Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal: India’s Goods and Services Tax (GST) system has undergone significant changes in recent years, and with it, the need for an effective dispute resolution mechanism has grown more crucial. One of the most important bodies in this regard is the GST Appellate Tribunal (GSTAT), and its latest appointment, Bhaskar Reddy Vemireddy, as a Judicial Member, is a major step forward. This article dives into Vemireddy’s appointment, his extensive experience, and the broader implications for India’s tax system.

Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal

The appointment of Bhaskar Reddy Vemireddy as a Judicial Member of the GST Appellate Tribunal is a key development in India’s tax landscape. His wealth of experience and legal expertise will help ensure that disputes are resolved more efficiently, benefiting both businesses and the public. This move promises to strengthen the GST system and contribute to the continued success of India’s tax reforms.

| Key Points | Details |

|---|---|

| Appointment | Bhaskar Reddy Vemireddy appointed Judicial Member of the GST Appellate Tribunal |

| Date of Appointment | July 2025 |

| Experience | Senior Advocate at Telangana High Court, specializing in tax laws since 1987 |

| Impact on GST System | Expected to streamline litigation, enhance public trust, and ensure fair judgment |

| Role in GST Appellate Tribunal | Oversee and interpret legal cases related to GST issues, fostering consistency and fairness |

| Official Resources | Official Gazette Appointment Notice |

What is the GST Appellate Tribunal?

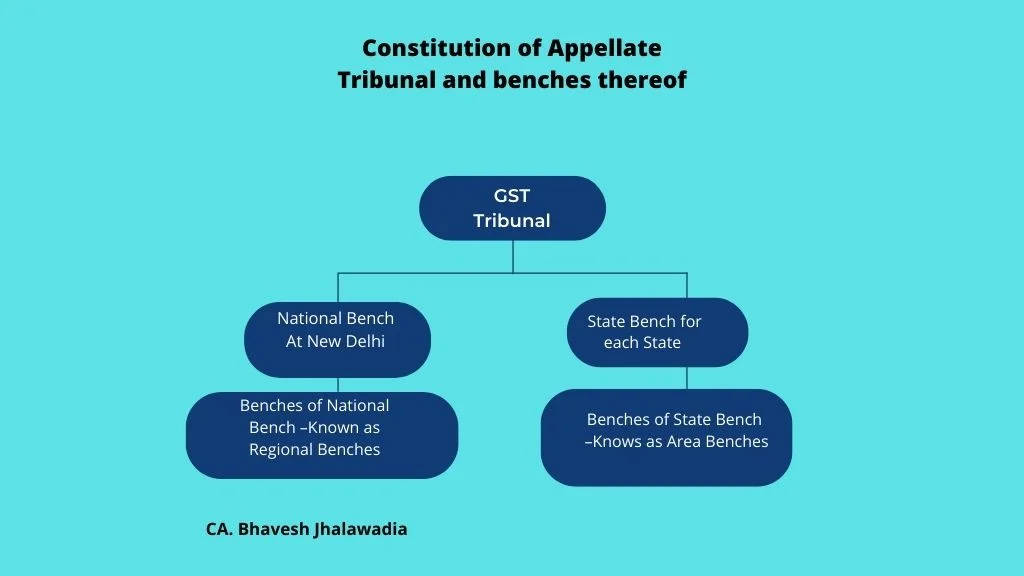

The GST Appellate Tribunal (GSTAT) is a quasi-judicial body that resolves disputes arising from India’s GST laws. The Tribunal’s purpose is to offer an efficient and accessible platform for businesses, taxpayers, and tax authorities to settle disputes that arise under the Goods and Services Tax Act.

GSTAT is divided into two main categories: Judicial Members and Technical Members. While Judicial Members like Bhaskar Reddy Vemireddy are responsible for interpreting the legal aspects of the case, Technical Members handle more specialized tax-related issues. The Tribunal acts as an intermediary between the taxpayer and the tax authorities, providing an independent review of contested cases.

The GSTAT has been designed to provide speedy resolutions to disputes and to ensure fairness and transparency in the taxation process. By offering an alternative to the lengthy and often costly court procedures, it aims to simplify tax compliance for both businesses and individuals.

Why Does Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal Matter?

Vemireddy’s appointment as a Judicial Member holds significant importance, not just because of his personal qualifications, but also in the broader context of India’s GST system. Here’s why his appointment is noteworthy:

1. Expertise in Taxation Law

Vemireddy brings more than three decades of experience in the legal field, specializing in taxation law. His profound knowledge of tax matters will help ensure that the GST Appellate Tribunal can resolve cases efficiently and fairly. As a Senior Advocate at the Telangana High Court, Vemireddy’s expertise is not just theoretical but rooted in years of hands-on experience.

His legal acumen is particularly valuable in complex GST cases, which often involve intricate interpretations of tax laws, rules, and policies. With a background in handling high-stakes tax cases, Vemireddy is likely to play a central role in shaping the Tribunal’s future decisions.

2. Boost to Efficiency and Speed

One of the core objectives of the GST Appellate Tribunal is to resolve disputes in a timely manner. With the growing complexity of India’s tax system, the demand for quick resolutions has never been more pressing. Vemireddy’s appointment is expected to bring in much-needed expertise that will help expedite the dispute resolution process, ensuring that appeals are heard and resolved without unnecessary delays.

3. Strengthening the GST System

Vemireddy’s appointment comes at a crucial time for the GST system, which has been evolving since its implementation in 2017. As India’s economy grows, more businesses are embracing GST, and it’s essential that the system remains robust and trusted. His appointment will help improve transparency, reduce the risk of corruption, and ensure that decisions are consistent and legally sound.

The public’s confidence in the system depends on the credibility of the individuals making judicial decisions. Having an experienced legal professional like Vemireddy in the GST Appellate Tribunal helps reassure the public and the business community that the Tribunal’s decisions will be fair, grounded in law, and consistent with established principles.

A Detailed Overview of Bhaskar Reddy Vemireddy’s Career

Bhaskar Reddy Vemireddy has spent a remarkable career specializing in tax law, which includes representing clients at the Telangana High Court. His reputation as a seasoned Senior Advocate is founded on his consistent record of success in complex tax litigation.

Here are some key milestones in his career:

- Started Legal Career in 1987: Vemireddy began his law practice in 1987, quickly establishing himself as a skilled tax lawyer.

- Special Assistant Government Pleader (1993-1994): His tenure as the Special Assistant Government Pleader for taxes at the Telangana High Court gave him deep insights into tax policy and dispute resolution.

- Designated Senior Advocate (2022): In 2022, Vemireddy was designated as a Senior Advocate, which is a prestigious title granted to lawyers recognized for their superior knowledge and experience in the legal field.

Vemireddy’s deep legal background makes him uniquely qualified to interpret and apply GST laws to ensure that disputes are resolved fairly and efficiently.

What This Means for the GST Appellate Tribunal’s Future

Vemireddy’s appointment signals a commitment to making the GST Appellate Tribunal a more effective body for resolving disputes related to GST. Here’s what we can expect moving forward:

1. Improved Dispute Resolution

With Vemireddy at the helm, the Tribunal is poised to resolve GST disputes in a manner that is more transparent and legally sound. His background in tax litigation will help speed up the process, leading to quicker decisions and less burden on businesses.

2. Consistency in Legal Interpretation

As a Judicial Member, Vemireddy will be responsible for making legal determinations on complex tax cases. This consistency will help establish clearer precedents and provide businesses and professionals with more certainty on how laws should be applied.

3. Streamlined Procedures

The GST Appellate Tribunal is expected to benefit from streamlined procedures that make it easier for taxpayers and businesses to present their cases. Vemireddy’s deep understanding of both legal frameworks and taxation systems will likely help simplify the procedural aspects, making it more accessible for the average taxpayer.

Practical Guide for Navigating the GST Appellate Tribunal

Whether you’re a business owner, a professional, or simply someone who is dealing with GST-related issues, it’s essential to understand how the GST Appellate Tribunal works. Here’s a breakdown:

1. Know When to Appeal

If you’ve received a decision from the GST authorities that you believe is unjust or inaccurate, filing an appeal with the GST Appellate Tribunal might be your next step. Appeals can be made within 3 months of receiving the order from the tax authorities.

2. Prepare Your Documents

To increase your chances of success, make sure you have all the required documentation ready. This includes:

- Tax invoices

- GST returns

- Relevant contracts or agreements

3. Seek Expert Legal Advice

Navigating the GST system can be tricky. It’s often beneficial to consult a tax lawyer or a GST expert who can guide you through the process and help you build a solid case.

4. Stay Updated on Legal Precedents

Keeping up-to-date with recent decisions made by the GST Appellate Tribunal and other courts will help you understand how GST laws are evolving. This knowledge will be crucial in ensuring that your case is aligned with the latest legal interpretations.

How to Add or Edit Bank Details on GST Portal Without Errors—Full Process Explained

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”

No GST on UPI Payments — Government Clears the Air in Rajya Sabha