Bengaluru PG’s ‘Cash Only, 12% GST if Online’ Notice: In the buzzing city of Bengaluru — often called the Silicon Valley of India — a paying guest (PG) accommodation recently set off a firestorm online. The reason? A notice posted for tenants read: “Cash only for rent. If you pay online, add 12% GST.” On the surface, this might sound like a quirky policy. But when you dig deeper, it raises questions about tax evasion, digital payment transparency, and the way small businesses are adapting — or avoiding — India’s Goods and Services Tax (GST) system.

Bengaluru PG’s ‘Cash Only, 12% GST if Online’ Notice

The Bengaluru PG “Cash Only, 12% GST if Online” notice isn’t just a local squabble — it’s a case study in how small businesses react when informal practices meet formal tax enforcement. For tenants, the lesson is simple: stay informed, demand transparency, and never accept a penalty for paying the right way.

| Topic | Details |

|---|---|

| Incident Date | August 9, 2025 (viral notice shared on Reddit) |

| What Happened | Bengaluru PG allegedly told tenants: pay rent in cash only, else pay 12% GST for online transactions |

| Public Reaction | Outrage over suspected tax evasion and unfair charges |

| Bigger Trend | Small businesses avoiding UPI/digital payments to dodge GST scrutiny |

| GST Thresholds | ₹40 lakh turnover for goods, ₹20 lakh for services |

| Possible Violation | Charging GST without issuing a proper tax invoice |

| Actionable Tip | Always demand an official GST invoice when GST is charged |

| Official Resource | GST Portal – Government of India |

The Viral Bengaluru PG Incident

The controversy kicked off when a Reddit user, SKDgeek, posted a photo of the PG’s notice on August 9, 2025. The message was blunt:

- Pay rent in cash — no extra fee

- Pay rent online — add 12% GST

That might sound straightforward, but here’s the problem: GST in India applies to the value of the supply, not the payment method. Whether you pay via cash, bank transfer, or UPI, the tax rate (if applicable) remains the same.

If a business or service provider is charging GST, they must be registered with a GSTIN and provide an official tax invoice. No invoice? That’s potentially illegal.

Why Bengaluru Is Seeing This Trend?

Bengaluru’s economy thrives on its massive workforce of IT professionals, students, and gig workers. Many live in PG accommodations because they offer affordable rent, shared facilities, and flexibility.

Over the past year, however, a noticeable shift has occurred: small businesses — from PGs to cafés — are putting up signs like “No UPI, Only Cash.”

