Parliament Passes Two New Tax Bills: If you’ve been wondering why everyone from your next-door neighbor to that chatty barista is suddenly talking about taxes, here’s the scoop — Parliament has just passed two new tax bills, and they’re about to change the way we deal with Uncle Sam’s long-lost cousin: the taxman. The Income-Tax (No. 2) Bill, 2025 and the Taxation Laws (Amendment) Bill, 2025 aren’t just tweaks — they’re a full-on remodel of India’s tax code. These bills are designed to make the system simpler, cleaner, and faster — and yes, that means fewer headaches during tax season. But before you kick back thinking this is all sunshine and deductions, let’s break it down in plain English.

Parliament Passes Two New Tax Bills

The new tax bills are like giving an old house a complete renovation. The foundation — India’s income tax framework — remains, but it’s now cleaner, more modern, and easier to navigate. For most taxpayers, this means less stress, more predictability, and better incentives to save for the future. If you want to take full advantage of these changes, start preparing now — digitize your financial records, understand the new timelines, and explore pension options for added benefits.

| Feature | Details | Impact on You | Official Source |

|---|---|---|---|

| Income-Tax (No. 2) Bill, 2025 | Replaces Income-Tax Act, 1961 | Simplified code: sections cut from 800+ to 536 | Gov. of India — PIB |

| ₹12 lakh basic exemption | Stays intact | Middle-income earners keep existing relief | Times of India |

| Faceless assessments | Digital-first processing | Reduced human bias, faster outcomes | Economic Times |

| Unified Pension Scheme tax relief | Added exemptions | Encourages retirement savings | Gov. of India — PIB |

| TDS refunds post-deadline | Allowed without penalties | More flexibility for late filers | Economic Times |

Why This Reform Was Needed — A Quick History Lesson

The Income-Tax Act, 1961 has been India’s main tax law for over six decades. When it was introduced, India’s economy was far smaller and less complex. Over time, layer upon layer of amendments turned it into a dense legal jungle with more than 800 sections and 47 chapters.

Critics — including accountants, economists, and even small business owners — complained that the old law was too complicated, full of outdated language, and slow to adapt to a fast-changing economy. Filing taxes meant dealing with technical jargon, unclear provisions, and sometimes unnecessary face-to-face interactions with officials.

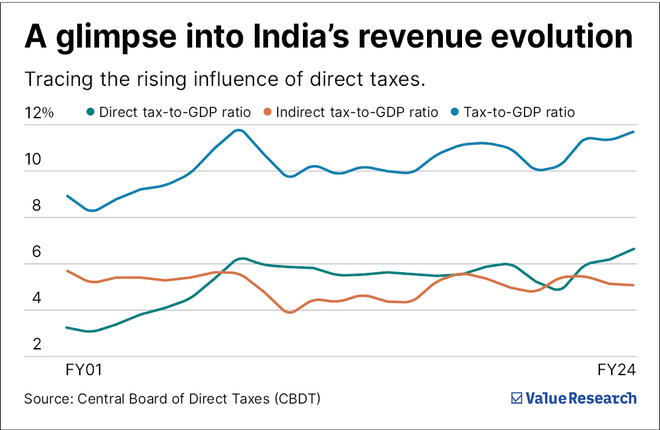

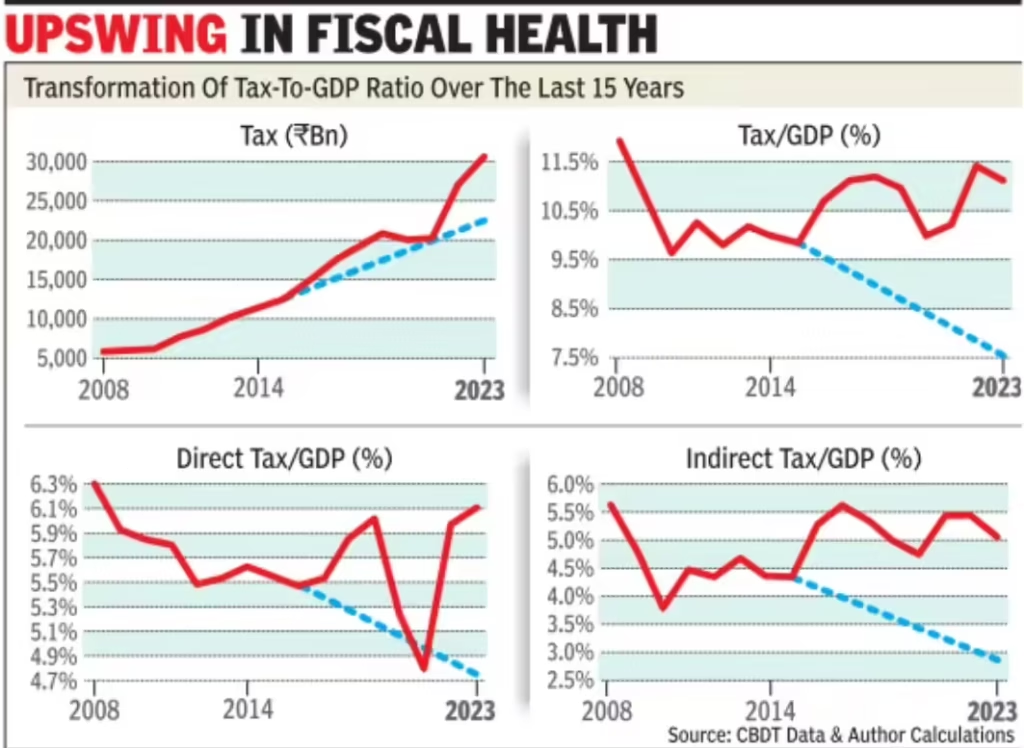

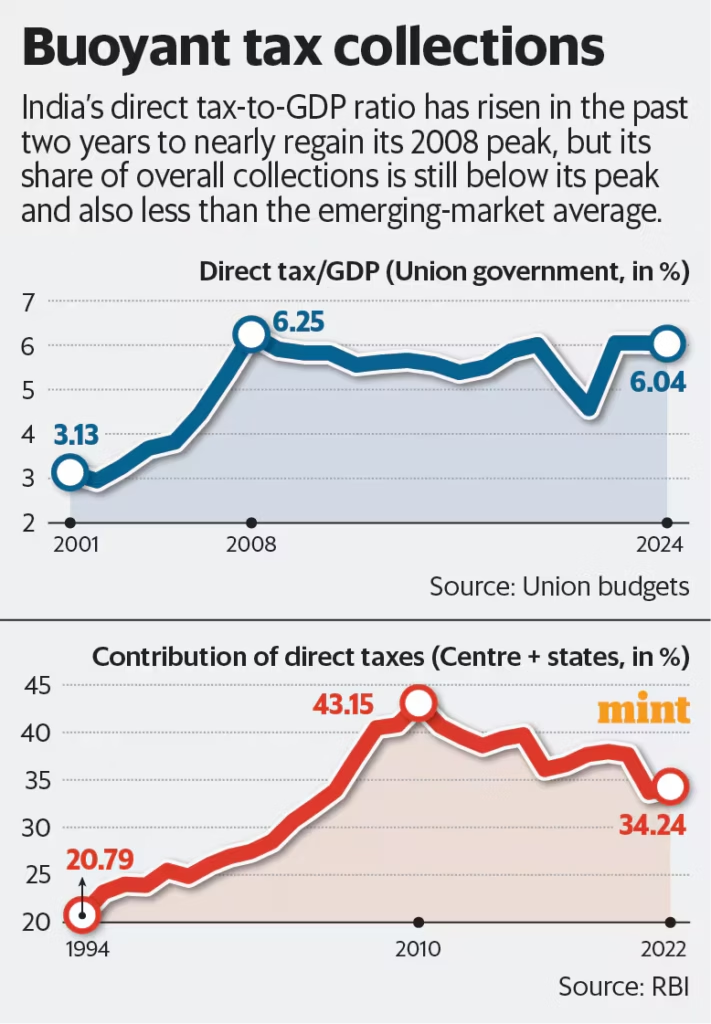

According to the World Bank, India’s tax-to-GDP ratio stood at around 11.7% in 2024, below the global average. Many experts linked this to the burdensome compliance process discouraging voluntary filings. A modernized, digital-first approach was seen as essential for widening the tax base while improving transparency.

Parliament Passes Two New Tax Bills — In Detail

1. Income-Tax (No. 2) Bill, 2025

This is the big one. Think of it as a massive decluttering project for India’s tax code.

- Simplification: Cuts sections from 800+ to 536 and reduces chapters from 47 to 23.

- Clarity: Uses more straightforward language to make it easier for both professionals and ordinary taxpayers to understand.

- Tax Year Simplification: Replaces the “Assessment Year” and “Previous Year” structure with a single “Tax Year” concept.

- Faceless Assessments: Online, paperless assessments to minimize physical interactions and reduce opportunities for corruption.

- Refund Flexibility: Allows TDS refunds even if you miss the filing deadline, without penalties.

- Transparency in Enforcement: Mandates that tax officers issue notices before taking action, providing taxpayers time to respond.

2. Taxation Laws (Amendment) Bill, 2025

This one is smaller in scope but highly targeted.

- Unified Pension Scheme Benefits: Introduces tax relief for subscribers, encouraging long-term retirement savings.

- Alignment Adjustments: Makes technical changes to existing taxation laws to match the new simplified code.

Expert Take — Why Economists Approve

Dr. Meera Sanyal, tax policy analyst, notes:

“By cutting down the sections and moving to faceless assessments, the government is sending a clear signal — compliance should be painless. This is a strong move toward taxpayer-friendly governance.”

Finance Minister Nirmala Sitharaman, speaking in Parliament, emphasized:

“The reform is not about raising more taxes but about raising trust. Taxpayers should feel confident that the system is fair and transparent.”

Benefits for You

Simplified Rules Mean Less Guesswork

You no longer have to flip through hundreds of legal provisions just to figure out if your grocery store receipts qualify for deductions.

No Surprise Hikes

The ₹12 lakh basic exemption stays, so most middle-income households will see no tax increase.

Faster Refunds and Fewer Hassles

Late TDS refunds are now penalty-free, giving taxpayers breathing room.

Retirement-Friendly Perks

Extra tax breaks for pension contributions encourage better long-term financial planning.

Step-by-Step Guide to Adapting

Step 1 — Learn the New Tax Year

Understand that there’s now just one tax year. Plan income and deductions accordingly.

Step 2 — Shift to Digital Filing

Ensure your records are digitized, update your digital signatures, and familiarize yourself with the income tax e-filing portal.

Step 3 — Review Your Retirement Savings

If you’re not part of the Unified Pension Scheme, consider joining to take advantage of the tax benefits.

Step 4 — Track Your TDS Closely

Keep an eye on your deductions throughout the year to avoid surprises and maximize your refund potential.

How Different Income Groups Are Affected?

Lower-Income Earners (Below ₹12 lakh)

- No change in tax burden.

- Easier filing process.

Middle-Income Earners (₹12–20 lakh)

- Continued benefits from simplified exemptions and deductions.

- Potentially quicker processing times for refunds.

High-Income Earners (Above ₹20 lakh)

- Will need to adjust to fewer, more streamlined provisions for deductions.

- More scrutiny possible under faceless systems.

Potential Challenges to Watch For

While the reforms are promising, there are some hurdles to consider:

- Adjustment Period: Tax preparers and accounting professionals will need time to adapt.

- Technology Dependence: A faceless system relies on stable internet and robust cybersecurity.

- Interpretation Issues: Simpler language doesn’t eliminate legal disputes entirely.

Practical Example — Meet “Everyman” Joe

Joe earns ₹11 lakh per year, does freelance consulting, and contributes to the Unified Pension Scheme.

Under the new system:

- He’s fully exempt from income tax due to the ₹12 lakh threshold.

- Filing his return takes less time since fewer sections apply.

- He qualifies for a pension tax deduction, increasing his retirement savings.

- If he misses the filing deadline, he can still claim his TDS refund.

Broader Economic Impact

Simpler tax laws can have ripple effects beyond individual wallets. The government expects:

- Increased Voluntary Compliance: A friendlier system encourages more people to file.

- Better Revenue Predictability: Consistent compliance improves forecasting.

- Boost to Digital Governance: A fully online system supports India’s broader digital transformation goals.

Countries like Estonia and New Zealand have already shown that simplified tax systems can significantly improve compliance rates while lowering administrative costs.

Global Parallels — Lessons for the U.S.

The U.S. has discussed similar reforms, particularly around IRS modernization and simplified tax brackets. According to the IRS Data Book, the average American spends 13 hours and more than $200 annually on tax preparation. India’s approach offers an example of how clarity and digital-first strategies could reduce costs and improve satisfaction.

Rajya Sabha Sends Back Manipur Budget Bill in Opposition’s Absence

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

BJP Labels GST Bill a ‘Formality’—AAP Calls It a ‘House Insult’