Vodafone Idea Faces ₹21.39 Crore GST Penalty: Vodafone Idea (VIL), one of India’s largest telecom giants, is currently embroiled in a significant tax dispute. The company is facing a penalty of ₹21.39 crore under Goods and Services Tax (GST) for allegedly underreporting tax payments under the Reverse Charge Mechanism (RCM). This is not the first time VIL has found itself in such a situation, and it won’t likely be the last, as tax-related challenges continue to plague the company. In this article, we’ll break down the situation in simple terms, explain the Reverse Charge Mechanism, why VIL is facing these penalties, and what this means for the company and its stakeholders. We’ll also discuss how such situations affect businesses in general, offer practical advice for companies looking to avoid similar pitfalls, and provide broader insights into the significance of tax compliance in India.

Vodafone Idea Faces ₹21.39 Crore GST Penalty

Vodafone Idea’s ₹21.39 crore GST penalty is a significant reminder for businesses about the importance of tax compliance and the potential consequences of errors in reporting and payment. Whether you’re a small business or a giant corporation, staying up to date with GST laws, maintaining accurate records, and seeking expert advice are key to avoiding costly penalties. VIL’s ongoing legal battle will serve as a case study for others in the industry to watch closely. In the end, tax compliance is not just about avoiding penalties—it’s about building trust, maintaining operational efficiency, and ensuring long-term success. It’s crucial that businesses, big and small, stay vigilant to avoid costly errors that can derail their financial health.

| Key Highlights | Details |

|---|---|

| Penalty Amount | ₹21.39 Crore GST penalty |

| Reason | Alleged short payment under Reverse Charge Mechanism (RCM) |

| Legal Action | Vodafone Idea plans to appeal the decision |

| Previous Penalties | VIL has faced multiple tax penalties amounting to ₹73 crore |

| Implications | Financial and operational impact on VIL |

| Industry Context | Ongoing GST disputes in the Indian telecom sector |

| Company’s Strategy | VIL intends to fight the penalty, citing disagreement with the charge |

Understanding Reverse Charge Mechanism (RCM)

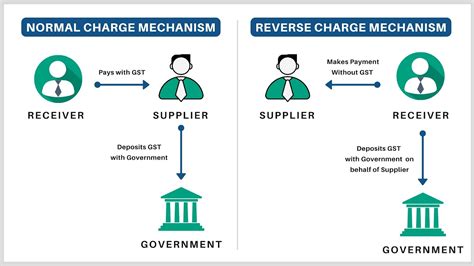

Before diving into the details of the penalty and its implications, let’s first understand what the Reverse Charge Mechanism (RCM) is.

In simple terms, the Reverse Charge Mechanism (RCM) is a tax mechanism under the GST regime where the recipient of goods or services is liable to pay the tax instead of the supplier. This is generally applicable when the supplier is either unregistered or based abroad. The recipient must report and pay the tax directly to the government, rather than the supplier doing so.

RCM is typically used in cases where businesses receive goods or services from foreign vendors or from vendors who are not registered under the GST system. It is meant to ensure that tax compliance remains consistent, even when the supplier may not be governed by the same set of regulations.

In the case of Vodafone Idea, the penalty stems from an alleged short payment of taxes under RCM, meaning they are accused of not paying the correct amount of GST on services or goods that they acquired under the RCM framework.

Why Vodafone Idea Faces ₹21.39 Crore GST Penalty?

The penalty of ₹21.39 crore levied on Vodafone Idea comes from an investigation carried out by the Joint Commissioner of Central Goods and Services Tax (CGST). The tax authorities have accused the telecom giant of short paying its GST liabilities under the Reverse Charge Mechanism. This allegation can arise for various reasons, including:

- Misreporting of taxable services or goods acquired under RCM.

- Failure to account for taxes due to complex tax structures in cross-border or unregistered supplier transactions.

- Clerical errors or accounting discrepancies when paying the GST.

However, it’s important to note that VIL disagrees with the allegations and plans to appeal the decision before the relevant authorities. This is not the first time the company has been involved in such a dispute, as it has faced previous penalties for similar reasons.

The Financial Impact of GST Penalties on Vodafone Idea

As we mentioned earlier, Vodafone Idea is no stranger to tax-related disputes. This ₹21.39 crore penalty is part of a larger trend of GST notices and penalties levied against the company. Over the past few years, VIL has received multiple notices totaling more than ₹73 crore for alleged short payments of taxes and excess Input Tax Credit (ITC) claims.

These penalties and legal challenges have a significant impact on the company’s bottom line. Vodafone Idea, already grappling with financial difficulties and a heavy debt load, faces even more strain as it battles tax-related issues. The company has made it clear that while it disagrees with the penalties, it will work through the legal process to resolve the disputes.

This ongoing tax scrutiny adds to the pressure VIL is facing in the Indian telecom market. With fierce competition from rivals like Jio and Airtel, regulatory issues such as these can hurt the company’s growth prospects. If VIL is unable to overturn the penalties, it could result in even greater financial difficulties and a dilution of investor confidence.

Practical Steps for Businesses to Avoid GST Penalties

For businesses looking to avoid similar issues, here are some practical tips:

1. Ensure Accurate Accounting and Reporting

It’s crucial to maintain accurate financial records, especially when dealing with cross-border transactions or services from unregistered vendors. Double-checking invoices, receipts, and the taxability of services is critical.

2. Stay Updated with GST Rules

GST laws and regulations are constantly evolving. Businesses need to stay updated with any changes in GST rules, including those related to RCM. Regularly reviewing tax compliance and seeking expert advice can help avoid inadvertent errors.

3. Train Your Finance Team

Make sure that your finance and accounting teams are well-trained in GST laws and are up-to-date with the latest tax policies. Investing in quality training can save your business from future penalties.

4. Consult a GST Expert or Consultant

If your business deals with international suppliers or unregistered vendors, consider working with a GST consultant who specializes in cross-border tax issues. They can help you navigate the complexities of the Reverse Charge Mechanism and ensure compliance.

5. Review ITC Claims Carefully

ITC (Input Tax Credit) claims are another area that often leads to disputes. Companies should carefully review their ITC claims and ensure they are not claiming credit for taxes that have not been paid or are not eligible for credit under GST rules.

The Bigger Picture: How Tax Disputes Affect Businesses

Tax disputes, particularly those involving large penalties, can have a far-reaching impact on businesses. Not only do they result in financial penalties, but they can also lead to:

- Reputation damage, as such disputes often make headlines and can tarnish a company’s image.

- Operational disruptions, as companies may have to divert resources to handle tax investigations and disputes.

- Cash flow issues, since businesses must pay fines and penalties even while disputes are ongoing.

For companies like Vodafone Idea, which are already dealing with financial pressures, these challenges can be particularly damaging. The company’s stakeholders, including investors and employees, will be watching closely to see how these legal battles unfold and whether they will affect the company’s long-term prospects.

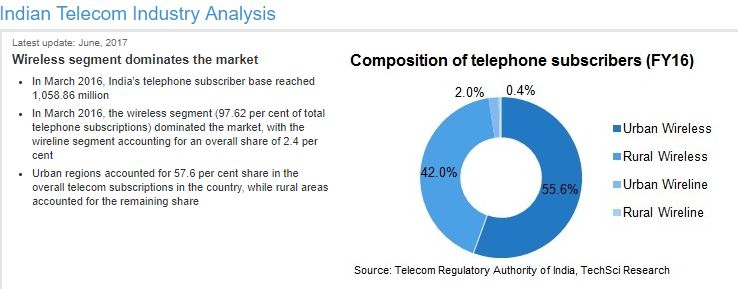

Insights from the Indian Telecom Industry

Vodafone Idea’s situation is not unique in the Indian telecom sector. Over the last few years, other telecom operators have faced similar scrutiny, including tax challenges and penalties related to GST compliance. The telecom industry is one of the most heavily regulated sectors in India, and with companies frequently engaging in cross-border transactions, tax disputes are not uncommon.

Government authorities, recognizing the financial burden on telecom companies, have sought to streamline tax processes and improve transparency. However, telecom giants like Vodafone Idea must remain diligent about compliance, particularly in light of the complex tax environment.

The Indian telecom industry is heavily dependent on foreign investments and cross-border services, making RCM a critical aspect of tax management for telecom companies. This has led to an increased focus on regulatory scrutiny in recent years.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

GST Crackdown in Aligarh: 11 Fake Firms Hit With Notices in Major Fraud Probe

New Laws That Could Change India Forever? GST Ordinance & Anti-Doping Amendments Hit Lok Sabha