ED Cracks Down on Fake ‘Input Tax Credit’ Fraud: In a major move to crack down on fraudulent practices involving the Goods and Services Tax (GST), the Enforcement Directorate (ED) has launched an extensive operation targeting fake Input Tax Credit (ITC) claims. The operation spans multiple states, including West Bengal, Maharashtra, and Jharkhand. This action highlights the increasing sophistication of financial fraud in the GST system, which not only harms the economy but also undermines the hard work of businesses that play by the rules. Let’s take a closer look at this massive fraud, the ED’s investigative efforts, and what businesses need to do to stay compliant and avoid falling victim to such schemes.

ED Cracks Down on Fake ‘Input Tax Credit’ Fraud

The recent crackdown by the Enforcement Directorate (ED) on fake Input Tax Credit fraud in West Bengal, Maharashtra, and Jharkhand demonstrates the government’s resolve to protect the GST system and ensure tax compliance. With fraudulent activities like these harming the economy and honest businesses, it is essential for companies to stay vigilant and compliant. By following best practices like conducting regular audits, verifying invoices, and staying updated on regulatory changes, businesses can protect themselves from falling victim to such scams.

| Key Facts | Details |

|---|---|

| Fraud Amount | ₹750 Crore (approx) in fake Input Tax Credit claims. |

| Criminal Activity | Fake invoices issued by shell companies, leading to ITC fraud. |

| States Affected | West Bengal, Maharashtra, Jharkhand. |

| Prime Suspect | Shiva Kumar Deora, orchestrator of the scam. |

| Businesses Involved | 135 shell companies used to issue fake invoices. |

| Assets Seized | ₹8.98 crore in cash, ₹5.29 crore in assets, ₹62.90 lakh in bank balances. |

| Investigation Methodology | ED raids, Prevention of Money Laundering Act (PMLA). |

| Official Sources | The New Indian Express, Times of India |

What is Input Tax Credit (ITC) and Why Does it Matter?

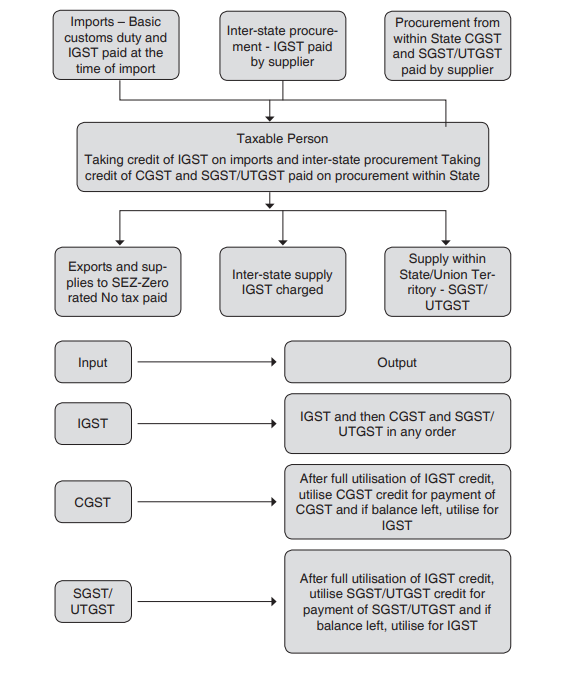

Before delving into the details of the fraud, it’s essential to understand what Input Tax Credit (ITC) is and how it functions within the Goods and Services Tax (GST) system.

What is ITC?

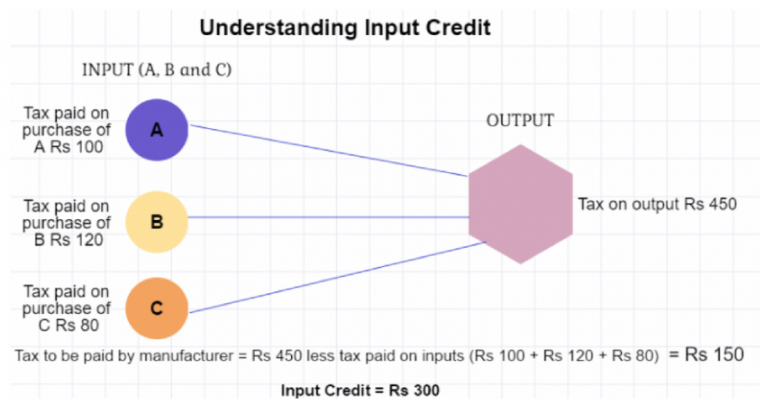

In essence, Input Tax Credit (ITC) allows businesses to offset taxes paid on their purchases (inputs like raw materials or services) against taxes collected from their sales (output tax). This system ensures that businesses don’t pay tax twice on the same goods or services, making the entire supply chain tax-efficient.

For example, if a business buys raw materials for ₹100 and pays ₹18 in GST, it can claim the ₹18 as an ITC when it sells the finished product. This helps lower the business’s tax burden and supports smoother economic activity across sectors.

Why ITC is Crucial for Businesses?

ITC is a lifeline for businesses in the GST ecosystem because it helps reduce costs and supports smooth cash flow management. Without the ITC mechanism, businesses would face a cascading tax effect, which could lead to higher operational costs and decreased market competitiveness.

The Fake ITC Scam – A Deep Dive into the Problem

In the past few months, the ED has uncovered a massive fraudulent ITC network spanning West Bengal, Maharashtra, and Jharkhand. The fraud was masterminded by Shiva Kumar Deora, a businessman based in Kolkata. His operation involved 135 shell companies, which issued fake invoices to claim non-existent ITC, leading to fraudulent claims worth ₹750 crore.

The Role of Shell Companies

A shell company is essentially a business that exists only on paper and does not engage in actual business activities. In this case, Deora used these shell companies to create fake invoices. These invoices were then passed along to genuine businesses, which used them to claim ITC. While this may sound like a small-time scam, the volume of the operation made it a serious threat to the integrity of the GST system.

How Was the Fraud Carried Out?

The fraudsters behind this scam took advantage of the loopholes in the GST system. They issued fake invoices for transactions that didn’t take place. These invoices were sold to legitimate businesses, allowing those businesses to claim ITC they weren’t entitled to. In total, the fraudsters generated ₹5,000 crore worth of fake invoices, leading to fraudulent ITC claims of approximately ₹734 crore.

By involving multiple entities and using a complex web of transactions, they ensured that their actions would be hard to trace. This made it easier for them to operate without detection, until the ED stepped in.

ED Cracks Down on Fake ‘Input Tax Credit’ Fraud: How the Investigation Unfolded

The ED’s recent action underscores its commitment to combating tax fraud. Over the course of its investigation, the ED carried out multiple raids at various locations in West Bengal, Maharashtra, and Jharkhand. These raids targeted the people and businesses involved in the scheme.

Raids and Arrests

One of the significant developments in the investigation was the arrest of Shiva Kumar Deora, the primary suspect in the scam. Deora was arrested in May 2025 and charged under the Prevention of Money Laundering Act (PMLA) for orchestrating the fraudulent network.

In addition to Deora, the ED also raided properties linked to several individuals and entities, including Shyam Thakkar, Kamdhenu Enterprises, and Amit Agrawal. These raids led to the seizure of ₹8.98 crore in cash and the attachment of assets worth ₹5.29 crore. Furthermore, the ED froze ₹62.90 lakh in bank balances linked to the fraudulent companies.

Official Statements and Actions

The ED’s crackdown was met with strong support from the public and the government, as it sends a clear message that financial fraud will not be tolerated. This operation also highlights the ED’s ability to trace complex financial transactions and shut down fraud networks that try to exploit the system for personal gain.

Impact of ITC Fraud on Legitimate Businesses

While the government focuses on catching the perpetrators, it’s important to understand the broader impact of ITC fraud on legitimate businesses. Fraudulent claims not only hurt the government’s tax revenue but also create an uneven playing field. Businesses that follow the rules are often at a disadvantage compared to those who exploit the system.

Financial Burden on the Government

The ₹750 crore fraud uncovered by the ED is just one example. Over time, such schemes can lead to substantial losses in tax revenue, which could otherwise be used for public welfare, infrastructure, and economic development. When fraudsters claim ITC on fictitious transactions, the GST system loses its credibility, and the entire tax structure can become unbalanced.

Increased Compliance Costs for Honest Businesses

For businesses that are trying to comply with GST regulations, fraudulent activity adds an additional layer of complexity. With more stringent checks and audits being conducted, it becomes harder for compliant businesses to streamline their operations, leading to higher compliance costs. This is especially challenging for small businesses, which may already be struggling with rising operational costs.

How to Protect Your Business from ITC Fraud?

While the ED is doing its part to tackle fraud, businesses can take proactive steps to protect themselves. Here are a few simple tips to ensure your business stays on the right side of the law.

1. Conduct Regular Audits and Verify Invoices

To avoid being caught in fraudulent schemes, businesses should conduct regular audits and ensure all invoices are legitimate. Make sure to verify the GSTIN of your suppliers and cross-check the details in the GST portal to confirm the authenticity of transactions.

2. Stay Updated with GST Laws

GST regulations are subject to frequent changes, and staying informed is key to compliance. The GST Portal provides updates on new tax policies, regulations, and amendments, making it easier for businesses to stay compliant.

3. Engage a Professional Tax Consultant

If you have any doubts about your business’s GST compliance, it’s always a good idea to seek help from a qualified tax consultant. These professionals can help you navigate the complexities of GST regulations and ensure that your business is operating within the law.

4. Verify Supplier Credentials

Before entering into business with a new supplier, verify their GST registration status. Engaging with unregistered suppliers can expose your business to the risk of being unknowingly involved in fraudulent activities.

“We Can’t Afford This”: Thozhi Hostel Residents Crushed by Sudden GST-Powered Rent Hike

Crores Lost, No One Watching? UP’s GST Growth Tanks as Fake Firms Multiply

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties