BJP Labels GST Bill a ‘Formality’: When politics meets taxation, the sparks can fly — and that’s exactly what happened in the Delhi Assembly over the Goods and Services Tax (GST) Amendment Bill, 2025. What started as a seemingly routine legislative session turned into a war of words. BJP MLA Kailash Gahlot dismissed the bill as “a mere formality” — just a procedural step to align with national-level changes. AAP Leader of Opposition Atishi, however, came back swinging, calling that remark “an insult to the House”. She claimed the bill could burden small traders while giving undue benefits to Special Economic Zones (SEZs) linked to BJP interests. This wasn’t just a clash over semantics. It was about how much scrutiny new laws deserve — and whether procedural bills can still have serious real-world effects.

BJP Labels GST Bill a ‘Formality’

The Delhi GST Amendment Bill, 2025 may look like a procedural step, but its effects could be far-reaching for businesses. BJP calls it a formality; AAP calls that stance an insult. In reality, it’s both — a routine alignment with national tax law and a chance to reshape compliance and dispute resolution for years to come. If you run a business in Delhi, the smart move is to prepare now: clean up your records, know the new deadlines, and be ready to leverage the amnesty scheme before the window closes.

| Point | Details |

|---|---|

| Bill Name | Delhi GST Amendment Bill, 2025 |

| BJP’s View | Mostly procedural — “mere formality” |

| AAP’s View | Disrespectful to legislative process; harmful to small traders |

| Key Changes | GST Appellate Tribunal, extended ITC timelines, GST amnesty scheme |

| Revenue Impact | ₹218 crore collected via GST amnesty scheme |

| Delhi GST Revenue FY24 | ₹38,550 crore (Delhi Govt. data) |

| Official Source | GST Council |

Understanding the GST Amendment Bill, 2025

The Goods and Services Tax (GST), rolled out nationwide in 2017, replaced a tangle of state and central taxes. Instead of dealing with VAT, service tax, excise duty, and other levies, businesses now pay a single, unified tax.

The GST Amendment Bill, 2025 in Delhi is essentially about implementing decisions already made by the GST Council — India’s top decision-making body on GST — with a few local adjustments.

Here’s what’s in it:

- GST Appellate Tribunal

A formal dispute resolution body to hear and decide GST-related appeals. - Extended Input Tax Credit (ITC) Timelines

Businesses get more time to claim refunds for GST already paid on purchases. - GST Amnesty Scheme

A temporary program letting businesses settle old GST dues with reduced penalties.

Why BJP Labels GST Bill a ‘Formality’?

BJP MLA Kailash Gahlot’s argument is that Delhi isn’t reinventing the wheel — it’s simply aligning its local GST law with changes already approved at the national level.

To him, debating this extensively is like a city council spending hours confirming they’ll follow federal daylight savings time changes. The heavy lifting has already been done; the state just needs to match the framework.

Why AAP Calls That an “Insult”?

AAP leader Atishi saw things differently. Her argument:

- Parliamentary dignity matters — even procedural bills deserve thorough debate.

- Small traders could be hurt — especially if the amendments increase the powers of GST officers to demand documents in any format.

- Corporate favoritism is a risk — SEZs could benefit disproportionately, and she alleged some of these SEZs have links to BJP-aligned businesses.

Think of it like this: If the U.S. Congress passed an IRS reform bill that was supposed to simplify audits, but small-town business owners feared it might make life easier for big corporations and harder for them, you’d expect lawmakers to dig into the details before signing off.

Chief Minister’s Defense

Chief Minister Rekha Gupta defended the bill as a commonsense step that benefits both government efficiency and business compliance.

Her main points:

- The Appellate Tribunal will cut red tape and resolve disputes faster.

- Extended ITC timelines mean fewer honest businesses lose refunds due to paperwork delays.

- The amnesty scheme has already boosted Delhi’s revenue by ₹218 crore and could bring in more before it closes.

Gupta’s stance is that this is about making the system smoother, not about politics.

Context: Why GST Matters for Delhi’s Economy

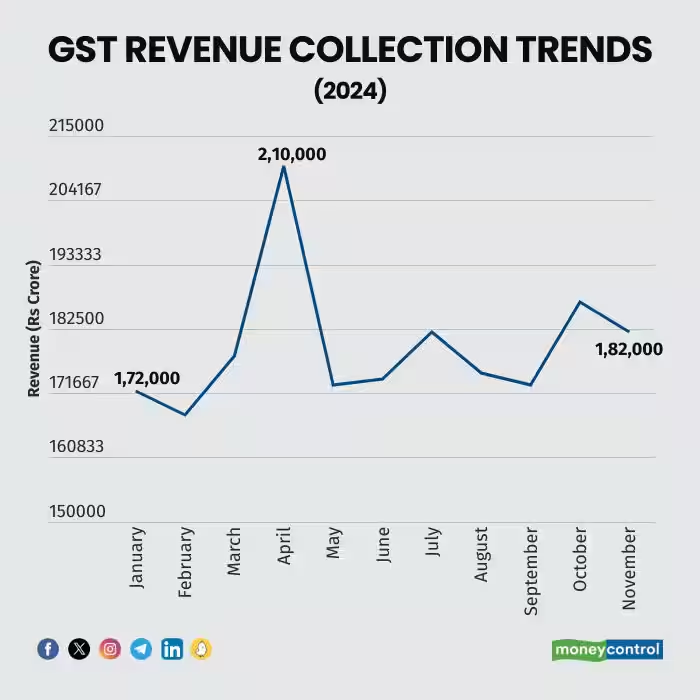

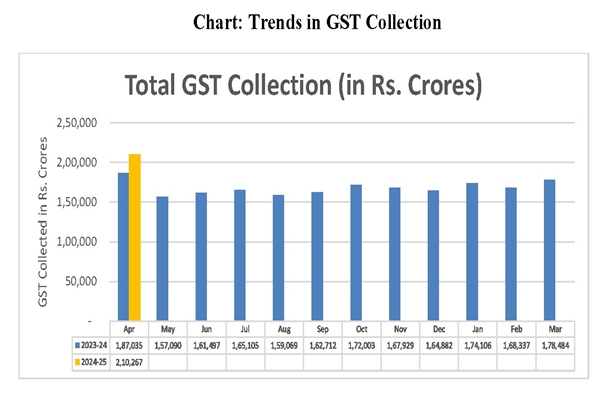

Delhi is one of India’s largest commercial hubs. In FY24, Delhi’s GST collections reached ₹38,550 crore, accounting for a significant chunk of the city’s revenue. The GST is vital for funding infrastructure, healthcare, education, and public safety in the capital.

Small and medium-sized enterprises (SMEs) — from neighborhood stores to export-oriented units — make up a large portion of Delhi’s tax base. Any changes in GST rules, even procedural, can ripple through supply chains, pricing strategies, and compliance costs.

Political Implications

This debate wasn’t just about the text of the bill — it reflected deeper tensions in Indian politics:

- Central vs. State Authority: BJP supports central alignment, while AAP argues for state-level scrutiny.

- Small Business Advocacy: AAP is positioning itself as the defender of small traders, a key voter base.

- Corporate Influence: Allegations of SEZ favoritism tie into broader concerns about the influence of big business on tax policy.

It’s a classic political play: use a procedural bill to draw battle lines on bigger themes.

What This Means for Businesses?

Whether you’re a corner grocery or a multinational branch office, here’s how the bill could affect you:

1. Faster Dispute Resolution

The new Appellate Tribunal could cut waiting times for case decisions from years to months, freeing up capital and reducing legal expenses.

2. Easier ITC Claims

Businesses often miss ITC deadlines due to slow vendor invoicing or accounting delays. More time to claim means more cash flow stability.

3. Amnesty Opportunities

If you’ve got old GST dues, the amnesty scheme could save you thousands in penalties. But it’s time-bound — miss the window and you’re back to full penalties.

Step-by-Step: How to Prepare

- Audit Your GST Records

Review filings from the past 3–4 years. Identify disputes, errors, or unclaimed ITC. - Know the New Deadlines

Keep a compliance calendar with the extended ITC claim dates. - Seek Expert Advice

Consult a GST-registered tax practitioner to assess whether you should use the amnesty scheme. - Organize Documentation

Keep invoices, contracts, and receipts — digital and hard copies — well organized. - Follow Official Updates

Watch the Delhi GST Department for implementation details.

Additional Examples for Clarity

Let’s make this practical:

- Example 1 — Retail Store: A clothing shop in Karol Bagh discovers it missed claiming ITC worth ₹80,000 from FY23 due to a late supplier invoice. Under the new timeline, they can still claim it and boost their bottom line.

- Example 2 — Small Manufacturer: A metal parts maker in Okhla has a ₹10 lakh GST dispute from 2021. With the tribunal, they might get a ruling within 6–8 months instead of waiting 3 years.

- Example 3 — Service Provider: A marketing agency owes ₹4 lakh in overdue GST but can use the amnesty scheme to pay without hefty penalties, saving over ₹1 lakh.

What to Watch For Next

- Tribunal Setup Speed: Will it be operational in months or bogged down in bureaucracy?

- Amnesty Scheme Rules: Will it be broad or limited to certain sectors?

- Compliance Costs: Will extended timelines reduce or inadvertently increase costs?

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

GST Amnesty Scheme Alert — Must-Read Advisory for All Registered Taxpayers

12% Surge in GST! West Bengal’s Economy Rebounds—Mamata Banerjee Breaks Silence