Wedding Gifts Not Taxable: Wedding gifts not taxable! ITAT scraps ₹10 lakh cash deposit addition—this ruling by the Bangalore Bench of the Income Tax Appellate Tribunal (ITAT) on August 9, 2025 has given taxpayers across India a reason to breathe easier. The tribunal reaffirmed that genuine gifts received on the occasion of marriage are not taxable, even if they are large and in cash. This isn’t just legal talk. It’s about how everyday customs—like giving envelopes of cash at weddings—are recognized and protected under Indian law.

Wedding Gifts Not Taxable

The August 9, 2025 ITAT Bangalore ruling is a powerful statement: genuine wedding gifts are not taxable in India. By aligning tax rules with cultural practices, the decision not only protects individuals but also promotes smoother compliance. The message to taxpayers is simple—celebrate your wedding, enjoy your gifts, but document everything.

| Highlight | Details |

|---|---|

| Date of ITAT Judgment | August 9, 2025 |

| Tribunal | Bangalore Bench, ITAT |

| Section Invoked by AO | Section 69A – Unexplained income |

| Applicable Exemption | Section 56(2)(vii) – Marriage gifts are exempt |

| Amount in Dispute | ₹10 lakh |

| Outcome | Addition deleted – amount treated as exempt |

| Documentation Recommended | Wedding invites, photos/videos, bank deposit slips, donor letters |

| Official Resource | Income-Tax Department of India |

The Case That Made the News

A taxpayer deposited ₹10 lakh in cash shortly after their wedding. The Assessing Officer (AO) questioned the source, treating it as “unexplained income” under Section 69A of the Income-Tax Act.

The taxpayer’s explanation was simple:

- The funds came from friends and relatives as wedding gifts.

- These gifts were customary, given openly during wedding ceremonies.

- Indian tax law clearly exempts such gifts under Section 56(2)(vii).

The ITAT agreed, pointing out:

- Wedding gifts are a cultural tradition and socially accepted practice.

- Section 56(2)(vii) contains no monetary limit for marriage gifts.

- The taxpayer had reasonable supporting documents—wedding invitations, photos, and deposit slips.

Result: the ₹10 lakh addition was deleted.

The Law: Section 56(2)(vii) and Section 69A in Detail

Section 56(2)(vii) – Marriage Gift Exemption

- Applies to cash, jewelry, movable/immovable property, shares, or securities.

- No value limit—whether ₹1,000 or ₹1 crore, if it’s a genuine wedding gift, it’s exempt.

- Applies to gifts from both relatives and non-relatives.

- Includes gifts given shortly before or after the wedding, if linked to the occasion.

Section 69A – The “Unexplained Money” Provision

- Invoked when a taxpayer cannot explain the source of money or assets.

- Allows the amount to be taxed at a higher rate (currently 60% + surcharge).

- Not applicable if there’s a legitimate exemption under the Act, like marriage gifts.

Historical Background and Precedents

Indian courts have repeatedly sided with taxpayers in genuine wedding gift disputes:

- CIT v. Smt. P. Sarada (1997) – Supreme Court recognized marriage gift exemption for substantial amounts.

- Smt. Kamal Kumari v. ITO (2015) – ITAT Jaipur allowed ₹15 lakh as wedding gifts.

- Prakash Chand v. ITO (2010) – ITAT Delhi accepted large deposits as marriage gifts when supported by wedding-related evidence.

These cases show that timing, documentation, and occasion linkage are critical.

Why This Ruling Matters Now?

Cultural Context

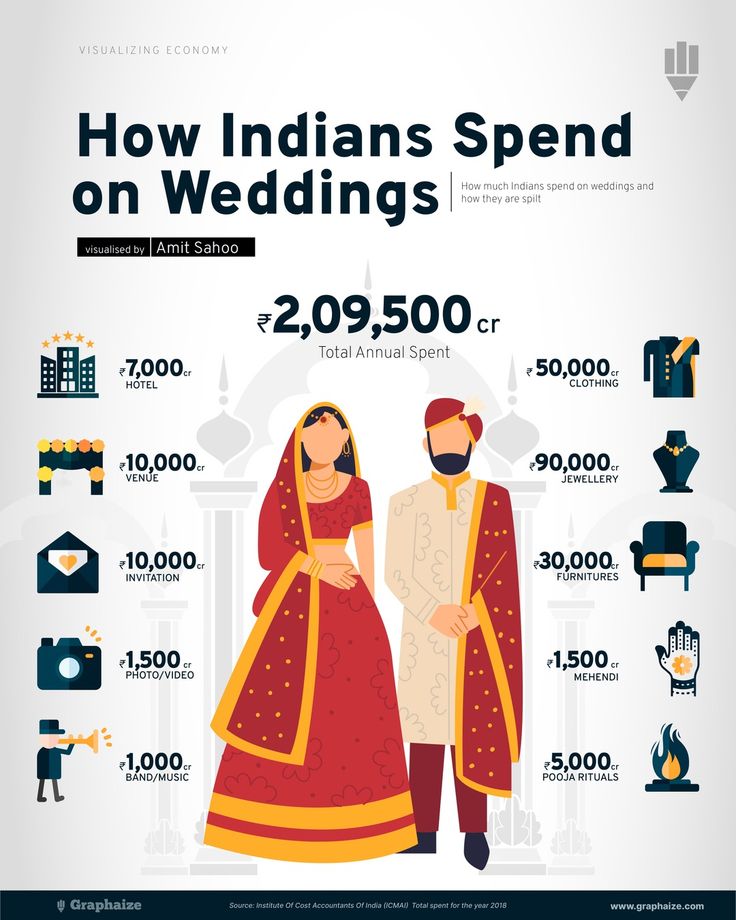

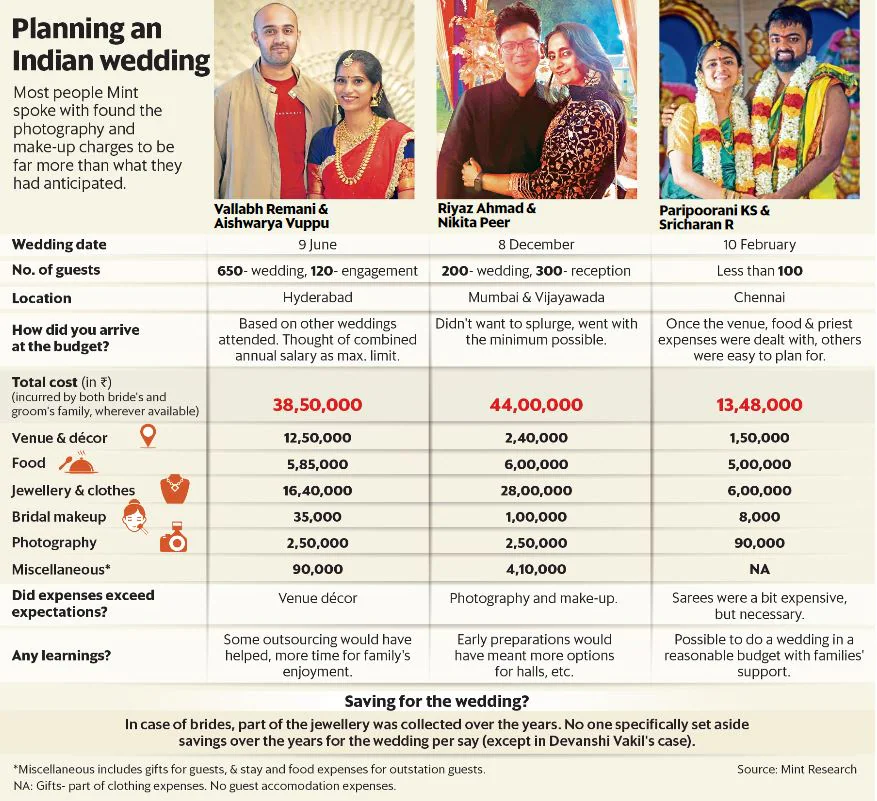

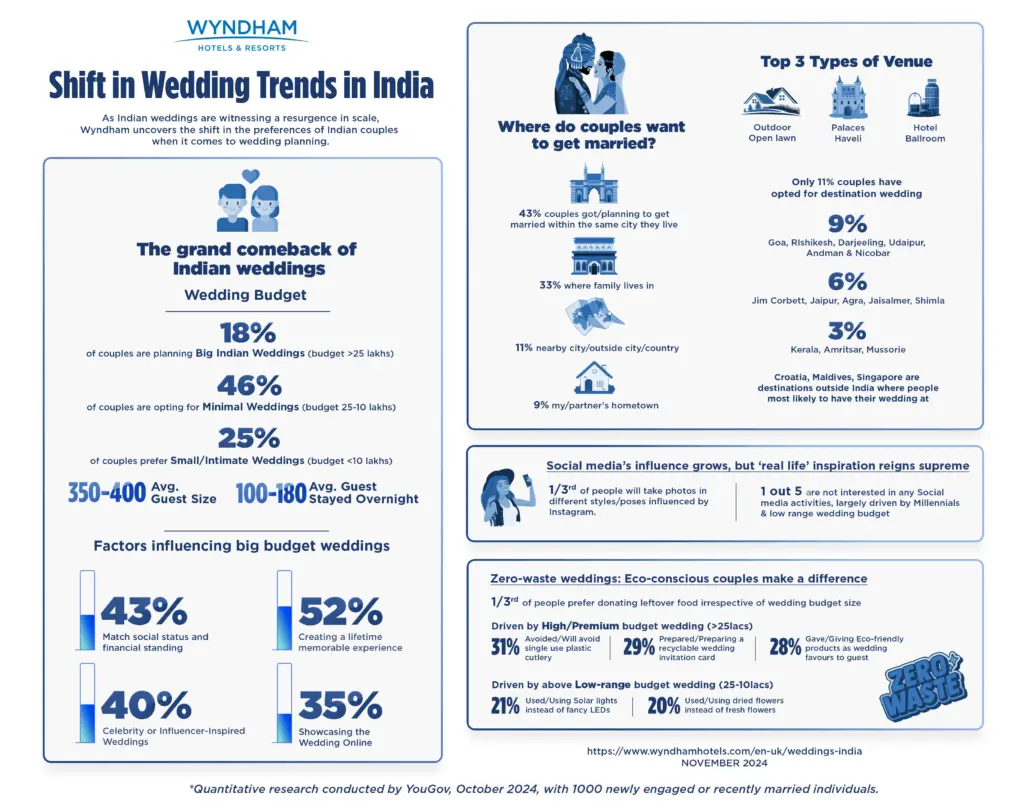

The Indian wedding industry is valued at over ₹3.75 lakh crore ($50 billion).

- Average urban guest list: 300–500 attendees.

- Average cash gift: ₹2,000–₹5,000 per guest in urban areas, ₹500–₹2,000 in rural areas.

- Total annual wedding gift transactions: estimated at ₹1–1.5 lakh crore.

Taxpayer Protection

This ruling:

- Prevents harassment of honest newlyweds.

- Gives tax officers clear boundaries.

- Encourages compliance through clarity.

Global Comparison: Wedding Gift Tax Rules

- United States – Tax-free to the recipient; giver must file gift tax return if gifts exceed $18,000 (2024).

- United Kingdom – Recipients not taxed; inheritance tax rules apply to givers if they pass within 7 years.

- Singapore – No gift tax; large cash amounts may require reporting under AML rules.

- Canada – No gift tax, but property gifts can trigger capital gains for givers.

- Australia – No gift tax; social security and reporting rules may apply.

India stands out for offering unlimited exemption for marriage gifts.

Practical Guide: Staying Compliant and Audit-Proof As Wedding Gifts Not Taxable

Step 1 – Keep Detailed Records

- Wedding invitation cards.

- Event photos and videos.

- Bank deposit slips with dates.

- Donor declarations for high-value gifts.

Step 2 – Deposit Timely

Deposit cash gifts soon after the wedding to avoid doubt about the link to the occasion.

Step 3 – Be Transparent

While you don’t declare marriage gifts in your ITR, maintain an internal record.

Step 4 – Handle Foreign Gifts Carefully

If receiving from abroad, comply with FEMA reporting rules, even though the gift is tax-exempt.

Myths About Wedding Gift Taxation – Debunked

Myth 1: Only relatives’ gifts are exempt.

Truth: All donors are covered under the marriage exemption.

Myth 2: ₹50,000 cap applies to weddings.

Truth: That cap applies to other occasions, not marriage.

Myth 3: Only gifts on the wedding day qualify.

Truth: Gifts given before or after, if tied to the marriage, are covered.

Mini Case Studies

Case 1 – NRI Relative Gift

Rahul’s US-based uncle gave ₹7 lakh. Exempt under Section 56(2)(vii), but Rahul kept bank transfer records and donor letters for FEMA compliance.

Case 2 – Property Gift

Meera received an apartment worth ₹60 lakh from her parents. Exempt under marriage rules, though stamp duty was payable.

Case 3 – Split Deposits

Ananya received ₹12 lakh in cash gifts but deposited them over 6 weeks. AO questioned the gap, but documentation and guest list saved her.

Economic Impact of the Ruling

This judgment:

- Saves taxpayers from wrongful additions, which can carry tax + penalty + interest (often totaling 80%+ of the amount).

- Encourages large sections of society to deposit wedding gifts without fear of triggering audits.

- Reduces the backlog of litigation in tax tribunals by clarifying law.

If such clarity didn’t exist, even a modest middle-class wedding with ₹5–₹10 lakh in cash gifts could become a tax headache.

Tips for Tax Professionals Defending Clients

- Always tie deposits to the event date.

- Maintain photographic evidence to support cultural customs.

- Use past tribunal rulings as citations in responses.

- For high-value gifts, collect signed confirmations from donors.

Statistics: Scope of Wedding Gift Transactions

- 75% of Indian weddings involve cash gifts (ICICI Lombard, 2022).

- Average total received in middle-class urban weddings: ₹5–₹15 lakh.

- High-end weddings: gifts can exceed ₹1 crore.

- In some communities, cash gifting is so ingrained that families budget for it as a key wedding expense.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Rs 16.30 Crore Missing? GST Officers Take Down Tax Evader in Major Crackdown!

GST Notification 56/2023 Declared Illegal by Madras HC in Major Setback to Tax Authorities

Call to Action: Protect Your Exemption

If you’re about to get married:

- Keep thorough documentation.

- Deposit gifts promptly.

- Consult a CA for large or foreign-origin gifts.

- Know your rights—Section 56(2)(vii) is on your side.