re ever unsure about any tax-related matter, consult a tax professional. Their expertise can help you avoid common pitfalls and ensure that you’re following the law to the letter.

The Role of Technology in Combating Tax Evasion

As fraud cases like this ₹16.30 crore evasion highlight, technology plays an increasingly important role in identifying tax evaders. E-invoicing, which became mandatory for businesses above a certain threshold, helps ensure that all transactions are reported to the government in real-time. This reduces the opportunity for fraudulent activities.

Additionally, advanced data analytics allows tax authorities to identify patterns of suspicious activity and flag returns that may require further scrutiny. With the help of such tools, the government can more easily track discrepancies in GST filings and clamp down on fraudsters.

As a business, adopting these technologies is not just a legal requirement, but a smart move. Not only do they help ensure compliance, but they also reduce the likelihood of errors that could lead to audits or penalties.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

No GST on UPI Payments — Government Clears the Air in Rajya Sabha