Punjab Vyapar Mandal Takes GST Concerns: In recent months, businesses in India have been grappling with increasing complexities under the Goods and Services Tax (GST) system. One group that has been particularly vocal about these challenges is the Punjab Vyapar Mandal. On August 8, 2025, a delegation from the Punjab Vyapar Mandal met with Union Minister of State for Finance, Pankaj Chaudhary, to discuss some of the pressing issues traders face with the GST framework. This meeting highlighted critical concerns affecting small businesses and offered a glimpse into the ongoing dialogue between the government and the business community. In this article, we’ll dive into the main issues raised during the meeting, the response from the government, and what these discussions mean for businesses under the current GST structure.

Punjab Vyapar Mandal Takes GST Concerns

The meeting between the Punjab Vyapar Mandal and Union Minister Pankaj Chaudhary was a pivotal moment in the ongoing conversation about GST reforms in India. It highlighted key pain points faced by small businesses, particularly in areas like complex tax filing, mandatory e-invoicing, and rising compliance notices. The government’s response indicates that it is actively working on addressing these concerns, and traders can expect significant changes in the coming months. As these changes unfold, it will be crucial for business owners, particularly in Punjab, to stay informed about the latest updates and take full advantage of any new support systems offered by the government. Whether you’re a small business owner or a professional in the accounting and finance sectors, staying ahead of the curve on GST changes will be key to ensuring smooth operations in the future.

| Key Issue | Details | Impact on Business | Action Taken |

|---|---|---|---|

| Complex GST Return Filing | Traders highlighted difficulties with GST return filing | Increased time and effort for compliance | Government acknowledged concerns, reforms underway |

| Mandatory E-Invoicing | Difficulty for small businesses to adapt to e-invoicing | Burden on small enterprises, compliance issues | MOS assured support for easing the process |

| Compliance Notices | Surge in compliance notices leading to unnecessary pressure | Increased administrative costs and stress | Discussions on simplifying compliance checks |

| Input Tax Credit (ITC) Issues | Confusion over ITC eligibility and utilization | Loss of potential credits, higher costs | MOS assured clearer guidelines and reform |

| GST on Hotel Tariffs | Hotels face high GST rates on room tariffs | Increased costs for the hospitality sector | MOS assured review of GST rate structure for hotels |

What is GST, and Why is it a Big Deal for Businesses?

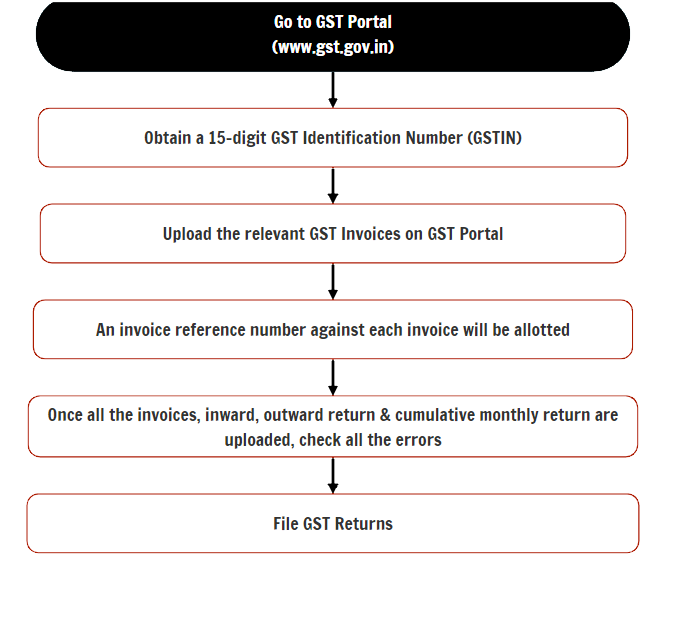

Before diving into the specifics of the meeting, it’s important to understand the Goods and Services Tax (GST) system itself. Introduced in India on July 1, 2017, GST replaced a host of indirect taxes such as VAT, excise duty, and service tax, consolidating them into one unified tax. Its goal is to simplify the tax structure, promote a seamless supply chain, and increase compliance across the country.

GST is levied on the sale of goods and services, and businesses need to file returns regularly to stay compliant. While it was intended to be a game-changer for the Indian economy, many small and medium-sized enterprises (SMEs) have found the system to be complex and challenging to navigate.

The Pain Points for Traders: What’s Really Going On?

