SEBI Scraps ₹10,000 Minimum for Mutual Fund: If you’ve ever dipped your toes into mutual funds in India, you might have run into a rule that felt like it was designed to keep small investors out. Well, that barrier just came down. The Securities and Exchange Board of India (SEBI) has announced a major change: as of August 8, 2025, it has scrapped the ₹10,000 minimum subscription requirement for paying transaction charges to mutual fund distributors. In simple terms, whether you invest ₹500 or ₹50,000, your distributor can now earn a transaction fee for guiding you. This might seem like a small technical update, but it’s actually a significant shift that could impact millions of investors and thousands of distributors.

SEBI Scraps ₹10,000 Minimum for Mutual Fund

By removing the ₹10,000 minimum threshold for distributor transaction charges, SEBI has made the mutual fund industry more inclusive, fair, and growth-oriented. Distributors can now serve all investors profitably, and small investors will finally get the same level of attention as their high-value counterparts. This is not just a regulatory tweak—it’s a strategic push toward greater financial participation, deeper market penetration, and improved investor education. If implemented responsibly, it could transform India’s mutual fund landscape in the coming decade.

| Detail | Information |

|---|---|

| Announcement Date | August 8, 2025 |

| Regulator | SEBI (Securities and Exchange Board of India) |

| Old Rule | ₹10,000 minimum investment required for distributors to earn transaction charges |

| New Rule | No minimum—transaction charges can be paid regardless of ticket size |

| Affected Parties | Mutual fund distributors, AMCs (Asset Management Companies), investors |

| Reason for Change | Greater flexibility, fairer compensation, encourage small-ticket investments |

| Consultations Held | Public (May 2023), Industry (June 2025) |

| Official Circular | SEBI/HO/IMD/IMD-RAC-1/P/CIR/2025/90 |

| Impact Level | High—benefits smaller investors & boosts distributor motivation |

A Little History: Why the ₹10,000 Rule Existed

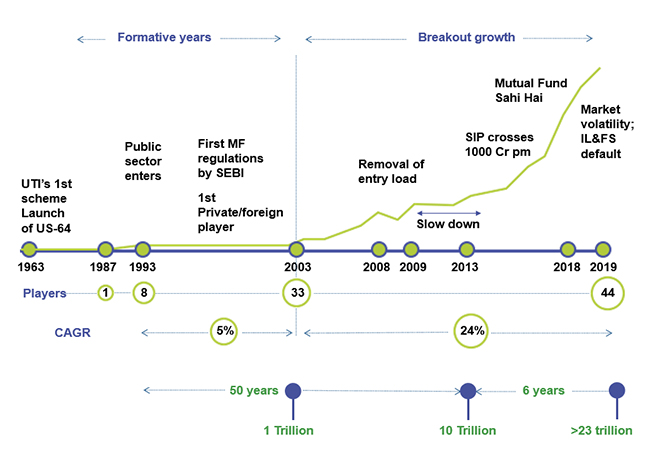

Back in June 2024, SEBI’s Master Circular on Mutual Funds introduced the ₹10,000 minimum for paying a fixed transaction charge to distributors. The goal was to reduce the administrative costs of processing tiny investments and focus on meaningful transactions.

But there was a problem. According to AMFI’s Annual Report 2025, India had over 24 crore mutual fund folios by mid-2025, and more than 50% of those folios had balances below ₹10,000. That meant millions of retail investors were essentially excluded from the distributor compensation structure.

This created a two-tier market:

- Tier 1: Big investors with access to top service.

- Tier 2: Smaller investors often left behind.

How does the SEBI Scraps ₹10,000 Minimum for Mutual Fund Distributor Transaction Charges Work?

As of August 8, 2025:

- Threshold removed: AMCs can now pay transaction charges for any investment size.

- Discretion allowed: AMCs decide if and when to pay—there’s no blanket rule to pay all transactions.

