Is the GST Appellate Tribunal Ready for You? If you’ve been waiting to file your GST appeal, you’ve probably heard the buzz lately: Chartered Accountants (CAs) are sounding the alarm — the Goods and Services Tax Appellate Tribunal (GSTAT) might not be as ready as the headlines suggest. Sure, the government has published the rules and appointed some top-level members, but many state benches are still half-built, and staffing numbers look more like a skeleton crew than a fully loaded team. For taxpayers, that means your “fast-track” appeal might not be so fast — unless you prepare now. This article takes you behind the curtain to see what’s working, what’s still missing, and exactly how you can be ready to file on Day 1 without hitting roadblocks.

Is the GST Appellate Tribunal Ready for You?

The GST Appellate Tribunal promises faster, fairer GST dispute resolution — but only if all its parts are in place. Right now, the rules and technology are ready, but staffing, state coordination, and infrastructure need to catch up. If you’re a taxpayer or professional, this is the perfect time to learn the filing process, prepare your documentation, and monitor your state bench’s readiness. That way, when GSTAT’s doors swing open, you’ll be first in line — not stuck in another waiting room.

| Point | Details |

|---|---|

| Official Rules | GSTAT Procedure Rules, 2025, effective April 24, 2025 |

| Core Members Appointed | Principal Bench: Mayank Kumar Jain (Judicial), Anil Kumar Gupta (Technical – Centre), A Venu Prasad (Technical – State) |

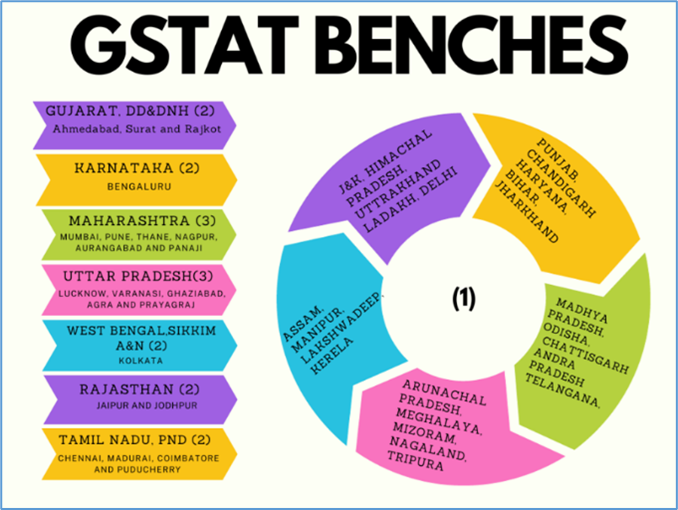

| State Coordination | Only a handful of states have recommended members (e.g., Uttar Pradesh, Odisha, Gujarat, Bihar, Maharashtra/Goa) |

| Staffing Status | 105 of 953 support staff positions filled (temporary deputation) |

| Digital Setup | Fully paperless, mandatory e-filing, hybrid hearings |

| Physical Infrastructure | 36 of 45 bench locations identified; Delhi HQ: 20,000 sq. ft |

| Official Website | GSTAT Official Portal |

What Exactly Is the GST Appellate Tribunal?

The GST Appellate Tribunal is your go-to forum if you’ve already appealed a GST order once and still feel the decision isn’t fair. In legal terms, it’s the “second appellate authority” under GST law — but in plain English, it’s the place where you get another shot before having to escalate to the High Court.

Without GSTAT, even small-value GST disputes have been clogging High Courts, forcing businesses to spend more time and money than necessary just to get clarity.

A Quick History: Why the Delay?

When the Goods and Services Tax launched in July 2017, GSTAT was supposed to be one of its cornerstones. But the road from blueprint to reality has been rocky.

Several factors stalled progress:

- Constitutional challenges: The original design of GSTAT was struck down by courts due to questions over judicial independence and the appointment process for members.

- Pandemic disruptions: COVID-19 slowed government hiring, procurement, and infrastructure setup.