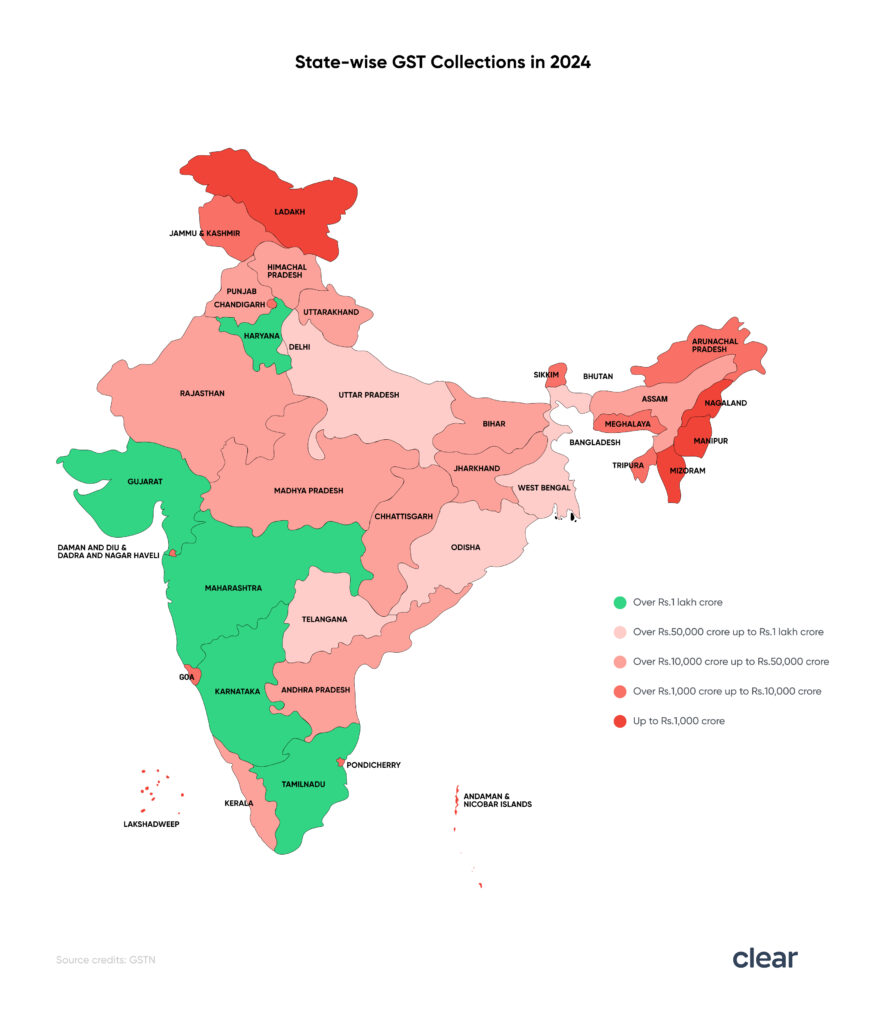

The reason is tied to tax surveillance. Karnataka’s GST department has been analyzing UPI and card transaction data to identify businesses whose turnover crosses the GST threshold — ₹40 lakh for goods and ₹20 lakh for services. Crossing these limits legally requires GST registration and tax payment.

When businesses receive GST notices based on digital payment data, some respond not by complying, but by ditching digital payments altogether to keep transactions off the books.

PGs in Bengaluru: The Bigger Context

Paying guest accommodations have been part of Bengaluru’s urban housing landscape for decades. With over 1.2 million migrants moving to the city annually for work or study (per Bengaluru Development Authority data), PGs are an essential bridge between hostels and full-fledged apartment rentals.

Many PGs operate in a semi-formal economy:

- They may not be registered as businesses.

- They often take payments in cash to avoid record-keeping.

- Amenities like food, Wi-Fi, and cleaning are bundled into one “rent” figure.

Because the market is competitive, PG owners often operate on thin margins — which can tempt some into questionable practices to avoid taxes.

Why Bengaluru PG’s ‘Cash Only, 12% GST if Online’ Notice Is Problematic?

Let’s break down why this policy sparked outrage:

1. It Discourages Transparency

Digital payments create a record that can be audited. Cash does not. By charging extra for online payments, the PG is pushing tenants toward untraceable transactions.

2. It May Violate GST Law

If GST is applicable, it must be applied consistently across payment methods. Selective charging is non-compliant.

3. It Undermines Consumer Rights

Tenants have the right to request — and receive — a GST invoice. Without one, they’re not obliged to pay GST.

GST Rules for Rentals in India

Under the Central Goods and Services Tax Act, 2017:

- Residential rent: Exempt from GST unless provided to a registered business.

- Commercial rent: 18% GST applies if the landlord is GST-registered.

- PG accommodation: Often classified as “short-term accommodation services,” attracting 12% GST for registered providers.

Penalties for violations include:

- 10% of the tax due (minimum ₹10,000) for genuine mistakes.

- 100% of the tax due for deliberate evasion.

Expert Insight

“Selective GST charging tied to payment method has no legal basis. If a PG is doing this, they’re either confused about GST law or they’re exploiting tenants’ lack of awareness,” says Ramesh Naidu, Bengaluru-based chartered accountant.

The Broader Economic Impact

When businesses turn away from digital payments, several things happen:

- Tax revenue declines — This affects public funding for infrastructure, healthcare, and education.

- Compliant businesses lose competitiveness — Those paying taxes fairly face higher operating costs than those evading them.

- Consumer trust drops — People become skeptical about hidden charges and under-the-table practices.

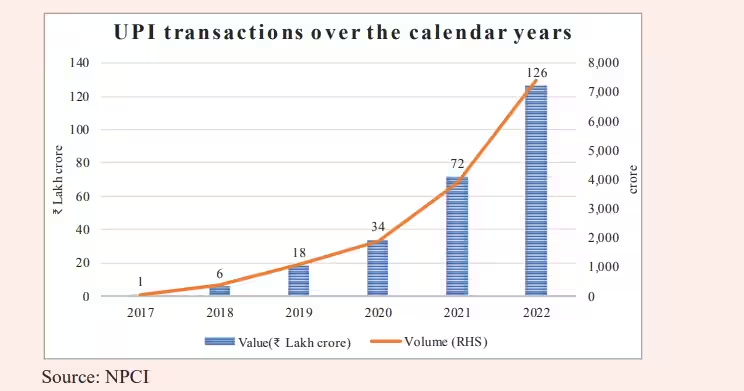

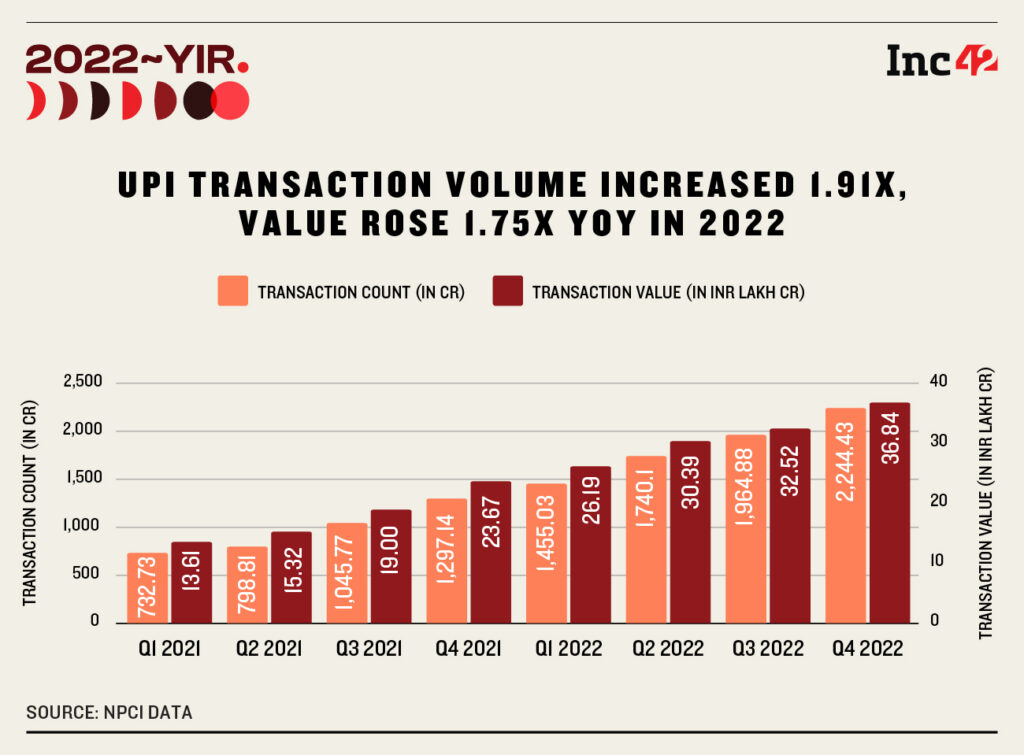

According to a 2024 National Payments Corporation of India (NPCI) report, UPI transactions in Karnataka grew by 23% year-over-year, but in certain sectors, usage is declining due to tax fears.

Practical Guide: How Tenants Should Respond

Step 1: Ask for a GSTIN and Invoice

Use the GST Search Tool to verify registration.

Step 2: Prefer Traceable Payments

Even if they insist on cash, politely explain you need digital proof for your own records.

Step 3: Document Everything

Save screenshots, receipts, and communications.

Step 4: Report to Authorities

Use the DGGI grievance portal or local consumer courts.

Step 5: Know Your Rights

In India, you cannot be charged GST without an official invoice.

Lessons from the U.S.

This situation is similar to how, in the United States, some small businesses offer “cash discounts” or add a surcharge for card payments. While legal in many states, these surcharges must be disclosed clearly, and taxes are still due regardless of payment type. The IRS, like India’s GST authorities, monitors cash-heavy businesses closely for underreporting.

Preventive Measures for Regulators

- Simplify GST compliance for small businesses.

- Offer education programs so landlords understand GST rules.

- Introduce penalties for discriminatory charges based on payment mode.

- Provide temporary tax relief for informal businesses transitioning to compliance.

The Cultural Angle

In Bengaluru’s tech-savvy culture, digital payments are not just convenient — they’re the norm. For a city leading India’s startup revolution, the idea of penalizing online payments feels like moving backwards. It’s a collision between India’s push for a cashless economy and the survival tactics of its informal sector.

Global Comparisons

Countries like Australia and Canada have faced similar issues. In Australia, for instance, the “cash economy” is estimated to cost billions in lost tax revenue annually. The Australian Taxation Office runs targeted crackdowns on cash-only businesses, much like India’s GST drives.

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

Rs 16.30 Crore Missing? GST Officers Take Down Tax Evader in Major Crackdown!