Is Using UPI Data to Track GST Evaders a Game-Changer? The Indian government’s decision to use Unified Payments Interface (UPI) data to track Goods and Services Tax (GST) evaders is making waves across the business and taxation sectors. But, is it truly a game-changer? Experts are weighing in, with opinions ranging from strong support to serious concerns about the impact on small businesses. In this article, we’ll break down what this new strategy entails, its potential benefits, challenges, and how it could reshape the future of tax collection in India.

Is Using UPI Data to Track GST Evaders a Game-Changer?

The use of UPI data to track GST evaders is a game-changer in many ways. It offers a streamlined, transparent method for identifying non-compliant businesses. However, it also poses significant challenges, particularly for small traders who may lack the resources to navigate the complexities of GST regulations. The government’s focus should be on balancing enforcement with education and support to ensure that businesses can comply without fear of retroactive penalties. With the right guidance, UPI data could play a vital role in transforming India’s tax system for the better.

| Key Insights | Details |

|---|---|

| Government Initiative | Using UPI transaction data to identify GST evaders who have crossed the mandatory GST registration threshold (₹40 lakh turnover for goods, ₹20 lakh for services). |

| Key Stakeholders | Traders, small vendors, Karnataka government, GST authorities. |

| Current Concerns | Small businesses struggling with compliance, fear of retroactive tax liabilities. |

| Potential Benefits | Enhanced tax compliance, reduced tax evasion, fairness for compliant taxpayers. |

| Expert Opinions | Mixed views – support from some, concerns about pushing small vendors back into the informal economy. |

| Next Steps | Government initiatives like “Know GST” campaigns to educate traders. |

What is UPI Data and Why is It Being Used for GST Compliance?

First things first—what is UPI, and how does it relate to GST? The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables users to transfer money instantly between bank accounts using mobile devices. Since its launch, UPI has revolutionized payments in India, making transactions faster, more secure, and, most importantly, traceable.

Now, GST, or Goods and Services Tax, is a consumption-based tax applied to most goods and services in India. Businesses exceeding certain annual turnover thresholds are required to register for GST. However, some traders deliberately evade registration, making it difficult for the government to track tax collection properly.

Why UPI Data?

By using UPI transaction data, the government can identify traders whose business activity exceeds the GST registration threshold but who have failed to register for GST. For example, if a vendor has transactions worth ₹50 lakh via UPI but hasn’t registered for GST, this discrepancy can now be flagged by the tax authorities.

This data-driven approach offers several benefits. For one, it helps identify potential GST evaders without relying solely on traditional methods like audits or manual inspections. It’s a faster, more efficient way to ensure tax compliance.

How Does the Government Use UPI Data to Track GST Evaders?

Once a business surpasses the GST registration threshold, it is legally required to register for GST and file regular returns. The government uses UPI data to compare the turnover of businesses against their GST registration status. This allows the tax authorities to identify unregistered traders who should be paying GST but aren’t.

In Karnataka, for instance, the state government has already sent notices to over 14,000 traders who have crossed the ₹40 lakh threshold in UPI transactions but haven’t registered for GST. The crackdown is not just about revenue; it’s about ensuring fairness in the market. As Vipul Bansal, Karnataka’s Commissioner of Commercial Taxes, puts it, the aim is not just to collect tax but to maintain fairness by holding all businesses to the same standard.

Example in Action: Karnataka’s Efforts

Karnataka has become one of the first states to implement this strategy. The state has already flagged numerous traders who exceed the turnover limit through UPI transactions but are yet to register for GST. The goal is to stop GST evasion before it becomes a larger issue. For traders who fail to comply, the government can issue tax notices and even impose penalties.

The “Know GST” campaign was also launched in Karnataka to educate small businesses about GST regulations and how to stay compliant.

The Pros: Benefits of Using UPI Data for GST Compliance

- Increased Transparency: UPI provides a digital trail for every transaction, making it harder for businesses to evade taxes.

- Efficient Identification: By analyzing transaction data, the government can identify potential GST evaders faster than relying on manual audits.

- Leveling the Playing Field: The government’s use of UPI data aims to ensure that all traders—whether big or small—are treated equally and adhere to the same tax obligations.

- Boosting Tax Revenue: A more accurate identification of tax evaders leads to increased revenue collection, which can be used to improve public infrastructure and services.

- Encouraging Digital Transactions: This move also encourages more businesses to adopt digital payments to stay compliant and avoid penalties.

The Cons: Challenges and Concerns for Small Businesses

While the government’s crackdown on GST evaders is undoubtedly beneficial from a compliance standpoint, it’s not without its drawbacks, particularly for small vendors.

- Small Business Struggles: Many small businesses, particularly those dealing in exempt goods like fruits and vegetables, may not be familiar with the intricacies of GST. They may find themselves in legal trouble due to confusion over the rules, especially when their UPI transactions cross the threshold inadvertently.