- Wider reach: Distributors can engage with clients of any size without worrying about minimums.

Industry scale in numbers:

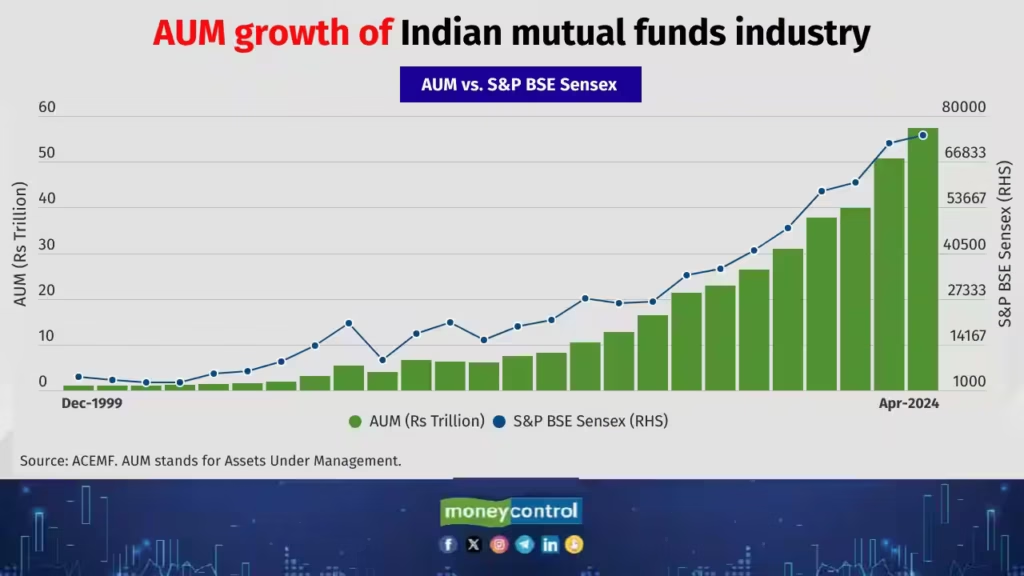

- Total AUM as of June 30, 2025: ₹74.4 lakh crore—three times higher than in 2020 (AMFI).

- SIP AUM: ₹15.31 lakh crore, about 20.6% of total industry AUM (Economic Times, June 2025).

- Investor additions: 4 lakh new investors and 30 lakh fresh folios added in June 2025 alone (Angel One data).

Why SEBI Made This Move?

This wasn’t an overnight decision—it was years in the making:

- May 2023: SEBI floated a public consultation paper seeking feedback.

- June 2025: Industry-level consultations were held with AMCs, distributor associations, and investor groups.

- August 8, 2025: SEBI issued Circular SEBI/HO/IMD/IMD-RAC-1/P/CIR/2025/90, officially removing the ₹10,000 rule from the 2024 Master Circular.

Key drivers behind the change:

- Boost financial inclusion, especially in rural and semi-urban markets.

- Provide fairer compensation to distributors.

- Increase market penetration beyond India’s current mutual fund participation rate of 3.6% of the population (Mordor Intelligence).

Who Gains from This Change?

Urban Investors

- More competition among distributors will mean better service for smaller investments.

- Small SIPs (₹500–₹2,000) will get more professional attention.

Rural & Semi-Urban Investors

- Distributors now have financial incentive to serve clients with smaller ticket sizes.

- Could drive financial literacy programs and first-time investments.

Small Distributors

- Can build client bases without focusing exclusively on wealthy investors.

- Steadier income from many small accounts.

Large Distributors

- Opportunity to diversify by including small-ticket, high-potential clients.

Global Context: How India Stacks Up

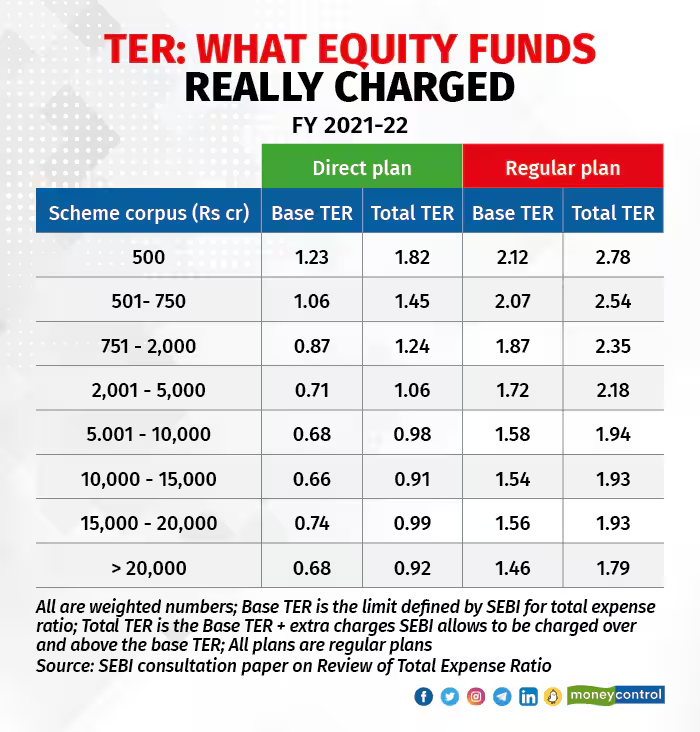

In developed markets like the United States, distributors earn via:

- Front-end loads (a percentage of the investment).

- 12b-1 fees (annual marketing/distribution fees).

Both are charged regardless of investment size, ensuring small investors still receive service. India’s old rule was restrictive by comparison; this change brings it more in line with global norms.

Step-by-Step Guide for Distributors

- Review AMC Policies – Each AMC may have different transaction charge rules post-change.

- Update Your Marketing – Tell potential clients they can start investing with any amount.

- Target New Segments – Students, first-jobbers, and rural investors are now viable markets.

- Educate Clients – Host webinars or offline sessions on investing basics.

- Track Long-Term ROI – Today’s small investor could be a high-value client in a few years.

Impact on the Mutual Fund Industry?

The removal of the ₹10,000 limit could:

- Increase SIP registrations from tier-2 and tier-3 cities.

- Push mutual fund penetration beyond the current AUM-to-GDP ratio of 19.9% (AMFI, March 2025).

- Strengthen retail participation, which rose from 26% in FY19 to 28% in FY25 (Economic Times).

Risks and Safeguards

While positive overall, the rule change isn’t risk-free:

- Mis-selling: Distributors could push unsuitable products for fees.

- Operational strain: Managing many small accounts may raise costs.

SEBI’s countermeasures:

- Enforce the Code of Conduct.

- Penalize mis-selling.

- Give AMCs discretion over payment eligibility.

Real-Life Case Studies

Case 1 – The Pune Distributor

Priya avoided clients with sub-₹10,000 investments before 2025. After the rule change, she accepted a ₹1,500 SIP from a college student. Within two years, that SIP grew to ₹8,000/month, and the student referred two friends.

Case 2 – Rural AMC Outreach

A major AMC launched a rural engagement program after the rule change. In June 2025 alone, they reported net inflows of ₹49,100 crore, largely from small-ticket accounts in B30 towns (Angel One data).

Practical Advice for Investors

- Start Small – Even ₹500/month can grow significantly over decades thanks to compounding.

- Choose Wisely – Work with SEBI-registered distributors who are transparent about fees.

- Ask Questions – Understand fund performance, risks, and costs before investing.

- Track Your Portfolio – Use AMFI India or Morningstar.

Andhra Pradesh Will Now Pay GST on Handlooms — Here’s What That Means

India’s Manufacturing Boom Pushes July GST Inflows Up by 7.5 Percent

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide