Cap GST on Construction Materials at 18% to Boost Recovery: India’s real estate industry, a backbone of the economy, is struggling with rising construction costs, which impact everything from affordable housing to large-scale commercial projects. Recently, a major voice in this sector, the National Real Estate Development Council (NAREDCO), has made an urgent appeal to the Indian government to cap the Goods and Services Tax (GST) on construction materials at 18%. This request aims to alleviate the mounting pressure on developers and provide a much-needed boost to the entire construction industry. But what does this mean for builders, buyers, and the economy? In this article, we will break down the reasoning behind this request, its potential impact, and the future of the Indian construction sector. The request for a reduced GST rate on construction materials addresses a long-standing issue: high taxes on raw materials, which add to the overall construction costs. In turn, these higher costs are passed down to homebuyers, making housing less affordable. NAREDCO’s proposal could reduce this burden and lead to more affordable homes for the public, ultimately stimulating a more robust real estate market.

Cap GST on Construction Materials at 18% to Boost Recovery

NAREDCO’s plea to cap GST on construction materials at 18% is a significant step toward making housing more affordable in India. By reducing the tax burden on essential materials and restoring the Input Tax Credit for commercial projects, the Indian government can stimulate the real estate sector, create jobs, and help more people access affordable homes. For developers and homebuyers alike, these changes could mean a future where housing is more within reach. The next steps will depend on the government’s response, but the proposal is undoubtedly one that could make a lasting impact on the industry.

| Key Issue | Details | Source |

|---|---|---|

| NAREDCO’s Request | Cap GST on construction materials at 18% | Economic Times |

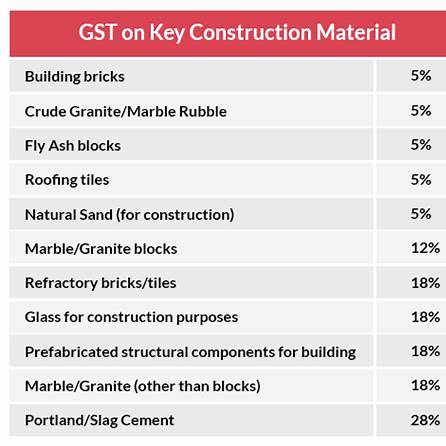

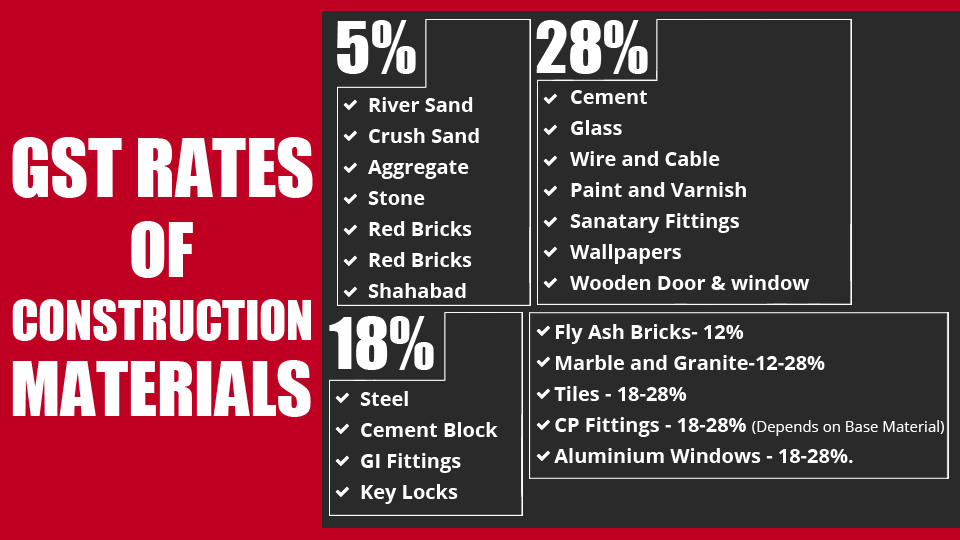

| GST on Construction Materials | Currently, many construction materials attract 28% GST | GST Learn |

| Impact on Real Estate | A reduction in tax could lower housing costs | RPrealty Plus |

| GST on Cement | Cement, a primary construction material, is heavily taxed | GST Council |

| Affordable Housing Projects | NAREDCO suggests increasing the eligibility for GST relief | Economic Times |

Why the GST Reduction Matters?

To understand why NAREDCO’s request for a cap on GST matters, we need to first consider the current state of the construction industry in India. For years, construction materials have been subject to high GST rates. Cement, steel, and bricks — some of the most essential materials in construction — are taxed at a 28% GST rate. The result is that the cost of building increases significantly, leading to higher prices for homebuyers.

This issue is especially critical in a country like India, where the demand for affordable housing continues to outstrip supply. While the government has made considerable strides in improving access to housing, high construction costs remain a barrier. By reducing the GST rate on these basic materials to 18%, developers could save money on raw materials, allowing them to pass those savings on to consumers. This move would ideally help lower the price of housing and make homeownership more accessible to a larger portion of the population.

For example:

Consider a developer building a mid-range residential project. If the price of cement is taxed at 28%, the developer faces higher input costs. A reduction in the GST rate to 18% would directly reduce the cost of the raw materials, either lowering the overall price of the property or allowing the developer to offer homes at more affordable rates. This could make a significant difference, especially for first-time homebuyers.

NAREDCO’s Proposal in Detail: Cap GST on Construction Materials at 18% to Boost Recovery

NAREDCO’s proposal isn’t just about a simple tax cut. It includes a multifaceted approach aimed at relieving developers from tax burdens and incentivizing affordable housing development. Here’s a breakdown of what NAREDCO is asking for:

1. Cap GST on Building Materials at 18%

NAREDCO’s most urgent request is for the government to reduce the GST rate on construction materials like cement, steel, and bricks, which are currently taxed at 28%. A reduced rate of 18% could help developers save on construction costs, and by extension, lower housing prices.

2. Restoration of Input Tax Credit (ITC)

Currently, developers building properties for leasing are unable to claim Input Tax Credit (ITC) when purchasing construction materials at concessional GST rates. NAREDCO has called for the restoration of ITC, which would allow developers to reclaim the GST paid on raw materials and reduce the overall cost of commercial real estate.

3. Increase Eligibility for Affordable Housing Projects

NAREDCO has also suggested raising the eligibility limit for affordable housing projects under the concessional GST rate. Currently, only projects worth ₹45 lakh or less qualify for the reduced GST rate. NAREDCO advocates for increasing this threshold to ₹60 lakh, enabling a broader range of buyers to access affordable housing.

These combined changes are designed to not only make housing more affordable but also improve the economic viability of large-scale real estate projects, particularly in the affordable housing sector.

Practical Impact of These Changes

Let’s take a deeper look at how these changes could affect both real estate developers and homebuyers.

1. Lower Housing Costs

By reducing the GST on construction materials, the overall cost of construction would decrease, leading to lower prices for homes. This is especially beneficial for first-time homebuyers, who are often more price-sensitive and constrained by limited budgets.

2. More Affordable Rental Properties

The restoration of ITC for commercial properties could encourage more developers to build affordable rental housing. This would be a boon for large urban centers, where the demand for rental properties is rising rapidly.

3. Stimulation of the Construction Sector

A reduction in GST rates could trigger more construction activity. Developers would be more inclined to launch new projects, particularly in the affordable housing sector, where there is massive untapped demand. This could lead to increased supply in the market, driving prices down and benefiting buyers.

4. Job Creation

As the construction sector grows, so does the need for labor. From engineers to construction workers to real estate agents, a growing construction market would require more workers, contributing to job creation across the economy.

Data and Facts: Is This Really Going to Help?

The real estate sector contributes about 8% to India’s GDP, and that share is expected to grow in the coming years. However, rising construction costs — particularly the cost of materials — are slowing that growth. The Economic Times reports that the price of key materials like cement and steel has skyrocketed over the last few years. A reduction in GST could ease some of these pressures, leading to more affordable homes.

India’s government has taken steps to improve access to affordable housing, such as through programs like the Pradhan Mantri Awas Yojana (PMAY), which aims to provide housing to all by 2022. However, high construction costs continue to be a barrier. A move to reduce GST on construction materials could help the government’s affordable housing initiatives reach their full potential, benefitting the population.

Global Comparisons: How Does India Stack Up?

When we look at GST on construction materials worldwide, many countries have more lenient tax structures for building materials. In the United States, the tax rates vary by state, but construction materials often fall under lower sales tax brackets. In the UK, VAT on construction materials is typically 5%, and in Australia, GST is charged at 10% on building materials. Compared to these countries, India’s 28% GST on materials is relatively high and could be seen as an impediment to growth in the sector.

Feedback from Industry Experts

Industry experts have widely supported NAREDCO’s call for a tax reduction, stating that it would ease pressure on both developers and buyers. According to Sanjay Chawla, a real estate investor and market analyst, “The high tax rates on construction materials have been a consistent issue for the industry. Reducing these rates could be a game-changer for both developers and homebuyers. It would stimulate the market and create a more favorable environment for growth.”

Challenges to Implementation

While the proposal seems straightforward, implementing these changes could be challenging. The GST Council, which is responsible for making changes to GST rates, must consider the impact on government revenues. Any tax cuts, even if beneficial in the long run, could cause short-term revenue loss, which some state governments may resist. Additionally, there may be opposition from sectors that feel left out of the tax relief measures.

What Should Developers Do Now?

Until the GST Council reviews and approves NAREDCO’s proposal, developers should prepare by exploring alternative ways to reduce costs, such as:

- Reevaluating Material Suppliers: Negotiate with suppliers for better pricing or explore cost-effective alternatives.

- Efficiency Measures: Invest in technology to streamline construction processes and reduce overall costs.

- Exploring Subsidies: Stay updated on government subsidies and grants that may offset construction costs in the interim.

New Laws That Could Change India Forever? GST Ordinance & Anti-Doping Amendments Hit Lok Sabha

Fraud Worth Crores? Group Booked for Creating Fake GST Invoices to Con Govt

How to Add or Update Bank Details on the GST Portal Without Errors