- Complex GST Return Filing

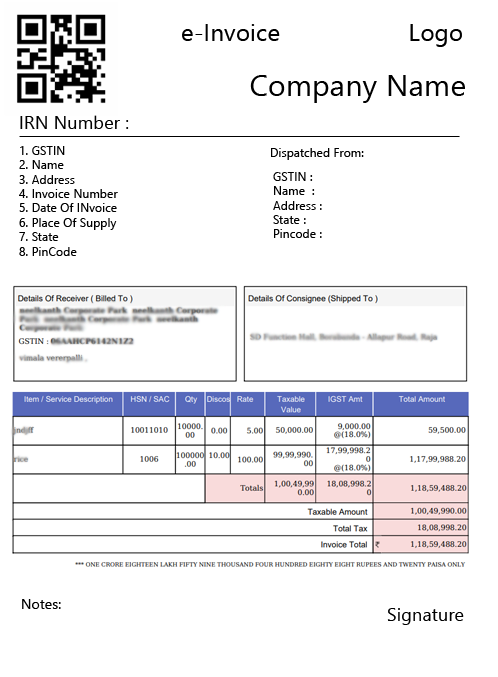

One of the most significant pain points raised by the Punjab Vyapar Mandal is the complexity of filing GST returns. Traders often have to navigate multiple forms, file returns on time, and maintain detailed records. For smaller businesses that don’t have dedicated accounting departments, this process can be overwhelming. As Amit Kapoor, President of the Punjab Vyapar Mandal, explained, many small traders struggle with the administrative burden that comes with the frequent filing deadlines. - Mandatory E-Invoicing

The e-invoicing system, which is mandatory for businesses above a certain turnover, has also been a major concern. While this move was meant to curb tax evasion, it has posed problems for many small businesses that lack the resources to implement such a system. The delegation at the meeting voiced the opinion that this requirement places an undue burden on smaller traders who might not have the technical know-how or infrastructure to comply with the e-invoicing rules. - Rising Compliance Notices

Another issue raised during the meeting was the increase in compliance notices from tax authorities. Traders across Punjab have reported a sharp rise in the number of notices they’ve been receiving, leading to confusion and frustration. The delegation pointed out that the volume of notices, often for minor discrepancies, adds to the stress and administrative load on businesses. - Input Tax Credit (ITC) Confusion

Input Tax Credit (ITC) allows businesses to offset the tax paid on purchases against the tax collected on sales. However, many traders are confused about how to properly claim ITC. Some even feel that they are missing out on credits they are eligible for, which in turn increases their operational costs. The Punjab Vyapar Mandal delegation emphasized the need for clearer guidelines on how businesses can make the most of ITC. - GST on Hotel Tariffs

One of the most notable concerns discussed was the GST imposed on hotel room tariffs, particularly in the hospitality sector. Deepansh Mittal, Vice-President of the Punjab Vyapar Mandal, pointed out that the current GST structure, which includes high tax rates on hotel services, has negatively impacted the tourism and hospitality industries. This concern is especially critical as the tourism industry in India is an essential part of the economy, and these high taxes can deter customers and hurt revenue for hotels and guesthouses.

Government’s Response: Punjab Vyapar Mandal Takes GST Concerns

During the meeting, Pankaj Chaudhary, the Union Minister of State for Finance, listened attentively to the concerns raised by the traders and assured them that the government was aware of the issues. According to Chaudhary, reforms are underway to make the GST system more trader-friendly and efficient.

- Simplification of Return Filing

The government is actively working on simplifying the process of GST return filing. While no specific timeline was provided, it is expected that the new system will be more straightforward and less burdensome for small businesses. - E-Invoicing Support

The Ministry of Finance is also working on providing more support to businesses transitioning to e-invoicing. This could include providing better tools, training, and even technical assistance to help smaller businesses get up to speed with this requirement. - Reducing Compliance Notices

To reduce the number of compliance notices and the stress it puts on businesses, the government is considering streamlining the audit process. This will make it easier for businesses to stay compliant without fear of excessive scrutiny for minor mistakes. - Clarification on ITC

The government is expected to release clearer guidelines on Input Tax Credit (ITC) soon. This is a welcome development for traders who have been frustrated by the confusion surrounding eligibility and how to utilize credits effectively. - Review of GST on Hotel Tariffs

On the issue of GST on hotel tariffs, the government has agreed to review the current tax structure. While no immediate changes are expected, the fact that the issue was discussed at such a high level indicates that the concerns of the hospitality sector are being taken seriously.

Practical Advice for Business Owners to Manage GST Compliance

While the government works toward reforming the GST system, small businesses can take several steps to manage their GST compliance more effectively:

- Invest in GST Software

Use specialized GST filing software to streamline the return-filing process. These tools are designed to automate calculations, generate invoices, and even help track Input Tax Credits (ITC). This can save time and reduce the risk of errors in your returns. - Seek Professional Help

If managing GST on your own is overwhelming, consider hiring an accountant or tax consultant who specializes in GST compliance. A professional can help you understand the nuances of filing and claiming ITC, ensuring you don’t miss out on potential tax credits. - Stay Updated

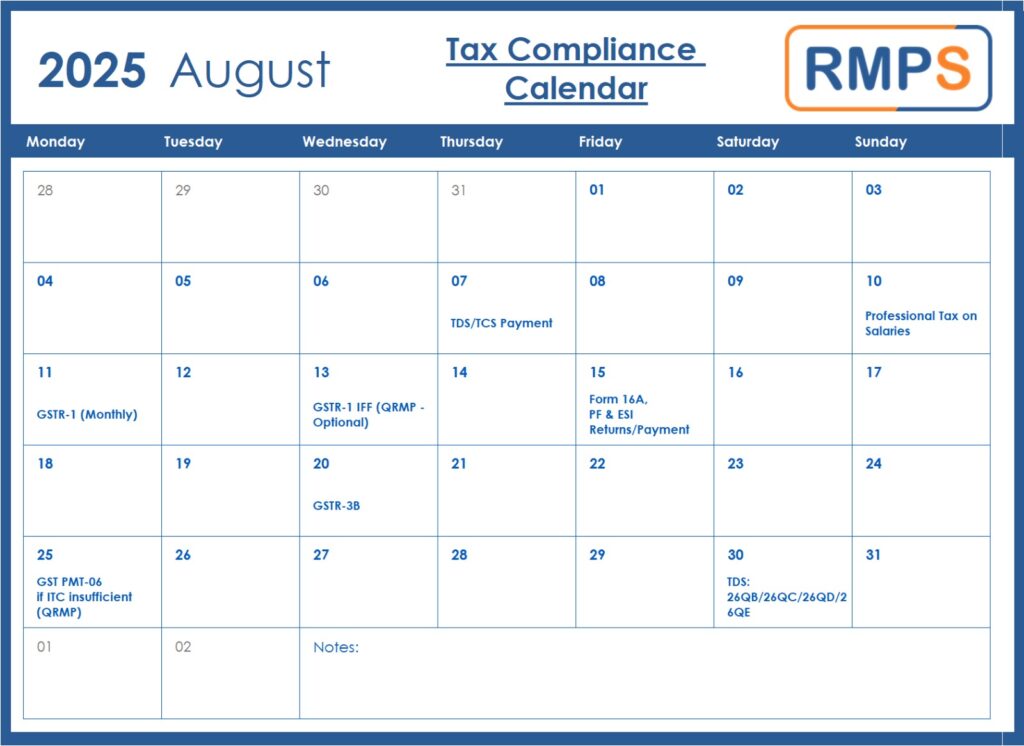

With the government continuously introducing changes, staying informed about the latest updates is critical. Regularly check official resources like the GST portal (www.gst.gov.in) for new guidelines, changes in tax rates, and other announcements. - Educate Your Team

Ensure that your accounting or finance team is well-versed in the GST process. Consider sending them for training sessions or webinars on the latest GST developments, especially if you have a large team dealing with multiple invoices and returns. - File Returns Early

Avoid last-minute filing, which increases the chances of mistakes and penalties. Set up a regular schedule to complete your returns well before the deadline. This will give you ample time to resolve any issues that may arise.

Economic Impact of GST on Small Businesses

While the GST system is designed to simplify the taxation process, it has had mixed effects on small businesses. On one hand, it has created a more transparent tax system by eliminating multiple taxes, which reduces the chances of tax evasion. On the other hand, the complexity of compliance and the burden of mandatory e-invoicing have proven challenging for many small businesses, particularly in sectors like retail, hospitality, and services.

However, if the reforms discussed in the meeting between the Punjab Vyapar Mandal and the Union Minister of State for Finance come to fruition, small businesses could see significant improvements. These changes would not only reduce the administrative burden but also help businesses take full advantage of the GST framework, potentially improving their cash flow and profitability.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

No GST Refund for Traders with Cancelled Registration—Delhi HC’s Ruling Shakes Business Community

New Laws That Could Change India Forever? GST Ordinance & Anti-Doping Amendments Hit Lok Sabha