- Centre–State coordination issues: Since GST is a dual tax system, both Centre and states need to agree on tribunal structures and appointments — not always a quick process.

It took until April 24, 2025, for the GSTAT Procedure Rules to be formally notified, finally setting a legal and procedural foundation.

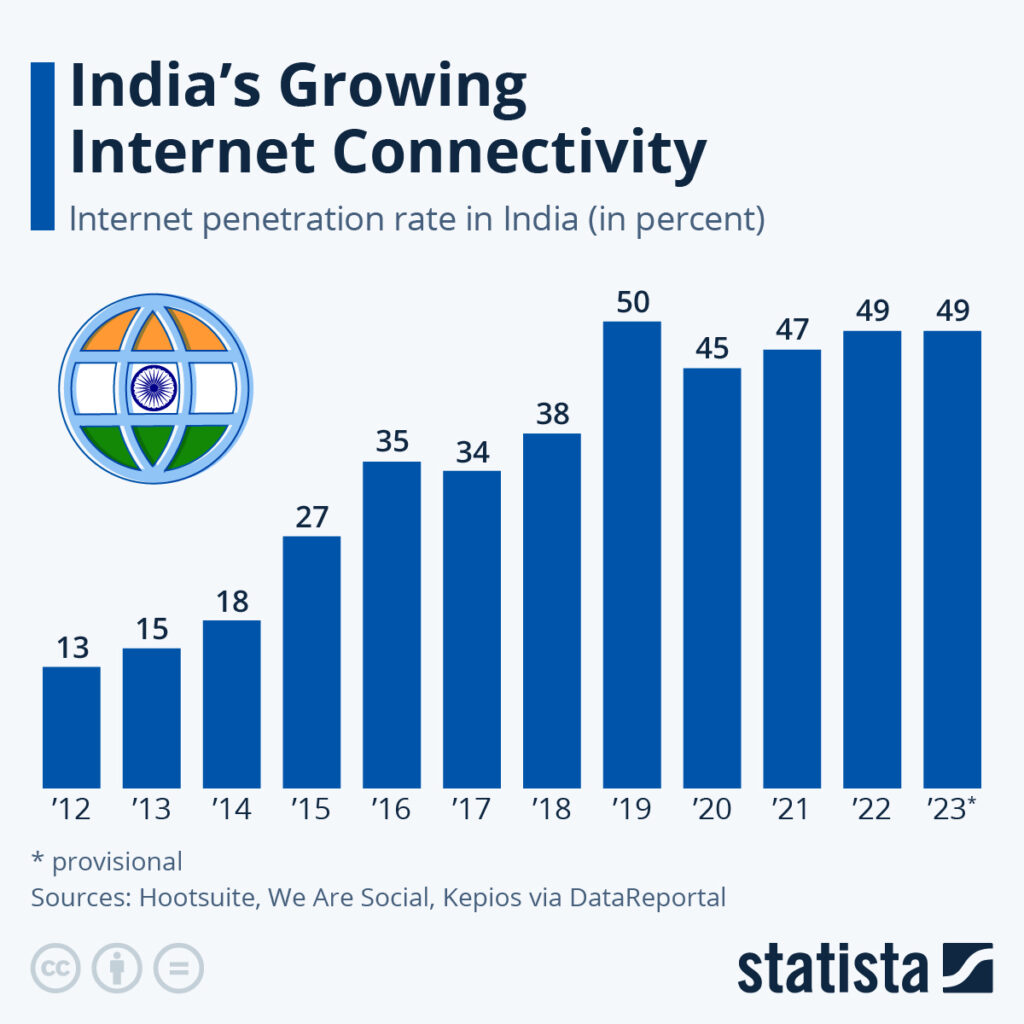

India vs. The World: A Global Comparison

In countries like Australia, the Administrative Appeals Tribunal handles tax disputes through a streamlined, user-friendly online process. Cases are often resolved within six months, and taxpayers can attend hearings remotely.

In the United Kingdom, the First-tier Tax Tribunal is known for its transparency — daily cause lists and written decisions are posted online.

India’s GSTAT is aiming for similar transparency and speed. But as of mid-2025, we’re still in the early innings of the game, with technology ready to play but human resources and infrastructure lagging behind.

The Government’s Promise vs. Ground Reality

Government announcements paint a picture of near-complete readiness:

- Procedure Rules enforced nationwide

- Principal Bench in Delhi staffed and ready

- National Informatics Centre (NIC) e-court software tested successfully

However, professional bodies like the Institute of Chartered Accountants of India (ICAI) report a less rosy picture:

- State benches are at various stages — some have space but no members, others have members but no functional offices.

- Staffing is just 11% complete — 105 of 953 positions filled.

- Physical setup: 36 of 45 planned bench locations finalized; 20 are still operating out of rented facilities.

How GSTAT Will Work: The Filing Process

Once GSTAT is fully functional, here’s the typical process flow:

- Login to GST Portal – Use your GST credentials to access the appeal filing section.

- Choose GSTAT Appeal – Select “Second Appeal” under the appellate menu.

- Fill Form GSTAT-1 – Provide details of the original order, grounds of appeal, and relief sought.

- Attach Documents – Upload the certified copy of the order, supporting evidence, and annexures in PDF format.

- Pay Filing Fee – Likely to be a nominal amount compared to High Court filing costs.

- Sign with DSC – Mandatory Digital Signature Certificate for authenticity.

- Get Acknowledgement – The system will generate an appeal reference number for tracking.

Hearings may be fully online, in-person, or hybrid depending on case type and bench availability.

Case Study: The Practical Difference

Let’s say you run a textile export business in Maharashtra. An audit claims you wrongly availed ₹80 lakh in input tax credit. You lose the first appeal and want to challenge it.

Without GSTAT: You head to the High Court, hire a senior advocate, and wait 2–3 years for a hearing. Legal costs eat up a big chunk of your budget.

With GSTAT: You log in, file your appeal online, and attend hybrid hearings. The case could close in less than a year, freeing up your money and time.

What Taxpayers Should Do Now?

Even if your state bench isn’t live yet, you can prepare by:

- Identifying your bench: Check the CBIC GSTAT Bench List.

- Drafting your appeal: Work with your CA to prepare strong, well-documented grounds.

- Scanning your documents: Keep PDFs ready to match GSTAT’s file size and format rules.

- Budgeting for representation: Decide if you’ll hire a CA, advocate, or represent yourself.

Professional Insights: CA Tips for a Smooth Appeal

- File Early – Don’t wait until the last week; the system may have teething issues at launch.

- Be Precise – GSTAT members deal with large caseloads; unclear appeals risk being dismissed quickly.

- Track Deadlines – The 3-month filing limit is strict; delays require valid justification.

- Know the Hybrid Hearing Etiquette – If attending online, test your setup in advance to avoid tech glitches.

Digital Infrastructure: The Backbone of GSTAT

NIC has developed an e-court platform integrated with the GST Network (GSTN), allowing:

- 24/7 e-filing

- Automated cause list publication

- Video conferencing with secure logins

- Real-time order uploads for public access

This “paperless first” model mirrors India’s Income Tax Appellate Tribunal (ITAT) digital upgrades in recent years.

Challenges Ahead

Even with great tech, GSTAT faces hurdles:

- Recruitment delays – Especially for technical and support staff

- State disparities – Some states are far ahead, others months behind

- Change management – Taxpayers and professionals adapting to mandatory digital workflows

- Training needs – New procedures require orientation for members and registry staff

The Numbers That Matter

- 953 total sanctioned posts for GSTAT

- 105 filled — just 11% staffing strength

- 45 planned bench locations nationwide

- 36 finalized, 20 rental spaces approved

- Procedure Rules enforced April 24, 2025

Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling