₹16.30 Crore Tax Evasion Bust: When you hear about a ₹16.30 crore GST tax evasion bust, you might think, “That’s a lot of zeros.” And you’d be right—it’s about $1.95 million USD in unpaid taxes. This story comes straight from Delhi, India, but the lessons apply from Wall Street to Main Street. Whether you’re talking about the IRS in the U.S. or the Central GST (CGST) in India, the message is the same: if you collect taxes and don’t hand them over, you’re asking for big trouble.

Recently, the CGST Delhi South Commissionerate uncovered a massive evasion scheme involving three companies in the manpower supply and facility management business. These businesses were charging GST to their clients, but instead of passing it along to the government, they kept it. Imagine a store in Texas charging you sales tax and then pocketing it instead of paying the state. That’s not just shady—it’s criminal.

₹16.30 Crore Tax Evasion Bust

The ₹16.30 crore GST evasion case in Delhi is more than just a headline—it’s a clear warning that tax authorities worldwide are using technology and analytics to crack down on fraud. From Delhi to Dallas, the principle is simple: collect taxes honestly, report them accurately, and remit them on time. The risks of cutting corners have never been higher.

| Detail | Info |

|---|---|

| Total Evasion Amount | ₹16.30 crore (~$1.95 million USD) |

| Location | Delhi, India |

| Offices Involved | Central GST Delhi South Commissionerate |

| Modus Operandi | Collected GST from clients, under-reported taxes, failed to remit |

| Number of Companies | 3 (manpower supply & facility management services) |

| Key Arrest | Common director controlling all 3 firms |

| Relevant Law | Section 132(1)(d) & (i) of CGST Act, 2017 |

| Penalty Type | Cognizable, non-bailable offense |

| Judicial Custody | 14 days |

| Official Source | Press Information Bureau |

Timeline of Events

Early 2024 – CGST’s data analytics team detected unusual tax return patterns from three related companies.

Mid 2024 – Investigators cross-checked GST returns with client invoices and bank records, finding large under-reporting.

January 2025 – Evidence confirmed the companies collected GST but did not remit it to the government.

February 2025 – Officers conducted raids, seizing records and questioning company officials.

March 2025 – The common director admitted to orchestrating the scheme and was arrested under CGST Act provisions.

Present – The accused remains in 14-day judicial custody, awaiting trial for a non-bailable offense.

How GST Works in India?

India’s Goods and Services Tax (GST) is a comprehensive indirect tax that replaced multiple previous taxes like excise duty, VAT, and service tax. It is levied on the supply of goods and services and is collected at every step of the supply chain, with credits for taxes already paid on inputs.

Example:

A cleaning company in Delhi charges a corporate office ₹1,00,000 for services, plus 18% GST (₹18,000). That ₹18,000 is collected on behalf of the government. The business then files monthly GST returns and pays the collected tax minus eligible credits for taxes it already paid to its suppliers.

Failing to remit that collected GST is equivalent to misappropriating public funds.

What Happened in This ₹16.30 Crore Tax Evasion Bust?

The three companies involved provided manpower supply and facility management services. They consistently collected GST from clients but under-reported their taxable turnover and failed to pay the correct amount to the government.

CGST investigators used advanced data analytics to match:

- GST returns filed by the companies

- Invoices issued to clients

- Payment records from bank statements

The discrepancies were too large to ignore. Field visits, interviews with clients, and examination of accounting systems revealed intentional manipulation.

Investigation Process in GST Evasion Cases

- Data Analysis – Tax departments use return data to flag suspicious patterns like low GST liability compared to reported sales.

- Cross-Matching – Sales declared by one company must match purchase records of another. Mismatches raise red flags.

- Site Inspections – Officers visit premises to verify operations and compare records.

- Summons & Statements – Key officials are questioned under oath.

- Arrest & Seizure – If evidence shows deliberate fraud over ₹5 crore, arrests are made, and records seized.

Legal Consequences Under CGST Act

Section 132(1)(d) – Offense of collecting tax but failing to remit within 3 months.

Section 132(1)(i) – If evasion exceeds ₹5 crore, it is punishable with up to 5 years imprisonment.

Section 132(5) – Offenses above ₹5 crore are cognizable and non-bailable, allowing arrest without a warrant.

In the U.S., similar laws exist under 26 U.S. Code § 7202, which makes willful failure to pay over collected taxes a felony, punishable by fines and prison time.

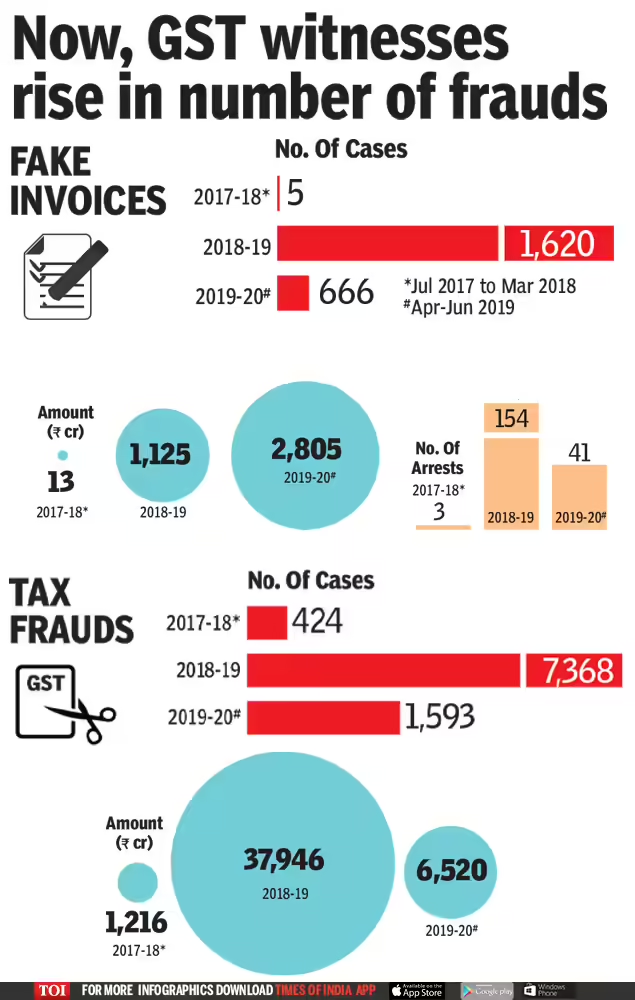

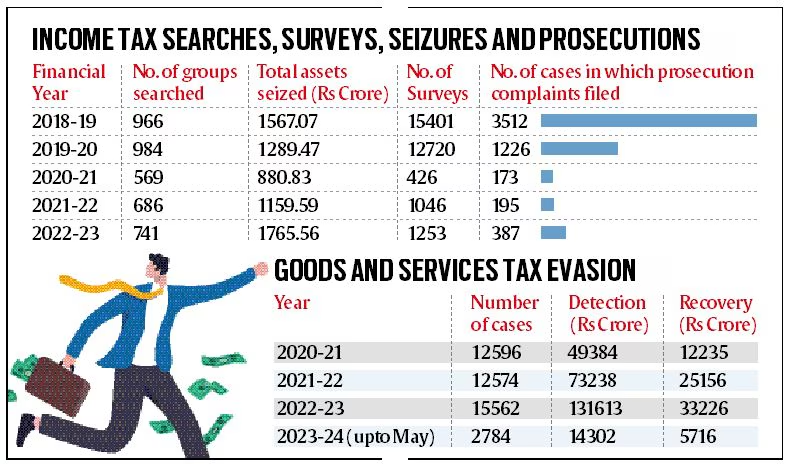

Past Big GST Evasion Cases

2024 – In Visakhapatnam, officials busted a ₹643.81 crore fraud involving fake invoices and shell companies.

2023 – In Lucknow, traders booked for ₹34.49 crore evasion via fake firms.

2022 – In Mumbai, a ₹1,200 crore racket involving fake input tax credit claims was dismantled.

These cases show that fraud is not limited to one industry—it spans manufacturing, services, and even IT.

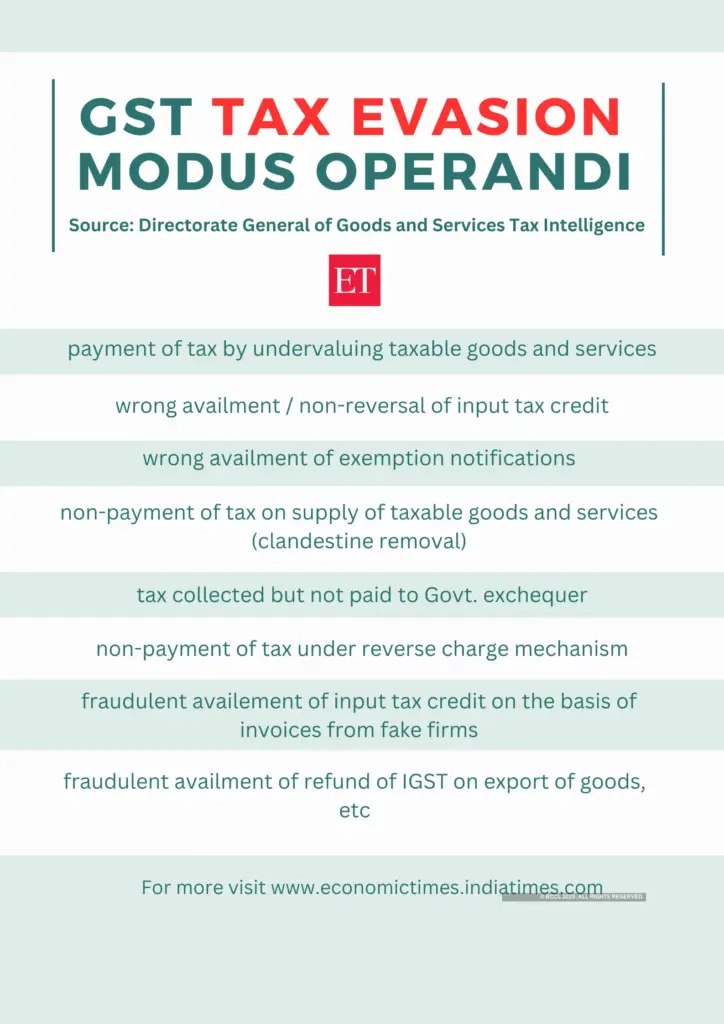

How Such Schemes Operate?

Collecting But Not Paying – Businesses charge GST but do not remit it.

Under-Reporting Sales – Filing lower turnover than actual revenue.

Fake Input Tax Credits – Using fake invoices to inflate credits and reduce payable tax.

How They Get Caught?

Data Matching – Comparing supplier and buyer records.

AI & Analytics – Spotting irregularities compared to industry averages.

Third-Party Data – Banks, e-way bills, and other agencies provide supporting evidence.

Whistleblowers – Insider tips often lead to large busts.

Lessons for Professionals: Compliance Checklist

Keep accurate, updated financial records.

File returns on time even if payment is delayed—request installment plans if needed.

Avoid cash transactions that bypass tax reporting.

Engage licensed CPAs or GST practitioners.

Respond promptly to notices from tax authorities.

U.S. Parallels: IRS Enforcement

In 2023, the IRS Criminal Investigation identified $37 billion in suspected tax fraud. Advanced methods include:

- AI-powered case selection

- Bank and third-party data integration

- Targeted audits in high-risk industries

Tax fraud is treated seriously across borders, and international cooperation is growing to trace cross-border tax evasion.

Myths vs. Facts About Tax Evasion

Myth – “If I don’t get caught in the first year, I’m safe.”

Fact – Fraud has no statute of limitations in many cases.

Myth – “It’s just a fine if I’m caught.”

Fact – Large-scale fraud often means jail time.

Myth – “Small businesses aren’t targeted.”

Fact – Technology flags suspicious patterns regardless of size.

Practical Advice for Businesses

Embrace transparency—clean records make audits easier.

Invest in accounting software for accurate compliance.

Train staff on compliance basics to avoid accidental errors.

Don’t ignore notices—address them promptly to reduce penalties.

Verify supplier GST numbers to avoid getting caught in fraudulent networks.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!