- Shift Back to Cash Transactions: Faced with the fear of GST scrutiny, some small traders are avoiding UPI altogether and resorting to cash transactions. While this might help them evade detection, it also goes against the government’s goal of promoting a cashless economy.

- Retroactive Tax Liabilities: For businesses that have been operating for years without GST registration, suddenly receiving tax notices for past transactions can lead to financial strain. Many vendors fear penalties and interest on past transactions.

- Impact on Informal Economy: Aggressive enforcement could drive small businesses back into the informal sector, where they don’t have to worry about taxes but also miss out on benefits like access to formal financing.

Expert Opinions: What Do the Pros Think?

Experts have mixed views on using UPI data for GST enforcement. Some believe this is a much-needed step in curbing tax evasion, while others argue that it may push small businesses into the informal economy, counteracting the government’s goals of formalization.

State Bank of India (SBI) Research has expressed concerns that too much focus on UPI transactions could drive small businesses into the shadows. They warn that aggressive enforcement could hurt businesses that are still learning the ropes of GST compliance.

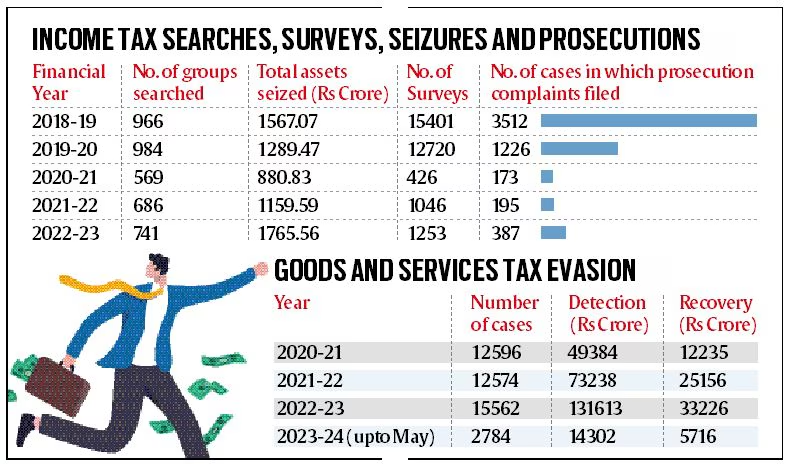

At the same time, the Directorate General of GST Intelligence (DGGI) has been actively involved in efforts to detect and address GST evasion, further supporting the government’s push for tax reform.

Step-by-Step Guide: How Businesses Can Stay Compliant with GST

- Know the Thresholds: Familiarize yourself with the GST registration thresholds for goods (₹40 lakh) and services (₹20 lakh). If your transactions exceed these amounts, you must register for GST.

- Register for GST: If your turnover exceeds the threshold, visit the official GST portal to complete the registration process. You’ll need your PAN, business address, and other details.

- File GST Returns Regularly: Once registered, ensure you file your GST returns on time. Missing deadlines could result in penalties.

- Keep Digital Records: Maintain records of all your transactions, both digital and cash. Digital transactions, especially via UPI, should be transparent and easy to track.

- Stay Updated: Stay informed about new tax policies and government initiatives like the “Know GST” campaign. This can help you avoid confusion and potential tax notices.

Impact on Digital Payments Ecosystem

The government’s push to use UPI data for GST enforcement is likely to have ripple effects across India’s digital payments ecosystem. This move aligns with the country’s “Digital India” initiative, which aims to promote digital payments, reduce corruption, and improve transparency. By tying UPI transactions to tax compliance, the government is incentivizing more businesses to adopt digital payments to avoid scrutiny. As a result, UPI may become even more widespread in daily business transactions, providing a significant boost to India’s digital economy.

Global Perspective: What Other Countries Are Doing

India’s use of UPI data for tracking GST evaders is part of a global trend of governments leveraging data analytics and digital transactions to tackle tax evasion. For instance, in the United States, the Internal Revenue Service (IRS) uses credit card transaction data to identify unreported income. Similarly, countries like the UK and Australia have successfully used digital transaction data to ensure tax compliance. India’s approach, however, is unique in its use of UPI, a platform that has seen explosive growth in recent years.

The Role of AI and Big Data in Tax Enforcement

Looking to the future, artificial intelligence (AI) and big data analytics could play a crucial role in further enhancing the government’s ability to track tax evaders. By integrating machine learning algorithms with UPI transaction data, the government could potentially identify patterns of tax evasion even more efficiently. Such technologies could also help small traders by providing them with automated tools and reminders to stay compliant, reducing the burden of manual compliance.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

No GST Refund for Traders with Cancelled Registration—Delhi HC’s Ruling Shakes Business Community

₹2 Crore Fake GST Scam Busted in Chhatarpur — 3 Firms Raided, 2 Were Just on Paper